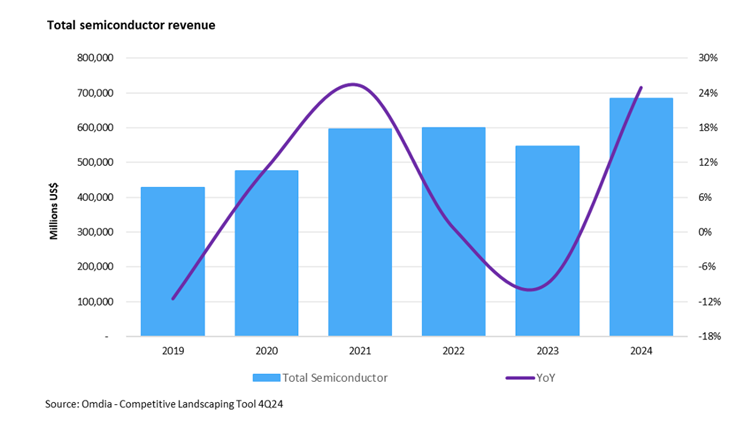

Omdia: Artificial intelligence drives strong demand, semiconductor market revenue surges about 25% in 2024

The year 2024 marked a record-breaking year for the semiconductor market, with Omdia data showing a surge of approximately 25% in semiconductor revenue, reaching $683 billion. This sharp growth is attributed to the strong demand for AI-related chips, particularly high-bandwidth memory (HBM) used in AI GPUs, which drove a 74% annual growth rate in the memory sector. Following a challenging 2023, the rebound in the memory market helped boost the overall industry.

However, this record-breaking year masks uneven performance across the industry. The data processing segment saw strong growth, while other key segments such as automotive, consumer, and industrial semiconductors experienced revenue declines in 2024. These struggles highlight the weak links in what was otherwise a booming market.

Throughout 2024, the influence of artificial intelligence on the semiconductor market has been dominant, driving record revenues and reshaping industry dynamics. NVIDIA has emerged as the undisputed leader, with its AI GPUs fueling strong revenue growth over the past few years and steadily increasing its market share. As a critical component for AI applications, the sales of HBM (High Bandwidth Memory) have also surged, significantly boosting the revenues of memory companies. While HBM's growth has outpaced other DRAM segments, improved supply-demand balance has further contributed to higher average selling prices (ASPs) and overall revenue growth in the memory market.

The industrial sector is facing a decline for the second consecutive year.

The downturn in the industrial semiconductor sector began in 2023 and deepened further in 2024, presenting challenges for companies focused on this field. "Historically, the industrial semiconductor market grows by about 6% annually. However, after two years of above-average growth in 2021 and 2022, semiconductor market revenue saw a double-digit decline in 2024," said Cliff Leimbach, chief analyst at Omdia. "Reduced demand combined with inventory adjustments made 2024 a difficult year for the industrial sector. Companies with significant business in this area also experienced a drop in their market share rankings."

The automotive market is at a standstill.

Although the automotive semiconductor market performed better than the industrial sector, it also experienced a revenue decline in 2024. From 2020 to 2023, the size of the automotive semiconductor market nearly doubled, far exceeding the historical average annual growth rate of 10%. Weak demand led to a contraction in 2024, breaking the steady upward trajectory seen in recent years.

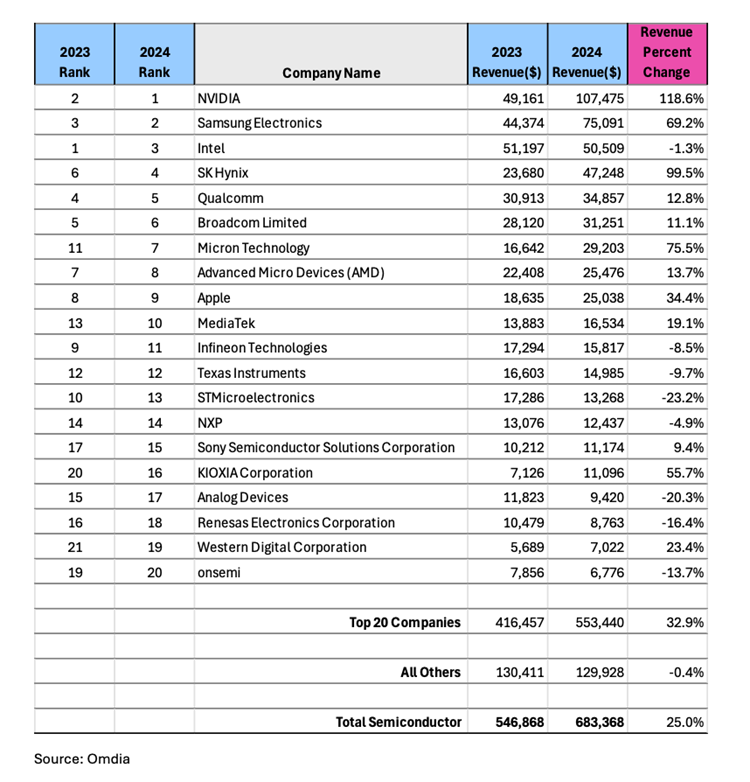

NVIDIA (NVDA.US) tops the list, and the market rankings have changed.

NVIDIA's dominant position in AI-driven GPUs has propelled it to the top of the semiconductor company revenue rankings, surpassing Samsung which led the list in 2023.

A robust memory market also reshuffled the rankings, with Samsung, SK Hynix, and Micron all making it into the list of the seven largest semiconductor companies by revenue. Compared to the rankings in 2023, these companies have each moved up at least one place, marking a significant shift from the previous year when they were spread across the top eleven.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Overseas Highlights: PPG Establishes New Aerospace Coatings Plant in the US, Yizumi Turkey Company Officially Opens! Pepsi Adjusts Plastic Packaging Goals

-

Abbott and Johnson & Johnson: Global Medical Device Giants' Robust Performance and Strategies Amid Tariff Pressures

-

BYD releases 2024 ESG report: Paid taxes of 51 billion yuan, higher than its net profit for the year.

-

Behind pop mart's surging performance: The Plastics Industry Embraces a Revolution of High-End and Green Transformation

-

The price difference between recycled and virgin PET has led brands to be cautious in their procurement, even settling for the minimum requirements.