Chemical fiber giant invests 100 million yuan in fdca, life biological valuation soars to 1.5 billion!

On July 17, 2025, polyester fiber industry giant Xinfengming (603225) announced that the company intends to increase its investment in Hefei Lif Biotechnology Co., Ltd. by 100 million yuan, after which it will hold a 7.0175% stake in the company.

This capital marriage is not only a key layout for Xinfengming's strategy of "greening, differentiation, and innovation," but also marks a new stage in the industrialization process of bio-based polyester materials in China. Relying on Livan Bio's technological accumulation in the field of FDCA (2,5-furandicarboxylic acid), the two sides have previously achieved large-scale production of 100% bio-based polyester PEF filaments, providing a feasible technological path for the green transformation of the textile industry.

1. The logic behind investment: breaking through homogeneous competition.

The recent investment by Xin Fengming is not a coincidence. As a global leader in polyester fiber with a total market value of 17 billion yuan, its traditional main business is facing increasing pressure from intensified homogenization competition. Biobased materials are seen as an important direction to break through this "involution." The announcement clearly states that the core goal of the investment is to explore the application of PEF in high-end biobased fibers and green packaging through Livi's FDCA technology, which aligns closely with Xin Fengming's strategy of "consolidating traditional businesses + laying out emerging industries."

The core value of Lifeng Biotechnology lies in its technological barriers related to furan-based biobased materials. Since its establishment in 2014, the company has focused on the research and development of FDCA and its downstream product PEF. It has built the world's first kiloton-level FDCA production line and a hundred-ton level continuous production line, with a ten-thousand-ton production line under construction expected to be operational by the end of 2025, which will make it the largest FDCA supplier in the world. More importantly, its technological pathway has broken through industry bottlenecks—by using the "glucose-HMF-FDCA" process, it has eliminated dependence on expensive raw materials, and the product purity reaches 99.99%, with polymerization performance leading the industry.

This technological advantage is directly reflected in the valuation logic: Liv Bio's post-investment valuation after the B1 round in 2023 was 768 million yuan, the pre-investment valuation reached 1.2 billion yuan, and the post-investment valuation has now exceeded 1.5 billion yuan. The announcement explains that the increase in valuation is supported by four core factors: the maturity of the continuous process using glucose as raw material, the globally leading quality of FDCA, the delivery capability advantage brought by the ton-level production line, and a clear cost reduction path—FDCA prices are expected to drop to 50,000-60,000 yuan/ton by 2025, and further down to 20,000-30,000 yuan/ton after 2027, gradually approaching the cost of petroleum-based raw materials.

2. Technical breakthroughs + capital support, PEF is about to be industrialized.

Biobased polyester PEF is regarded by the industry as the best alternative to petroleum-based PET. Its chemical structural similarity to PET means it is compatible with existing production equipment, while its performance advantages are more significant: in addition to the low carbon attributes brought by being fully biobased, PEF fibers exhibit outstanding performance in moisture absorption and quick drying (with moisture absorption rates over twice that of PET) and natural antibacterial properties (with an antibacterial rate exceeding 99%). This makes it highly applicable in fields such as activewear and medical textiles.

Image source: Livzon Biotech

The breakthrough in large-scale mass production is the result of the combination of Xin Fengming's industrial capabilities and Lifu Biotechnology.

Lif Biotech provides core raw material assurance: its FDCA products have a purity of 99.99%, exhibiting more stable reactivity during the polymerization process, laying the foundation for the physical properties of PEF filaments.

Xin Fengming contributed mass production experience: As a polyester production expert, it solved process challenges such as melt fluidity and stretching and shaping in the PEF spinning process, transforming laboratory technology into industrial production capacity.

According to OECD forecasts, by 2030, biobased products will replace 25% of the organic chemicals market. As a biobased material closest to PET, PEF is expected to rapidly penetrate fields such as textiles and packaging. Through this investment, Xin Fengming secures FDCA supply, effectively obtaining a "ticket" to the industrialization of biobased materials in advance.

Opportunities and challenges coexist, and Livzon Bio is continuously in the red.

