New Industry Trend: African Pipe Market, Welcoming a "Golden Decade"

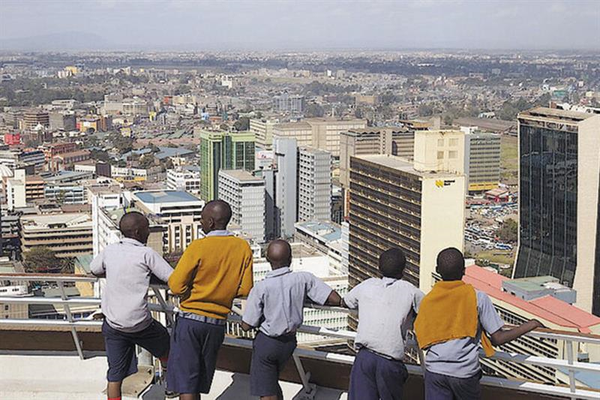

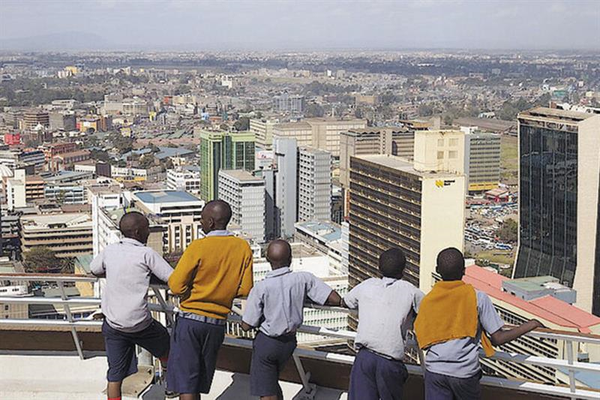

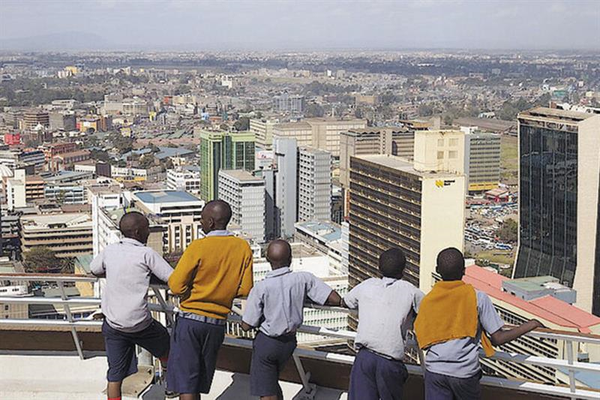

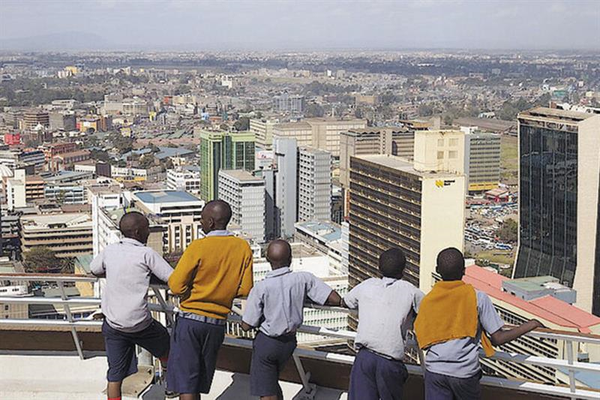

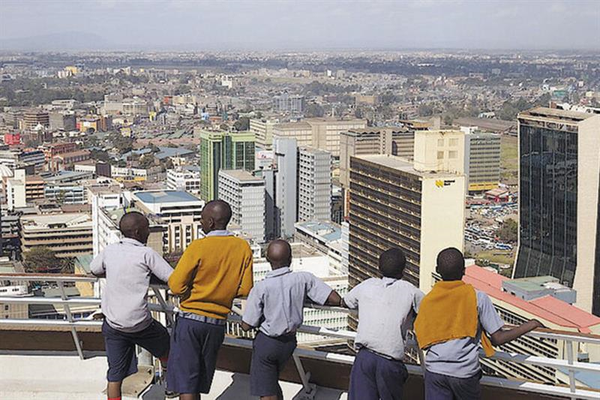

Africa is experiencing an unprecedented process of urbanization.

The Infrastructure Gap and the Blue Ocean Born from Urbanization

According to UN projections, by 2050, Africa's urban population will grow to 1.3 billion, with an urbanization rate exceeding 50%.

This process has spurred a huge demand for infrastructure construction. In 2023 alone, the size of the African construction market exceeded 500 billion US dollars, with the coverage of water supply, drainage, gas, and other pipeline systems being less than 40%, indicating a significant market gap.

Taking Nigeria as an example, its capital, Lagos, sees up to 30% of its water resources wasted each year due to aging pipelines, and in municipal renovation projects, the procurement ratio of PVC and PPRC pipes exceeds 70%.

Data Highlights:

- The African PVC pipe market size was approximately 5 billion US dollars in 2023, expected to exceed 10 billion US dollars by 2025, with a compound annual growth rate of 15%.

- East African Community (EAC) countries plan to invest 12 billion US dollars in upgrading urban water supply networks by 2025, with PPRC pipes becoming the top choice due to their high-temperature resistance and strong pressure resistance.

1

Africa is experiencing an unprecedented process of urbanization.

Africa is experiencing an unprecedented process of urbanization.

Africa is experiencing an unprecedented process of urbanization.

Africa is experiencing an unprecedented process of urbanization.

Africa is experiencing an unprecedented process of urbanization.The gap in infrastructure and the blue ocean created by urbanization

The gap in infrastructure and the blue ocean created by urbanization

The gap in infrastructure and the blue ocean created by urbanization

The gap in infrastructure and the blue ocean created by urbanizationAccording to UN projections, by 2050, Africa's urban population will grow to 1.3 billion, with an urbanization rate exceeding 50%.

This process has generated a huge demand for infrastructure construction. In 2023 alone, the African construction market size exceeded $500 billion, with the coverage of water supply, drainage, and gas pipeline systems being less than 40%, indicating a significant market gap.

For example, in Nigeria, the capital Lagos experiences an annual water waste of up to 30% due to aging pipelines. In municipal renovation projects, the procurement of PVC and PPRC pipes accounts for more than 70%.

According to UN projections, by 2050, Africa's urban population will grow to 1.3 billion, with an urbanization rate exceeding 50%.

According to UN projections, by 2050, Africa's urban population will grow to 1.3 billion, with an urbanization rate exceeding 50%.This process has generated a huge demand for infrastructure construction. In 2023 alone, the African construction market size exceeded $500 billion, with the coverage of water supply, drainage, and gas pipeline systems being less than 40%, indicating a significant market gap.

This process has spurred a massive demand for infrastructure construction. In 2023 alone, the African construction market has surpassed $500 billion, with the coverage of water supply, drainage, and gas pipeline systems being less than 40%, indicating a significant market gap.Taking Nigeria as an example, its capital, Lagos, experiences a 30% waste of water resources annually due to aging pipelines, and in municipal renovation projects, the procurement ratio of PVC and PPRC pipes exceeds 70%.

Taking Nigeria as an example, its capital, Lagos, experiences a 30% waste of water resources annually due to aging pipelines, and in municipal renovation projects, the procurement ratio of PVC and PPRC pipes exceeds 70%.Data highlights:

- The African PVC pipe market size was approximately $5 billion in 2023, projected to exceed $10 billion by 2025, with a compound annual growth rate of 15%.

- The East African Community (EAC) countries plan to invest $12 billion by 2025 in upgrading urban water supply networks, with PPRC pipes becoming the top choice due to their high-temperature resistance and strong pressure resistance.

Data highlights:

- The African PVC pipe market size was approximately $5 billion in 2023, projected to exceed $10 billion by 2025, with a compound annual growth rate of 15%.

- The East African Community (EAC) countries plan to invest $12 billion by 2025 in upgrading urban water supply networks, with PPRC pipes becoming the top choice due to their high-temperature resistance and strong pressure resistance.

Data highlights:

- The African PVC pipe market size was approximately $5 billion in 2023, projected to exceed $10 billion by 2025, with a compound annual growth rate of 15%.

- The East African Community (EAC) countries plan to invest $12 billion by 2025 in upgrading urban water supply networks, with PPRC pipes becoming the top choice due to their high-temperature resistance and strong pressure resistance.

Data highlights:

- The African PVC pipe market size was approximately $5 billion in 2023, projected to exceed $10 billion by 2025, with a compound annual growth rate of 15%.

- The East African Community (EAC) countries plan to invest $12 billion by 2025 in upgrading urban water supply networks, with PPRC pipes becoming the top choice due to their high-temperature resistance and strong pressure resistance.

Data Highlights:

- The African PVC pipe market size was approximately $5 billion in 2023, expected to exceed $10 billion by 2025, with a compound annual growth rate of 15%.

- East African Community (EAC) countries plan to invest $12 billion by 2025 for upgrading urban water supply networks, making PPRC pipes the preferred choice due to their high-temperature resistance and strong pressure resistance.

Data Highlights:

Data Highlights:- The African PVC pipe market size was approximately $5 billion in 2023, expected to exceed $10 billion by 2025, with a compound annual growth rate of 15%.

- The African PVC pipe market size was approximately $5 billion in 2023, expected to exceed $10 billion by 2025, with a compound annual growth rate of 15%.- East African Community (EAC) countries plan to invest $12 billion by 2025 for upgrading urban water supply networks, making PPRC pipes the preferred choice due to their high-temperature resistance and strong pressure resistance.

- East African Community (EAC) countries plan to invest $12 billion by 2025 for upgrading urban water supply networks, making PPRC pipes the preferred choice due to their high-temperature resistance and strong pressure resistance.

1

Comparison of Performance and Application Scenarios

1

1

1

1

1

1

1Comparison of Performance and Application Scenarios

Comparison of Performance and Application Scenarios

Comparison of Performance and Application Scenarios

Comparison of Performance and Application Scenarios- PPRC (Polypropylene Random Copolymer): High temperature resistance (long-term use temperature 95℃), strong impact resistance, suitable for hot water systems and high-pressure water supply, but with a higher cost, the penetration rate in the African market is about 20%.

- PVC (Polyvinyl Chloride): Low cost (only 60% of the cost of PPRC), corrosion resistant, widely used in drainage and low-pressure water supply, occupying 65% of the African pipe market.

- PPRC (Polypropylene Random Copolymer): High temperature resistance (long-term use temperature 95℃), strong impact resistance, suitable for hot water systems and high-pressure water supply, but with a higher cost, the penetration rate in the African market is about 20%.

- PVC (Polyvinyl Chloride): Low cost (only 60% of the cost of PPRC), corrosion resistant, widely used in drainage and low-pressure water supply, occupying 65% of the African pipe market.

- PPRC (Polypropylene Random Copolymer): High temperature resistance (long-term use temperature 95℃), strong impact resistance, suitable for hot water systems and high-pressure water supply, but with a higher cost, the penetration rate in the African market is about 20%.

- PVC (Polyvinyl Chloride): Low cost (only 60% of the cost of PPRC), corrosion resistant, widely used in drainage and low-pressure water supply, occupying 65% of the African pipe market.

- PPRC (Polypropylene Random Copolymer): High temperature resistance (long-term use temperature 95℃), strong impact resistance, suitable for hot water systems and high-pressure water supply, but with a higher cost, the penetration rate in the African market is about 20%.

- PVC (Polyvinyl Chloride): Low cost (only 60% of the cost of PPRC), corrosion resistant, widely used in drainage and low-pressure water supply, occupying 65% of the African pipe market.

- PPRC (Polypropylene Random Copolymer): High temperature resistance (long-term use temperature 95℃), strong impact resistance, suitable for hot water systems and high-pressure water supply, but with a higher cost, the penetration rate in the African market is about 20%.

- PVC (Polyvinyl Chloride): Low cost (only 60% of the cost of PPRC), corrosion resistant, widely used in drainage and low-pressure water supply, occupying 65% of the African pipe market.

- PPRC (Polypropylene Random Copolymer): High temperature resistance (long-term use temperature 95℃), strong impact resistance, suitable for hot water systems and high-pressure water supply, but with a higher cost, the penetration rate in the African market is about 20%.

