The alliance procurement for five categories of consumables will be launched.

The low-value consumables alliance procurement is back.

Sutures and five other types of consumables will be included in the alliance procurement.

According to Huazhao Medical Device Network, on March 28, the Liaoning Provincial Medical Insurance Platform issued a notice titled "Notice on Carrying Out Information Maintenance Work for Concentrated Bulk Purchase Products of Five Categories of Medical Consumables such as Interprovincial Alliance Sutures." It shows that in order to properly conduct the concentrated bulk purchasing of medical consumables such as interprovincial alliance sutures, information maintenance for the proposed bulk purchase products is now being carried out.

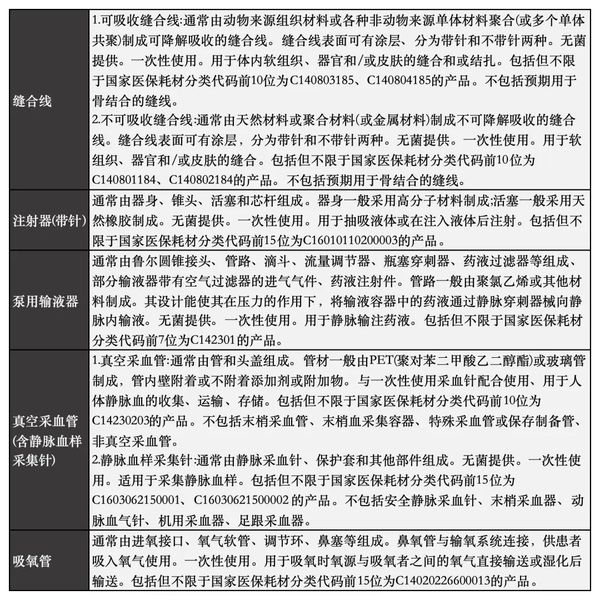

The product range includes: sutures, syringes (with needles), infusion sets for pumps, vacuum blood collection tubes (including venous blood collection needles), and oxygen supply tubes.

In terms of inter-provincial alliance centralized procurement, there were also some projects last year focusing on low-value consumables. The overall bargaining power was strong, with larger-scale projects including the pre-filled catheter flushing device centralized procurement led by Inner Mongolia (average reduction of 85.4%) and the centralized procurement of six categories of needle-free connectors and other consumables led by Liaoning (average reduction of 77%).

Liaoning has accumulated certain experience in leading the alliance procurement of low-value consumables. The official documents for the new round of procurement have not yet been released, and relevant companies can further pay attention during the subsequent solicitation of opinions.

Since the beginning of the year, there has been a concentrated effort in the collection of low-value consumables. According to the analysis by Saibolan Medical Devices, as of now, several regions including Hunan, Jiangxi, Hebei, Jiangsu, Liaoning, and Fujian have advanced the collection of low-value consumables.

Hebei and Jiangsu are conducting follow-up procurement. The collection of 17 types of consumables such as infusion ports in Hebei and 7 types of consumables including blood glucose test strips led by Sanming has recently announced the proposed winning results. The Sanming-led collection mainly focuses on low-value consumables, with an average price drop of 70.62% in the previous round, and a maximum drop of 93.02%. Jiangsu's vacuum blood collection tubes will also conduct follow-up procurement, with an average price drop of 37% in the previous collection.

02

"Under the 'Hurricane' of Centralized Procurement"

According to different clinical uses, low-value medical consumables can be divided into categories such as medical sanitary materials and dressings, injection and puncture materials, medical polymer materials, medical disinfectants, anesthesia consumables, operating room consumables, and medical technology consumables. Data from the "China Medical Device Blue Book (2021 Edition)" predicts that by 2025, the domestic market scale of low-value medical consumables will reach 220 billion yuan.

In the hundred billion market, the disruptive impact of centralized procurement "hurricane" has become increasingly evident. Overall, while centralized procurement of consumables has mainly focused on high-value consumables, widely used low-value consumables have also attracted significant attention. Years of price suppression have intensified competition in this red ocean market.

In the era of centralized procurement, the Matthew Effect is more pronounced. For general consumption manufacturers, the importance of "cost control" is highlighted. Leading enterprises, based on their larger production and sales scale, can effectively enhance their cost competitiveness by relying on advantages in the industrial chain and cross-regional layout.

Kangdelai, which specializes in medical puncture needles and infusion devices, pointed out in its financial report that in the intense competitive environment driven by centralized procurement policies, product cost has become a crucial factor for market competitiveness in the medical device industry.

Under centralized procurement, companies are also changing their business strategies.

Kang Delai pointed out that centralized procurement encourages distributors to transform into distribution and service providers. The company has established regional channels and distribution service agencies in East China, South China, North China, Central China, Southwest, and Northwest through resource integration and investment mergers and acquisitions. It has also increased the expansion of SPD distribution services to hospital terminals, formed specialized product marketing service teams, and promoted the marketing model of "agent distribution + distribution + third-party supply chain services." At the same time, taking centralized procurement bidding as an opportunity, the company is expanding into untapped markets, exploring the marginal benefits of products after winning centralized procurement bids, and extending more products through new centralized procurement channels to terminal hospitals in various regions.

Jianerkang, which primarily produces medical dressings, stated that it will further strengthen its product layout in the high-end medical dressing sector and increase investment in research and technological innovation. Currently, the medical dressing industry is continuously transitioning and upgrading towards high-end production. From a global perspective, there is a noticeable increase in demand from downstream markets for multifunctional, new material, and high value-added medical dressings. However, the production and manufacturing technology of medical dressing products in China still lags behind that of developed countries, with products mainly consisting of traditional medical dressings and sanitary textiles.

Overall, the exploration of the high-end market is imperative, and innovation will continue to bring significant growth opportunities.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories