Deep Analysis of China's Medical Device Industry in 2025: Transformation in the Medical Device Sector, How Should We Position Ourselves?

introduction

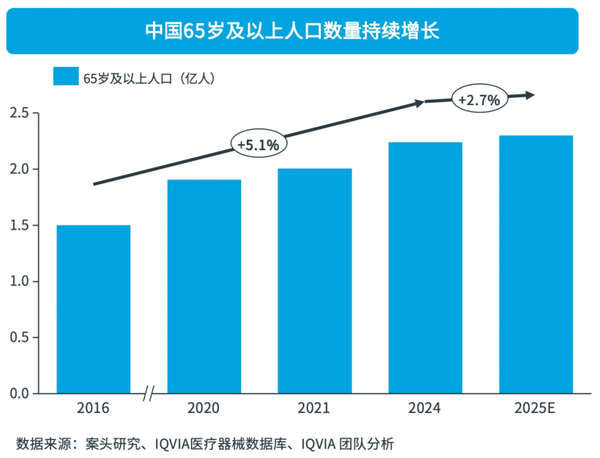

In recent years, China's medical device industry has experienced a transition from rapid growth to a rational adjustment period under the multiple drivers of policy, technology, and market demand. As the aging population deepens, medical needs upgrade, and policy regulation intensifies, the industry is shifting from an expansion in "quantity" to a breakthrough in "quality".

Recently, while chatting with a few friends who are in the consumables agency business, they said, "Now, when going to bid, it's embarrassing to submit materials without a 'break-bone price' on the quotation." This statement sounds heart-wrenching but is also true - from 2020 until now, the turbulence in the medical device industry has been more intense than expected. The intertwining of three forces—accelerated aging, high-pressure policies, and technological iteration—has transformed this once "easy money-making" industry into an extreme competition.

As a follower of the medical device industry, this article will analyze for you: What will the medical device market look like in 2025? The survival rules hidden behind the data may be more thought-provoking than the apparent fluctuations on the surface.

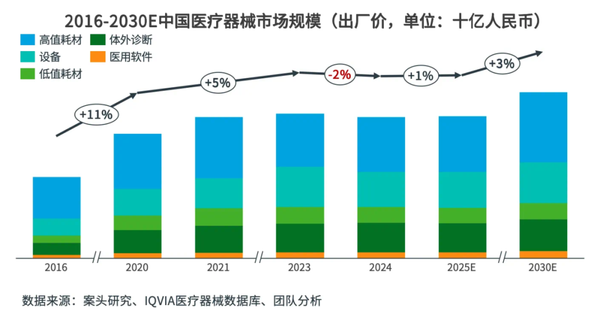

Current Situation and Dilemma: Structural Adjustment Behind the Slowing Growth

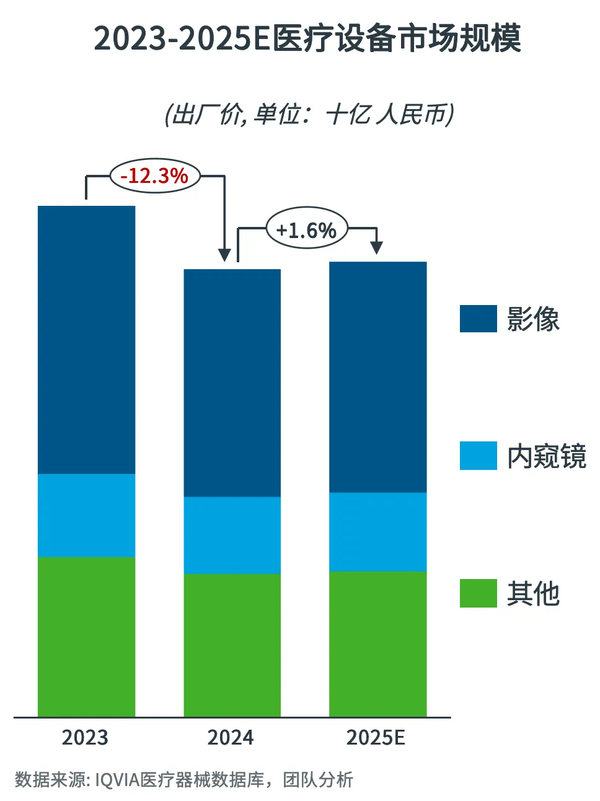

Since 2020, the growth rate of China's medical device market has gradually declined to a low single digit. The market size (excluding tax) in 2024 is 484.7 billion yuan, a year-on-year decrease of 2.4%, mainly due to the shrinking demand for medical equipment and a significant decline in high-priced, low-value consumables. For example, the demand for traditional equipment products such as imaging equipment and ventilators is weak, with a year-on-year decrease of 12%; while vascular intervention consumables, driven by clinical necessity and technological iteration, still maintain a growth rate of over 9%.