- PVC (Polyvinyl Chloride): Low cost (only 60% of the cost of PPRC), corrosion-resistant, widely used in drainage and low-pressure water supply, occupying 65% of the African pipe market share.

- PVC (Polyvinyl Chloride): Low cost (only 60% of the cost of PPRC), corrosion-resistant, widely used in drainage and low-pressure water supply, occupying 65% of the African pipe market share.2

Regional Market Segmentation

2

2

2

2

2

2

2Regional Market Segmentation

Regional Market Segmentation

Regional Market Segmentation

Regional Market Segmentation- North Africa (Egypt, Morocco): Prefers high-end PPRC pipes, influenced by European standards, PPRC accounts for 40% in government project tenders.

- Sub-Saharan Africa: Dominated by PVC, such as in Nairobi, the capital of Kenya, where 90% of the drainage systems in affordable housing projects use PVC pipes.

- North Africa (Egypt, Morocco): Prefers high-end PPRC pipes, influenced by European standards, with PPRC accounting for 40% in government project tenders.

- Sub-Saharan Africa: Dominated by PVC, for example, 90% of the drainage systems in the affordable housing project in Nairobi, the capital of Kenya, use PVC pipes.

- North Africa (Egypt, Morocco): Prefers high-end PPRC pipes, influenced by European standards, with PPRC accounting for 40% in government project tenders.

- Sub-Saharan Africa: Dominated by PVC, for example, 90% of the drainage systems in the affordable housing project in Nairobi, the capital of Kenya, use PVC pipes.

- North Africa (Egypt, Morocco): Prefers high-end PPRC pipes, influenced by European standards, with PPRC accounting for 40% in government project tenders.

- Sub-Saharan Africa: Dominated by PVC, for example, 90% of the drainage systems in the affordable housing project in Nairobi, the capital of Kenya, use PVC pipes.

- North Africa (Egypt, Morocco): Prefers high-end PPRC pipes, influenced by European standards, with PPRC accounting for 40% in government project tenders.

- Sub-Saharan Africa: Dominated by PVC, for example, 90% of the drainage systems in the affordable housing project in Nairobi, the capital of Kenya, use PVC pipes.

- North Africa (Egypt, Morocco): Prefers high-end PPRC pipes, influenced by European standards, with PPRC accounting for 40% in government project tenders.

- North Africa (Egypt, Morocco): Prefers high-end PPRC pipes, influenced by European standards, with PPRC accounting for 40% in government project tenders.- Sub-Saharan Africa: Dominated by PVC, for example, 90% of the drainage systems in the affordable housing project in Nairobi, the capital of Kenya, use PVC pipes.

- Sub-Saharan Africa: Dominated by PVC, for example, 90% of the drainage systems in the affordable housing project in Nairobi, the capital of Kenya, use PVC pipes.Market drivers:

Policies, infrastructure, and environmental transition

Market drivers:

Policies, infrastructure, and environmental transition

Market drivers:

Market drivers:Policies, infrastructure, and environmental transition

Policies, infrastructure, and environmental transition

1. Policy Dividends

- The African Union's Agenda 2063 clearly lists "safe drinking water for all" as a core objective, with countries like Nigeria and South Africa enacting legislation to mandate the use of compliant plastic piping in new constructions.

- Under the framework of China's Belt and Road Initiative, Chinese companies have adopted Chinese standard PPRC pipes in the construction of the light rail project in Ethiopia, driving the upgrade of the local supply chain.

1. Policy Dividends

- The African Union's Agenda 2063 clearly lists "safe drinking water for all" as a core objective, with countries like Nigeria and South Africa enacting legislation to mandate the use of compliant plastic piping in new constructions.

- Under the framework of China's Belt and Road Initiative, Chinese companies have adopted Chinese standard PPRC pipes in the construction of the light rail project in Ethiopia, driving the upgrade of the local supply chain.

1. Policy Dividends

- The African Union's Agenda 2063 clearly lists "safe drinking water for all" as a core objective, with countries like Nigeria and South Africa enacting legislation to mandate the use of compliant plastic piping in new constructions.

- Under the framework of China's Belt and Road Initiative, Chinese companies have adopted Chinese standard PPRC pipes in the construction of the light rail project in Ethiopia, driving the upgrade of the local supply chain.

1. Policy Dividends

- The African Union's Agenda 2063 clearly lists "safe drinking water for all" as a core objective, with countries like Nigeria and South Africa enacting legislation to mandate the use of compliant plastic piping in new constructions.

- Under the framework of China's Belt and Road Initiative, Chinese companies have adopted Chinese standard PPRC pipes in the construction of the light rail project in Ethiopia, driving the upgrade of the local supply chain.

1. Policy Dividends

- The African Union's Agenda 2063 clearly lists "safe drinking water for all" as a core objective, with countries like Nigeria and South Africa enacting legislation to mandate the use of compliant plastic piping in new constructions.

- Under the framework of China's Belt and Road Initiative, Chinese companies have adopted Chinese standard PPRC pipes in the construction of the light rail project in Ethiopia, driving the upgrade of the local supply chain.

1. Policy Dividends

1. Policy Dividends- The African Union's Agenda 2063 clearly lists "safe drinking water for all" as a core objective, with countries like Nigeria and South Africa enacting legislation to mandate the use of compliant plastic piping in new constructions.

- The African Union's Agenda 2063 clearly lists "safe drinking water for all" as a core objective, with countries like Nigeria and South Africa enacting legislation to mandate the use of compliant plastic piping in new constructions.- Under the framework of China's "Belt and Road" initiative, the light rail project in Ethiopia, constructed by a Chinese company, adopted Chinese standard PPRC pipes, driving the upgrade of the local supply chain.

2. Infrastructure Investment Boom

- The total investment in Egypt's new administrative capital project is $45 billion, with over $800 million spent on pipe procurement, 30% of which is for PPRC.

- South Africa's "National Water Strategy" plans to replace old pipelines over the next decade, projecting a demand for 500,000 tons of PVC pipes.

2. Infrastructure Investment Boom

- The total investment in Egypt's new administrative capital project is $45 billion, with over $800 million spent on pipe procurement, 30% of which is for PPRC.

- South Africa's "National Water Strategy" plans to replace old pipelines over the next decade, projecting a demand for 500,000 tons of PVC pipes.

2. Infrastructure Investment Boom

- The total investment in Egypt's new administrative capital project is $45 billion, with over $800 million spent on pipe procurement, 30% of which is for PPRC.

- South Africa's "National Water Strategy" plans to replace old pipelines over the next decade, projecting a demand for 500,000 tons of PVC pipes.

2. Infrastructure Investment Boom

- The total investment in Egypt's new administrative capital project is $45 billion, with over $800 million spent on pipe procurement, 30% of which is for PPRC.

- South Africa's "National Water Strategy" plans to replace old pipelines over the next decade, projecting a demand for 500,000 tons of PVC pipes.

2. Infrastructure Investment Boom

- The total investment in Egypt's new administrative capital project is $45 billion, with over $800 million spent on pipe procurement, 30% of which is for PPRC.

- South Africa's "National Water Strategy" plans to replace old pipelines over the next decade, projecting a demand for 500,000 tons of PVC pipes.

2. Infrastructure Investment Boom

2. Infrastructure Investment Boom- The total investment in Egypt's new administrative capital project is $45 billion, with over $800 million spent on pipe procurement, 30% of which is for PPRC.

- The total investment in Egypt's new administrative capital project is $45 billion, with over $800 million spent on pipe procurement, 30% of which is for PPRC.- South Africa's "National Water Strategy" plans to replace old pipelines over the next decade, projecting a demand for 500,000 tons of PVC pipes.

South Africa's "National Water Strategy" plans to replace aging pipelines over the next decade, expected to release a demand of 500,000 tons of PVC pipes.3. Environmental Transition Pressure

- Multiple African countries banning lead-containing PVC (such as South Africa's SANS 966 standard) are forcing companies to switch to environmentally friendly formulations.

3. Environmental Transition Pressure

- Multiple African countries banning lead-containing PVC (such as South Africa's SANS 966 standard) are forcing companies to switch to environmentally friendly formulations.

3. Environmental Transition Pressure

- Multiple African countries banning lead-containing PVC (such as South Africa's SANS 966 standard) are forcing companies to switch to environmentally friendly formulations.