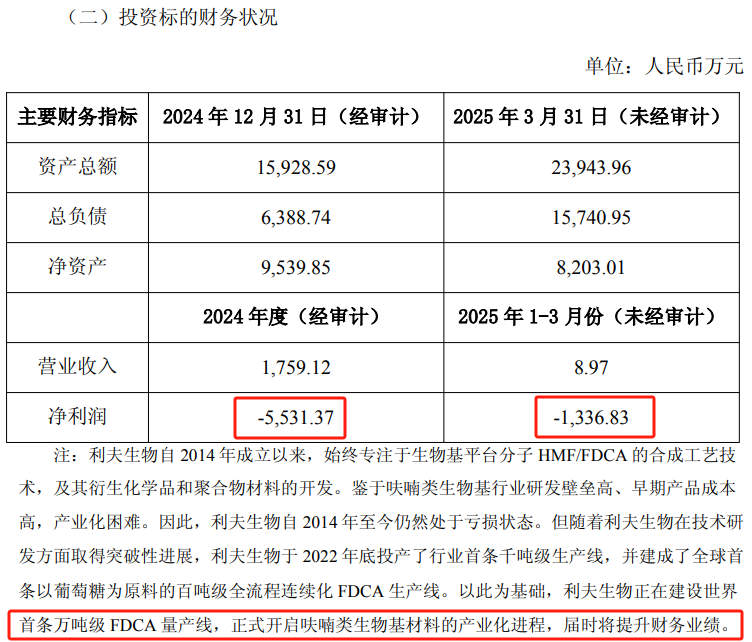

Despite the promising prospects, this cooperation still faces numerous challenges. The announcement clearly outlines three major risks: 1. Market uncertainty: The acceptance and price sensitivity of bio-based materials still need to be tested by the market; 2. Production line commissioning risk: If Liv Bio's 10,000-ton FDCA production line cannot be put into operation on schedule, it will affect the scale-up process of PEF; 3. Profitability cycle issue: Liv Bio has been continuously losing money since its establishment (net profit of -55.3137 million yuan in 2024 and net profit of -13.3683 million yuan from January to March 2025), making it difficult to contribute profits to New Feng Ming in the short term.

However, as technology continues to mature, these risks are gradually being mitigated. LivBio's losses are mainly due to early-stage R&D investments, but with the production of the ten-thousand-ton line and cost reductions, profit expectations are clear; New Fengming also controls risks through a "stakeholding rather than controlling" approach, while retaining flexibility for technological collaboration. More importantly, both parties have formed a closed loop of "technology R&D - raw material supply - mass production": LivBio is responsible for reducing FDCA costs, while New Fengming is responsible for expanding PEF application scenarios. This division of labor model provides sustainable driving force for industrialization.

4. FDCA industry financing heats up, capital races in the biobased track.

FDCA, as a core raw material for bio-based polyesters, has become a hot track for capital competition. From the perspective of industry financing, multiple companies have received capital injection at different stages: Lif Biological has recently received 100 million yuan in a C-round financing from New Fengming; Tangneng Technology is expected to complete a B+ round financing in 2024, although the amount is unknown, it has support from Zhoushan Financial Capital and Daishan Investment Group; Zhongke Guosheng secured 200 million yuan in an A+ round financing in March 2025, with participation from CITIC Jinshi and PwC Capital; Yunshang New Materials, Saierke, and Yujun Bio have also respectively gained capital favor at the angel+ and B round stages.

Behind the capital-intensive layout is a long-term optimism for bio-based materials to replace petroleum-based materials. Different rounds of financing reflect the development stages of enterprises: angel rounds focus on technology validation, A/B rounds promote capacity landing, and C rounds accelerate industrialization expansion. Xin Fengming's investment in Lifu Bio is not only an extension of its own strategy but also aligns with the rising trend of financing in the FDCA industry. By leveraging capital, it aims to deepen its bio-based polyester layout and work together with other companies in the industry to advance the FDCA-PEF industrial chain from technology development to large-scale application, seizing opportunities in the green materials revolution.

With the production line of Livzon Bio's 10,000-ton FDCA coming online and the expansion of PEF application scenarios, this investment, which began with technological cooperation, is expected to reshape the global polyester material competition landscape. As stated in the announcement, this is not only a choice for enterprises to seek new momentum but also a practice to "contribute new quality power for the green development of the global textile fiber industry."

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Abbott and Johnson & Johnson: Global Medical Device Giants' Robust Performance and Strategies Amid Tariff Pressures

-

Overseas Highlights: PPG Establishes New Aerospace Coatings Plant in the US, Yizumi Turkey Company Officially Opens! Pepsi Adjusts Plastic Packaging Goals

-

BYD releases 2024 ESG report: Paid taxes of 51 billion yuan, higher than its net profit for the year.

-

The price difference between recycled and virgin PET has led brands to be cautious in their procurement, even settling for the minimum requirements.

-

Which brand of AI TV is good? Samsung Vision AI interprets the new industry standard with its "technical advantage."