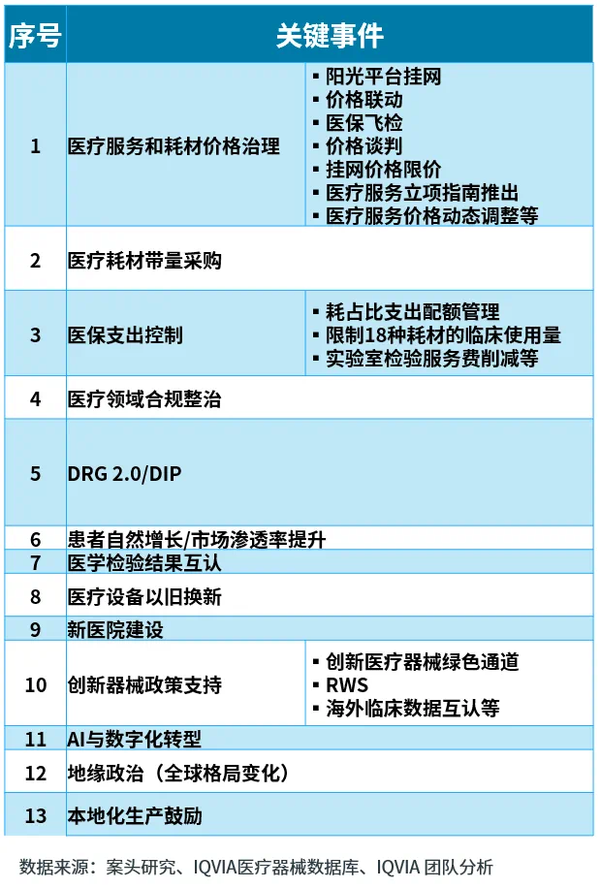

Policy has become a key variable in industry development. The coverage of volume-based procurement continues to expand, with the coverage rate of high-value consumables exceeding 70%, leading to significant pressure on product prices. Meanwhile, policies such as DRG/DIP payment reform and price linkage further compress the market space for low-value consumables and products with lower clinical necessity. Companies generally face the challenge of "volume and price dual decline" and urgently need to break through by innovation and efficiency improvement.

Current Situation and Dilemma: Structural Adjustment Behind the Slowing Growth

Driven by factors such as an aging population, the demand for surgical and inpatient medical services will continue to grow in the future; due to the influence of policies and other comprehensive factors, the growth rate will slow down in 2024.

Currently, the trend of population aging in China is evident, with the total number and proportion of the elderly population increasing year by year, leading to a significant rise in the demand for medical services.

It is expected that 13 key events will impact the medical device market, consumables and service prices, market demand, and industry structure by 2025.

Dynamics and Trends: Value Reconstruction Driven by Innovation

Despite short-term pressure, the long-term growth logic of the industry remains clear. Three major trends are reshaping the market landscape:

