New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

Image source: Tianchen Qixiang

On December 7th, China Chemical Engineering Tianchen Qixiang New Materials Co., Ltd. announced that its 200,000 tons/year adiponitrile unit has achieved full production capacity. During a 72-hour full-load performance assessment, all key technical indicators exceeded the design values. This marks the official transition of China's first industrialized production project of adiponitrile via the butadiene method into a high-efficiency and stable operation phase, breaking a technological monopoly that has lasted for half a century by foreign countries.

Source: China Chemical Engineering Corporation

As a crucial chemical raw material, every technological advancement or production capacity change in adiponitrile quickly becomes the focus of industry attention. This is not only due to its irreplaceable role as a core raw material for nylon 66 but also concerns the autonomy and cost security of the entire high-end materials supply chain. So, what key breakthroughs has China achieved in the domestic production of adiponitrile? What profound changes are currently occurring in the market landscape? This article will provide a comprehensive analysis of the path to "breaking the deadlock" for adiponitrile from multiple dimensions, including technology routes, corporate layout, and industrial impact.

1. Adiponitrile - Nylon 66The "industrial chain""Gate of Life"

Hexanedinitrile, chemically known as 1,4-dicyanobutane, is a colorless, transparent oily liquid with a slightly bitter taste. It is flammable and toxic, primarily used for the production of nylon 66, nylon 610, HDI, and other products. Among these, nylon 66 is the most important downstream application, accounting for over 70% of its consumption.

Compared to nylon 6, nylon 66 exhibits superior properties such as heat resistance, crystallinity, strength, and water absorption. It is widely used in various fields including civilian fibers, industrial fibers, engineering plastics, aerospace, and robotics. For instance, in the field of engineering plastics, nylon 66 is extensively applied in components such as automotive engines, electrical appliances, high-speed train bodies, as well as in the turbines, propeller shafts, and sliding bearings of large vessels. In the robotics field, PA66 is used in housings and coverings, joint areas, auxiliary parts of transmission systems, and insulation structural components.

Flame-retardant PA66 used in automotive connectors (Source: CHINAPLAS)

Although nylon 66 has superior performance, its market share is less than 20%. The main bottleneck is the limited supply of adiponitrile.

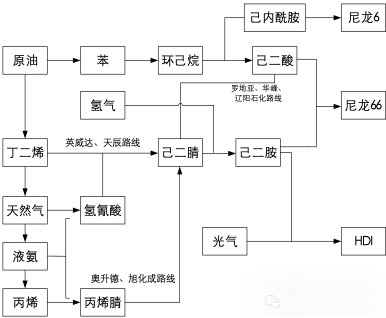

The position of adiponitrile in the industrial chain is crucial. As an intermediate, it connects upstream basic chemical raw materials (such as butadiene and acrylonitrile) with downstream high-end materials.(Source: Organized based on publicly available information)

For a long time, the production technology of adiponitrile has been monopolized by international giants such as Invista, Ascend, and BASF, leaving China's nylon 66 industry heavily reliant on imports and facing the risk of being "choked."

The success of the Tianchen Qixiang project undoubtedly injects a strong boost into the process of localization.

According to the data, the total investment in the Tianchen Qixiang New Materials Project amounts to 22.7 billion yuan, with the first phase of the project investing 10.4 billion yuan and the second phase investing 12.3 billion yuan. Both phases have been classified as "major provincial projects."

In August 2019, the foundation was laid for the Tianchen Qixiang 1 million tons/year Nylon 66 new material industrial base project. The project is planned to have an annual production capacity of 1 million tons of nylon new materials, 500,000 tons of hexamethylenediamine, 500,000 tons of hexanenitrile, and a simultaneous production of 500,000 tons of acrylonitrile.

The first phase of the project covers an area of 1,800 acres and mainly involves the construction of a 200,000 tons/year adiponitrile production facility, a 200,000 tons/year nylon 66 salt and chip production facility, and other related installations. The first phase of the project has been completed.

The second phase project covers an area of 1,300 acres and mainly involves the construction of facilities for 300,000 tons of adiponitrile and 300,000 tons of hexamethylenediamine.

Diversified technological routes are competing for layout.

In this information, Zhuan Su Shi Jie believes that what deserves more attention is the advanced technology route of Tianchen Qixiang.

The synthesis process of adiponitrile is complex, with mainstream technologies including the butadiene method, acrylonitrile electro-dimerization method, and adipic acid ammoniation method. Among them, the direct cyanation of butadiene is considered the most ideal industrial route globally due to its low raw material cost, low energy consumption, and short pathway, accounting for 65%-70% of the world's total production capacity. This process was developed by DuPont in the 1970s and includes three steps: pentenenitrile formation, isomerization, and adiponitrile preparation, with very high technical barriers.

The direct cyanation method of butadiene used by Tianchen Qixiang is currently the most mainstream and advanced process route for butadiene.

