India's Anti-Dumping Final Ruling is Set! China's PVC Exports Face a Major Blow

error

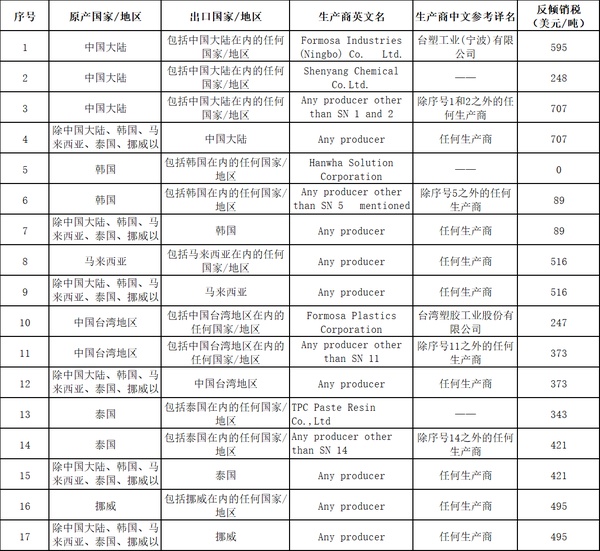

Appendix: India's Final Ruling Tariff Table for Polyvinyl Chloride Paste Resin Involving China

Indian anti-dumping duties have been finalized, causing a stir in the PVC spot market. From price fluctuations to market supply and demand, and then to industry structure, the PVC market has been affected to varying degrees.

China's PVC export competition weakens

From the perspective of the anti-dumping tariffs imposed by India on various countries, the tariff levied on mainland China is the highest (248-707 USD/ton), far exceeding other countries and regions. For many years, India has steadily ranked first in China's PVC exports, and this high tariff will significantly weaken the price competitiveness of Chinese products. According to PlastInsight, in 2024, China's total PVC export volume is 2.6175 million tons, with 1.33 million tons exported to India, accounting for 50.81% of China's total domestic exports. If calculated based on the current FOB price of Chinese PVC paste resin exported to India at approximately 1200 USD/ton, after adding the anti-dumping duty, the landed cost may increase by 20%-60%, leading to Chinese products losing their competitive edge in the Indian market.

Considering the strong demand in the Indian market, over 50% import dependency, and the temporary lack of alternative sources to Chinese supplies, there is still a possibility for growth in PVC exports to India, even if Chinese prices are slightly higher.

PVC regional trade flow changes

Affected by policies such as additional tariffs and anti-dumping duties on imports in India, the future of PVC import and export trade may see another divergence. In the short term, Chinese manufacturers might be forced to turn to emerging markets in Southeast Asia and Africa. Although countries in Southeast Asia and Africa are currently in a stage of rapid economic development and are vigorously promoting infrastructure construction, the overall volume is still insufficient to significantly support an increase in the scale of China's PVC exports. Under this situation, the export potential of the Indian market becomes increasingly significant for China's PVC industry. Therefore, over the past five years, India has remained the top destination for China's PVC exports.

PVC price focus probes low

Affected by India's anti-dumping policy on imported PVC, the stockpiling mentality of Indian trading companies has weakened, and they are more cautious about stockpiling during the peak season compared to previous years. The market transaction volume is weak, and the focus of PVC transaction prices is fluctuating downward. From the current market situation, the main Asian PVC producers' advance sales quotations for April are expected to be announced next week. With sufficient supply from major exporting countries and regions, and with demand growth still uncertain, coupled with the recent weakening trend of shipping costs, it is expected that PVC quotations will have a downward adjustment space of 20-30 USD/ton compared to March.

India's anti-dumping measures will reshape the trade landscape of PVC paste resin in the short term, promoting local capacity to replace imports. However, it may also increase the cost of downstream manufacturing, weakening the competitiveness of "Make in India." For Chinese companies, they need to focus more on increasing product value-added, developing high-end products, improving product quality and brand influence, to enhance their competitiveness in the international market and reduce the risk of anti-dumping actions triggered by price competition.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Amcor Opens Advanced Coating Facility for Healthcare Packaging in Malaysia

-

ExxonMobil and Malpack Develop High-Performance Stretch Film with Signature Polymers

-

Plastic Pipe Maker Joins Lawsuit Challenging Trump Tariffs

-

Pont, Blue Ocean Closures make biobased closures work

-

Over 300 Employees Laid Off! Is Meina Unable to Cope?