Wey, Jiayue, and HiPhi Are Set to Make a Comeback

By December 2025, the market penetration rate of new energy vehicles has exceeded 50%. In the fierce market competition, leading car manufacturers, leveraging their advantages in technology, channels, and brand, have captured over 70% of the market share, pushing most small and medium-sized brands to the brink of survival.

Image / New Energy Vehicle Penetration Rate Trend from January to October 2025 Source / Internet New Energy View Screenshot

However, some newly established car brands that have gone bankrupt or suspended operations still have not given up on the idea of "coming back to life."

WM Motor and Ji Yue have successively announced new developments, either registering new companies or starting legal procedures to regroup and revitalize.Earlier, HiPhi Motors also took substantial steps on the path to "revival" by establishing Jiangsu HiPhi Company and restarting its after-sales service system.

However, it cannot be ignored that these brands failed to establish a strong foothold and enter the final competition in the industry during earlier years when the market environment was more lenient. Nowadays, the speed of product iteration and the level of technological innovation in the new energy vehicle industry are vastly different from before. Whether it is the upgrade of the three-electric systems, breakthroughs in intelligent driving, or the increased demands of users for service experience, they all represent generational differences compared to the past.

In this context, the difficulty for these "suspended brands" to successfully "revive" is imaginable.

"Dead" but wanting to "live": The new car brands.

Recently, new car brands that have "died" but want to "live" again have been making frequent moves.

According to the Tianyancha app, on November 27, Zhima Hang (Wenzhou) New Energy Vehicle Sales Co., Ltd. was established with a registered capital of 200 million RMB. Its business scope includes the sales of complete new energy vehicles, sales of new energy vehicle electrical accessories, and automobile sales, among others.

Image / Zhima Xing (Wenzhou) New Energy Vehicle Sales Co., Ltd. Established Source / Internet New Energy View Screenshot

It is noteworthy that, according to shareholder information, the company is wholly owned by WM Motor Technology Group Co., Ltd.

This is not the first time WM Motor has shown signs of "coming back to life" this year.

On November 3rd, WM Motor posted on their official account stating "Good things are coming, please stay tuned," along with a picture that read "What you think of will come to pass" (now deleted). Two days later, they announced that the "Little Wei Companion App is back online starting today," and the features such as Bluetooth car control, remote car control, and Bluetooth key are now restored.

Image / WM Motor announces the re-launch of the Xiaowei Suixing APP Source / Screenshot from Internet New Energy View

Previously, Weima Automobile's restructuring investor Shenzhen Xiangfei Automotive Sales Co., Ltd. (hereinafter referred to as Shenzhen Xiangfei) released a "White Paper to Suppliers" (hereinafter referred to as the "White Paper") through Weima Automobile's official WeChat account, announcing plans for the new company. The plan is to introduce more than 10 new products to the market over the next five years, catering to the diverse needs of the global market.

A series of actions all demonstrate WM's determination to "revive." Coincidentally, also in November,Due to the uproar caused by the "sudden explosion" incident, Jiyue also had the idea of a "revival."

