Another veteran home appliance company goes bankrupt, the OEM dilemma under industrial clustering

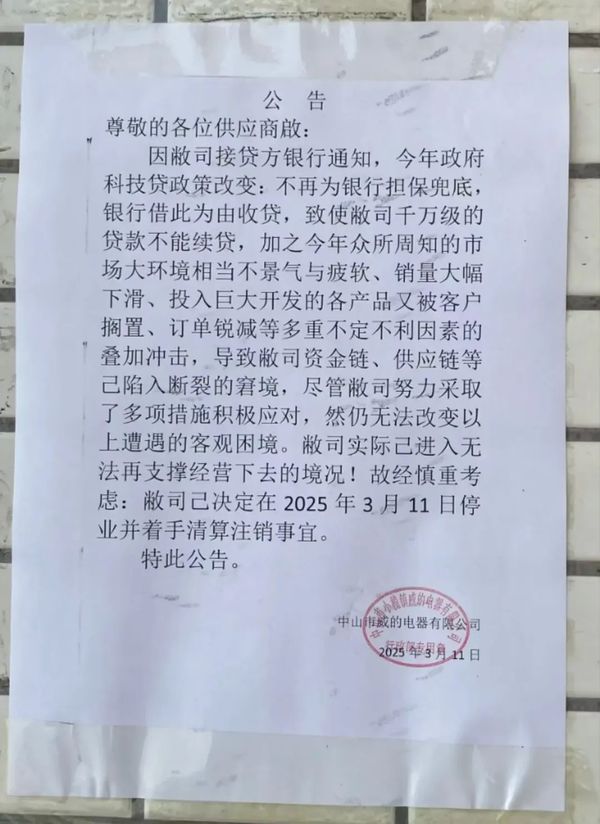

On March 11, Zhongshan Weidi Electric Co., Ltd. announced its closure and liquidation, marking the official end of this well-established home appliance company with over twenty years of history. Weidi Electric had deep cooperation with Midea Group and, at its peak, employed several hundred people, gaining significant recognition in the small appliance industry. Its closure and liquidation evoke a sense of regret. The company's downfall not only reveals the fragility of the traditional OEM model but also reflects the survival challenges faced by the Chinese home appliance industry amid the wave of transformation towards intelligence and branding.

The double-edged sword of OEM: success lies in OEM, failure also lies in OEM

Since its establishment, Wei's Electric Appliances has focused on OEM manufacturing as its core business, producing soy milk makers, juicers, electric ovens, and other small appliances for various domestic and international brands. At its peak, the company had hundreds of employees and a monthly production capacity of over 200,000 units. However, the excessive reliance on the OEM model has resulted in the company being stuck at the low end of the industry chain for a long time.

V-Dome Electric, despite owning hundreds of patents, failed to incubate its own brand, missing the opportunity to enhance profits through brand premium. In recent years, the profit margins of OEM companies have been severely squeezed, with OEM profit rates generally below 10%. Brand owners, who control pricing power and market channels, left V-Dome Electric with weak bargaining power. Especially in 2024, external shocks such as rising raw material costs and fluctuations in overseas orders hit OEM companies the hardest. Additionally, a client's cancellation of a new product order after paying a deposit resulted in V-Dome Electric losing its prior R&D investment, leading to a rapid break in its cash flow.

From the perspective of Wei's Electrical Appliance's own situation, the break in the capital chain was a direct and important reason for its collapse. Capital is like the lifeblood of a company; once the capital chain breaks, the company struggles to operate. Banks consider the company's product sales and the healthy state of its operations when providing continuation loans. When sales plummet, and the products into which the company has invested heavily are shelved due to customer issues—for example, customers only pay a deposit, and after the company invests a large amount of capital in development, the customers no longer place orders—this leads to a significant occupation of the company's funds, preventing normal cash flow.

The impact and challenges of the clustering of the home appliance industry on small and medium-sized brands.

Amid the wave of global economic integration and industrial upgrading, the cluster-based development of China's home appliance industry has become increasingly prominent, forming representative industrial clusters in regions such as Guangdong, Shandong, and Zhejiang. Leveraging advantages like economies of scale and industrial chain synergy, these clusters have played a pivotal role in propelling China's home appliance industry onto the global stage. However, behind the vigorous growth of industrial clustering, small and medium-sized home appliance brands are facing unprecedented challenges and pressures.

In the process of industrial cluster development, large home appliance companies leverage their strong financial resources to continuously increase R&D investments, leading the trend of technological innovation in the industry. Taking the smart home appliance clusters in Qingdao and Guangfohui as examples, leading enterprises such as Haier and Midea not only have their own R&D centers but also collaborate with universities and research institutions, investing substantial funds annually in the development of new technologies and products. In contrast, smaller brands, due to limited financial resources, struggle with inadequate R&D funding and find it difficult to compete with major players in terms of technology.

The formation of industrial clusters has attracted a large number of suppliers and supporting enterprises. Large home appliance enterprises, leveraging their scale advantages and market position, can establish long-term stable cooperative relationships with suppliers, securing high-quality raw material supplies, more favorable prices, and priority delivery rights. In supply chain management, large enterprises can also optimize supply chain processes through digital means, achieving zero inventory management and reducing costs. Small and medium-sized brands, due to their small procurement volumes, are often at a disadvantage when negotiating with suppliers, not only facing higher procurement costs but also potential instability in raw material supplies. Once raw material prices fluctuate, it is difficult for small and medium-sized brands to absorb the cost pressure, forcing them to compress profit margins and even affecting normal product production.

In the context of industrial cluster development, small and medium-sized brands in China's home appliance industry are facing impacts from multiple aspects such as technology, brand, supply chain, and channels. To survive and develop in the fierce market competition, these small and medium-sized brands must recognize their own advantages, seek differentiated development paths, strengthen technological innovation and brand building, optimize supply chain management, expand sales channels, and enhance their core competitiveness. At the same time, the government and industry associations should provide more support and guidance to small and medium-sized brands, create a fair competitive market environment, and promote the healthy and sustainable development of China's home appliance industry.

The cessation of operations, liquidation, and deregistration of Zhongshan WeiDi Electric Appliance Co., Ltd. is an isolated case, yet it also epitomizes the structural conflict between the traditional OEM model and the era of intelligent technology. China's home appliance industry is undergoing brand clustering, with the "Matthew Effect" brutally filtering participants through its elimination mechanism. Only by breaking free from the shackles of OEM and embracing innovation and transformation can enterprises remain invincible in the wave of "digital intelligence."

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Overseas Highlights: PPG Establishes New Aerospace Coatings Plant in the US, Yizumi Turkey Company Officially Opens! Pepsi Adjusts Plastic Packaging Goals

-

Abbott and Johnson & Johnson: Global Medical Device Giants' Robust Performance and Strategies Amid Tariff Pressures

-

BYD releases 2024 ESG report: Paid taxes of 51 billion yuan, higher than its net profit for the year.

-

Behind pop mart's surging performance: The Plastics Industry Embraces a Revolution of High-End and Green Transformation

-

The price difference between recycled and virgin PET has led brands to be cautious in their procurement, even settling for the minimum requirements.