Shengquan Group is so profitable, with a net profit of 868 million yuan, half of which is used for dividends!

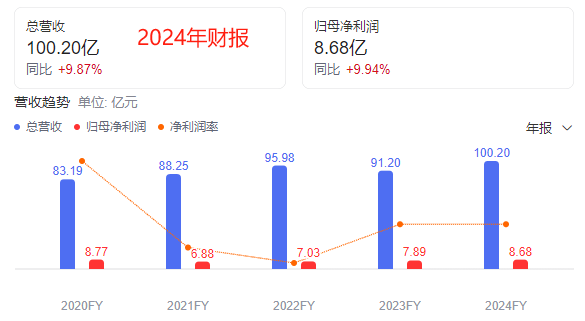

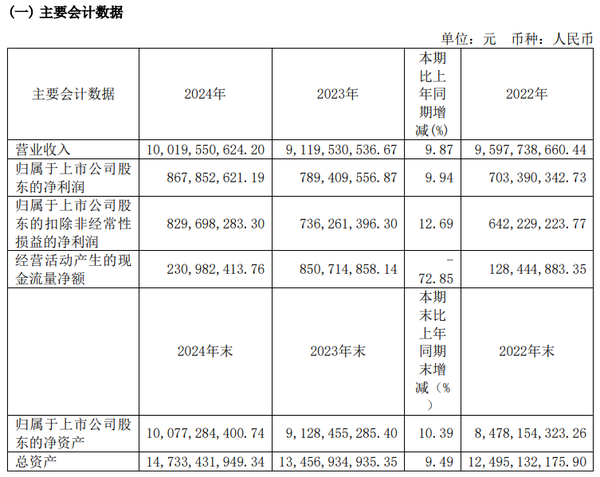

On the evening of March 31, 2025, Shengquan Group (605589.SH) released its 2024 annual report. The company's revenue exceeded the 10 billion yuan mark for the first time, reaching 10.02 billion yuan, representing a year-on-year increase of 9.87%; the net profit attributable to shareholders of the listed company was 868 million yuan, representing a year-on-year increase of 9.94%. Under the impressive performance, the company plans to distribute a cash dividend of 5.50 yuan (tax included) for every 10 shares to all shareholders, totaling a dividend of 453 million yuan, accounting for 52.24% of the net profit.

Shengquan Group's main products include 150,000 tons of furfural resin, 650,000 tons of phenolic resin, and biomass refined products. The report shows that Shengquan Group's biomass chemical and new energy sector has become the main driver of performance growth.

In the biomass industry, the company's independently developed "Shengquan Method" biomass integrated refining technology has achieved significant breakthroughs and been included in the National Development and Reform Commission's "Green Technology Promotion Catalogue" (2020 edition). The world's first project on this scale—the 1 million ton/year Biomass Integrated Refining Complex (Phase I) in Daqing, Heilongjiang—was resumed in June 2024. Capacity utilization has steadily increased, achieving a production and sales balance by the end of the year. The total revenue from the biomass industry for the year reached 956 million yuan, representing a year-on-year increase of 11.74%.

The new energy sector has also achieved remarkable success. Shengquan Group, leveraging its advantages in biomass refining technology, has accelerated its layout in the battery materials business. A 300-ton/year porous carbon production line was completed and put into operation in the third quarter of 2024, quickly achieving full production and sales, while a 1,000-ton/year porous carbon production line was completed in February 2025 and is gradually being brought online. The products are widely used in the fields of consumer electronics and power batteries, effectively meeting the market demand for high-energy-density batteries. Significant progress has been made in the research and development of hard carbon anode materials for sodium-ion batteries, with high bulk density products successfully entering the energy storage, power, and 3C battery markets.

In the field of advanced electronic materials, benefiting from the rapid development of AI computing power, 5G communication, and the semiconductor packaging industry, Shengquan Group's demand for high-end electronic materials is strong. The company is accelerating the mass production of high value-added products, with a 1,000 tons/year PPO resin production line and a 100 tons/year hydrocarbon resin production line set to be completed and put into operation in 2024. The product performance meets the requirements of high-frequency and high-speed copper-clad laminates for 5G/6G, successfully entering the supply chain of leading enterprises, which has significantly boosted the revenue growth of the electronic materials business.

At the same time, Shengquan Group also released a performance forecast for the first quarter of 2025, expecting a net profit attributable to the owners of the parent company to be between 200 million yuan and 215 million yuan, representing a year-on-year increase of 45.58% to 56.49%. The company stated that this is mainly due to the continuous increase in orders in the advanced electronic materials sector and the stable supply from the porous carbon production line.

Notably, in 2024, Shengquan Group also repurchased shares worth 4.71 billion yuan through centralized bidding. Together with this cash dividend, the total amount returned to shareholders throughout the year reached 9.24 billion yuan, surpassing the 8.75 billion yuan raised from the private placement to the actual controller Tang Diyuan. After the completion of the private placement, the shareholding ratio of Tang Yilin and Tang Diyuan increased from 19.43% to 25.36%. According to their current shareholding ratio, the father and son will receive a dividend of 115 million yuan. Additionally, from 2020 to 2024, Chairman Tang Yilin's annual salary was: 5.488 million yuan, 5.5 million yuan, 5.502 million yuan, 5.5 million yuan, and 4.98 million yuan respectively, with a total salary of approximately 26.97 million yuan over the five years.

Despite its outstanding performance, Shengquan Group also faces some challenges. By the end of 2024, the company's inventory balance increased to 1.826 billion yuan, and accounts receivable and notes receivable rose to 2.443 billion yuan, which poses a certain burden on the company's funds. In addition, the proportion of fixed assets to total assets is high, reaching 5.027 billion yuan, along with construction in progress of 1.351 billion yuan, indicating characteristics of heavy asset operations. However, the company's asset-liability ratio remains low, at only 28.29%.

Looking to the future, Shengquan Group will continue to deepen its布局 in the fields of biomass chemicals, new energy, and advanced electronic materials, continuously promoting technological innovation and industrial upgrading to respond to market changes and challenges, creating greater value for shareholders.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Amcor Opens Advanced Coating Facility for Healthcare Packaging in Malaysia

-

ExxonMobil and Malpack Develop High-Performance Stretch Film with Signature Polymers

-

Plastic Pipe Maker Joins Lawsuit Challenging Trump Tariffs

-

Pont, Blue Ocean Closures make biobased closures work

-

Over 300 Employees Laid Off! Is Meina Unable to Cope?