Overview of the low-value medical consumables industry: The market size is expected to continue rising, demonstrating broad prospects for development.

Content Summary:Low-value medical consumables primarily refer to disposable sanitary materials frequently used by medical institutions during healthcare services. With the continuous improvement of China's medical insurance system and the rising living standards of the population, per capita medical insurance expenditures and healthcare costs have maintained rapid growth. The low-value medical consumables market has shown considerable growth, accounting for an increasingly larger share of the hospital consumables market. In China's low-value medical consumables industry, injection and puncture products hold the largest market share, while medical dressing products represent the second-largest segment. In 2024, the market size of low-value medical consumables in China is projected to reach approximately 147 billion yuan, with the medical dressings market estimated at around 26.5 billion yuan. By 2025, the low-value medical consumables market is expected to grow to 160 billion yuan, and the medical dressings market is anticipated to reach 29.1 billion yuan. As a subset of the medical device industry, low-value medical consumables are a vital component of China's national economic development and are closely tied to the country's macroeconomic growth. With the ongoing advancement of China's healthcare system, the market size of the low-value medical consumables industry is likely to continue expanding in the future.

Listed companies:BGI Genomics (300676.SZ), Mindray Medical (300760.SZ), Lepu Medical (300003.SZ), Intco Medical (300677), Cainiao Shares (301122.SZ), Winner Medical (300888), Kangdelai (603987), Gongdong Medical (605369), Zhende Medical (603301), Aomi Medical (002950), Sanxin Medical (300453), Nanwei Shares (603880), Weili Medical (603309), Yangpu Medical (300030)

wait

Low-value medical consumables market size, low-value medical consumables market competition pattern, low-value medical consumables industry development prospects

1. Definition and Classification of Low-value Medical Consumables Industry

Medical consumables refer to the medical and sanitary materials used by hospitals for patient examination and treatment. They can be further categorized into high-value and low-value medical consumables. According to the Shanghai Medical Device Industry Association, low-value medical consumables primarily include disposable sanitary materials frequently used by medical institutions during healthcare services. These include disposable syringes, infusion sets, blood transfusion sets, drainage bags, drainage tubes, indwelling needles, sterile gloves, surgical sutures, surgical needles, surgical blades, gauze, cotton swabs, medical masks, and more.

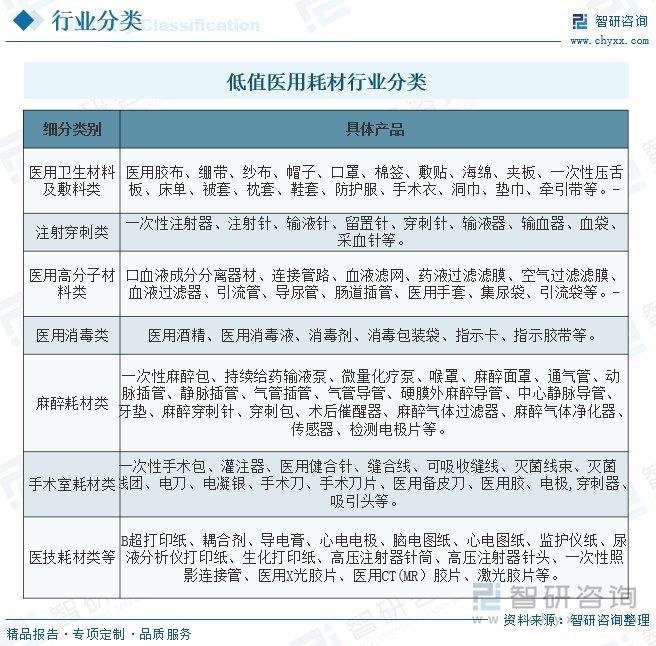

Low-value medical consumables can be divided into categories such as medical sanitary materials and dressings, injection and puncture, medical polymer materials, medical disinfection, anesthesia consumables, operating room consumables, and medical technical consumables, according to their specific uses. The classification of the low-value medical consumables industry is as follows:

The low-value medical consumables industry development现状 现状 should be "current situation" in this context, so a more accurate translation would be: "The current situation of the low-value medical consumables industry development" However, if you want a more natural-sounding translation, it could be: "II. Current Development Status of the Low-Value Medical Consumables Industry"

With the continuous improvement of China's medical insurance system and the rising living standards of the people, per capita medical insurance expenditures and health expenses are maintaining rapid growth. The market for low-value medical consumables is experiencing considerable growth, and its proportion of the hospital consumables market is continuously expanding. In 2023, the market size of low-value medical consumables in China reached 128 billion yuan. In 2024, it is expected to be approximately 147 billion yuan, and it is projected that the market size will reach around 160 billion yuan by 2025. Low-value medical consumables belong to the medical device industry and are an important component of China's national economic development. Their growth is closely related to China's macroeconomic development. In the future, as China's medical system continues to develop, the market size of the low-value medical consumables industry is likely to keep rising.

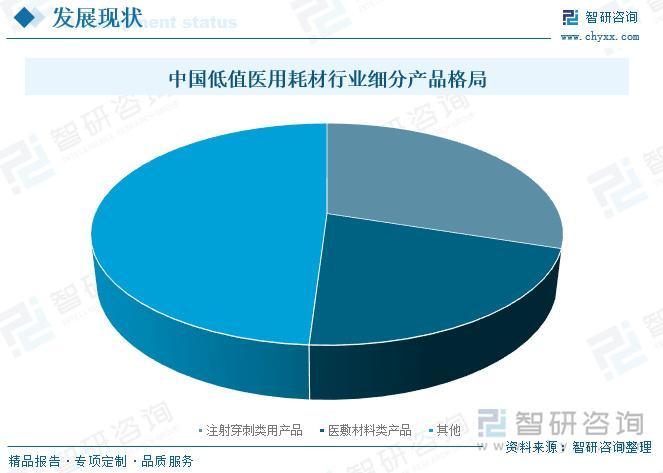

In China's low-value medical consumables industry, injection and puncture products account for the largest share, approximately 30%, followed by medical dressing products, which account for about 21%.

The full name of medical dressings is medical hygiene materials and dressings, which is the second largest sub-category of low-value medical consumables in China. In recent years, China's medical dressing market has also entered a period of rapid development. According to statistics, the market size of medical dressings in China grew to 26.5 billion yuan in 2024 and is expected to reach 29.1 billion yuan in 2025. With the continuous expansion of domestic market demand, large medical dressing export enterprises have increased their efforts to explore the domestic market, and foreign manufacturers have also gradually implemented localization strategies for the Chinese market.

Relevant report: "Research Report on Market Competition Situation and Future Strategy of China's Low-value Medical Consumables Industry" published by Zhiyan Consulting

Three, the industrial chain of low-value medical consumables

1. Low-value medical consumables industry industrial chain structure

The low-value medical consumables industry includes a wide range of categories. Its upstream supply chain involves raw materials such as textile materials, medical metal materials, polymer materials, and bioceramic materials; the midstream consists of the production and manufacturing of various low-value consumables; and the downstream is primarily applied in various medical institutions, military, medical schools, rehabilitation institutions, and so on.

IV. Development Environment of the Low-Value Medical Consumables Industry - Relevant Policies

Low-value medical consumables belong to the category of medical devices. They are an indispensable part in the medical field. In recent years, China has successively introduced a series of laws, regulations, and policies to promote the development of the medical device industry, laying a solid foundation for the healthy development of the low-value medical consumables industry and driving its high-quality rapid development. As the reform of medical systems deepens in China, it also provides a healthier, more orderly, and standardized development environment for the low-value medical consumables industry.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories