Market Research and Development Trend Forecast Report for the Display Panel Industry from 2026 to 2032

1. Overview of the Development of the Display Panel Industry

The display device industry is an important pillar in the electronic information field, encompassing various sub-sectors such as glass substrates, liquid crystal materials, polarizers, and more. It involves disciplines like optoelectronics, microelectronics, and chemistry, with a long industrial chain that crosses multiple fields and drives the development of upstream and downstream sectors. Display panels are the core products in the midstream of the industrial chain, integrating components like glass substrates, liquid crystals, and polarizers, and have a significant impact on market demand.

The industrial chain is divided into upstream materials, midstream assembly, and downstream products. After fine processing, display panels are assembled with other components to form display modules, which are widely used in terminals such as smartphones and tablets. With consumers' demand for thinner and lighter products, integrated touch display technologies (such as On-Cell and In-Cell) have become a new trend, driving new developments in the industry.

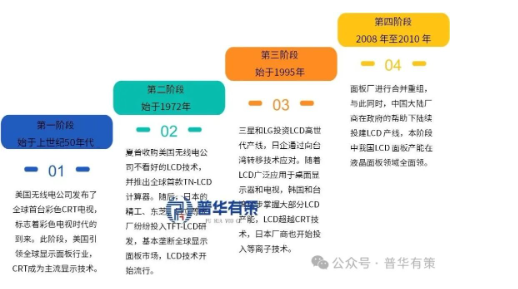

The development of the display panel industry can be divided into four stages, having undergone technological iterations and upgrades from CRT display technology to LCD display technology, plasma display technology, OLED display technology, and Mini/MicroLED.

Industry Development Experience

Source: PwC Advisory

2. Industry Market Situation and Development Trends

The demand in the display panel market is expected to maintain stable growth, driven by the trend towards larger screens and new-generation display technologies such as OLED and MiniLED. In 2024, the global display panel shipment area is approximately 263 million square meters, with a market size of about $133.8 billion, reflecting a year-on-year increase of 6% and 13%, respectively. It is anticipated that by 2030, the market size will reach $148.7 billion, with a total shipment volume of approximately 4.08 billion units. The replacement demand for terminal products such as mobile phones and televisions will continue to grow, driven by 5G, innovations in display technology, and the trend towards larger screens. The rise of the new energy vehicle market and emerging industries such as smart cities, smart homes, VR/AR, and drones also presents new development opportunities for the display panel industry. The main development trends in the industry are as follows:

The global panel industry structure continues to adjust, with panel production capacity further shifting to mainland China.

In recent years, Japanese and Korean panel manufacturers have been planning to exit the LCD panel market. LG and Samsung announced in 2019 that they would completely shut down and withdraw from LCD production lines, preparing to transition to OLED. As Japanese and Korean manufacturers exit the LCD panel market, global panel production capacity will further shift to mainland China. According to data from Sigmaintell Consulting, the global share of LCD panel production capacity by Chinese mainland display panel manufacturers rapidly increased from 69% in 2022 to 74% in 2024, and it is expected to further reach a high level of 76% in 2025. Concentrated production capacity helps to enhance the market pricing power of domestic panel manufacturers, contributes to the stability of display panel market prices, and drives the overall market share growth of the domestic new display device industry.

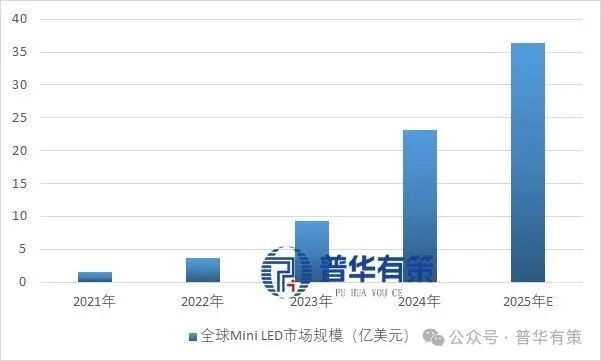

The penetration rate of the Mini/MicroLED market is accelerating, and the scale of downstream applications is rapidly growing.

The applications of Mini/MicroLED technology are mainly divided into two directions: RGB direct display and as a backlight solution. With the reduction in supply chain costs and improvement in production yield, the market prospects for Mini/MicroLED are broad. From 2021 to 2024, the global MiniLED market size is expected to grow from $150 million to $2.32 billion, with an annual growth rate of over 140%.

Global MiniLED Market Size from 2021 to 2025

Source: PwC Research

In recent years, MiniLED technology has rapidly developed, with leading companies accelerating commercialization. Domestic manufacturers such as BOE have launched multiple MiniLED display products, covering gaming monitors, televisions, and automotive displays; TCL has introduced MiniLED televisions in various sizes. Foreign companies like Sony and Philips have also launched MiniLED application products in the television and monitor sectors.

(3) Glass-based circuit boards have significant cost and performance advantages, and are expected to lead the application of MiniLED backlighting in higher partitioned and medium-to-large size products.

In the material selection for MiniLED backlight displays, traditional PCB substrates have issues such as poor heat dissipation, thermal expansion problems, and the impact of high partition requirements on LED lifespan. With technological advancements, glass-based circuit boards are gradually becoming a better choice due to their superior performance. Compared to PCBs, glass substrates have three times higher thermal conductivity, effectively preventing MiniLED chip brightness decay and supporting high partition numbers and high brightness performance. Their ultra-high flatness improves chip packaging yield and light source control precision. Moreover, glass substrates have lower production costs, making them suitable for large-scale production and simplifying backlight structures. Hisense's glass-based MiniLED backlight technology has been successfully applied to its Dasheng G9 display, significantly enhancing display performance. With the advancement of industrialization, glass-based MiniLED backlights are expected to accelerate the proliferation of medium and large-sized display products.

3. Industry Competitive Landscape and Major Enterprises

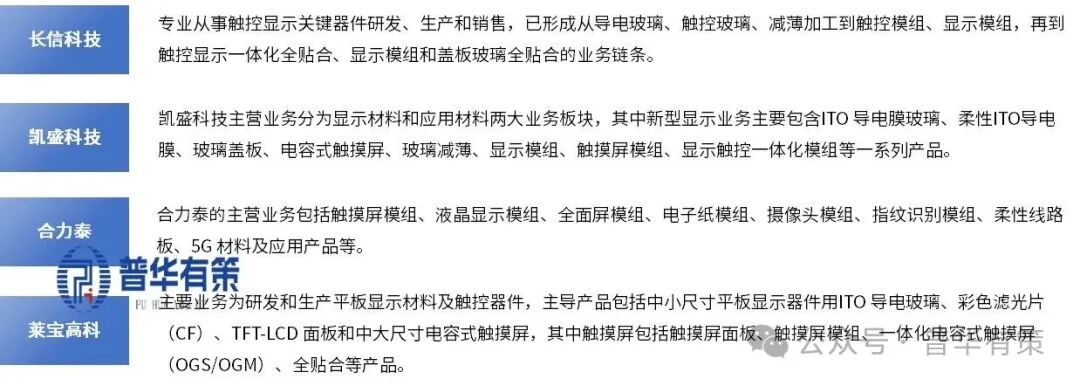

In the precision processing business of flat panel display devices, the main domestic companies that constitute competitive relationships include Changxin Technology (300088.SZ), Kaisheng Technology (600552.SH), and Woge Optoelectronics Group, as well as specialized flat panel display precision processing manufacturers, and subsidiaries or joint ventures established by panel manufacturers such as Laibo Gaoke (002106.SZ) that only undertake part of their internal processing business.

In the optoelectronic display device business, the domestic companies that constitute competitive relationships mainly include Truly International Holdings Limited (300088.SZ), Holitech Technology Co., Ltd. (002217.SZ), Leyard Optoelectronic Co., Ltd. (002106.SZ), and World Optoelectronics Group. Their main business covers products such as glass cover plates, touch display modules, and backlight modules. The aforementioned competitors started their development in various subfields of the industry earlier and are well-known companies in their respective fields, possessing certain advantages in terms of revenue scale and market share.

Major enterprises in the industry

Source: PwC Advisory

4. Industry Barriers

(1) Technical and Process Barriers

The development of display device manufacturing enterprises relies on profound technological accumulation and excellent production processes. This industry involves the comprehensive application of multiple disciplines, requiring mastery of core technologies such as etching, cutting, and bonding, with production processes continuously updated. Customers are demanding higher quality products, thus enterprises need years of technical experience to optimize processes and improve yield rates. New entrants face technical barriers, making it difficult to quickly acquire the necessary technologies and processes, resulting in low product yield and high costs.