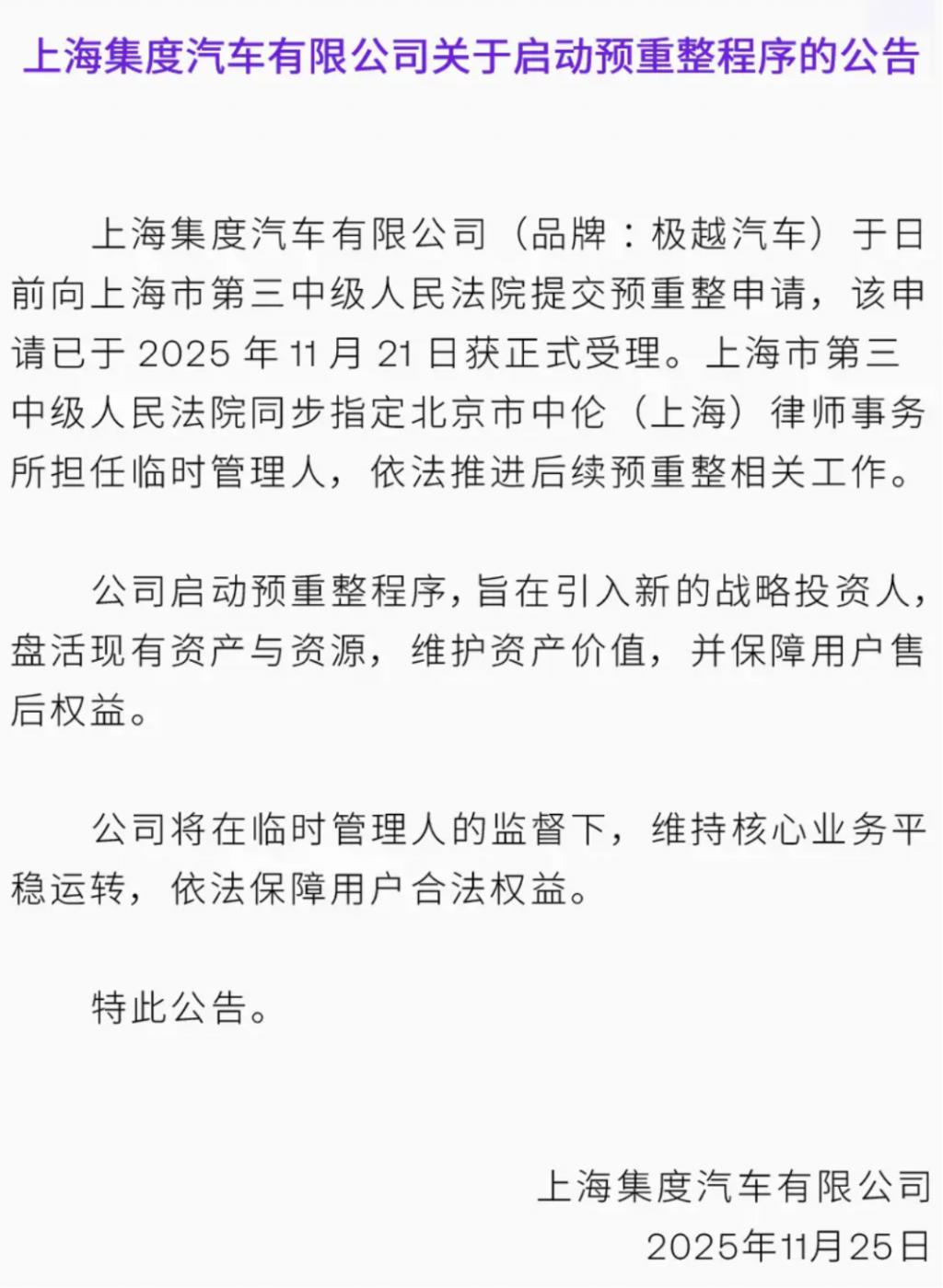

According to Jiyue Auto, Shanghai Jidu Automotive Co., Ltd. announced on November 25 that the company recently submitted a pre-restructuring application to the Shanghai Third Intermediate People's Court, which was officially accepted on November 21, 2025.

Image / Jidu Auto to initiate pre-restructuring process Source / Internet Screenshot of New Energy View

In addition, according to information from Tianyancha, a company named "Jiangsu Gaohe Automobile Co., Ltd." was established in May this year, with a business scope covering the production of new energy vehicles and the research and development of components in core areas. In its shareholder information, Gaohe's parent company, Human Horizons, holds a 30.2% stake. On September 27, the manager of Nezha's parent company, Hozon New Energy, officially released an announcement disclosing the results of the public recruitment of restructuring investors.

Image / Jiangsu HiPhi Automobile Co., Ltd. established Source / Internet New Energy View Screenshot

In fact, whether it is WM Motor, Neta, Zeekr, or HiPhi, it is not difficult to understand the frequent rumors of revival surrounding these car companies that have gone bankrupt.

