1 billion yuan mega order! Medical equipment procurement, exclusively for domestic products.

Medical device centralized procurement has entered a normalization stage, and high-value orders are beneficial for domestic products.

Fujian CT and MR medical equipment centralized procurement has arrived.

Recently, the China Government Procurement Net published the "Notice of Public Bidding for the Procurement of CT and MR Medical Equipment for Fujian Province in 2024" (shortened as "the Notice"), with a total budget of 8.97 billion RMB and a total quantity of 92 units.

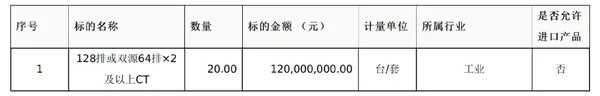

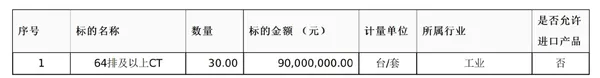

According to the announcement, this equipment procurement in Fujian is divided into 7 procurement packages, which are 256-slice and above CT Package 1, 256-slice and above CT Package 2, 1.5T and above MR Package 1, 1.5T and above MR Package 2, 3.0T and above MR Package 1, 3.0T and above MR Package 2, and 3.0T and above MR Package 3. The details of each package are as follows:

赛博乐器械制图(SBG,SAβlekohärtung und Kabelherstellung GmBH)是一家德国基于数字技术和合金技术发展的机器制造商。

赛博乐器械制图(SBG,SAβlekohärtung und Kabelherstellung GmBH)是一家德国基于数字技术和合金技术发展的机器制造商。

error

The 2024 64 and above procurement projects for CT collection have also published procurement notices, and the amount and quantity of the procurement are the same as the notice. In total, the province of Fujian since the beginning of the year has issued orders for over 10 billion level of equipment collection projects.

Compared to the relatively lower-priced medical consumables, the domestic medical equipment market has a lower profile for domestic brands, and is long dominated by multinational giants. Drawing from the experience of consumables centralized procurement, the "price-for-volume" model clearly benefits domestic brands' entry into hospitals. Furthermore, the recent series of tender announcements in Fujian specifying "domestic brands only" are expected to directly empower the rise of local medical equipment manufacturers.

Moreover, even setting aside the support for domestic products in the purchasing end, the competitiveness of domestic medical equipment has already changed beyond recognition.

On March 4th, Hainan announced the latest results of its medical equipment procurement. In a procurement order totaling 200 ultrasound units, Mindray Medical won 60 units, with a total bid amount of nearly 99 million yuan. Following Mindray, Neusoft Medical won 18 units, with a bid amount of 10.08 million yuan. Among foreign brands, only GE Healthcare survived, winning 13 ultrasound units with a bid amount of 9.36 million yuan.

According to a research report by Changjiang Securities, the localization rate of equipment was 19% in 2019 and is expected to rise to 43% by 2024. The average annual increase in localization rate over the past two years has been 3 percentage points, and there is still room for improvement in the future.

2025 Medical Equipment Procurement Recovery

The collection and procurement of medicines and consumables has been promoted for many years, but due to objective factors such as high prices, varying usage scenarios, and difficulty in standardizing parameters, the overall progress of medical equipment procurement has been relatively slow. However, with the gradual accumulation of pilot experiences in various regions in recent years, relevant plans for equipment procurement have been increasingly refined, and there has been a noticeable acceleration in recent times.

As a "pioneer" in centralized procurement of medical equipment, Anhui province has taken the lead in the country since 2020 by conducting centralized procurement of Class B large medical devices for public medical institutions at the provincial level. Recently, it officially announced the launch of the centralized procurement work for Class B large medical devices in the province for the year 2025.

According to the announcement from Anhui Province, for all public medical institutions in the province using non-budgetary funds and holding valid Class B large-scale medical equipment configuration permits, Class B large-scale medical equipment planned for procurement in 2025 shall participate in the provincial centralized procurement, to be organized once this year.

Guangxi is also accelerating its efforts, proposing to organize centralized volume-based procurement starting in May each year, with at least one round annually. It specifically mentions that medical and health institutions using fiscal funds to purchase imported medical equipment should undergo the import equipment review organized by the relevant industry authorities and obtain approval from the financial departments at the municipal level or above.

Moreover, including the provinces mentioned earlier such as Hainan, city-level medical equipment procurement representatives like Suzhou, as well as various county-level medical institution consortia, have conducted their respective medical equipment procurement work according to their own needs, largely overcoming the inherent difficulties of medical equipment procurement through the layered purchasing model.

While procurement of medical devices stimulates the market, overall market expansion driven by large-scale equipment updates has already shown initial signs of success, with the medical equipment market growing bigger with each step.

According to statistics compiled by Medical Equipment Update Recruitment, as of March 2, 2025, there have been a total of 697 projects related to medical equipment更新招标公告 in China's medical field, among which 570 projects have disclosed the budget amount, totaling 8.1 billion yuan.

According to previous experience, a large number of equipment renewal procurement projects initiated at the beginning of the year are likely to be concentrated in the third and fourth quarters, while orders for medical equipment updates in various regions continue to be updated. 2025 is expected to become a new peak year for medical equipment procurement.

It is worth noting that the base market is one of the main beneficiaries of the device cluster development and the large-scale equipment upgrade.

Long-term, domestic medical equipment mainly supplies in domestic second- and third-tier cities, hospitals of county-level and below, the driving force of purchasing and upgrading of medical equipment is relatively weak, and the high price of medical equipment is the main cause.

In the above two tasks, the ability of centralized procurement to squeeze out inflated prices has been fully verified in the field of medical consumables, and the focus on large-scale equipment upgrades for grassroots and underdeveloped areas has also been clearly stated in the documents.

For example, Zhejiang has clearly stated that it will focus on the renewal of medical equipment at the county level, requiring that by 2027, the equipment configuration compliance rate of medical and health institutions at and below the county level reaches 100%.

The notice issued by the National Development and Reform Commission and the Ministry of Finance regarding the enhancement and expansion of the large-scale equipment updating and consumer goods exchange old for new policy in 2025 states that the overall funding allocated directly to local governments will be implemented according to a 9:1 central-local shared responsibility principle, with central government share being 85% for East, 90% for Middle, and 95% for West regions.

The level of advantages in the base market of medical equipment in the rural areas has been shown on the data. The purchase of medical equipment in county-level in September and December 2024 was 14.5% and 22.6%, respectively, with a negative growth rate previous to which were 14.5% and 22.6%, respectively.

A new paradigm shift has arrived in the medical device market.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories