Shen Guofang Precision Strategic Investment in Compart Systems: The Path of a Parts Supplier's Breakthrough

In recent years, with the domestic semiconductor industry actively advancing industrial upgrading, the materials, equipment, and components sectors of the broader semiconductor industry have garnered widespread attention, becoming a focal point for breakthroughs. Semiconductor gas delivery system components, as a niche segment within the entire semiconductor manufacturing process, play a critical role in precisely controlling the flow, pressure, and purity of reactive gases in semiconductor equipment, earning them the title of the "vascular system" of chip manufacturing. In key wafer fabrication processes such as etching and thin-film deposition, the performance of the gas delivery system directly impacts chip yield. Consequently, this critical field exhibits three major characteristics:

Illustration: Characteristics of Semiconductor Gas Transmission System Components Industry Source: Organized by CINNO Research

1. High technological barriers: Components of semiconductor gas delivery systems must meet stringent requirements such as nanometer-level machining precision, ultra-high cleanliness, and resistance to strong corrosion, thus involving interdisciplinary technological expertise in materials science, precision machinery, and more.

2. Strong Customer Stickiness: Since semiconductor equipment directly determines chip yield rates, customers are extremely cautious when selecting equipment manufacturers, with certification cycles potentially lasting 2-3 years. Once integrated into the supply chain, the need for process stability typically fosters long-term, stable partnerships. Customers tend to focus more on how gas delivery system components enhance overall yield rates rather than reducing short-term procurement costs.

3. Highly Monopolistic Landscape: Due to the aforementioned characteristics, the industry is currently dominated by established giants such as the U.S.-based UCT and Japan’s Fujikin, with significant first-mover advantages, as the global CR5 reaches 75%. At present, the localization rate of China's gas delivery systems is only 10%, with core components almost entirely dependent on imports.

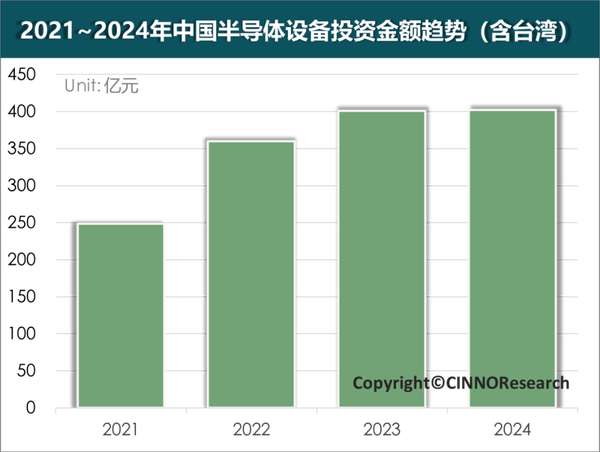

According to statistics from CINNO Research, the total investment in China's (including Taiwan) semiconductor industry in 2024 is 683.1 billion yuan, a decrease of 41.6% compared to the same period last year. Despite this, data from细分领域的数据显示,半导体设备投资逆势增长1.0%, reaching 40.23 billion yuan, making it the only category to achieve positive growth.

Illustration: Trend of semiconductor equipment investment amount in China (including Taiwan) from 2021 to 2024 Source: CINNO Research

Currently, the market size of semiconductor equipment components in China is approximately $17.5 billion. Specifically, in the gas transmission sector, the market size for gas cabinets and gas lines in China in 2024 is expected to be around $2.2 billion, but the high-end market is largely dominated by foreign companies.

Shenyang Fund Management: Strategic Investment in Compart Systems: An Important Piece of the Full Industry Chain Puzzle

Founded in 2008, FuChuang Precision is China's highest-purity, largest-scale, and most comprehensive semiconductor component supplier, as well as one of the few global providers capable of delivering precision components for 7nm process semiconductor equipment. The company's core business involves supplying precision components for semiconductor equipment, pan-semiconductor equipment, and devices in other industrial sectors.

Fuchuang Precision's main products include process components, structural components, module products, and gas pipelines. As of the 2024 semi-annual report, the revenue share of process components is 23%, structural components 27%, module products 40%, and gas products 10%. In terms of revenue by region, the revenue share from mainland China has been continuously increasing, rising from 14% in 2018, 54% in 2022, to 75% in the first half of 2024.

After its上市 in 2022, Fuchuang Precision achieved rapid growth in operating revenue, with revenue exceeding 3 billion yuan in 2024, a 47% increase from 2023 and a 97% increase from 2022. Fuchuang Precision is actively accelerating the expansion and research and development of advanced process products while also actively laying out its production capacity. Domestically, it has established two production bases in Shenyang and Nantong, with a forward-looking plan for a production base in Beijing. Once all three production bases reach full production, the capacity will reach 6 billion yuan. Internationally, to further expand the company's international business scale, deepen the company's ties with international clients, and enhance global supply chain procurement capabilities, the Singapore factory is being constructed in an orderly manner according to plan.

The struggle and development journey of FuChuang Precision mirrors that of domestic pan-semiconductor supply chain enterprises. However, despite catching up rapidly and achieving fast growth, the lack of modular capabilities in gas delivery systems remains a strategic pain point for FuChuang Precision. Currently, in advanced processes below 14nm, high-purity gas control technology is constrained by overseas suppliers, severely limiting the supply chain security of equipment manufacturers.

Compart Systems is one of the leading suppliers in the field of gas delivery systems, and it is also one of the few companies globally capable of completing all stages of precision processing for components in this field. Its main products include surface mount components (gas flow blocks), BTP (Built To Print) assemblies, assemblies, seals, gas quill assemblies, welded components, etc., which are used in precise gas delivery systems required by equipment for oxidation/diffusion, etching, and deposition processes in integrated circuit manufacturing. At the same time, the company is one of the few globally capable of providing assembly services for mass flow controllers (MFCs). Compart Systems also offers products including high-precision metal machining parts to customers in industries such as industrial and oil and gas sectors.

In terms of global industry position, Compart Systems' surface-mounted components (gas flow manifold) hold a leading position in the gas transmission system segment and possess the patented next-generation product iBlock. Compart Systems has rich experience and product layout in the field of gas delivery systems, with comprehensive technical capabilities in R&D design, flow control, secondary processing, and assembly testing.

Through the acquisition of Zhejiang Prism (the controlling shareholder of Compart Systems) via a special purpose company, FuChuang Precision has achieved an indirect significant shareholder position in Compart Systems as a strategic investor, gaining key capability synergies and reserving operational space for further integration of its industrial chain. FuChuang Precision will vigorously promote the integration of both parties' advantageous resources. In the short to medium term, this strategic investment will help FuChuang Precision secure a dominant position in the gas transmission supply chain, enhancing its global supply chain status. Meanwhile, FuChuang Precision's already robust domestic customer channels can effectively assist Compart Systems in capturing market share, creating a win-win situation. Post-strategic investment, FuChuang Precision will establish a five-location collaborative system spanning Shenyang, Nantong, Beijing, Singapore, and Malaysia, improving global customer coverage and response speed while reducing its own supply chain risks.

Domestic semiconductor supply chain enterprises are transitioning towards platformization through mergers and acquisitions.

Semiconductor components represent a high-threshold, strong-stronger track. Domestic related enterprises started late and have a shallow foundation, often achieving breakthroughs in certain single fields, while the layout of the entire industrial chain and the richness of product lines are still significantly behind that of established international first-tier suppliers. Although the vast domestic demand can effectively promote companies to accelerate investment for rapid development, in practical operations, they inevitably encounter various obstacles such as the first-mover advantages of American and Japanese companies, patent positioning, long customer onboarding cycles, and the difficulty for new entrants to break through and miss the window period.

As a result, in recent years, Chinese semiconductor companies have completed several strategically significant cross-border acquisitions under the influence of globalization layout, the catalysis of the domestic market, and the drive of technological upgrades. For instance, in 2019, Wingtech completed the acquisition of Nexperia (formerly known as NXP's Standard Products Business), thereby rapidly establishing its own IDM (Integrated Device Manufacturing) model. Leveraging Nexperia’s global Tier 1 customer base and production capacity, by 2022, Wingtech achieved over 10 billion chip shipments for automotive applications, realizing rapid business expansion. Similarly, in 2019, Will Semiconductor also completed the acquisition of OmniVision Technologies in the U.S., thereby obtaining core technologies and capacities for smartphone and automotive CIS (CMOS Image Sensor). This helped ensure the stability of its supply chain when related customers encountered U.S. export restrictions.

This strategic investment by Fusion Precision in Compart Systems also carries a similar meaning of “using capital to save time and expanding production capacity to gain space.” On one hand, successfully integrating advanced industry resources can effectively shorten the R&D cycle for similar products by about five years for Fusion Precision, enabling its products to quickly align with the latest equipment requirements of its customers. On the other hand, through the existing supply relationships between Compart Systems and international clients, Fusion Precision’s products can significantly reduce the certification period, thereby capturing market share during the favorable window of advanced process capacity landing and large-scale equipment production. Furthermore, after this strategic investment, Fusion Precision’s phased layout in China and Southeast Asia will help the company expand its domestic and international markets. Moreover, for the future development of Fusion Precision, this strategic investment may hold even greater significance.