An industry insider pointed out thatCompanies like WM Motor, Jiyue, and HiPhi are collectively "reviving" for fundamental reasons. On one hand, these car manufacturers possess scarce assets such as production qualifications and intelligent driving technology, making the cost of resource reuse far lower than that of new startups. On the other hand, although the current new energy vehicle market is fiercely competitive, there are still incremental gaps in niche segments, allowing car companies to leverage their advantages for differentiated positioning.

For example, WM Motor has complete production qualifications. In September, a person related to WM mentioned that the Wenzhou base has indeed resumed production and is currently in the stage of ramping up production before mass production. Jidu, backed by Baidu and Geely, has both a mature industrial chain and a considerable competitive advantage in intelligent driving. As for HiPhi, it has been labeled as "high-end" since its inception. In 2021, HiPhi X sold 4,237 units, surpassing the Porsche Taycan to become the sales champion of electric vehicles with over 500,000 units.

If they resume work and production, who would be the happiest?

The industry insiders further emphasized that the core logic behind the automotive companies' initiation of the "revival" process lies in the high alignment of strategic demands from enterprises, investors, and partners, ultimately forming a collaborative force that promotes the "revival.""Whether it is the shareholders or the local government departments deeply involved, they are unwilling to let their previous investments go to waste. Instead, they hope to revitalize existing assets—especially the core factory capacities and vehicle manufacturing qualifications—to achieve a secondary utilization of resources."

Before entering bankruptcy proceedings, data shows that WM Motor had accumulated over 40 billion RMB in financing, setting a record for new car brands at one point. Its lineup of investors included top industry star institutions such as Baidu, Tencent, and Sequoia Capital, highlighting the significant investment of funds and resources.

Compared to WM Motor, Ji Yue, which is also caught in the predicament of "exploding thunder," has a more dazzling "capital halo" behind it. Whether it was Jidu Auto when Baidu was the largest shareholder or the subsequent Ji Yue brand after transitioning to Geely Holding due to qualification adjustments, it is no exaggeration to say that Ji Yue has been regarded by the industry as a typical "second-generation rich" in the new car manufacturing field since its inception.

As early as 2022, the brand, which was still operating under the name Jidu Auto at the time, successfully completed an A-round financing of nearly 3 billion RMB. Baidu will invest over 150 billion RMB in research and development of its Apollo autonomous driving core technology to empower Jidu without any charge, while Geely will open its SEA platform and vehicle production capacity.

If these new car brands completely exit the market, it means that the previous investments amounting to tens of billions will completely become "sunk costs."In addition, local state-owned assets have high hopes for these car companies, expecting that their "revival" will continue to drive the collaborative development of the local industrial chain, assist in the cultivation and growth of the new energy vehicle industry cluster, and thereby inject momentum into local tax revenue growth and employment stability.

From this, it can be seen thatNew car brands eager to try their luck on the "Resurrection" track, once successfully rebooted, will create a situation of mutual benefit for multiple parties, rather than just a single entity reaping the rewards.

In addition to the urgent demands of the capital side, the smooth "revival" of car companies is more directly related to the vested interests of the existing car owner community.