In fact, China's breakthrough in the adiponitrile process can be described as a "counterattack history." As early as the 1970s, CNPC Liaoyang Petrochemical introduced French technology, but it was shut down due to poor operation. It wasn't until 2019 that Chongqing Huafon adopted the adipic acid method to achieve industrialization of 50,000 tons per year, marking the beginning of localization. In 2022, Tianchen Qixiang successfully overcame the butadiene method technology and put it into production, making China the third country in the world to master this process. In 2025, Wanhua Chemical also obtained patent authorization for the electrolysis method.

These developments signify that China's adiponitrile technology has entered a stage of diversified innovation.

1. Butadiene method: Breakthrough in the localization of the mainstream route.

The Tianchen Qixiang project uses the direct butadiene cyanation method, which is the same as the Invista process. This method uses butadiene and hydrogen cyanide as raw materials to produce adiponitrile through catalytic reactions, resulting in high product yield and good quality. According to data, China's chemical industry produced 69,000 tons of adiponitrile in the first three quarters, with a load rate of 85%, demonstrating strong competitiveness. Additionally, Zhejiang Petrochemical's 250,000 tons/year facility also uses the butadiene chlorination method and is expected to become a production giant in the future.

2. Electrolysis: New Exploration of Green Technology

In August 2025, Wanhua Chemical was granted a patent for "A Preparation Method of Adiponitrile," which centers on adding acrylonitrile, ionic liquids, and water to an electrolytic cell and generating adiponitrile through a cathodic reduction reaction. This method innovatively employs a three-layer composite cathode material, aiming to address issues of complexity and high safety risks associated with traditional processes, highlighting its "green and efficient" advantages.

3. Shenma Group: Alternative Path to Bypassing Adiponitrile

In a departure from the traditional route, China's Pingmei Shenma Group has taken an unconventional path. In June 2025, its 100,000-ton/year adiponitrile (ASN) plant will be put into operation. The technology involves the direct production of adiponitrile through the ammoniation and dehydration of caprolactam, followed by hydrogenation to obtain hexamethylenediamine, bypassing the adiponitrile stage.

Image source: Shenma Group

This route reduces dependence on imported raw materials and provides new ideas for nylon 66 synthesis. As the largest nylon 66 salt producer in Asia, Shenma Group's move is expected to alleviate its annual demand pressure of 300,000 tons, achieving a transformation from "being controlled by others" to "leading others".

Domestic production capacity is about to explode.

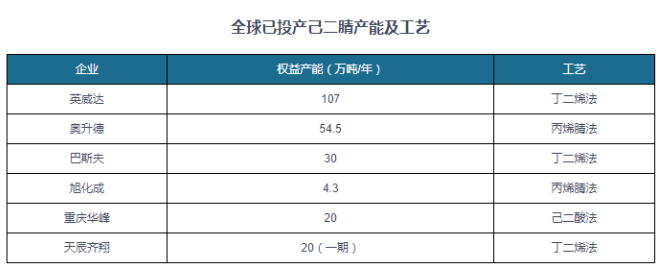

The global adiponitrile market has long been characterized by an oligopolistic structure. As of the end of 2023, the global production capacity is approximately 2.36 million tons per year, with a very high concentration: Invista has a capacity of 1.07 million tons per year, Ascend has 545,000 tons per year, and BASF has 300,000 tons per year, with these three giants accounting for over 80%. In addition, Asahi Kasei, Chongqing Huafeng, and Tianchen Qixiang have a small amount of capacity.

Source: Public information, Guanyan Tianxia

It is noteworthy that approximately 75% of global adiponitrile production capacity is integrated with downstream facilities, resulting in limited external sales and causing supply and demand tensions.

As the world's largest consumer of nylon, China's dependence on imported adiponitrile once exceeded 90%. However, since 2019, Chongqing Huafeng Chemical Company has built a production facility with an annual capacity of 50,000 tons of adiponitrile using independently developed process technology, marking the onset of the domestication era for the adiponitrile industry in China. Subsequently, China National Chemical Engineering Company developed a butadiene-based process technology and established a production facility with an annual capacity of 200,000 tons in 2022. This not only changed the competitive landscape of the industry but also signifies that the domestic adiponitrile sector has entered a rapid development phase after years of dormancy.

