Major Manufacturers Act, Polyester Filament Prices Rise! Is This a Bottom Rebound or a "Trial Balloon"?

On March 19, the price of polyester filament increased...

Major polyester manufacturers collectively raise prices

On March 19, multiple polyester factories including Tongkun, Xin Fengming, and Rongsheng increased the price of polyester filament. Although only some specifications were adjusted, with an increase of just 50 yuan per ton, this was the first price hike for polyester filament since the Spring Festival.

Recalling the last rumor of a price increase, it was still at the end of February, on February 28th. Accompanied by promotions and the expectation of a price increase on March 1st, polyester factories cleared a good amount of inventory, but in the end, the price increase turned out to be all bark and no bite, with prices failing to rise at all.

Why has the price of polyester filament started to rise now?

Why has the price of polyester filament risen

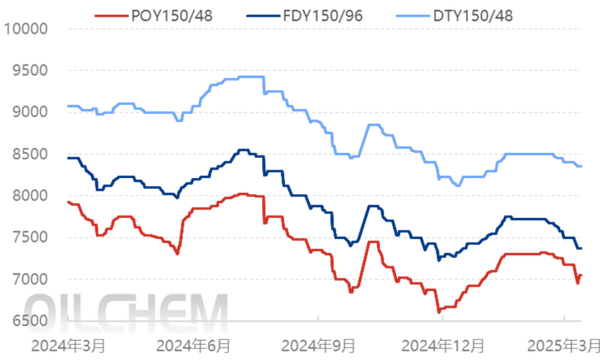

First, the polyester factory has just experienced a wave of promotional activities. On March 18th, polyester filament companies concentrated on selling at reduced profits, and the market saw a partial recovery in production and sales. Some users replenished their inventories out of necessity, while others waited for the end of the month to buy at the bottom. The market's production and sales did not fully increase, and the transaction focus shifted downward. Taking the Jiangsu-Zhejiang market as an example, POY150D was traded at 6900-7000, about 50 lower than the previous trading day.

Secondly, the costs of PTA and PX, which are upstream of polyester fiber, have risen. Recently, the domestic PTA market has shown some improvement, with a slight recovery. As of March 18th, the average price of PTA in the East China region was 4,855 yuan/ton, an increase of 2.26% compared to March 12th. The rise in PTA is largely due to the increase in upstream PX. Since mid-March, there have been maintenance plans for Zhejiang Petrochemical's 2.5 million tons, CNOOC Huizhou's 1.5 million tons, Jiujiang Petrochemical, Hainan Refining & Chemical's 0.66 million tons, and Tianjin Petrochemical, leading to a gradual decline in the domestic PX operating rate. In April-May, planned maintenance for PX facilities remains relatively concentrated, though the scale is slightly lower than the same period last year. It is estimated that the destocking of PX in the second quarter may exceed 500,000 tons, and the future liquidity of PX spot might be tight.

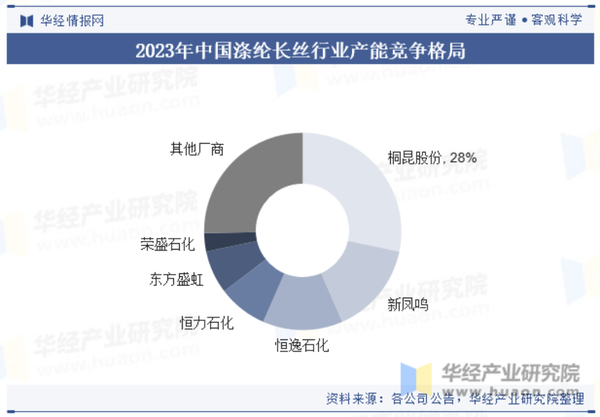

Finally, under the current market conditions, the price of polyester filament can still rise, thanks to the industry influence of major polyester manufacturers. In 2023, the national production of polyester filament reached 45.09 million tons, with the capacity share of the top six companies in the polyester filament industry (Tongkun Co., Ltd., Xin Fengming, Shenghong Group, Hengyi Petrochemical, Hengli Petrochemical, Rongsheng Petrochemical) reaching 74%, and this proportion continues to increase over time.

However, so-called prolonged stability will eventually lead to a decline. The price of polyester filament has been able to remain stable since the beginning of the year without a significant drop, which is largely due to the strong industry influence of the polyester giants.

downstream finds it difficult to support price increases

However, although the polyester giants have relatively consistent ideas and hold the strongest pricing power in the industry, the ones ultimately buying the raw materials are still the individual textile people in the market, and for them, there indeed lacks a reason to purchase a large amount of polyester filament at this stage.

Now, the prices across the entire textile industry chain have been squeezed to the extreme. In recent years, people in the textile industry often say that consumers do not have enough money and cannot absorb so many products. Moreover, they are pursuing the ultimate cost-effectiveness, which forces garment companies to lower their procurement prices, passing the pressure down layer by layer. The market simply cannot support an increase in grey cloth prices.

The overseas market is no different, with Trump wielding the tariff stick everywhere. Even giant chains like Walmart can't withstand it and have to pass on the costs to merchants, but the merchants are already unable to bear the burden.

Therefore, the most important factor for getting weaving companies to accept the increase in raw material prices is to raise the price of gray cloth; otherwise, it would be difficult for them to bear such raw material costs.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Amcor Opens Advanced Coating Facility for Healthcare Packaging in Malaysia

-

ExxonMobil and Malpack Develop High-Performance Stretch Film with Signature Polymers

-

Plastic Pipe Maker Joins Lawsuit Challenging Trump Tariffs

-

Pont, Blue Ocean Closures make biobased closures work

-

Over 300 Employees Laid Off! Is Meina Unable to Cope?