China will welcome its first specialized administrative regulations on listed company supervision! international oil prices rise, plastic futures mostly decline

Overnight Crude Oil Market Dynamics

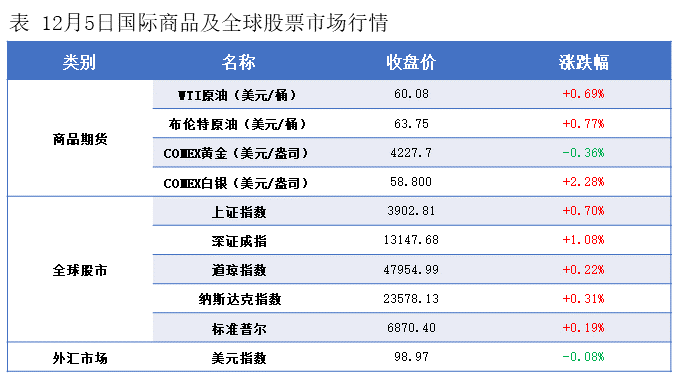

The Federal Reserve is expected to cut interest rates, boosting economic and demand expectations, combined with unstable geopolitical situations, leading to an increase in international oil prices. NYMEX crude oil futures for the January contract rose by $0.41/barrel to $60.08, a month-on-month increase of +0.69%; ICE Brent crude futures for the February contract increased by $0.49/barrel to $63.75, a month-on-month rise of +0.77%. China's INE crude oil futures for the 2601 contract increased by 2.1 to 453.4 yuan/barrel, with night trading up by 3.7 to 457.1 yuan/barrel.

Market Forecast

The probability of the Federal Reserve lowering interest rates in December has reached 87%.

2. The unstable situation between Russia and Ukraine, as well as between the US and Venezuela, continues to bring potential supply risks. (Positive)

OPEC+'s production increase operation will not change in December. (Bearish)

The Russia-Ukraine negotiations have once again hit a deadlock, with a low probability of completing peace talks in the short term, and U.S.-Venezuela relations are tightening. Coupled with a high probability of the Federal Reserve lowering interest rates in December, the recent weakness of the U.S. dollar index provides support for oil prices. It is expected that international crude oil prices may rise today. In terms of import oil differentials, both ESPO and TUPI crude oil differentials are showing a downward trend.。

Section 2: Macroeconomic Trends

1、The U.S. core PCE price index annual rate unexpectedly fell to 2.8% in September, hitting a three-month low.The market expects to record 2.9% for the third consecutive month.

2、White House Economic Council Director Hassett: It is time for the Federal Reserve to cautiously cut interest rates. No discussions have been held with Trump regarding the selection of the Federal Reserve Chair.

3、Besent: The United States will achieve 3% GDP growth by the end of this year.

Trump: Has approved the production of small cars in the United States.

Trump on the Supreme Court Tariff Case: The United States has other ways to impose tariffs, and the current method should be more straightforward.

G7 and the EU reportedly consider banning maritime services for Russian oil exports, replacing the oil price cap.

Vietnam's trade surplus narrowed for the third consecutive month, reaching 1.09 billion USD.

Elon Musk: There are many media reports claiming that SpaceX is raising funds at an $800 billion valuation, which is not accurate.

9、Li Qiang will hold a "1+10" dialogue with the heads of major international economic organizations worldwide.

10、He Lifeng held a video call with U.S. Treasury Secretary Besant and Trade Representative Greer.

The China Securities Regulatory Commission issued the "Regulations on the Supervision and Management of Listed Companies (Draft for Public Comments)".China is set to introduce its first dedicated administrative regulation for the supervision of listed companies.

12. Wu Qing: We must approach new businesses such as crypto assets with caution, and firmly refrain from operating in areas that are unclear or uncontrollable. Strict legal regulation should be applied to problematic securities firms. The capital space and leverage limits for securities firms should be moderately expanded, shifting from price competition to value competition.

Ren Hongbin, Chairman of the China Council for the Promotion of International Trade, led a delegation of Chinese entrepreneurs to visit the United States.

Notification from the National Financial Regulatory Administration on Adjusting Risk Factors for Relevant Business Activities of Insurance Companies.

15、The People's Bank of China: As of the end of November, China's gold reserves stood at 74.12 million ounces, an increase of 30,000 ounces month-on-month, marking the 13th consecutive month of gold accumulation.