3. Environmental Transition Pressure

- Multiple African countries banning lead-containing PVC (such as South Africa's SANS 966 standard) are forcing companies to switch to environmentally friendly formulations.

3. Environmental Transition Pressure

- Multiple African countries banning lead-containing PVC (such as South Africa's SANS 966 standard) are forcing companies to switch to environmentally friendly formulations.

3. Environmental Transition Pressure

3. Environmental Transition Pressure- Multiple African countries banning lead-containing PVC (such as South Africa's SANS 966 standard) are forcing companies to switch to environmentally friendly formulations.

- Multiple African countries banning lead-containing PVC (such as South Africa's SANS 966 standard) are forcing companies to switch to environmentally friendly formulations.Made in China VS International Giants:

Supply Chain, Geopolitical Challenges

Made in China VS International Giants:

Supply Chain, Geopolitical Challenges

Made in China VS International Giants:

Made in China VS International Giants:Supply Chain, Geopolitical Challenges

Supply Chain, Geopolitical Challenges

1. International Brand Layout

1. International Brand Layout- European companies such as Germany's Banninger and Turkey's RAKtherm are capturing the high-end market by setting up local factories, but their prices are 30% higher than Chinese products.

- Indian Finolex and Saudi Arabian Pipes dominate the mid-to-low end markets in North Africa due to their geographical advantages.

- European companies such as Germany's Banninger and Turkey's RAKtherm are capturing the high-end market by setting up local factories, but their prices are 30% higher than Chinese products.

- Indian Finolex and Saudi Arabian Pipes dominate the mid-to-low end markets in North Africa due to their geographical advantages.

- European companies such as Germany's Banninger and Turkey's RAKtherm are capturing the high-end market by setting up local factories, but their prices are 30% higher than Chinese products.

- Indian Finolex and Saudi Arabian Pipes dominate the mid-to-low end markets in North Africa due to their geographical advantages.

- European companies such as Germany's Banninger and Turkey's RAKtherm are capturing the high-end market by setting up local factories, but their prices are 30% higher than Chinese products.

- Indian Finolex and Saudi Arabian Pipes dominate the mid-to-low end markets in North Africa due to their geographical advantages.

- European companies such as Germany's Banninger and Turkey's RAKtherm are capturing the high-end market by setting up local factories, but their prices are 30% higher than Chinese products.

- Indian Finolex and Saudi Arabian Pipes dominate the mid-to-low end markets in North Africa due to their geographical advantages.

- European companies such as Germany's Banninger and Turkey's RAKtherm are capturing the high-end market by setting up local factories, but their prices are 30% higher than Chinese products.

- European companies such as Germany's Banninger and Turkey's RAKtherm are capturing the high-end market by setting up local factories, but their prices are 30% higher than Chinese products.- Indian Finolex and Saudi Arabian Pipes dominate the mid-to-low end markets in North Africa due to their geographical advantages.

- Indian Finolex and Saudi Arabian Pipes dominate the mid-to-low end markets in North Africa due to their geographical advantages.2. Breakthrough Strategies of Chinese Enterprises

- Cost Advantage: The average price of PPRC pipes exported from China to Africa is 2500 USD/ton, which is 40% lower than that in Europe.

- Technological Adaptation: Some companies have developed "tropical type" PVC pipes, with a 50% increase in UV resistance. Their market share in Kenya has jumped from 5% to 18% within three years.

- Localization Cooperation: A company from Guangdong has established a joint venture factory in Ghana, with an annual capacity of 100,000 tons, serving the West African market.

2. Breakthrough Strategies of Chinese Enterprises

- Cost Advantage: The average price of PPRC pipes exported from China to Africa is 2500 USD/ton, which is 40% lower than that in Europe.

- Technological Adaptation: Some companies have developed "tropical type" PVC pipes, with a 50% increase in UV resistance. Their market share in Kenya has jumped from 5% to 18% within three years.

- Localization Cooperation: A company from Guangdong has established a joint venture factory in Ghana, with an annual capacity of 100,000 tons, serving the West African market.

2. Breakthrough Strategies of Chinese Enterprises

- Cost Advantage: The average price of PPRC pipes exported from China to Africa is 2500 USD/ton, which is 40% lower than that in Europe.

- Technological Adaptation: Some companies have developed "tropical type" PVC pipes, with a 50% increase in UV resistance. Their market share in Kenya has jumped from 5% to 18% within three years.

- Localization Cooperation: A company from Guangdong has established a joint venture factory in Ghana, with an annual capacity of 100,000 tons, serving the West African market.

2. Breakthrough Strategies of Chinese Enterprises

- Cost Advantage: The average price of PPRC pipes exported from China to Africa is 2500 USD/ton, which is 40% lower than that in Europe.

- Technological Adaptation: Some companies have developed "tropical type" PVC pipes, with a 50% increase in UV resistance. Their market share in Kenya has jumped from 5% to 18% within three years.

- Localization Cooperation: A company from Guangdong has established a joint venture factory in Ghana, with an annual capacity of 100,000 tons, serving the West African market.

2. Breakthrough Strategies of Chinese Enterprises

- Cost Advantage: The average price of PPRC pipes exported from China to Africa is $2,500 per ton, which is 40% lower than that of Europe.

- Technological Adaptation: A related company has developed "tropical type" PVC pipes, with a 50% improvement in UV resistance, increasing its market share in Kenya from 5% to 18% within three years.

- Localization Cooperation: A Guangdong-based company has established a joint venture factory in Ghana, with an annual production capacity of 100,000 tons, serving the West African market.

2. Breakthrough Strategies of Chinese Enterprises

2. Breakthrough Strategies of Chinese Enterprises- Cost Advantage: The average price of PPRC pipes exported from China to Africa is $2,500 per ton, which is 40% lower than that of Europe.

- Cost Advantage: The average price of PPRC pipes exported from China to Africa is $2,500 per ton, which is 40% lower than that of Europe.- Technological Adaptation: A related company has developed "tropical type" PVC pipes, with a 50% improvement in UV resistance, increasing its market share in Kenya from 5% to 18% within three years.

- Technological Adaptation: A related company has developed "tropical type" PVC pipes, with a 50% improvement in UV resistance, increasing its market share in Kenya from 5% to 18% within three years.- Localization Cooperation: A Guangdong-based company has established a joint venture factory in Ghana, with an annual production capacity of 100,000 tons, serving the West African market.

- Localization Cooperation: A Guangdong-based company has established a joint venture factory in Ghana, with an annual production capacity of 100,000 tons, serving the West African market.3. Challenges and Risks

- Congestion at African ports leads to a 30% extension in delivery cycles (e.g., Lagos Port with an average delay of 21 days), prompting some Chinese companies to establish regional distribution centers at Mombasa Port in East Africa.

- The Economic Community of West African States (ECOWAS) mandates that pipes must pass ISO 4427 certification, increasing compliance costs for small and medium-sized enterprises by 20%.

- The Nigerian Naira is expected to depreciate by 40% in 2024, putting pressure on importers' cash flow, leading Chinese suppliers to start accepting barter trade (e.g., using cocoa beans as payment).

3. Challenges and Risks

- Congestion at African ports leads to a 30% extension in delivery cycles (e.g., Lagos Port with an average delay of 21 days), prompting some Chinese companies to establish regional distribution centers at Mombasa Port in East Africa.

- The Economic Community of West African States (ECOWAS) mandates that pipes must pass ISO 4427 certification, increasing compliance costs for small and medium-sized enterprises by 20%.

- The Nigerian Naira is expected to depreciate by 40% in 2024, putting pressure on importers' cash flow, leading Chinese suppliers to start accepting barter trade (e.g., using cocoa beans as payment).

3. Challenges and Risks

- Congestion at African ports has led to a 30% increase in delivery cycles (for example, the average delay at Lagos Port is 21 days), prompting some Chinese companies to establish regional distribution centers at Mombasa Port in East Africa.

- The Economic Community of West African States (ECOWAS) mandates that pipes must be certified under ISO 4427, increasing compliance costs for small and medium-sized enterprises by 20%.

- The Nigerian Naira is expected to depreciate by 40% in 2024, putting pressure on importers' cash flow, leading Chinese suppliers to begin accepting barter trade (such as using cocoa beans to offset payment).