Fuchuang Precision is a典型的“时代企业” (typical "era enterprise"): The reason for its current achievements and becoming a leading enterprise in the semiconductor components industry cannot be ignored. In the early stages of the company's growth, Fuchuang Precision almost occupied all the first-mover advantages and favorable terrain. Amid the global restructuring of the semiconductor industry chain and the eastward shift of the international economic center, Fuchuang not only seized the opportunity of the rise of the East Asian semiconductor industry but also grasped the demand for the逆势崛起 (resilient rise) of the Chinese semiconductor industry. Fuchuang Precision's chairman, Zheng Guangwen, summarizes the future path of Fuchuang as "new four modernizations," namely "internationalization, intelligence, lean management, and greenness." The strategic investment in Compart Systems is a key initiative to achieve these four major goals, and in the future, the company will continue to adhere to the development approach of balancing independent development and resource integration.

Through this strategic investment, FuChuang Precision will be able to complete the final piece of the gas delivery system puzzle, forming a comprehensive product matrix of "metal process structural components + modules + gas systems," which can cover approximately 85% of equipment costs. In terms of business development, the company is advancing from OEM to product-driven growth, with its products evolving toward platformization, effectively increasing average customer spending. At the same time, leveraging this opportunity, FuChuang Precision will initiate global capacity expansion measures, prioritizing Southeast Asia for overseas production. In the future, the company will also pursue more mergers and acquisitions to strengthen technological capabilities, synergize with domestic factories to form a capacity matrix, and achieve a balanced global presence, capacity export, and revenue growth.

In addition, Fuchuang is also planning more strategic initiatives, such as model innovation and management innovation: by integrating the technology and processes of Compart Systems and Fuchuang, it will achieve a 1+1>2 effect, helping Fuchuang to conquer more advanced process supporting technologies and incubate next-generation materials and process technologies. The company's resources and policies will be tilted towards creativity, and it will more firmly execute the intelligent manufacturing strategy and the construction of platformization and standardization.

Strategic Insights under the Wave of Domestic Substitution

Fuchuang Precision's strategic investment in Compart Systems coincides with three major turning points facing China's semiconductor industry.

Chart: China's semiconductor industry is facing three major turning points Source: CINNO Research整理

1. Policy Window: The second phase of the National Integrated Circuit Industry Investment Fund (also known as the "Big Fund") with a scale of 150 billion yuan focuses on investing in the equipment and components sector, particularly highlighting the gas transmission system as one of the ten key areas under the "Industrial Strengthening Project." This integration directly aligns with the goal of "breaking through critical components for high-purity processes" as outlined in "Made in China 2025."

2. Demand Surge: Domestic projects such as the second phase of Yangtze Memory and SMIC Shenzhen, totaling 12 new wafer fabs, involve a total investment exceeding 300 billion yuan, with the import substitution ratio requirement increasing from 10% to 40%. Investments in wafer fabs drive demand for semiconductor equipment, and the continuous growth in semiconductor equipment sales boosts the scale of component production.

3. Technical Inflection Point: As the number of NAND stacking layers surpasses 200, major global flash memory manufacturers are now developing 400+ layer technology. The 3D structure demands over ten times more precision in gas control compared to the past, and the technological upgrade imposes higher requirements for equipment and component iteration as well as manufacturing processes.

Through this strategic investment, Fuchuang Precision not only gained access to the advanced process supply chain, helping it to build a complete profit chain of "materials-components-systems-services," but also validated its platform-based approach of "horizontal technology integration + vertical industry chain extension." By 2027, the synergy between the two parties is expected to significantly boost Fuchuang Precision's market share in the gas transmission sector, potentially making it the first Chinese company to enter the global top 10 semiconductor component manufacturers. This strategy of leveraging capital to drive industrial resources and expand production capacity to redefine market boundaries is precisely the way for Chinese manufacturing enterprises to break through the "middle technology trap." With this investment, Fuchuang Precision has provided its answer to industrial upgrading: not only must it possess core technologies, but it must also excel in resource integration.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Overseas Highlights: PPG Establishes New Aerospace Coatings Plant in the US, Yizumi Turkey Company Officially Opens! Pepsi Adjusts Plastic Packaging Goals

-

Abbott and Johnson & Johnson: Global Medical Device Giants' Robust Performance and Strategies Amid Tariff Pressures

-

BYD releases 2024 ESG report: Paid taxes of 51 billion yuan, higher than its net profit for the year.

-

Behind pop mart's surging performance: The Plastics Industry Embraces a Revolution of High-End and Green Transformation

-

The price difference between recycled and virgin PET has led brands to be cautious in their procurement, even settling for the minimum requirements.