GAC reports first loss in 20 years: success and failure both tied to Japanese brands

The automotive industry has undergone a drastic transformation over the past century.

GAC's recent financial report is quite surprising.

I knew that it is no easy task for an elephant to turn around, but I didn't expect that a few years ago, the leading giant in the new energy transition, GAC, has now reached an unprecedented urgent moment.

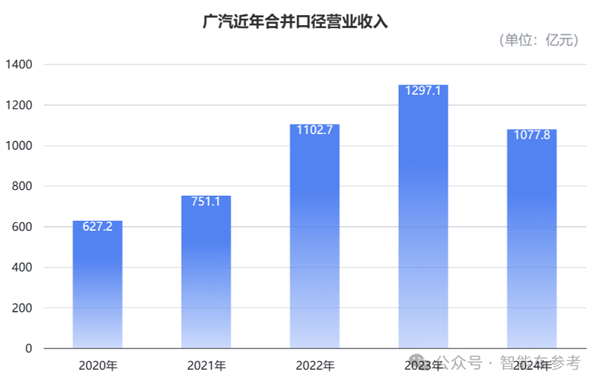

Full-year consolidated revenue was 107.8 billion yuan, down 17%; net profit attributable to parents of the company was 824 million yuan, down 81.40%; non-recurring profit or loss attributable to parents of the company turned from a gain to a loss, with a loss of 4.35 billion yuan, a sharp decline of 221.8%.

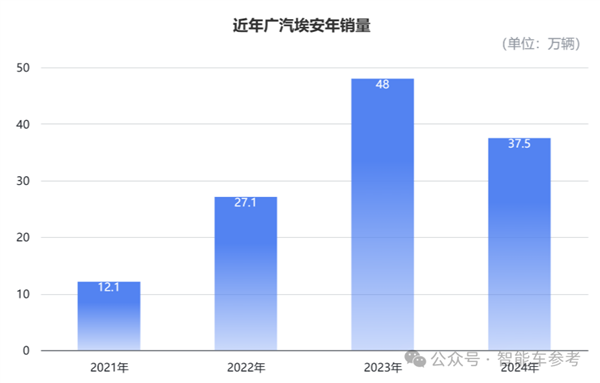

In 2024, automobile deliveries reached 2.0031 million units, a year-on-year decrease of 20%. Among them, the once "cash cows" GAC Toyota and Honda both saw double-digit declines in sales, while the transformation's key player, the "favored son" Aion, also experienced a significant drop in sales.

Despite this, Feng Xingya, who has just taken over as chairman for more than a month, still provided a positive guidance of a 15% increase in annual sales—about 2.3 million vehicles.

GAC's confidence is entirely based on its heavy investment in an intelligent future.

Joint venture "cash cows" face plummeting sales, squeezing profits.

Amid the heated competition where multiple car manufacturers are submitting their "strongest ever" financial reports, GAC's report seems somewhat "weak."

In 2024, Guangzhou Automobile Group's consolidated revenue (i.e., autonomous brands) was 107.78 billion yuan, a year-on-year decrease of 16.8%; the combined revenue (including joint ventures and subsidiaries) was 401.65 billion yuan, a year-on-year decrease of 20%.

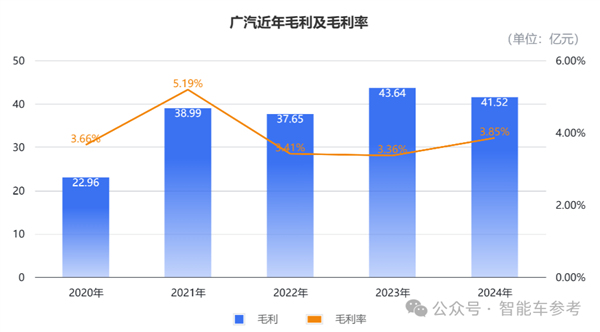

Guangqi's annual gross profit was 4.152 billion yuan, a year-on-year decrease of 26.72%.

The group's overall gross profit margin was 3.85%, a decrease of 0.52 percentage points compared to the same period last year; among these, the part related to "vehicles," the gross profit margin for整车制造 (vehicle manufacturing) was only 2.18%, a decrease of 0.52 percentage points year-over-year, while the gross profit margin for the parts manufacturing industry was 7.83%, an increase of 1.04 percentage points year-over-year. Note: "整车制造" is translated as "vehicle manufacturing" since "整车" typically refers to "complete vehicle" or "entire vehicle." If "整车制造" specifically refers to "whole vehicle manufacturing" in this context, it should be kept as is. However, based on common practice, "vehicle manufacturing" is used here.