(2) Talent Barrier

The development of manufacturing enterprises for display devices relies on high-quality production, R&D, and management talent. Firstly, skilled workers are the foundation of precision production, and companies need to invest a significant amount of time and cost in their training. Secondly, due to rapid technological updates, R&D personnel are needed for quality improvement and new product development. Additionally, equipment maintenance requires experienced personnel. Finally, optimizing process flows, precise technical parameters, strict quality control, and specialized experience are key to improving yield rates. New entrants to the industry find it difficult to quickly cultivate these key talents, creating a barrier to talent acquisition.

(3) Capital Barriers

Display device manufacturing enterprises require large-scale capital investment to ensure development. First, the initial investment is substantial, as expensive equipment must be purchased, and the production process involves multiple procedures that require specialized equipment, resulting in high fixed costs. Enterprises need to control costs through economies of scale and efficient equipment utilization. Second, suppliers face large-scale end manufacturers and must endure long accounts receivable periods, resulting in a significant demand for working capital. Finally, technological updates and product upgrades also require substantial investment in research and development. These factors create a capital barrier for new entrants. (4) Scale Barrier

Larger production scales are key for display device processing and manufacturing companies to reduce costs and enhance market position. Scalable production helps to spread fixed costs, improve bargaining power, and lower procurement costs. Since customers usually engage in long-term partnerships with only a few suppliers, companies with large-scale production capabilities can compete in the mainstream market. New entrants need to invest a significant amount of capital at once to establish stable scalable production capacity.

Customer resource barrier

Rich customer resources and stable customer relationships are key to the development of display device processing and manufacturing enterprises. Intelligent consumer electronics products have high requirements for technology and quality, and customers are cautious when choosing suppliers, with long certification cycles. Enterprises need to provide high-quality products and services over the long term to gain customer recognition and establish stable cooperative relationships. Once becoming a core supplier, customers usually do not easily change suppliers, forming a customer resource barrier.

The "2026-2032 Display Panel Industry Market Research and Development Trend Forecast Report" covers the global and Chinese development overview of the industry, supply and demand data, market size, industry policies/plans, related technologies/patents, competitive landscape, upstream raw materials situation, downstream main application market demand size and prospects, regional structure, market concentration, key enterprises/players, enterprise market share, industry characteristics, driving factors, market outlook forecast, investment strategies, main barrier composition, related risks, and more. Additionally, Beijing Phua Information Consulting Co., Ltd. provides specialized market research projects, industry research reports, industry chain consulting, project feasibility study reports, Specialized and Innovative Giant certification, market share reports, Fifteenth Five-Year Plan, project post-evaluation reports, BP business plans, industry maps, industry planning, blue and white papers, national-level manufacturing single champion enterprise certification, IPO fundraising feasibility study, and IPO working paper consulting services. (PHPOLICY:MJ)

Chapter 1 Overview of the Display Panel Industry

Section 1: Definition and Classification of the Display Panel Industry

I. Industry Definition

II. Industry Characteristics and Their Position and Impact in the National Economy

Section 2: Characteristics and Models of the Display Panel Industry

I. Development Characteristics of the Display Panel Industry

II. Business Model of the Display Panel Industry

Section 3: Industry Chain Analysis of the Display Panel Industry

I. Industry Chain Structure

II. Supply Scale Analysis of the Main Upstream of the Display Panel Industry from 2021 to 2025

III. Price Analysis of Major Upstream in the Display Panel Industry from 2021 to 2025

4. Analysis of Development Trends in the Major Upstream Sectors of the Display Panel Industry from 2026 to 2032

V. Analysis of the Development Overview of the Main Downstream Industries of the Display Panel Sector from 2021 to 2025

6. Analysis of Development Trends in Major Downstream Sectors of the Display Panel Industry from 2026 to 2032

Chapter 2: Global Development Analysis of the Display Panel Industry

Analysis of the Overall Situation of the Global Display Panel Market in the First Section

1. Development Characteristics of the Global Display Panel Industry

II. Global Display Panel Market Structure

3. Analysis of the Market Size of the Global Display Panel Industry

IV. Competitive Landscape of the Global Display Panel Industry

V. Regional Distribution of the Global Display Panel Market

6. Global Display Panel Industry Market Size Forecast

Section 2: Analysis of Major Global Country (Region) Markets

I. Europe

1. Market Size of the European Display Panel Industry

2. Structure of the European Display Panel Market

3. Forecast of the Development Prospects of the European Display Panel Industry from 2026 to 2032

Section Two: North America

1. Market Size of the North American Display Panel Industry

2. North American Display Panel Market Structure

3. Forecast for the Development Prospects of the North American Display Panel Industry from 2026 to 2032

3. Japan and South Korea

Market size of the display panel industry in Japan and South Korea.

