Investment in lithium battery separators "cools down," industry enters a period of calm.

The lithium battery separator, as a key internal component of lithium batteries, is undoubtedly important. With the vigorous development of the new energy industry, although the lithium battery separator market is gradually returning to rationality, it still attracts a lot of capital attention.

Investment enthusiasm fluctuates, returning to rational development.

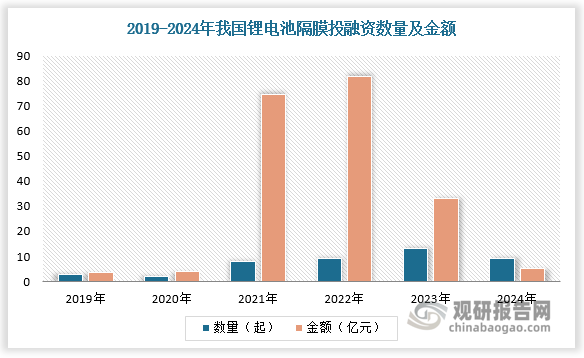

The promising prospects of lithium battery separators have attracted numerous capital investments. According to the "Analysis and Forecast Report on the Development Status and Investment Prospects of China's Lithium Battery Separator Industry (2025-2032)" released by Guanyan Report Network, the number of lithium battery separator investments in China increased from 3 cases in 2019 to 13 cases in 2023. The investment amount rose from 350 million yuan to 3.301 billion yuan during the same period, with the peak investment amount reaching 8.15 billion yuan in 2022. In 2024, investments in lithium battery separators in China gradually returned to rationality, with 9 investment cases and an amount of 501 million yuan.

Continuous increase in shipment volume, with wet-process separator membranes dominating the mainstream.

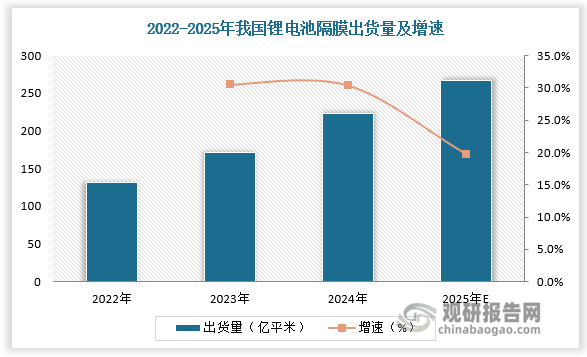

Driven by the development of new energy vehicles, energy storage, and consumer electronics, coupled with the enhanced shipping capacity of domestic diaphragm manufacturers, the shipment volume of lithium battery diaphragms in China has continued to grow rapidly. In 2023, the shipment volume reached 17.1 billion square meters, a year-on-year increase of 30.5%; in 2024, the shipment volume is expected to further increase to 22.3 billion square meters, with a year-on-year growth rate of 30.4%. It is estimated that by 2025, the shipment volume will reach 26.7 billion square meters, with a growth rate of 19.7%.

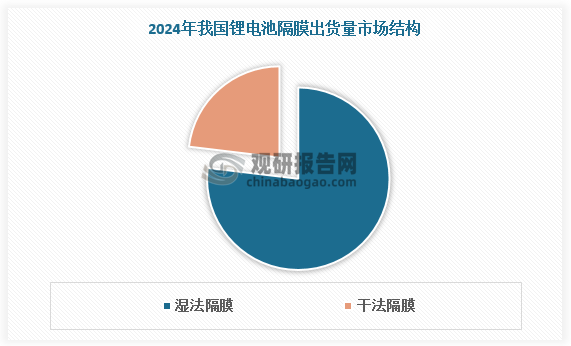

According to the different mechanisms of micropore formation, separator processes are divided into dry and wet methods. The dry process involves blending raw materials such as high-molecular polymers and additives to form a uniform melt, stretching it at a specific temperature to create slit-like micropores, and then thermally setting it to obtain a microporous membrane. This mainly includes uniaxial and biaxial stretching processes. The wet process, also known as the phase separation method, mixes liquid hydrocarbons and polyolefin resins, heats them into a uniform mixture, cools them to induce phase separation, and presses them into film sheets. These sheets are then heated to the melting point for biaxial stretching, and volatile substances are used to wash away residual solvents, resulting in an interconnected microporous membrane.

