In-depth analysis of the current status and development trends of the automotive thermal management industry

Current Status and Development Trends of the Automotive Thermal Management Industry: In-Depth Analysis

Introduction: The Strategic Value and Industry Pain Points of Thermal Management Systems

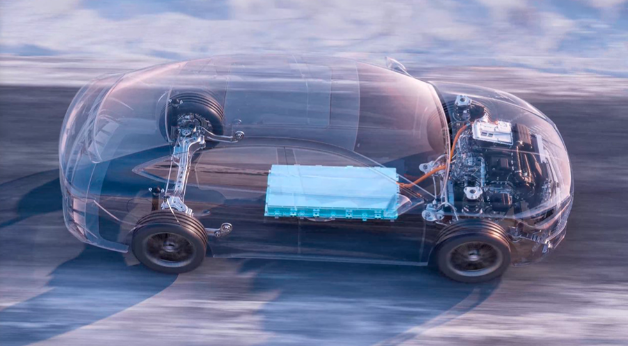

As the penetration rate of new energy vehicles surpasses 50%, thermal management systems have evolved from auxiliary systems in traditional fuel vehicles to a battlefield of core technology that determines the overall vehicle performance. Their performance directly affects vehicle range, fast charging capability, and adaptability to extreme environments. However, the industry still faces dual challenges of technological bottlenecks and market structure: traditional thermal management systems experience efficiency degradation of over 30% in low-temperature environments, and heat pump technology has not been widely adopted due to high costs. International Tier 1 suppliers occupy 70% of the high-end market share, and domestic enterprises urgently need to overcome technological barriers and cost dilemmas.

I. Industry Status: Dual Transformation of Technological Iteration and Market Structure

(I) Technical System: From Discrete Control to Global Coordination

The Research Report of China Research Institute of IndustryAnalysis Report on the Current Status and Future Development Trends of the Thermal Management Systems Industry from 2024 to 2029In traditional fuel vehicles, the thermal management system centers around engine cooling and air conditioning systems, utilizing a discrete control architecture where each module operates independently and lacks coordination. The widespread adoption of new energy vehicles has completely changed this pattern: the battery thermal management system needs to control temperature fluctuations within ±2℃, the motor and electronic control systems require a 50% improvement in heat dissipation efficiency, and the cabin thermal management needs to balance comfort with energy consumption optimization. The current technological advancements in the industry exhibit three main characteristics.

Integrated Design: By replacing traditional solenoid valves with integrated valve bodies like eight-way valves and twelve-way valves, multi-loop integrated control of battery cooling, motor heat dissipation, and cabin heating is achieved. For example, Huawei's DriveONE thermal management system utilizes an eight-way valve design, reducing the number of pipelines by 40%, decreasing weight by 25%, and improving response speed by 50%.

Intelligent Control: AI algorithms deeply integrate with vehicle network big data to achieve predictive thermal management. The system can adjust thermal management strategies in advance based on user travel habits, real-time traffic conditions, and environmental data. For example, the BYD DiLink 4.0 system generates personalized temperature control models through machine learning, maintaining temperature fluctuations within ±0.5℃ and reducing energy consumption by 15%.

Material Innovation: The application of new materials such as graphene thermal conductive films and silicon carbide-coated water cooling plates is driving system lightweighting and efficiency. The Tesla Model 3 Performance model uses silicon carbide-coated water cooling plates, improving thermal response speed by 30%, allowing the motor to maintain efficient cooling even at high power output.

(2) Market Structure: Acceleration of Domestic Substitution and Global Competition

The global automotive thermal management market presents a competitive landscape characterized by "International Tier 1 dominance + rising domestic enterprises." Four major international suppliers—Denso from Japan, Halla from Korea, Mahle from Germany, and Valeo from France—dominate the high-end market, possessing technological monopoly advantages in core components such as electronic expansion valves and multi-way valves. Domestic enterprises, on the other hand, have rapidly risen through "technological breakthroughs + cost advantages."

Segment breakthroughs: Sanhua Intelligent Controls holds over a 35% market share in the electronic expansion valve market; Yinlun Co., Ltd.'s oil cooler products have reached international performance standards; Aotecar's electric compressor costs are 20% lower than those of foreign brands.

Global Layout: Companies such as Sanhua Intelligent Controls and Yinlun Co., Ltd. have entered the global supply chain through overseas factory construction and localized research and development. In 2024, the market share of Chinese companies in the global new energy vehicle thermal management market increased from 12% in 2020 to 28%.

Policy-driven effect: China's "dual carbon" goals and new energy vehicle industry planning provide policy dividends for the industry. According to data from China Research and Puhua, the market size of China's new energy vehicle thermal management is expected to reach 49.59 billion yuan in 2024, with a year-on-year growth of 95.6%, accounting for 48.9% of the global market.

(3) Industrial Chain Reconstruction: From Linear Supply to Ecological Collaboration

The automotive thermal management industry chain is undergoing a profound restructuring: upstream raw material suppliers are transitioning to high thermal conductivity and lightweight materials, midstream component manufacturers are enhancing modular design capabilities, and downstream vehicle manufacturers are promoting the deep integration of thermal management systems with vehicle architecture. Typical cases include:

Contemporary Amperex Technology Co., Limited (CATL): Integrate battery thermal management system with cell design, develop embedded thermal management structures to improve battery pack volume utilization by 8% and double the heat dissipation area.

BYD: Through the combination of "blade battery + direct cooling technology with refrigerant," cell temperature difference is controlled within ±2℃, supporting 4C fast charging technology (80% charge in 10 minutes).

Tesla: The Model Y features an octo-valve heat pump system that manages the heat of the battery, motor, and cabin, enhancing winter range by 15%.

Section Two: Development Trends - Synergistic Evolution of Technological Breakthroughs and Market Expansion

According to the research report by the China Research Institute of Industry==Analysis Report on the Current Status and Future Development Trends of the Thermal Management Systems Industry from 2024 to 2029Analysis

(I) Technological Trends: Efficiency, Intelligence, Globalization

Efficient Technology Popularization:

Refrigerant direct cooling technology: Introducing the air conditioning system refrigerant directly into the battery pack, achieving a cooling efficiency that is 30% higher than liquid cooling. In 2024, over 90% of newly launched electric vehicle models will adopt liquid cooling solutions, while refrigerant direct cooling technology will begin to gradually penetrate the market.

Wide Temperature Range Heat Pump System: CO₂ refrigerant and jet enthalpy enhancement technology enable the heat pump to operate stably in a wide temperature range from -30℃ to 50℃, reducing heating energy consumption by 30% in winter. The Tesla Model Y's heat pump system has already achieved integrated thermal management for the battery, motor, and passenger cabin.

Intelligent Control Upgrade:

Multi-sensor integration: Integrating temperature, humidity, infrared human presence, and sunlight sensors to achieve comprehensive perception of the in-car environment. The infrared sensor can detect whether passengers are sweating and automatically lower the temperature in the corresponding area; the sunlight sensor can detect the intensity of sunlight on the car roof and increase the air output in that area.

OTA Remote Upgrade: Automakers can use OTA to push new algorithms to the thermal management system, improving performance without needing to replace hardware. For example, if users in a certain region commonly report "slow air conditioning cooling" during the summer, automakers can push optimized compressor control strategies.

Standardization of globalization

Industry Standards Development: China's industrial planning clearly calls for improved energy efficiency through thermal management technology. The EU regulations have added requirements for battery thermal runaway protection. The domestic proposed energy efficiency evaluation standards will establish an industry evaluation system from multiple dimensions.

Testing and validation collaboration: The industry is promoting the establishment of unified testing standards for thermal management systems to address the current challenges of high simulation validation difficulty and the lack of a unified testing evaluation system.

(2) Market Trends: Dominance of New Energy and Commercial Vehicle Growth

Expansion of the new energy passenger vehicle market.

According to the forecast by China Research and Puhua, the global market size of new energy vehicle thermal management will reach 226.46 billion yuan by 2030, with the Chinese market size reaching 96.748 billion yuan. The value per vehicle of the thermal management system for new energy vehicles has risen from 2,150-2,450 yuan for traditional fuel vehicles to 6,000-10,000 yuan, with high-end models exceeding 12,000 yuan.

Commercial Vehicle Electrification Transition

The electrification of commercial vehicles such as heavy trucks and logistics vehicles is accelerating, and it is expected to become an important source of incremental growth in the thermal management market after 2026. Commercial vehicle thermal management systems need to meet high-load and long-endurance requirements, such as using liquid cooling/air cooling composite technology to adapt to extreme environments ranging from -30°C to 60°C.

Aftermarket potential release.

With the growth in the number of new energy vehicles, the aftermarket demand for maintenance and upgrades of thermal management systems will surge. It is estimated that by 2030, the scale of China's automotive thermal management aftermarket will reach 42 billion yuan, with an annual compound growth rate of 7.8%.

(3) Competitive Trends: Technological Barriers and Ecological Competition

Technical Barrier Enhancement:

Integrated system simulation verification: The thermal management system needs to simulate extreme conditions such as high temperature, low temperature, high humidity, and high-speed driving to verify system performance. The simulation verification is challenging and requires companies to have multi-physics field coupling simulation capabilities.

Cost Reduction and Technology Upgrade Conflict: Against the backdrop of rising raw material costs, companies need to reduce system costs through material innovation and process optimization. For example, using aluminum alloy radiators can reduce weight, but the cost is 15% higher than traditional materials.

Intensified ecological competition:

Automaker Self-Research Trend: Leading automakers like Tesla and BYD are increasing their efforts in self-developing thermal management systems, enhancing their control over the supply chain through vertical integration. For example, BYD has developed an all-scenario intelligent pulse self-heating technology, which increases the heating rate by 230% in -30°C environments.

Cross-industry collaboration deepens: Automakers are partnering with tech companies and startups to develop new thermal management technologies. For example, Huawei has collaborated with car manufacturers to launch the DriveONE thermal management system, which integrates AI algorithms to achieve dynamic thermal strategy optimization.

3. Industry Challenges and Response Strategies

(1) Technical Challenges: Balancing Efficiency, Cost, and Safety

Improvement of thermal management system efficiency: The current system energy consumption accounts for 10%-15% of the total vehicle energy consumption. It is necessary to reduce energy consumption by optimizing control algorithms and using efficient materials. For example, the coefficient of performance (COP) of heat pump technology can reach 2-3, but it has difficulties in low-temperature start-up and needs to be used in conjunction with PTC heaters.

Cost Control Pressure: The cost of thermal management systems in new energy vehicles is over 50% higher than that of traditional fuel vehicles. Cost reduction is needed through large-scale production and localized support. Domestic companies have managed to reduce costs by 20% to 30% compared to foreign brands by setting up factories overseas and using domestically produced core components.

Safety Risk Management: Battery thermal runaway is a significant safety hazard that requires real-time monitoring of battery temperature through thermal management systems to prevent its occurrence. For example, CATL has developed a multi-modal thermal management technology that can predict battery temperature changes in advance and adjust proactively.

(2) Market Challenges: Intensified Competition and Diversified Demand

International Competition Pressure: Foreign brands hold an advantage in the high-end market, and domestic companies need to enhance their competitiveness through technological innovation and service optimization. For example, Sanhua Intelligent Controls successfully entered the supply chains of international car manufacturers like Tesla and BMW by providing customized solutions.

Customer demand diversification: The demand for thermal management systems varies significantly across different regions and vehicle models, necessitating the development of modular and scalable products. For example, GAC AION's "Star Spirit Electronic and Electrical Architecture" supports plug-and-play thermal management modules, reducing the development cycle of new models by 30%.

The automotive thermal management industry is currently at a critical phase of technological iteration and market expansion. On the technology front, integration, intelligence, and efficiency have become mainstream trends. New technologies such as direct cooling with refrigerants, wide temperature range heat pumps, and AI control will drive significant improvements in system performance. On the market front, the thermal management market for new energy vehicles continues to expand, the electrification transition of commercial vehicles brings new growth, and the potential of the aftermarket is gradually being realized. On the competition front, domestic companies are accelerating the replacement of imports through technological breakthroughs and cost advantages, global expansion is deepening, and ecosystem competition is becoming the new norm.

In the future, the industry will achieve greater breakthroughs in technological innovation and scenario expansion by focusing on the three core demands of "safety, energy saving, and comfort." For enterprises, grasping technological trends, deepening ecological cooperation, and optimizing cost control are key to winning the market. With the dual drive of policy support and market demand, the automotive thermal management industry is expected to become an important supporting force in the transformation and upgrading of the automotive industry, injecting core momentum into the global automotive electrification process.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

[Today's Plastics Market] General Materials Weakly Fluctuate, Engineering Materials Steadily Rise

-

U.S. Appeals Court Officially Rules: Trump Tariff Unlawful and Void!

-

Daily Review: Polyethylene Prices Under Weak Consolidation, Sellers Face Significant Pressure to Move Inventory