2. The Market Structure of Display Panels in Japan and South Korea

3. Forecast of the Development Prospects for the Korean and Japanese Display Panel Industry from 2026 to 2032

IV. Others

Chapter 3 "Classification and Codes of National Economy Sectors" Overview of the Display Panel Industry Plan for 2026-2032

Section 1: Review of Industry Development from 2021 to 2025

I. Operating Conditions of the Industry from 2021 to 2025

II. Development Characteristics of the Industry from 2021 to 2025

3. Achievements in Industry Development from 2021 to 2025

Interpretation of the display panel industry's sector plan from 2026 to 2032.

The overall strategic layout of the 2026-2032 plan

Section 2: Impact of the 2026-2032 Plan on Economic Development

III. Main Objectives of the 2026-2032 Plan

Chapter 4 Analysis of Industry Development Environment from 2026 to 2032

Section 1: Trends in World Economic Development from 2026 to 2032

The economic situation facing China from 2026 to 2032.

Section 3: Forecast of China's Foreign Economic and Trade from 2026 to 2032

Section 4 Analysis of the Industry Technological Environment from 2026 to 2032

I. Industry-related technologies

II. Patent Situation in the Industry

1. Chinese Display Panel Patent Applications

2. Disclosure of Chinese Display Panel Patents

3. Popular Applicants for Chinese Display Panels

4. Popular Technologies in Chinese Display Panels

Section 5: Analysis of the Social Environment of the Industry from 2026 to 2032

Chapter 5: PwC's Strategy on the Overall Development Status of the Display Panel Industry

Section 1: Analysis of Characteristics of the Display Panel Industry

Chapter 2: Characteristics and Importance of the Display Panel Industry

Section 3 Analysis of the Development of the Display Panel Industry from 2021 to 2025

I. Analysis of Development Trends in the Display Panel Industry from 2021 to 2025

Section 2: Analysis of Development Characteristics in the Display Panel Industry from 2021 to 2025

Section 3: Regional Industrial Layout and Industrial Transfer from 2026 to 2032

Section 4: Analysis of the Display Panel Industry Scale from 2021 to 2025

I. Analysis of the Scale of Industry Units

II. Analysis of Industry Personnel Scale Status

3. Analysis of Industry Asset Scale Status

IV. Analysis of Industry Market Size Status

Section 5: Financial Capability Analysis of the Display Panel Industry from 2021 to 2025 and Forecast from 2026 to 2032

1. Industry Profitability Analysis and Forecast

II. Analysis and Forecast of Industry Debt Repayment Capability

3. Analysis and Forecast of Industry Operational Capability

IV. Industry Development Capability Analysis and Forecast

Chapter 6: Analysis of the Supply and Demand Situation of China's Display Panel Market from 2026 to 2032

Section 1: Supply and Demand Analysis of China's Display Panel Market

I. Supply Situation of China's Display Panel Industry from 2021 to 2025

II. Demand Situation of China's Display Panel Industry from 2021 to 2025

1. Display Panel Industry Demand Market

2. Customer Structure of the Display Panel Industry

3. Regional Demand Structure of the Display Panel Industry

III. Analysis of Supply and Demand Balance in China's Display Panel Industry from 2021 to 2025

Section 2: Market Application and Demand Forecast for Display Panel Products

1. Overall Demand Analysis of Display Panel Product Application Market

1. Display panel product application market demand characteristics

2. Total market demand scale for display panel product applications

II. Forecast of Demand in the Display Panel Industry for 2026-2032

1. Product Function Forecast for the Display Panel Industry from 2026 to 2032

2. Forecast of Market Structure for Demand of Products in the Display Panel Industry from 2026 to 2032

Chapter 7: Analysis of the Operation of the Display Panel Industry in China

Section 1: Analysis of the Development Status of China's Display Panel Industry

I. Development Stages of China's Display Panel Industry

II. Overview of the Development of China's Display Panel Industry

Section 2: Development Status of the Display Panel Industry from 2021 to 2025

I. Market Size (Growth Rate) of China's Display Panel Industry from 2021 to 2025

II. Analysis of the Development of China's Display Panel Industry from 2021 to 2025

3. Analysis of the Development of Chinese Display Panel Enterprises from 2021 to 2025

Section 3: Analysis of the Display Panel Market from 2021 to 2025

I. Overview of China's Display Panel Market from 2021 to 2025

Section 2: Analysis of the Development of the Chinese Display Panel Market from 2021 to 2025

Section 4 Analysis of Price Trends in China's Display Panel Market

1. Components of the Pricing Mechanism for the Display Panel Market

Section 2: Factors Affecting the Market Price of Display Panels

III. Analysis of Display Panel Price Trends from 2021 to 2025

IV. Forecast of Display Panel Price Trends from 2026 to 2032

Chapter 8: Analysis of the Market Size of China's Display Panel Industry under Policy

Section 1: Analysis of the Market Size of China's Display Panel from 2021 to 2025

Section 2: Analysis of the Regional Structure of China's Display Panel Industry from 2021 to 2025

Section 3: Market Size of China's Display Panel Regional Market from 2021 to 2025

Market Size Analysis of Northeast China from 2021 to 2025

II. Market Size Analysis of North China Region from 2021 to 2025

III. Market Scale Analysis of East China Region from 2021 to 2025

Section 4: Analysis of Market Size in Central China from 2021 to 2025

V. Analysis of Market Size in South China from 2021 to 2025

Section 6: Analysis of Market Size in the Western Region from 2021 to 2025

Section 4: Forecast of Regional Market Prospects for Display Panels in China, 2026-2032

1. Market Outlook for the Northeastern Region from 2026 to 2032

Section 2: Market Outlook for North China from 2026 to 2032

3. Market Outlook for the East China Region from 2026 to 2032

Section 4: Market Outlook for Central China Region from 2026 to 2032

V. Market Outlook for South China from 2026 to 2032

Section 6: Market Outlook for the Western Region from 2026 to 2032

Chapter 9: Analysis of Industrial Structure Adjustment in the Display Panel Industry from 2026 to 2032 by PwC

Analysis of the Display Panel Industry Structure

1. Analysis of the Degree of Market Segmentation

II. Demand Structure Proportion in Downstream Application Fields

III. Structural Analysis of Leading Application Fields (Ownership Structure)

Section 2: Structural Analysis of the Industry Value Chain and Overall Competitive Advantage Analysis of the Industry Chain

1. Composition of the Industrial Value Chain

II. Analysis of Competitive Advantages and Disadvantages of the Industrial Chain

Chapter 10: Analysis of Competitive Advantages in the Display Panel Industry

Section 1: Analysis of Competitive Advantages in the Display Panel Industry

I. Overall Industry Competitiveness Evaluation

Evaluation and Analysis of Industry Competitiveness Results

3. Competitive Advantage Evaluation and Construction Suggestions

Section 2: Analysis of the Competitiveness of China's Display Panel Industry

Third Section: SWOT Analysis of the Display Panel Industry

1. Analysis of Advantages in the Display Panel Industry

II. Analysis of Disadvantages in the Display Panel Industry

3. Opportunity Analysis in the Display Panel Industry

4. Threat Analysis of the Display Panel Industry

Chapter 11: Analysis of Market Competition Strategies in the Display Panel Industry from 2026 to 2032

Section 1: Analysis of Overall Market Competition in the Industry

1. Competitive Structure Analysis of the Display Panel Industry

Current competition among enterprises.

2. Analysis of Potential Entrants

3. Threat of Substitutes Analysis

4. Bargaining Power of Suppliers

5. Customer Bargaining Power

6. Summary of Competitive Structure Characteristics

2. Analysis of the Competitive Landscape Among Enterprises in the Display Panel Industry

1. Competitive Landscape of Enterprises of Different Sizes

2. Competitive Landscape of Enterprises with Different Types of Ownership

3. Competitive Landscape of Enterprises in Different Regions

III. Analysis of Industry Concentration in the Display Panel Sector

1. Market Concentration Analysis

2. Enterprise Concentration Analysis

3. Regional Concentration Analysis

Section 2 Overview of the Competitive Landscape of China's Display Panel Industry

I. Overview of Competition in the Display Panel Industry

II. Analysis of Market Share of Key Enterprises

3. Analysis of the Competitiveness of Major Enterprises in the Display Panel Industry

Comparison and Analysis of Total Assets of Key Enterprises

2. Comparative Analysis of Employees in Key Enterprises

3. Comparative Analysis of Key Enterprises' Revenue

4. Comparison and Analysis of Total Profits of Key Enterprises

5. Comparative Analysis of Total Liabilities of Key Enterprises

Section 3 Analysis of the Competitive Landscape of the Display Panel Industry from 2021 to 2025