3. Challenges and Risks

- Congestion at African ports has led to a 30% increase in delivery cycles (for example, the average delay at Lagos Port is 21 days), prompting some Chinese companies to establish regional distribution centers at Mombasa Port in East Africa.

- The Economic Community of West African States (ECOWAS) mandates that pipes must be certified under ISO 4427, increasing compliance costs for small and medium-sized enterprises by 20%.

- The Nigerian Naira is expected to depreciate by 40% in 2024, putting pressure on importers' cash flow, leading Chinese suppliers to begin accepting barter trade (such as using cocoa beans to offset payment).

3. Challenges and Risks

- Congestion at African ports has led to a 30% increase in delivery cycles (for example, the average delay at Lagos Port is 21 days), prompting some Chinese companies to establish regional distribution centers at Mombasa Port in East Africa.

- The Economic Community of West African States (ECOWAS) mandates that pipes must be certified under ISO 4427, increasing compliance costs for small and medium-sized enterprises by 20%.

- The Nigerian Naira is expected to depreciate by 40% in 2024, putting pressure on importers' cash flow, leading Chinese suppliers to begin accepting barter trade (such as using cocoa beans to offset payment).

3. Challenges and Risks

3. Challenges and Risks- Congestion at African ports has led to a 30% increase in delivery cycles (for example, the average delay at Lagos Port is 21 days), prompting some Chinese companies to establish regional distribution centers at Mombasa Port in East Africa.

- Congestion at African ports has led to a 30% increase in delivery cycles (for example, the average delay at Lagos Port is 21 days), prompting some Chinese companies to establish regional distribution centers at Mombasa Port in East Africa.- The Economic Community of West African States (ECOWAS) mandates that pipes must be certified under ISO 4427, increasing compliance costs for small and medium-sized enterprises by 20%.

- The Economic Community of West African States (ECOWAS) mandates that pipes must be certified under ISO 4427, increasing compliance costs for small and medium-sized enterprises by 20%.- The Nigerian Naira is expected to depreciate by 40% in 2024, putting pressure on importers' cash flow, leading Chinese suppliers to begin accepting barter trade (such as using cocoa beans to offset payment).

- The Nigerian Naira is expected to depreciate by 40% in 2024, putting pressure on importers' cash flow, leading Chinese suppliers to begin accepting barter trade (such as using cocoa beans to offset payment).Africa is shifting from a "resource exporter" to a "major construction site," and the competition between PPRC and PVC pipes essentially boils down to a contest of cost-effectiveness and standardization. Chinese companies need to seize the policy window period, through technological adaptation and deep localization, to establish long-term advantages in this blue ocean.

For investors, paying attention to the infrastructure tender dynamics of the East African Community (EAC) and the Economic Community of West African States (ECOWAS) might be the next growth hotspot.

Africa is shifting from a "resource exporter" to a "major construction site," and the competition between PPRC and PVC pipes essentially boils down to a contest of cost-effectiveness and standardization. Chinese companies need to seize the policy window period, through technological adaptation and deep localization, to establish long-term advantages in this blue ocean.

For investors, paying attention to the infrastructure tender dynamics of the East African Community (EAC) and the Economic Community of West African States (ECOWAS) might be the next growth hotspot.

Africa is shifting from a "resource exporter" to a "major construction site," and the competition between PPRC and PVC pipes essentially boils down to a contest of cost-effectiveness and standardization. Chinese companies need to seize the policy window period, through technological adaptation and deep localization, to establish long-term advantages in this blue ocean.

Africa is shifting from a "resource exporter" to a "major construction site," and the competition between PPRC and PVC pipes essentially boils down to a contest of cost-effectiveness and standardization. Chinese companies need to seize the policy window period, through technological adaptation and deep localization, to establish long-term advantages in this blue ocean.For investors, paying attention to the infrastructure tender dynamics of the East African Community (EAC) and the Economic Community of West African States (ECOWAS) might be the next growth hotspot.

For investors, paying attention to the infrastructure tender dynamics of the East African Community (EAC) and the Economic Community of West African States (ECOWAS) might be the next growth hotspot.【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Nissan Cuts Production of New Leaf EV in Half Due to Battery Shortage