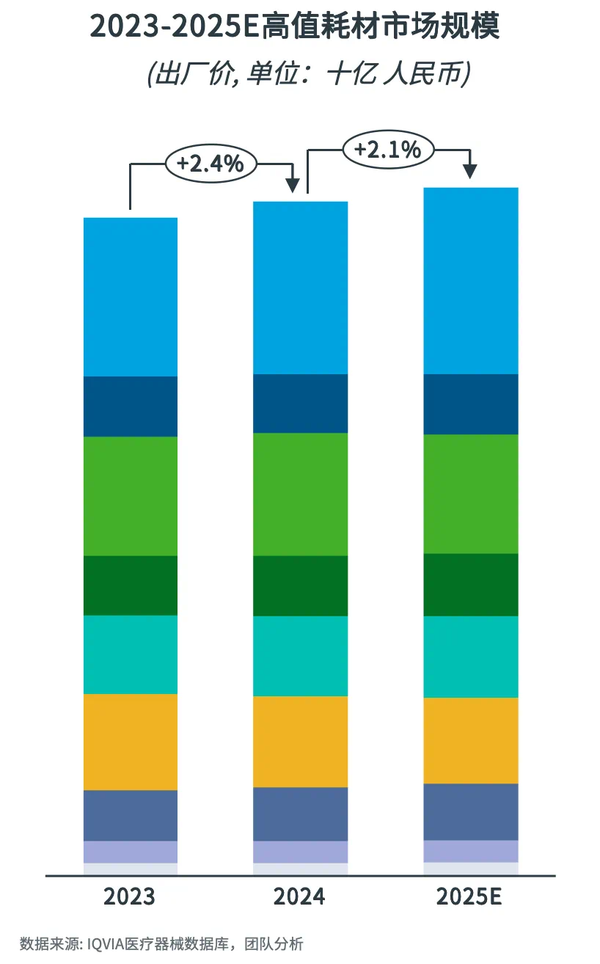

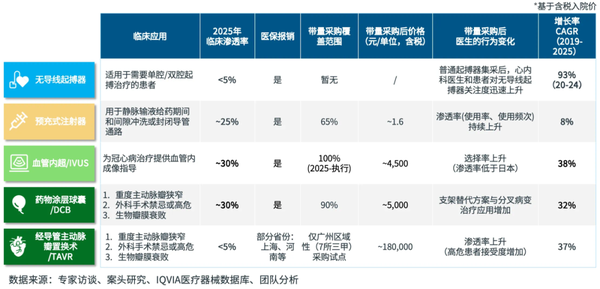

Upgrade and Extension of High-Value Consumables

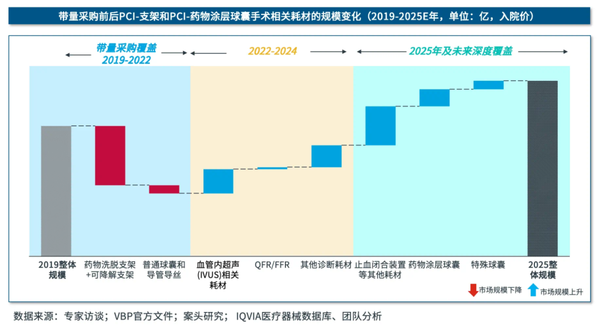

Volume-based procurement forces companies to shift from "trading volume for price" to "trading volume for innovation." For example, in the field of ophthalmology, bifocal and multifocal intraocular lenses are rapidly replacing monofocal products; in coronary artery surgeries, the penetration rate of innovative consumables such as drug-coated balloons and IVUS (intravascular ultrasound) continues to rise. It is estimated that by 2025, the market size of high-value consumables will grow by 2.1% year-on-year, with upgraded products and extended procedures becoming the main drivers.

high-value consumables market size

2. Intelligence and Domestic Substitution of Medical Equipment

Since the fourth quarter of 2024, many regions have launched centralized procurement of medical equipment, covering high-value categories such as CT, MR, and endoscopes. Policies clearly support the updating of high-end and intelligent devices, with domestic manufacturers accelerating the replacement of imported products due to their cost-effectiveness. At the same time, AI technology is deeply empowering medical equipment, for example, the integration of imaging diagnostic software and surgical robots, promoting the penetration of minimally invasive surgery into more departments.