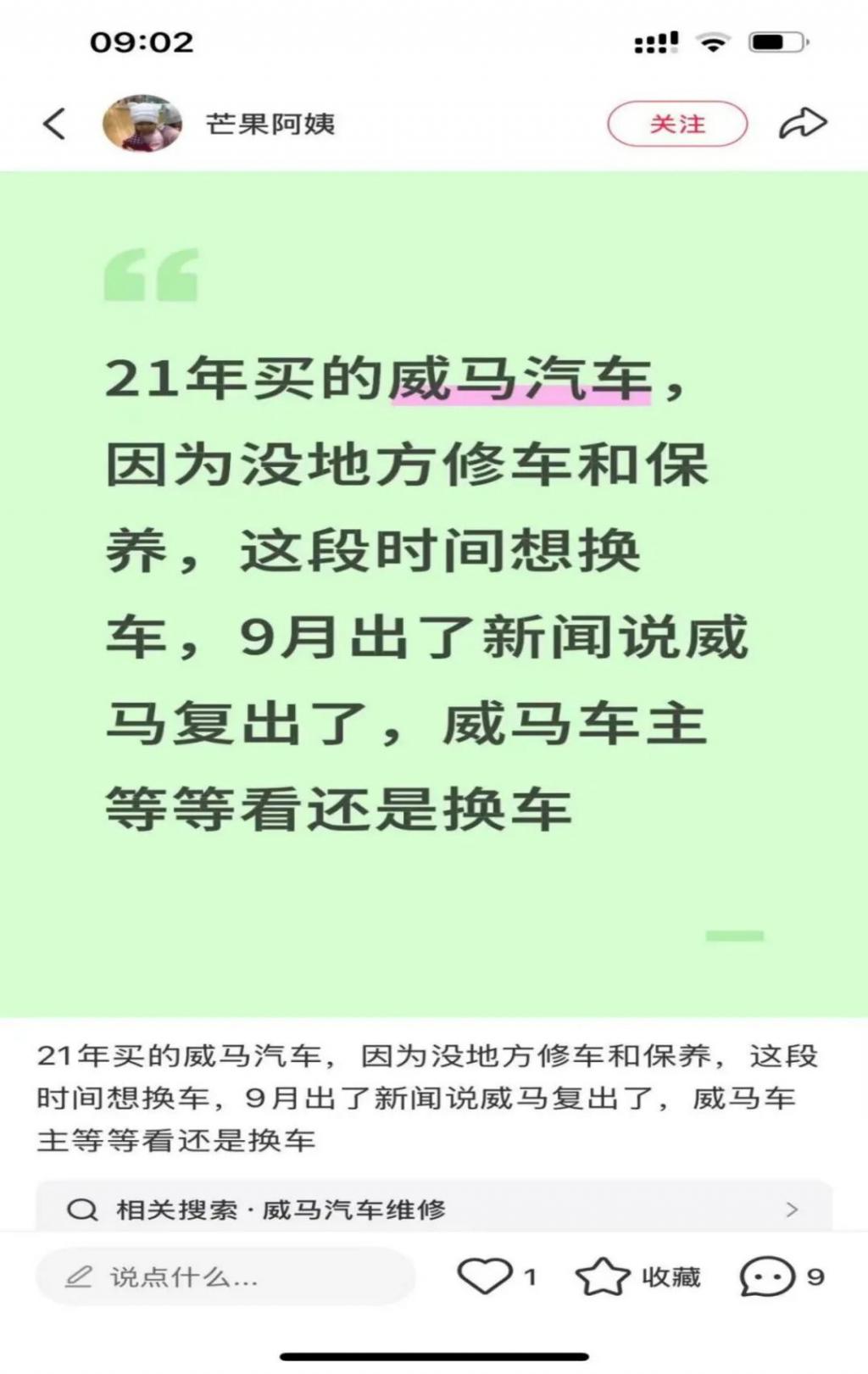

On the Xiaohongshu platform, a WM Motor owner candidly said: "I bought a WM Motor in 2021, and because there's no place for repairs and maintenance, I've been considering changing cars. In September, there was news that WM Motor is making a comeback. Should WM Motor owners wait and see or change cars?"

Image / WM Motor Owner Attitude Source / Internet Screenshot from New Energy Perspective

Another WM car owner mentioned, "Besides, the trust of 100,000 old car owners, WM's car manufacturing qualifications, and the accumulated market reputation are all extremely valuable. Rather than seeing the brand go bankrupt and liquidated, I would rather see WM return to the competitive track. I believe all users who have consistently supported WM are also looking forward to the reboot of this car company."

It is not difficult to see from the car owners' remarks that they have a strong expectation for the "revival" of the car companies.After all, if car manufacturers exit the market, the core rights of car owners, such as after-sales maintenance support, insurance coverage, and system updates for in-car technology, will be severely impacted, potentially leading to a situation where no one is held responsible.

A HiPhi car owner shared on Xiaohongshu that the annual insurance cost for their HiPhi X has exceeded 9,000 yuan. Not only is the premium high, but mainstream insurance companies like PICC also refuse to provide collision coverage for it. Another HiPhi owner lamented, "Without collision coverage, I have to be extra cautious while driving, fearing any bumps or scratches."

Will anyone still pay for them?

Objectively speaking, the likelihood of brands that have been abandoned by the times successfully rebooting is extremely low.

Multiple industry insiders have stated frankly,"These brands, when they first entered the market, held multiple advantages of timing, location, and human factors, receiving capital enthusiasm and technological empowerment, while coinciding with the explosive growth period of the new energy vehicle market. Despite possessing such advantages, they still failed to establish a firm foothold in the market."

Indeed, relying on "cost performance + first-mover advantage," WM Motor saw the mass production and delivery of its first model, the EX5, in 2018. In 2019, the WM EX5 surpassed NIO's ES8 with sales of 16,000 units, becoming the champion of single pure electric SUV sales. However, in the end, it faced bankruptcy due to issues with product strength and blind expansion.

JiYue, backed by the dual endorsements of "Baidu Intelligent Driving + Geely Manufacturing," had high expectations for its first model, JiYue 01. However, after its launch, the brand's positioning was vague, failing to highlight Baidu's technological advantages or leverage Geely's channel resources.

Gaohe, labeled as "high-end intelligence," gained attention at the initial launch of HiPhi X with innovative features such as "digital mecha" design. However, the price exceeding 600,000 yuan limited its audience, and the follow-up products were slow to come, ultimately leading to a broken cash flow and a forced suspension of deliveries.

The industry competition has already reached a fever pitch, with the speed of technological iteration and product upgrades far surpassing the past. Re-entering the market relying solely on three-year-old technology reserves and product architecture is tantamount to using the old against the new, the weak against the strong, greatly reducing the odds of a successful breakthrough.

According to data from the China Association of Automobile Manufacturers, from January to October 2025, China's automobile production and sales reached 27.692 million units and 27.687 million units, respectively, representing year-on-year growth of 13.2% and 12.4%. Among them, passenger car production and sales were 24.237 million units and 24.209 million units, respectively, with year-on-year growth of 13.5% and 12.9%. The sales of new energy vehicles accounted for 46.7% of the total new car sales.

The increasingly saturated market capacity has put a lot of pressure on many car manufacturers still "fighting" in the market, making it difficult for them to move forward.

What's more challenging is that these car companies that have already stopped operating, if they want to return to the market, can only rely on technology and products from several years ago to directly compete with the advanced technology and iterative products of current mainstream car companies, with almost no chance of winning.

After all, the current competition among car manufacturers has long transcended simple price wars, shifting towards a higher-dimensional comparison of value, where product strength, core performance, and intelligent experience have all become key considerations in consumers' car purchasing decisions.

During the 2-3 years when companies like WM Motor and HiPhi were stagnant, mainstream new energy vehicle technology underwent a "generational upgrade"—configurations such as the 800V high-voltage platform, 5C fast charging, and urban NOA have gradually become industry standards. In contrast, these "revived" companies are still stuck at the 400V platform and older chips, showing a clear technological gap compared to market leaders.

Image / 800V Fast Charging -- 5C Super Charging -- City NOA Source / Internet New Energy Observer screenshot

Furthermore, an undeniable key issue is: even if these already bankrupt car companies "revive," how many consumers would be willing to pay for them?

Mr. Li, a WM Motor owner, might have a representative viewpoint: "Although I am willing to see WM Motor resume work and production, I will definitely buy my next car from a leading brand automaker."

When Aian UT super rolls out a battery-swapping model with a 500 km range priced at 50,000 yuan, when Leapmotor A10 offers advanced intelligent driving features with lidar for under 100,000 yuan, when large six-seat SUVs are priced at the 150,000 yuan level, and when integrated body casting technology and intelligent cockpit panoramic interaction become standard features, how will the "revived" "WM Motor" respond?

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

[Today's Plastics Market] General Materials Weakly Fluctuate, Engineering Materials Steadily Rise

-

U.S. Appeals Court Officially Rules: Trump Tariff Unlawful and Void!

-

Daily Review: Polyethylene Prices Under Weak Consolidation, Sellers Face Significant Pressure to Move Inventory