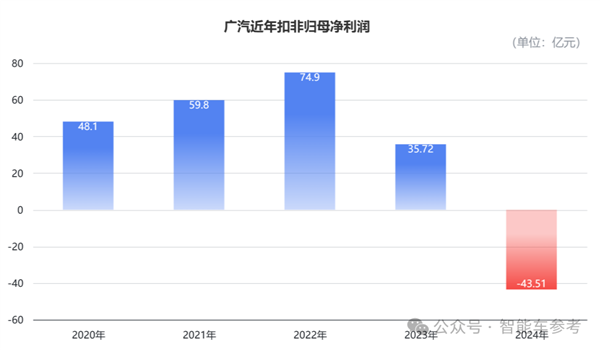

In terms of profit, the group's net profit attributable to shareholders for the year was only 824 million yuan, a year-on-year decrease of 81.4%.

Moreover, this is based on the premise of a non-recurring profit contribution of 5.175 billion yuan, including GAC's transfer of 18.82% equity in Guangzhou Juban Technology Research, which directly increased net profit by 2.26 billion yuan, among other factors.

Excluding non-recurring gains and losses, GAC's attributable net profit turned to a loss, with a net loss of 4.351 billion yuan in a year, a year-on-year decrease of 221.8%, marking the first loss for GAC in 20 years.

Core indicators are all declining, and in GAC's view, the blame points directly to the drop in sales caused by price wars.

On the joint venture side, for the entire year of 2024, Guangzhou Toyota's sales reached 738,000 units, a year-on-year decrease of 22.3%; Guangzhou Honda sold 471,000 units, a year-on-year decrease of 26.5%, making it the brand with the largest decline within Guangzhou.

The revenue from two joint venture brands was 177.8 billion yuan, a year-on-year decrease of 27.8%.

On the other side, GAC's自主品牌 (independent brand) accounted for 40% of total sales in 2024. Among them, the main force in the transformation, sales of new energy vehicles, accounted for 22.7% of total annual sales.

GAC's biggest hope for transitioning to new energy, Aion, is困by the saturation of the ride-hailing market and is also constrained by the difficulty in shedding its transformation label. It delivered 375,000 vehicles for the year, a同比下降of 21.9%.

The high-end brand Hyper launched by GAC埃安, also failed to open up the high-end market as expected, with annual sales reaching only 15,600 units.

Only GAC Trumpchi saw a 2% increase in sales, delivering 415,000 vehicles for the year.

Moreover, Hycan, a new energy vehicle brand in which GAC Aion holds a 25% stake, has also been officially confirmed by GAC to cease operations at the beginning of this year.

Joint venture cars and self-owned brand new energy vehicles are both losing momentum. GAC's sales volume in the domestic market last year could almost be described as being caught between a rock and a hard place.

On the bright side, GAC has made smooth progress in overseas markets, especially with its own brands.

In 2024, GAC exported 127,000 vehicles, an increase of 67.6% year over year. Among these, its自主品牌 (self-owned brand) broke through the 100,000 mark for the first time, surging by 92.3% year over year, accounting for 83% of the total export volume.

GAC's 490 outlets across 74 countries worldwide generated revenue of 11.74 billion yuan in 2024, a year-on-year increase of 112.6%. The overseas gross profit margin reached 14.72%, significantly higher than the company's overall margin of 3.85%.

This is because GAC's main models, such as Aion and Trumpchi, have reduced costs through local procurement of low-cost parts and direct production in local factories, while enjoying higher premiums in overseas markets, jointly contributing to this relatively high level of gross profit margin.

In 2025, GAC plans to introduce 4 new models based on this foundation,开拓13 new countries and 200 new outlets, making a push for an ambitious target of exporting 180,000 vehicles annually. (Note: There appears to be a missing word in the original Chinese text, likely "open" or "expand to", which is translated as "开拓" in the context of opening up or expanding into new markets.)

Faced with such a financial report and market pressure,冯兴亚, who has just taken over from 曾庆洪 and has been in office for just over a month, provided the annual sales guidance:

GAC plans to deliver 2.3 million vehicles for the whole year, increasing by 15% over 2024.

In the incremental market of China's automotive industry, this growth rate is not difficult to achieve, but the prerequisite is that GAC can find a breakthrough for sales growth this year.

Especially in 2024, a year when new forces in the auto industry are soaring, GAC has not told a particularly compelling story in the new energy sector.

Perhaps the three-year "Panyu Action" is proof of GAC's determination to transform into new energy without turning back.

How to do it specifically?

"Three-year 'Panyu Action,' embracing Huawei again"

GAC has already revealed its trump card.

The specific focus should start with the "Panyu Action," which is a three-year transformation plan initiated by GAC at the end of 2024.

The core goal is to restructure the proprietary brand, enabling it to achieve a production and sales scale of over one million units and advance towards a scale of two million units.

The reason it is called "Panyu" is that Panyu is the core area of GAC's independent brands, gathering the factories, research institutes, component industrial bases of Trumpchi and Aion, as well as the GAC Intelligent Connected New Energy Vehicle Industrial Park.

GAC even moved its headquarters from Guangzhou CBD to Panyu, just to let "those who hear the gunfire" make decisions.

This year marks the inception of the "Panyu Action." Feng Xingya stated that the集团将在“番禺行动”指引下,深化“智行 2027”行动计划—— It seems there is a part missed in your text. However, the direct translation of the provided sentences would be: This year marks the beginning of the "Panyu Action." Feng Xingya said that the Group will deepen the "Smart Travel 2027" action plan under the guidance of the "Panyu Action."

GAC will enter the top tier of intelligent driving product levels in China by 2025; by 2027, it will join the global top tier in both intelligent driving product levels and R&D capabilities.

This is both GAC's "ambition" for future layout and the long-awaited result of GAC's years of planning.From the perspective of intelligent driving strategy, GAC is playing the long game, having laid the groundwork for a comprehensive path from L2 to L4.

GAC has launched its latest intelligent driving system, "Xingling Zhixing," which serves as the foundation for its comprehensive strategic layout.

"Star Spirit Intelligence" is actually the 6.0 version of the ADIGO system. After the update, the biggest difference from the past is that the algorithm has changed from a rule-driven segmented architecture to an end-to-end architecture.

Based on its new intelligent driving system, GAC has divided the L2 to L4 levels into five product platforms, with computing power ranging from 70 to 2000 TOPS.

At the L2+ level, the focus this year will be on achieving the goal of entering the first tier in China.

Among the five platforms, G100, G200, G300, and G700 all offer corresponding solutions. Among them, G100 and G200 support high-speed NOA and urban commuting navigation, which is urban NOA on fixed routes.

G300 supports urban NOA, while G700 achieves "from parking space to parking space" with the help of VLM.

The highest level G1000 is suitable for L3/L4 architecture, and the algorithm is based on a visual language model combined with a world model.

At the L3 level, GAC plans to launch the country's first L3 autonomous driving mass-produced vehicle by the end of this year, the Haobo HL, which will support urban NDA (Navigation Assisted Driving).

By 2026, GAC will accelerate the mass production and implementation of L3, covering more high-end models, and plans to first achieve widespread adoption in the ToB sector (such as the祺出行 platform).

At the L4 level, GAC will deliver its first pre-installed mass-produced L4 vehicle this year; additionally, GAC has experience and a foundation in ride-hailing services and will become China's first automaker to achieve large-scale L4 operations next year.

By 2027, GAC will launch L4 level autonomous cars for individual users.

The three lines chasing the process of intelligenceization face tasks that are both urgent and daunting. Relying solely on self-research and development is no longer feasible within the time constraints, which is why we often see investment and cooperation moves by GAC in recent times.

Part of it involves collaboration with the supply chain, such as adopting computing solutions from NVIDIA, Horizon, and Qualcomm to support the computing power requirements of the G1000 platform.

Part of it involves establishing connections with tech giants, jointly developing the underlying models with Tencent, building a global hybrid cloud platform, and creating an "end-to-cloud" integrated autonomous driving lightweight map solution.

There are also more in-depth collaborations, such as the joint venture, Xinghe Intelligent Connectivity, established by GAC and iFlytek in 2020, focusing on the research of smart cockpits applied in models like the Hyper GT; as well as the joint venture, Andi Technology, set up with Didi last year, from which the L4 mass-produced model this year originates.

And once again, embrace Huawei.

Almost simultaneously with the announcement of the shutdown of Xuanjiao Automobile, GAC announced that it had approved a proposal for cooperation with Huawei on the GH project, revealing plans to invest 1.5 billion yuan. The two parties will work together in an office setting, and the first vehicle is positioned as a luxury smart new energy vehicle in the 300,000 yuan price range.

Not long ago, Huawang Auto, a new company with an investment of 1.5 billion yuan, was officially established. Its new models will be equipped with Huawei's intelligent driving software, intelligent cockpit, intelligent vehicle control and other solutions, becoming another "believer" in Huawei's car-making lineup.

After all, there are already quite a few successful cases ahead. Even Chang'an, which did not become one of Huawei's "realms," has achieved remarkable transformation results among traditional automakers through its investment in Yinwang, cooperation in the HI model, and the leadership of technical expert Tao Ji.

GAC's 1.5 billion "tuition fee" may not be paid too late after all.

One More Thing

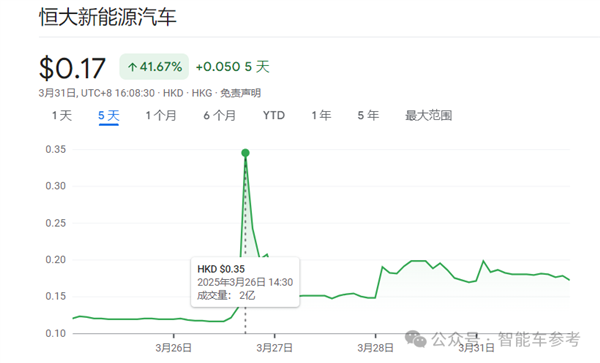

Recently, the long-silent Evergrande Auto suddenly saw its stock price soar by over 230%.

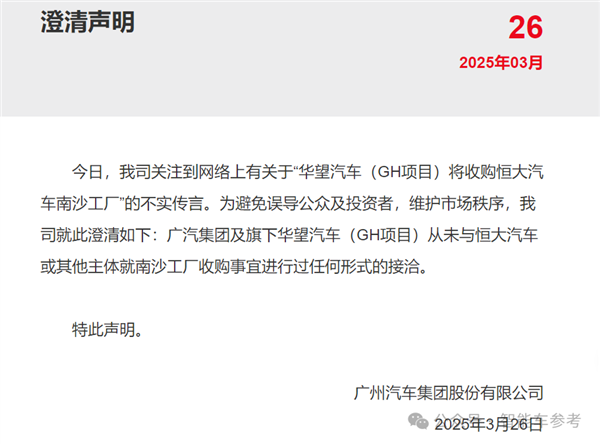

There were rumors that "the GAC and Huawei project will be located at the former Evergrande Auto Guangzhou factory," and "the GAC Group Huawang (GH) project will acquire Evergrande Auto's Nansha factory."

However, GAC quickly released an announcement refuting these claims, stating that they had not been in talks regarding any acquisition. As a result, the surge in恒大汽车's stock price immediately receded.

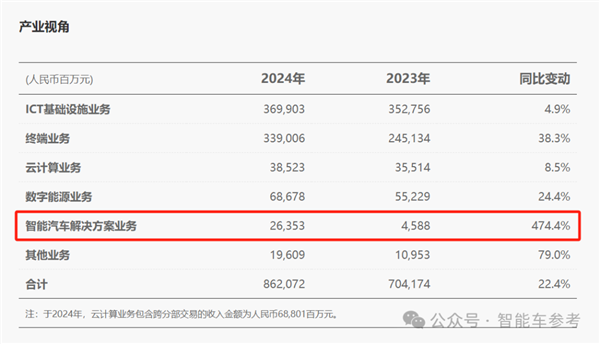

On the other side, completely opposite to this scene, Huawei has just released its 2024 financial report.The revenue from the intelligent car solution business was 26.35 billion yuan, a year-on-year surge of 474%.

Although it only accounts for 3% of Huawei's total revenue, the amount Huawei earns from helping others build cars is nearly enough to match half of a new car manufacturer's income.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Amcor Opens Advanced Coating Facility for Healthcare Packaging in Malaysia

-

ExxonMobil and Malpack Develop High-Performance Stretch Film with Signature Polymers

-

Plastic Pipe Maker Joins Lawsuit Challenging Trump Tariffs

-

Pont, Blue Ocean Closures make biobased closures work

-

Over 300 Employees Laid Off! Is Meina Unable to Cope?