Chemical Bulk Commodities: With U.S. "Reciprocal Tariffs" Imminent, How Will the Domestic Chemical Market Respond?

Introduction: U.S. President Trump is expected to announce "reciprocal tariffs" on April 2. Industry analysts have summarized three main scenarios and their corresponding market impacts. First, if only reciprocal tariffs are announced, the market reaction may be relatively limited. Second, if reciprocal tariffs are combined with a value-added tax (VAT), the U.S. dollar index could immediately rise by 50–100 basis points, and global stock markets may also decline. Third, if industry-specific tariffs are added on top of reciprocal tariffs and VAT, the market reaction could be even more severe. How will the domestic chemical market respond in such a scenario?

Overseas Macro: Global Attention on April 2nd U.S. "Reciprocal Tariffs"

Since taking office, the actual tariff policies implemented by Trump: The Trump administration has imposed an additional 20% tariff on China, a uniform 25% tariff on steel and aluminum products, and additional tariffs on Mexico and Canada. On March 26, Trump also signed a proclamation announcing a 25% tariff on imported automobiles and certain parts.

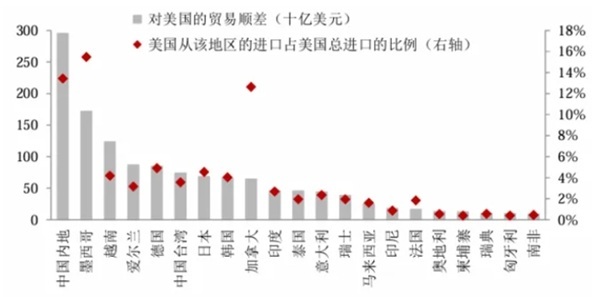

Trump is expected to announce "Reciprocal Tariffs" on April 2. Industry analysis suggests three key aspects to watch regarding the reciprocal tariffs: the scope of targeted countries, the tariff rates, and whether there are any exemptions. Trump's reciprocal tariffs primarily target economies that impose high tariffs on the U.S. and account for a significant share of trade. These may include Ireland, Germany, Italy, France, Switzerland, Japan, South Korea, India, Vietnam, Malaysia, Canada, Mexico, China, and other countries and regions.

The 20 countries and regions with the highest trade volume with the United States.

Data source: publicly available information

The industry has summarized three main scenarios and their corresponding market impacts: The first scenario is the announcement of reciprocal tariffs only, which would lead to a relatively limited market reaction; the second scenario is reciprocal tariffs plus Value-Added Tax (VAT), under which the US Dollar Index might immediately rise by 50 to 100 basis points and the global stock market might also fall; the third scenario includes sector-specific tariffs in addition to reciprocal tariffs and VAT, and the market reaction in this scenario might be even more intense.

Under the shadow of Trump's tariff policies, international trade is moving further down the path of deglobalization. Countries around the world may introduce more protectionist measures, hindering multilateral trade cooperation and further exacerbating global economic uncertainty.

This week, the bulk commodity market experienced frequent fluctuations.

From Monday to Thursday, the OPEC+ compensation production cut plan was announced, coupled with increased U.S. sanctions on Iran, leading to expectations of tight supply and strong support for oil prices. International crude oil prices rose consecutively, approaching the $70 mark. However, on Friday, concerns that Trump's tariff policies could disrupt supply chains and exacerbate global economic uncertainty caused international crude oil prices to retreat again.

The new round of U.S. tariff policies has heightened market concerns over global trade friction, leading to a significant surge in gold prices this week. As of the close on March 28, spot gold rose by 0.94% to $3,084.33 per ounce, while COMEX gold futures increased by 0.88% to $3,118 per ounce, both hitting record highs.

Chemical bulk: Spot market continues weak trend this week, futures only hold for two days

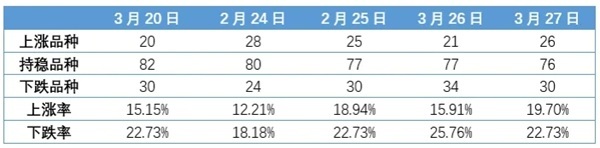

According to data monitoring by Jinlianchuang, in the domestic chemical spot market, from last week to this week, the overall market showed little change, continuing the weak trend observed since March.

Data source: JLC

From the perspective of the domestic chemical futures market, the chemical market closed this week with gains mainly on Monday (March 24) and Thursday (March 27). However, this upward trend only held for two days, as the market shifted back to a decline-dominated performance by Friday (March 28).

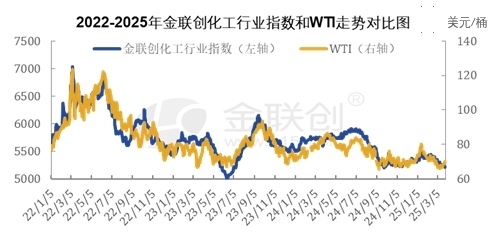

Data Source: Jin Lian Chuan (Gold Union Creation)

As shown in the above figure, according to the monitoring of the chemical industry index by Jinlianchuang, as of March 28, the chemical market and international crude oil trends have diverged significantly this week. International crude oil continued to strengthen above 69 but closed lower on March 28, although it did not break below 69. During the same period, the chemical industry index has been fluctuating downward around the 5200 mark and has now refreshed the new low since 2025.

The market has certain expectations regarding the direction and magnitude of tariffs, and the short-term impact on the chemical market is relatively limited.

Industry analysis suggests that the U.S. is likely to continue imposing tariffs on China, but the extent of the increase will likely not exceed expectations, with the primary aim being to exert pressure. Trump's core objective is to drive the reshoring of manufacturing. Currently, the actual implementation of tariff policies remains limited, and it is expected that the current tariff policies will remain highly uncertain, requiring ongoing monitoring of subsequent developments and reactions from all parties.

In the face of this situation, export-oriented enterprises need to promptly adjust their production and strategies to mitigate risks. In the short term, the market has certain expectations regarding the direction and extent of tariffs, which limits the impact on chemical product prices; however, over the long term, this could lead to a decline in demand for chemical products exported to Europe and America. Enterprises will need to consider transformation or seek new sources of revenue.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Overseas Highlights: PPG Establishes New Aerospace Coatings Plant in the US, Yizumi Turkey Company Officially Opens! Pepsi Adjusts Plastic Packaging Goals

-

Abbott and Johnson & Johnson: Global Medical Device Giants' Robust Performance and Strategies Amid Tariff Pressures

-

BYD releases 2024 ESG report: Paid taxes of 51 billion yuan, higher than its net profit for the year.

-

Behind pop mart's surging performance: The Plastics Industry Embraces a Revolution of High-End and Green Transformation

-

The price difference between recycled and virgin PET has led brands to be cautious in their procurement, even settling for the minimum requirements.