I. Trends of Major Domestic Display Panel Enterprises

II. Analysis of Proposed Projects by Domestic Display Panel Enterprises

III. Analysis of Market Concentration in China's Display Panel Industry

Section Four: Competitive Strategy Analysis of Display Panel Enterprises

Strategies to Enhance the Competitiveness of Display Panel Enterprises

Factors Affecting the Core Competitiveness of Display Panel Enterprises and Ways to Enhance It

Chapter 12: Analysis of Development Trends for Key Enterprises in the Industry by PwC

Section 1: Enterprise One

I. Company Overview and Introduction of Display Panel Products

II. Analysis of Core Competitiveness of Enterprises

3. Analysis of Major Profit Indicators of Enterprises

Section Four: Key Operating Data Indicators for 2021-2025

V. Enterprise Development Strategic Planning

Section Two: Enterprise Two

I. Company Overview and Display Panel Product Introduction

II. Analysis of Core Competitiveness of the Enterprise

3. Analysis of Key Profit Indicators of the Enterprise

Section 4: Key Operating Data Indicators for 2021-2025

V. Enterprise Development Strategy Planning

Section 3: Enterprise Three

I. Company Overview and Introduction to Display Panel Products

II. Analysis of Core Competitiveness of the Enterprise

III. Analysis of Major Profit Indicators of the Enterprise

4. Main Operating Data Indicators for 2021-2025

V. Corporate Development Strategic Plan

Section 4: Enterprise Four

1. Company Overview and Display Panel Product Introduction

II. Analysis of Core Competitiveness of the Enterprise

Section 3: Analysis of Key Profit Indicators for Enterprises

4. Main Operating Data Indicators for 2021-2025

V. Corporate Development Strategic Planning

Section Five: Enterprise Five

I. Company Overview and Display Panel Product Introduction

II. Analysis of Core Competitiveness of the Enterprise

3. Analysis of Major Profit Indicators of the Enterprise

4. Main Operating Data Indicators for 2021-2025

V. Corporate Development Strategy Plan

Chapter 13: Outlook on the Investment Prospects of the Display Panel Industry from 2026 to 2032 by Pu Hua You Ce

Section 1: Investment Opportunity Analysis of the Display Panel Industry from 2026 to 2032

1. Analysis of Typical Projects in the Display Panel Industry

Section 2: Investable Display Panel Models

Section 3: Investment Opportunities in Display Panels from 2026 to 2032

Section 2: Development Forecast and Analysis of the Display Panel Industry from 2026 to 2032

I. Industry Concentration Trend Analysis

II. Industry Development Trends from 2026 to 2032

3. Technical Development Directions of the Display Panel Industry from 2026 to 2032

4. Overall Industry Planning and Forecast for 2026-2032

The plan for the period 2026-2032 will find new growth points for the display panel industry.

Chapter 14: Analysis of the Development Trends and Investment Risks of the Display Panel Industry from 2026 to 2032 by Pu Hua You Ce

Section 1: Issues with Display Panels from 2021 to 2025

Section 2: Development Forecast Analysis for 2026-2032

1. Analysis of the Development Direction of Display Panels from 2026 to 2032

Section 2: Forecast of Development Scale for the Display Panel Industry from 2026 to 2032

III. Forecast of the Display Panel Industry Development Trends from 2026 to 2032

IV. Key Development Focus of the Display Panel Industry from 2026 to 2032

Section 3: Analysis of Industry Entry Barriers from 2026 to 2032

I. Technical Barrier Analysis

2. Analysis of Financial Barriers

3. Policy Barrier Analysis

4. Other Barrier Analysis

Section 4: Investment Risk Analysis of the Display Panel Industry from 2026 to 2032

I. Competitive Risk Analysis

2. Raw Material Risk Analysis

3. Talent Risk Analysis

Section 4: Technical Risk Analysis

V. Other Risk Analysis

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

[Today's Plastics Market] General Materials Weakly Fluctuate, Engineering Materials Steadily Rise

-

U.S. Appeals Court Officially Rules: Trump Tariff Unlawful and Void!

-

Daily Review: Polyethylene Prices Under Weak Consolidation, Sellers Face Significant Pressure to Move Inventory