Due to differences in performance characteristics, the two types of separator production processes are applied in different scenarios. Dry-process separators, with their high safety and lower cost, are primarily used in large lithium iron phosphate (LFP) power batteries. In contrast, wet-process separators, which are thinner, have higher porosity, and offer superior uniformity in pore size and air permeability, outperform dry-process separators in mechanical properties, breathability, and physicochemical performance. As a result, they are more widely used in ternary batteries, where energy density is a priority. Currently, wet-process separators dominate China's lithium battery separator industry. Data shows that in 2024, wet-process separators accounted for 76.9% of China's total lithium battery separator shipments, while dry-process separators made up only 23.1%.

High industry barriers, high market concentration

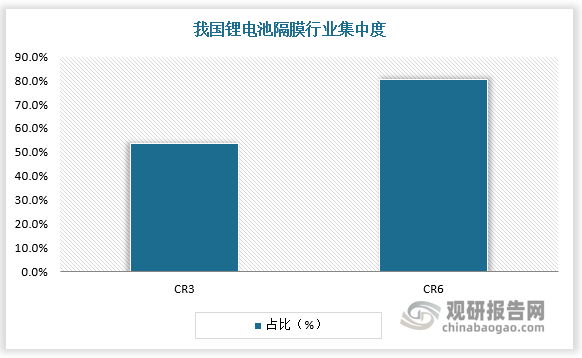

The lithium battery separator industry is a typical "heavy asset" industry, with fixed assets accounting for the highest proportion among the four major materials. Separator production demands high requirements for equipment selection, necessitating customized production lines based on different manufacturing processes, making production challenging. The choice of production equipment and processes can directly impact the comprehensive physical and chemical properties of the separator. Additionally, the lithium battery separator industry involves complex processes and significant material loss. Compared to other materials, the separator industry has more stages in the production process that result in notable losses. Even after forming the master roll, losses continue to occur during subsequent processes. The master roll needs to be slit according to product specifications, generating a small amount of scrap edges, and certain losses also occur during the coating process of the base film. The high manufacturing difficulty leads to relatively low yield rates in the separator industry, creating higher industry barriers and concentrated market distribution. Data shows that the CR3 of China's lithium battery separator industry is approximately 55%, while the CR6 exceeds 80%.

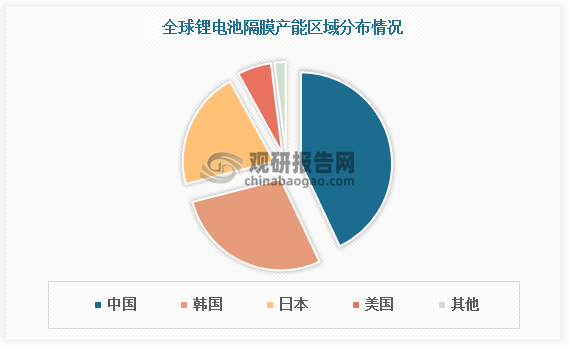

From an international perspective, China, South Korea, Japan, and the United States are the primary suppliers of global lithium-ion battery separators, accounting for a total capacity share of 98%. Among them, China's lithium-ion battery separator products stand out in terms of scale and cost-effectiveness, gradually occupying a significant position in the global supply market. According to data, China's lithium-ion battery separator capacity accounts for 43% of the global market, far exceeding South Korea (28%), Japan (21%), and the United States (6%). With the expansion plans of Japanese and Korean companies falling short of expectations, the global lithium-ion battery separator industrial chain will continue to shift towards China.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Overseas Highlights: PPG Establishes New Aerospace Coatings Plant in the US, Yizumi Turkey Company Officially Opens! Pepsi Adjusts Plastic Packaging Goals

-

Abbott and Johnson & Johnson: Global Medical Device Giants' Robust Performance and Strategies Amid Tariff Pressures

-

BYD releases 2024 ESG report: Paid taxes of 51 billion yuan, higher than its net profit for the year.

-

Behind pop mart's surging performance: The Plastics Industry Embraces a Revolution of High-End and Green Transformation

-

The price difference between recycled and virgin PET has led brands to be cautious in their procurement, even settling for the minimum requirements.