Late Night Surge! The U.S. Imposes Fourth Round of Sanctions on Iran Targeting Refineries, Oil Prices Close with a Strong Gain! A Turning Point for the "Golden March" Plastics Market Has Arrived

I. Overnight Futures Market Dynamics

The United States continues to strengthen sanctions against Iran, and the instability in the Middle East brings potential supply risks, leading to an increase in international oil prices. NYMEX crude oil futures contract for April rose by $1.10 per barrel to $68.26, up 1.64% month-over-month; ICE Brent crude oil futures contract for May increased by $1.22 per barrel to $72.00, up 1.72% month-over-month.

Market forecast: Oil prices surged with a long bullish candle on Thursday evening, rising nearly 3% from the intraday low.The US has announced new sanctions related to Iran, targeting an independent refinery in Asia and the vessels supplying crude oil to these refineries. A comprehensive assessment of the fourth round of US sanctions on Iran suggests that this round of sanctions may bring a risk premium of 3-5 dollars. How long oil prices can maintain a strong performance subsequently will depend on the resource adjustment and recovery capabilities at the supply level of the crude oil market. Under the impetus of sudden news, oil prices remain highly volatile.

II. Macro Market Dynamics

China's LPR for March was released, with the 1-year LPR at 3.1% and the over-5-year LPR at 3.6%, remaining unchanged for 5 consecutive months, in line with expectations. Industry experts generally believe that looking ahead, policy-driven interest rate cuts will still need to be made on a case-by-case basis, and structural interest rate cuts and reserve requirement ratio reductions are expected to be prioritized, with the timing of LPR cuts possibly being delayed.

The National Bureau of Statistics released data, in February, excluding students, the unemployment rate for urban 16-24 year old labor force was 16.9%, the unemployment rate for 25-29 year old labor force was 7.3%, and the unemployment rate for 30-59 year old labor force was 4.3%.

The EU has postponed its plan to impose a 50% tariff on American whiskey until mid-April, aligning with broader countermeasures against US steel and aluminum tariffs. The whiskey tariff was originally scheduled to take effect on April 1.

The Swiss National Bank lowered the policy rate from 0.5% to 0.25%, marking the lowest interest rate since September 2022, and it is the fifth consecutive rate cut, in line with expectations. The Swiss National Bank stated that it remains willing to act in the foreign exchange market if necessary.

According to the National Association of Realtors (NAR), U.S. existing home sales increased by 4.2% in February, reaching an annual rate of 4.26 million units, exceeding market expectations. The median sale price rose 3.8% year-over-year to $398,400, setting a record high for the period.

◎The number of initial jobless claims in the U.S. last week increased by 2,000 to 223,000, slightly below market expectations. The number of continuing jobless claims for the previous week was 1.892 million, slightly above expectations.

◎The UK's unemployment rate in February was 4.65%, with the previous value at 4.6%. The ILO unemployment rate for the three months to January was 4.4%, meeting the expectation of 4.4%, and the previous value was also 4.4%.

Three, early morning dynamics of the plastic market

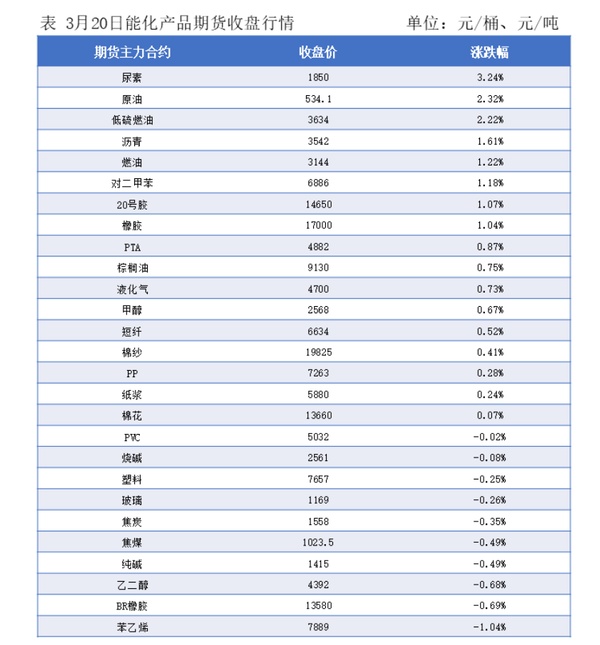

Crude oil surged, and the main domestic plastic futures contract showed a volatile trend overnight:

Plastic 2505 contract is quoted at 7748 yuan/ton, down 0.49% from the previous trading day;

PP2505 contract is quoted at 7271 yuan/ton, down 0.01% from the previous trading day;

The PVC2505 contract was quoted at 5046 yuan/ton, a slight increase of 0.08% from the previous trading day.

IV. Market Forecast

PP:On the supply side, the number of PP units planned to resume operations next week is limited, and there are plans for maintenance shutdowns of PP units with a capacity of about 1.1 million tons, such as Maoming Petrochemical and Lankang Petrochemical. The impact of these shutdowns may increase, potentially providing some support to the PP market. On the demand side, with rising temperatures, daily travel by residents is expected to increase, and seasonal consumption combined with favorable policies may boost demand for plastic products in areas such as food and daily necessities. Additionally, the start of construction projects may lead to an increase in orders for the downstream plastic weaving industry. Under the combined influence of these factors, it is expected that the polypropylene market will see an upward trend next week.

PE:On the supply side, although there are plans for maintenance shutdowns of PE plants such as Zhongan United and Wanhua Chemical, involving around 650,000 tons of capacity, there are also plans for resumption of operations at PE plants like Maoming Petrochemical, Guangdong Petrochemical, and Shanghai Jinfen, involving around 1.4 million tons of capacity. It is expected that the supply pressure in the market may increase. On the demand side, overall terminal demand may rise steadily, but given the current lack of new orders leading to downstream factories purchasing raw material PE on an as-needed basis, it may be difficult to provide significant momentum to the PE market. Under the combined influence, it is expected that the polypropylene market will consolidate within a range next week.

PVC:PVC futures have been consolidating at low levels, unable to provide a good guide for the spot market. However, the advantage of low futures prices is relatively obvious, even so, the trading in the spot market remains mediocre, with downstream players cautiously observing, and overall, the supply in the spot market is still ample. Although both the futures and spot markets showed narrow consolidation during the week, the upstream ex-factory prices remained stable. Even if prices fall to a low level and continue to decline, it may not necessarily lead to better trading, coupled with support from the cost side. However, the fundamental factors that PVC provides for price guidance are few. In the short term, the PVC spot market will continue to consolidate at low levels.

ABS:It is expected that the ABS market price trend will be weak next week. Some manufacturers will start up their facilities, which is expected to result in a slight increase in production. However, terminal demand continues to be weak, and the situation of oversupply remains, leading to a bearish price expectation.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Amcor Opens Advanced Coating Facility for Healthcare Packaging in Malaysia

-

ExxonMobil and Malpack Develop High-Performance Stretch Film with Signature Polymers

-

Plastic Pipe Maker Joins Lawsuit Challenging Trump Tariffs

-

Pont, Blue Ocean Closures make biobased closures work

-

Over 300 Employees Laid Off! Is Meina Unable to Cope?