device market size

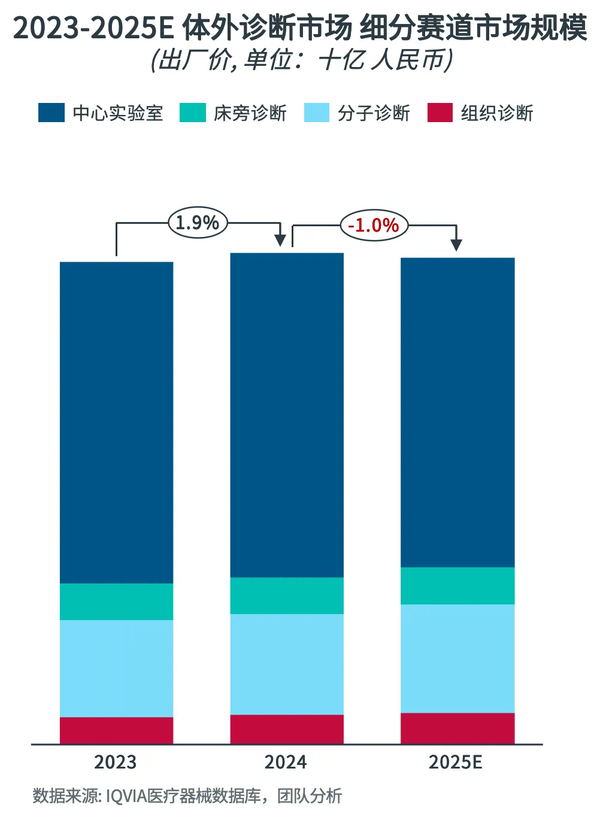

3. Structural Differentiation of In Vitro Diagnostics (IVD)

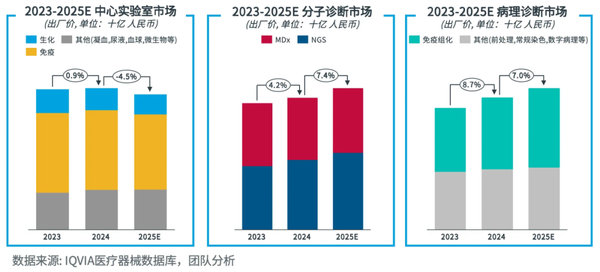

The IVD market presents a "tale of two extremes": traditional immunodetection is significantly impacted by centralized procurement, showing a year-on-year shrinkage in 2024; while molecular diagnostics and pathological tissue testing are maintaining high growth due to the surging demand for infectious disease control and early cancer screening. In the future, with the expansion of ICUs and the下沉 of医疗资源,请注意,最后一部分似乎没有完全转换为英文。完整的翻译应该是: The IVD market presents a "tale of two extremes": traditional immunodetection is significantly impacted by centralized procurement, showing a year-on-year shrinkage in 2024; while molecular diagnostics and pathological tissue testing are maintaining high growth due to the surging demand for infectious disease control and early cancer screening. In the future, with the expansion of ICUs and the decentralization of medical resources, point-of-care testing (POCT) may become a new growth point for primary healthcare.

IVD market trends

While the demand for molecular diagnostics and pathological tissue diagnostics continues to rise, driving growth in niche markets. It is expected that by 2025, the growth rate of the central laboratory market will further decline under the influence of multiple policies; while the molecular market and pathological diagnosis market will maintain a steady growth rate.

IVD细分市场趋势 IVD submarket trends

2025 Outlook: Demand Differentiation and Value Breakthrough

Population aging remains the most certain growth engine for the industry. It is projected that by 2025, the proportion of people aged 65 and over will exceed 15%, driving a continuous increase in the demand for surgeries, chronic disease management, and more. However, policy regulation and payment reform will intensify market segmentation:

Device market modest recovery: With the support of the "trade-in" policy, the demand for medical equipment may bottom out and rebound in 2025, and the need for updating CT, ultrasound, and other equipment in county hospitals and grassroots institutions will gradually be released.

Innovation in consumables and technology leads growth: The market size of PCI (Percutaneous Coronary Intervention) consumables is expected to increase to 38.9 billion yuan by 2025, with products such as drug-eluting balloons and special balloons contributing the main increment; new technologies like surgical robots and AI-assisted diagnostic systems are accelerating commercialization.

PCI market size change situation

Compliance and常态化成本控制: Enterprises need to strengthen the full lifecycle management of products, achieving precise operations from R&D, market entry to promotion, in order to cope with the pressure of reduced tender volumes and price declines. Note: "常态化" is typically translated as "normalization" or "regularization", but in this context, it seems to be emphasizing a continuous or regular state, so I've left it out for smoother English, assuming it's implied by the context. If you prefer a more literal translation, it could be "normalization of cost control".

Future Value: Agile Innovation and Ecosystem Synergy

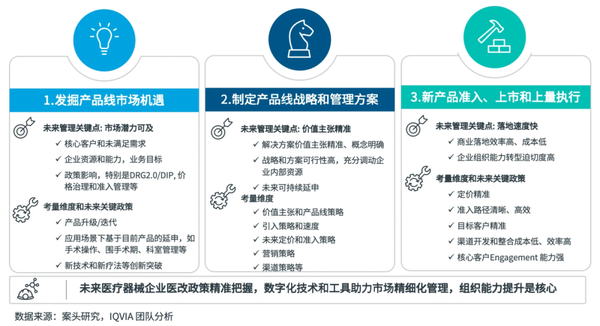

Industry competition has shifted from single product comparisons to systematic capability building. Leading companies build moats through strategic construction.

current enterprise growth strategies

Precision product line management: Expand penetration in mature fields through centralized procurement, while accelerating the launch of innovative products, such as targeted consumables for tumors and cardiovascular diseases;

Ecosystem collaboration: Cooperating with AI companies and research institutions to develop intelligent solutions, such as DeepSeek and other AI technologies empowering image diagnosis and surgical planning, helping hospitals reduce costs and improve efficiency.

The medical device industry in 2025 will be a year of both challenges and differentiation. Under the triple waves of policy regulation, technological innovation, and demand upgrades, only those enterprises that persist in innovation and deeply cultivate clinical value can navigate through the cycle.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories