From Europe Exiting to China Focusing: How Adipic Acid Can Navigate the New Cycle

Over the past year, the global adipic acid market, particularly in China, has been undergoing significant transformations. The core characteristics can be summarized as "strong supply, weak demand, structural differentiation, low prices, and weak cost correlation."

The industry has been oscillating in a low prosperity range for a long time, with the competitive landscape showing characteristics of "high-cost capacity gradually exiting, market share of large integrated enterprises stabilizing, and new production being more cautious." In the absence of substantial improvement in macro demand, the upward momentum for adipic acid prices remains limited.

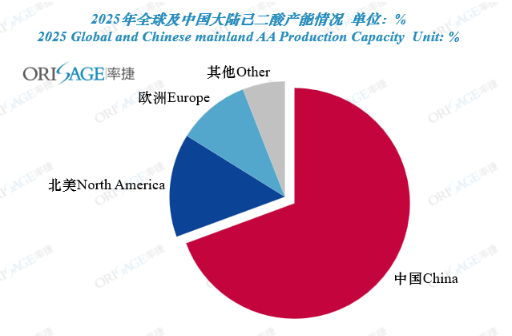

In 2025, the adipic acid market is undergoing a profound supply-side structural transformation. Globally, with BASF officially shutting down its adipic acid plant at the Ludwigshafen production site, Europe's production capacity system is facing reconstruction. This withdrawal not only reflects the disadvantages of European chemical plants in terms of scale and cost competition but also indirectly proves that the global competitiveness of China's adipic acid industry is strengthening.

Source: RuiJie Consulting / OriSage

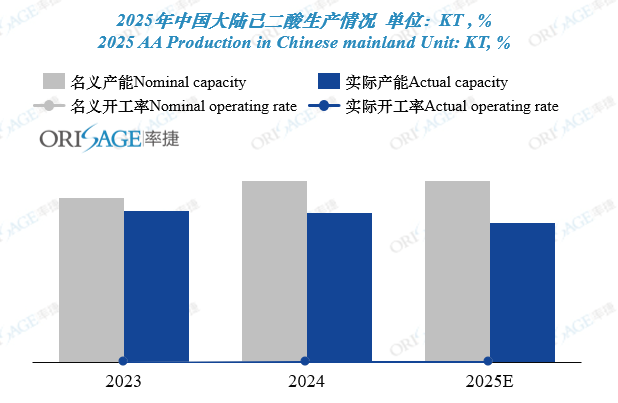

In China's domestic market, the situation has evolved from a phase of temporary ease to a more pronounced pattern of oversupply. The expansion of production capacity in the adipic acid industry has significantly slowed, and the industry has entered a marked phase of clearing and consolidation. Therefore, the high production capacity data in China also reveals an apparently paradoxical phenomenon: nominal capacity continues to expand, but actual effective capacity is contracting.According to statistics from Rate Consulting, China's total production capacity of adipic acid is expected to be around 4 million tons by 2025, but the actual production capacity is less than 3 million tons.This essentially represents a spontaneous capacity optimization and load adjustment in the industry driven by efficiency and cost considerations. On one hand, in the context of oversupply and insufficient demand, companies proactively shut down some facilities to reduce operating costs, while the remaining facilities can maintain a higher operating rate to further lower production costs and ensure corporate profits. On the other hand, leading companies leverage their integration and scale advantages in both upstream and downstream sectors to survive, while high-cost, small-scale, and outdated capacities will be phased out more quickly.

Source: OriSage Consulting

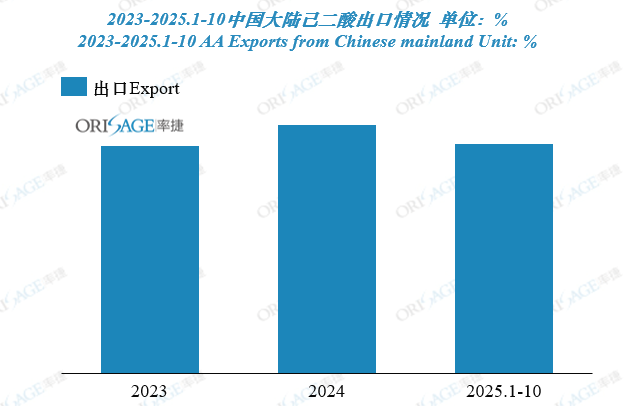

As of October 2025, China's export volume of adipic acid is approximately 451,000 tons, accounting for about 23% of the domestic production that year, representing a 9.2% increase compared to the same period last year.Rate Consulting believes that the high export proportion is an inevitable result of China's adipic acid industry seeking a way out amidst a severe imbalance of domestic supply and demand, leveraging its international competitiveness. This reflects the scale and efficiency advantages of Chinese manufacturing, but also exposes the deep-seated risks of the industry being overly reliant on export market growth and vulnerable to external policy shocks.

OriSage Consulting

In March 2025, a lawsuit jointly filed by German chemical giant Lanxess and Italian company Lantich triggered an anti-dumping investigation by the EU into adipic acid originating from China. Following the commencement of the anti-dumping investigation, China's export volume of adipic acid not only did not decrease but instead increased. In April, the monthly export volume reached a historic high of 83,000 tons, with significant growth in the main destinations for Chinese adipic acid, including Turkey, the Netherlands, India, Italy, and Singapore.This "abnormal" growth is driven by dual logic: on one hand, EU customers are worried about the uncertainty of future tariff policies and are choosing to stock up in advance; on the other hand, Chinese companies are actively adjusting their export structure to reduce dependence on a single market. Now, Chinese enterprises are actively exploring emerging markets such as ASEAN and Central Asia, especially in regions undergoing industrial transfer, to find new outlets for excess capacity. With the EU's preliminary anti-dumping ruling on Chinese adipic acid, it may become a watershed moment for the adjustment of China's adipic acid export direction, profoundly changing global trade flows and corporate export strategies.

Source: RuiJie Consulting/OriSage

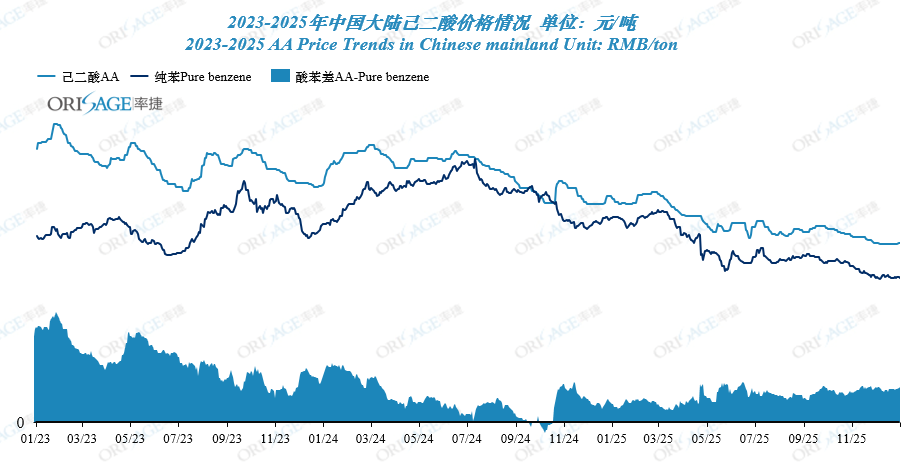

2025The price trend of adipic acid this year shows a "weak decline and low-level consolidation" fluctuation pattern, with prices in the East China market long fluctuating around 7,000 yuan/ton. The annual average ex-factory price of manufacturers has dropped by more than 20% compared to 2024.On the one hand, the price of pure benzene remains low due to the decline in crude oil prices, with a significant increase in overseas imports and weak demand from the main downstream styrene market, resulting in a stagnant price at low levels and reduced support from the cost side for adipic acid. On the other hand, the imbalance in the supply and demand fundamentals has contributed to the ongoing decline in the price of adipic acid.

Rate Consulting believes that amidst the ongoing exit of small and medium-sized enterprises, market concentration is increasing, and the pricing behavior of major production enterprises is becoming more rational. Although price stability has become a common demand within the industry, periodic price competition may still occur under profit pressure, and the balance of supply and demand in the industry still requires attention.

Moreover, the market psychology behind price fluctuations has also changed. In recent years, the speculative sentiment in the adipic acid market has significantly weakened, and traders and downstream customers are making more rational purchases, generally adopting an "on-demand purchasing" strategy. Therefore, a stable price trend is also more conducive to the healthy development of the industry.

Source: OriSage Consulting

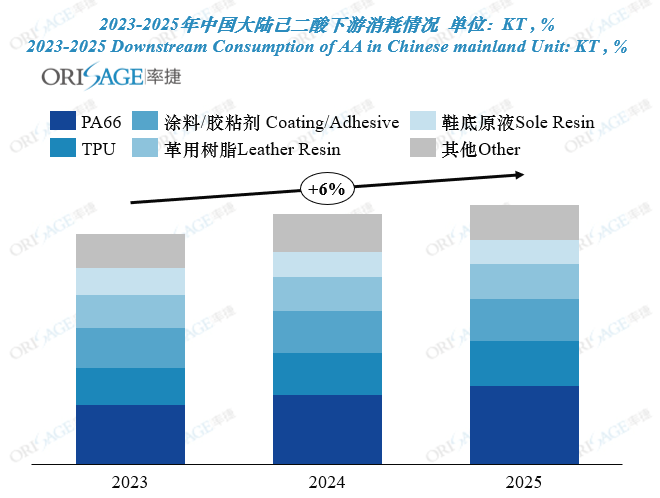

According to Rate Consulting, the downstream demand for adipic acid in China is expected to maintain stable growth in 2025, but there will be a noticeable structural differentiation in downstream demand. Traditional application areas are experiencing sluggish growth, while the potential of emerging markets remains to be tapped.

PA66: As a significant downstream product of adipic acid, it is undergoing a technological revolution led by Chinese companies. The accelerated iteration of domestic adiponitrile technology has significantly increased the localization rate of raw materials, simultaneously stimulating investment in the domestic PA66 industry.However, the slowdown in the growth rate of the terminal market for automobiles and electronic appliances has led to actual consumption growth being far lower than the rate of capacity expansion. The deceleration in downstream demand growth, combined with prior investment expansion, has further exacerbated the supply-demand imbalance, intensifying market competition.

With domestic overcapacity, the export market has become an important outlet, and China is transitioning from a net importer to a net exporter of PA66. By October 2025, China's PA66 import volume has significantly decreased by 28% year-on-year, while export volume has simultaneously increased by 15.5%. The cost advantage makes domestically produced PA66 more competitive in the international low to mid-end market, and growth in the export market will effectively alleviate domestic overcapacity pressure.

In summary, the localization of PA66 raw materials has opened a new chapter for industry independence, allowing the sector to enter a phase characterized by higher competitive intensity and greater challenges to comprehensive cost and innovation capabilities. In the future, the focus of industry competition will shift from "expanding production capacity" to "reducing costs" and "moving towards high-end products."

Unlike the fierce competition in the PA66 market, the PU market has maintained steady growth, offsetting the weak demand caused by price wars in the traditional PA66 sector and providing a more robust and diversified demand base for adipic acid.Particularly in the TPU sector, polyester TPU remains the main product, with its applications in footwear materials, films, and tubing continuously expanding. In terms of PU resin, the market for slurry and shoe sole liquid has been influenced by changes in the international trade environment, showing a "first suppress then rise" trend, with overall growth falling short of expectations. Meanwhile, the PU market is increasing pressure on controlling upstream raw material costs to cope with its own price competition. Overall, the future development of TPU and PU resin presents potential directions for demand expansion to the adipic acid industry, which is facing an excess capacity dilemma, and also poses clearer challenges for cost optimization and product upgrading.

Source: OriSage Consulting

The market environment of overcapacity has accelerated the reshuffling of the industry. Leading enterprises consolidate their market position through scale effects and industrial chain integration. In the face of ongoing industry downturns, companies' production strategies have also undergone fundamental changes. According to Ruijie Consulting, the future competitive landscape of enterprises will present the following characteristics:

Leading enterprises continue to consolidate their market share.

b. Small and medium-sized enterprises flexibly adjust their load based on the profit cycle.

The entire industry has entered a state of "rational production and low-profit operation."

Integration layout has become a key strategy for enterprises to maintain profits in low-price competition.

The export structure is gradually shifting from "scale-driven" to "profit-oriented."

At the same time, the price space of the adipic acid industry has been squeezed to a historical low, and the industry is undergoing an accelerated clearing and concentration phase, with the price center operating in a low range. In the short term, the improvement in supply and demand is limited, and prices remain weak and stable, with purchasing behavior becoming more rational. However, as the macroeconomic environment gradually improves, and if policies to guide the healthy development of the industry are introduced subsequently, the potential downstream demand is expected to gradually translate into effective pull for adipic acid consumption. Rate== Consulting believes that the adipic acid market will exhibit the following trends in the future:

Short term (3-6 months)

a. There is no significant improvement in supply and demand, and the low-price trend is likely to continue, resulting in weak and stable fluctuations.

b. There is a strong sentiment of watching in the market, and purchasing is mainly based on immediate needs.

Mid to long term (1-3 years)

a. The capacity clearing or economic recovery in the PA66 and footwear industry could be the most important variable for adipic acid.

b. The addition of new industry capacity is constrained, which may lead to tighter supply and demand in the future.

c. Green processes (such as improved oxidation methods and reduced energy consumption) may lead to changes in cost structure.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

[Today's Plastics Market] General Materials Weakly Fluctuate, Engineering Materials Steadily Rise

-

U.S. Appeals Court Officially Rules: Trump Tariff Unlawful and Void!

-

Daily Review: Polyethylene Prices Under Weak Consolidation, Sellers Face Significant Pressure to Move Inventory