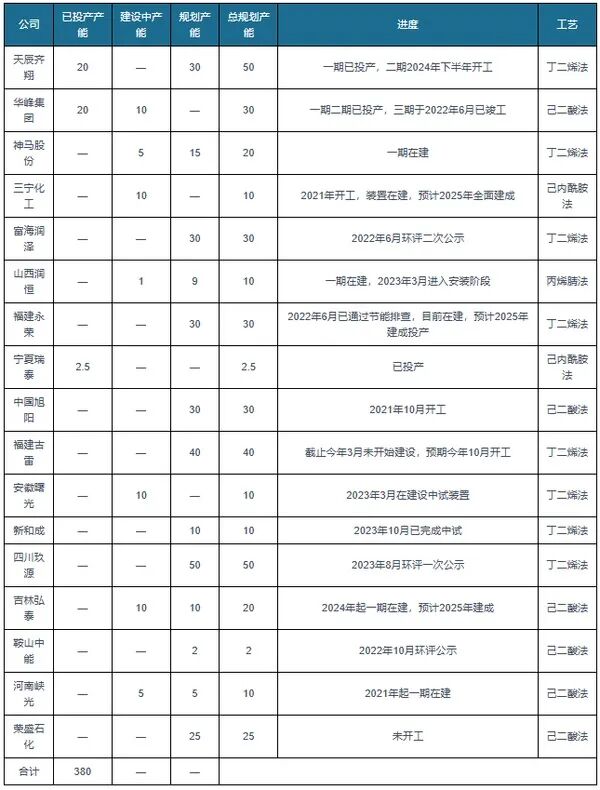

The breakthrough in domestic technology is attracting more and more local companies to enter the adiponitrile industry. Between 2020 and 2024, as many as 22 local companies announced plans to build adiponitrile production facilities. Among these companies are those with years of technical accumulation in the adiponitrile industry chain, such as Henan Shenma Industry, PetroChina Liaoyang Petrochemical, Runheng Chemical, and Rongsheng Petrochemical.

Currently, China has established production capacities such as Tianchen Qixiang (200,000 tons) and Chongqing Huafon (200,000 tons). The capacity under construction and planning is astonishing: according to incomplete statistics, there is an additional 510,000 tons under construction (such as the new material industry chain project of Tianjin NHU Materials Technology Co., Ltd.), and 2.86 million tons in the planning stage. If all are realized, China's total capacity will reach 3.8 million tons per year, equivalent to 1.6 times the global capacity in 2022, potentially completely rewriting the market landscape.

China's Adiponitrile Capacity Expansion Plan (Unit: 10,000 tons/Year, Source: Organized by Guanyan Tianxia

Market competition will intensify accordingly. In the short term, pioneers like Tianchen Qixiang will gain an advantage due to their technological strengths; in the medium to long term, the entry of giants like Wanhua Chemical and Zhejiang Petrochemical may trigger a price war.

On the other hand, capacity release will reduce downstream costs and promote the widespread application of nylon 66. For example, the demand for automotive lightweighting is increasing, and new energy vehicles have a strong demand for high-end materials, making the localization of adiponitrile timely.

In terms of regional layout, projects are concentrated in chemical bases such as Shandong, Chongqing, and Henan, forming an industrial cluster effect. Meanwhile, stricter environmental policies are pushing companies to transition to green processes, such as Wanhua Chemical's electrolysis method, which emphasizes low energy consumption and aligns with the dual carbon goals.

4. The outlook for localization is promising, and the security of the industrial chain can be expected.

The full production capacity of the Tianchen Qixiang project is undoubtedly a milestone in China's journey toward the localization of adiponitrile. It not only signifies a breakthrough in a single technology but also symbolizes the increasingly mature independent innovation system in China's high-end chemical materials sector. From the past predicament of being "choked" to today's prosperous situation with multiple technological routes advancing concurrently, the resilience of China's nylon industry chain is being enhanced like never before.

Looking ahead, the wave of domestic production of adiponitrile will bring about three profound impacts:One, ensuring the security of the industrial chain.With the continuous release of domestic production capacity, the production of downstream high-end materials such as nylon 66 will completely eliminate dependence on imported raw materials, thus establishing a solid foundation for the safety and stability of key national industries.Secondly, activate the downstream application ecosystem.The reduction in raw material costs and the improvement in supply stability will greatly promote the widespread use and innovative application of nylon 66 in fields such as automotive lightweighting, electronic information, and specialized apparel, providing material support for the upgrade from "Made in China" to "Intelligent Manufacturing in China."Third, reshape the global competitive landscape.The collective breakthrough of Chinese enterprises is changing the oligopolistic structure of the global acrylonitrile market. In the future, leveraging its vast domestic market, complete industrial system, and advantages in technological iteration, China is expected to shift from being a follower of the rules to becoming an important participant and even a leader.

Of course, the road ahead is not without its challenges. Continuous technological optimization, increasingly intense market competition, and tightening environmental requirements are all long-term challenges that enterprises must face. However, looking at the overall situation, the domestic adiponitrile industry has entered a fast track of development, with a bright future ahead. This industrial leap from being "dependent on others" to "self-controllable" will not only reshape the nylon industry chain but will also make a significant contribution to the high-quality development of China's chemical industry.

Edited by: Lily

Material sources: Wind, China Chemical Announcement, Olefins and High-end Downstream, Guanyan World, Zhuangsu Vision, Chinaplas International Rubber and Plastics Exhibition, etc.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

[Today's Plastics Market] General Materials Weakly Fluctuate, Engineering Materials Steadily Rise

-

U.S. Appeals Court Officially Rules: Trump Tariff Unlawful and Void!

-

Daily Review: Polyethylene Prices Under Weak Consolidation, Sellers Face Significant Pressure to Move Inventory