China Federation of Logistics & Purchasing: The global manufacturing recovery in November decreased slightly by 0.1% compared to the previous month, reaching 49.6%.

17、China to purchase MI308 chips from the US? Ministry of Foreign Affairs: We hope the US will take concrete actions to maintain the stability and smoothness of global production and supply chains.

18. Announcement of the 2025 Medical Insurance Drug List: 114 new drugs added, including 50 category 1 innovative drugs.

3. Early Morning Dynamics of the Plastic Market

International oil prices closed higher! Overnight, the main domestic plastic futures contracts mostly fell with few gains.

Plastic contract 2601 reported at 6,654 yuan/ton, down 0.85% from the previous trading day.

The PP2601 contract reported at 6274 yuan/ton, down 0.59% from the previous trading day.

PVC2601 contract reported at 4409 yuan/ton, down 0.99% from the previous trading day.

Styrene contract 2601 is quoted at 6,618 yuan/ton, up 0.75% from the previous trading day.

Section Four: Market Forecast

The weak demand for PE exhibits clear industry and regional differences. In northern regions, due to a significant drop in temperature, the agricultural film industry has entered its traditional off-season. The production of greenhouse films has mostly wrapped up, and the pre-stock orders for mulch films have not commenced, leading to a sharp decline in the demand for PE raw materials. In the pipe sector, the impact of halted municipal projects and home renovation projects has caused the procurement of HDPE pipe-specialized materials to come to a virtual standstill. Although the southern regions have relatively mild climate conditions, the improvement in demand is very limited. After the "Double Eleven" stockpiling rush, the order volume in the packaging film industry has significantly declined. Even with the approach of Double Twelve, there has been no effective increase in demand for necessities like express packaging, and companies are mostly making small-batch purchases as needed. End-user factories generally lack confidence in the market outlook, maintaining low raw material inventories and only restocking in small quantities when urgently needed for production, leading to consistently low market transactions. Traders are under increasing pressure to sell due to the dual pressure of abundant spot goods and weak demand. Even with flexible discounts to attract customers, it is difficult to significantly improve the transaction atmosphere. Overall, in the short term, the PE market lacks the key momentum to reverse its weakness. The supply-demand loose pattern and off-season demand effect will continue to dominate the market. It is expected that the domestic polyethylene market will continue to exhibit a weak and volatile trend in the short term.

PP: Currently, downstream industries have gradually entered the seasonal off-peak period. The purchasing sentiment in major sectors such as plastic weaving, home appliances, and automotive modifications is generally weak, with companies mainly focusing on digesting existing inventories. Even with the approach of Double Twelve and New Year's Day, pre-holiday stocking demand has not yet fully expanded, with only a few packaging companies making sporadic restocking moves due to short-term orders. Overall purchasing strength is insufficient. On the supply side, domestic PP facilities are operating stably, with no large-scale maintenance or production reduction plans, and the spot market resources remain abundant, further exacerbating the loose supply-demand pattern. As a result, market sentiment remains pessimistic. In summary, in the short term, the PP market is unlikely to escape the pattern of "weak benefits, strong negatives," with unstable cost support and the effects of the off-season demand continuing to manifest. Pre-holiday stocking is unlikely to form an effective increase, and it is expected that the domestic polypropylene market will continue to experience weak fluctuations in the short term.

PVC: From the perspective of rigid demand, downstream product enterprises and traders both have demand, and the ex-factory prices of upstream factories are already at historical lows. Correspondingly, after the decline in futures prices, the spot market's resistance to falling increases. Returning to the issue of demand, although demand still exists, it is still too early to discuss inventory time at this stage, as high capital occupation affects cash flow, and delivery time also becomes a constraint. For the recent decline in prices in both futures and spot markets, spot market prices may still face low-level challenges in the short term. However, the downside space is likely limited, and conditions for price increases are not present. Prices may continue to test the bottom over a longer period.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

[Today's Plastics Market] General Materials Weakly Fluctuate, Engineering Materials Steadily Rise

-

Daily Review: Polyethylene Prices Under Weak Consolidation, Sellers Face Significant Pressure to Move Inventory

-

U.S. Appeals Court Officially Rules: Trump Tariff Unlawful and Void!