The implementation of reciprocal tariffs! What energy and chemical products does China import from the United States?

Local timeOn April 2, U.S. President Donald Trump signed two executive orders on so-called "reciprocal tariffs" at the White House, announcing that the United States will establish a 10% "minimum benchmark tariff" on trade partners and impose higher tariffs on certain trade partners.

It is worth noting that Trump launched a series of actions against China during his first term.The "trade war" has resulted in an average tariff increase on China of about 20%. At the beginning of his second term, in March, an additional 20% tariff was imposed, and considering the 34% increase added early this morning, the current average tariff level imposed by the United States on China is over 75%. This marks a formal shift in U.S. trade policy towards China from competition to comprehensive containment. This policy, through a cumulative mechanism, enhances the suppression effect, but it will also face backlash risks such as the cost of supply chain restructuring and rising inflation. China will counter the tariff impact through industrial chain upgrades and multilateral cooperation, and the global trade pattern is inevitably entering a period of deep adjustment.

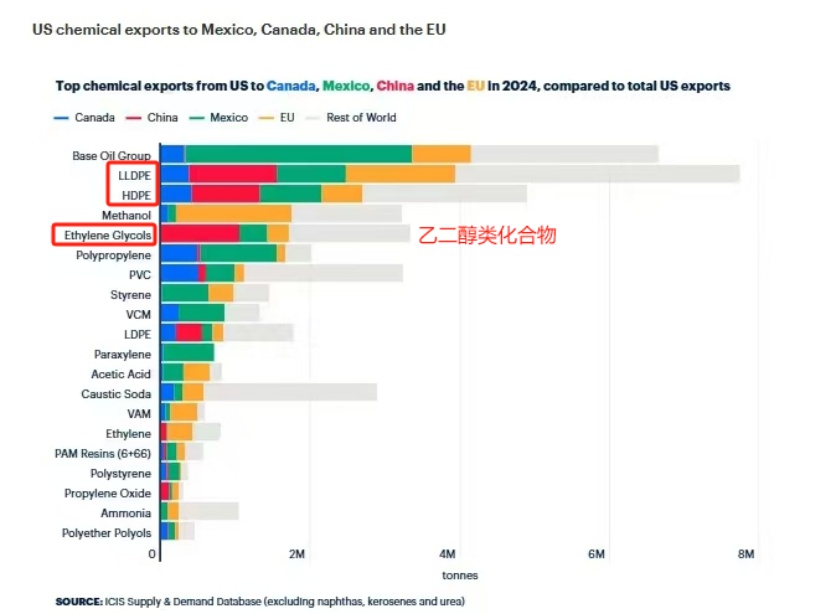

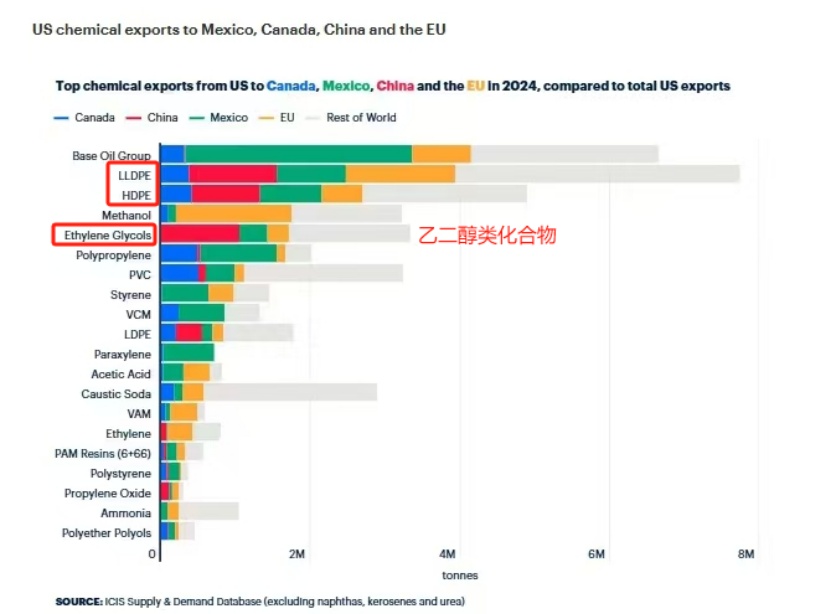

We observe the export structure of American energy and chemical products to China and find that the most exported energy and chemical products from the US to China include: propane andPolyethylene。

U.S. propane prices (withThe MB price (based on which) has been consistently lower than the Middle East's CP price in the long term, coupled with the increase in production brought about by the shale gas revolution, making it significantly more price competitive. Furthermore, the expansion of U.S. propane export terminals has further supported the quantity of its exports to China. Despite the fact that during the Sino-U.S. trade friction in 2018, China imposed a 26% retaliatory tariff on U.S. propane, resulting in a sharp decrease in import share from 25% in 2017. However, after the tariff exemption in 2020, U.S. propane exports to China quickly rebounded.

In 2024, U.S. propane exports reached a record high of 1.8 million barrels per day, the highest level since data collection began in 1973, mainly due to new P projects in China.DHThe demand for propane from the equipment has significantly increased.

In 2024, China imported propane.2%From the United States, followed by Iran (17%), Qatar (7%), and the UAE (3%).

Additionally, another major category of chemical products that China imports from the United States in significant quantities is polyethylene (see the figure below).In 2024, China's import of polyethylene is approximately 13.85 million tons, of which about 2.4 million tons are imported from the United States, accounting for more than 10% of imports from the US.7%In comparison, the proportion of polyethylene imported from Saudi Arabia is16.9%。

The United States possesses abundant and low-cost ethane resources, giving it a strong competitive advantage in terms of production costs. Building on this, the U.S. has been continuously expanding its polyethylene production capacity, particularly—From 2022 to 2023, the United States has seen the commissioning of multiple new production capacities. According to statistics from consulting agencies, in 2024, the total polyethylene (PE) capacity in the United States region reached 28.171 million tons, significantly increasing the local polyethylene supply. To absorb this supply increase, the United States actively increased its polyethylene export volume. According to statistics from 2024, the net export volume of polyethylene in the North American region will approach 1.200Ten thousand tons, making the United States the world's largest exporter of polyethylene.

Category-wise, the most imported polyethylene category from the United States is standard products.LLDPE accounts for 21% of the imported LLDPE; followed by HDPE, with imports from the United States accounting for more than.17%For the above content, translate it from Chinese to English and output the translation result directly without any explanation.For HDPE products, the resources in the United States are known for being of medium quality and low price. Therefore, if countermeasures are initiated against relevant varieties, the impact on the market will be relatively significant.

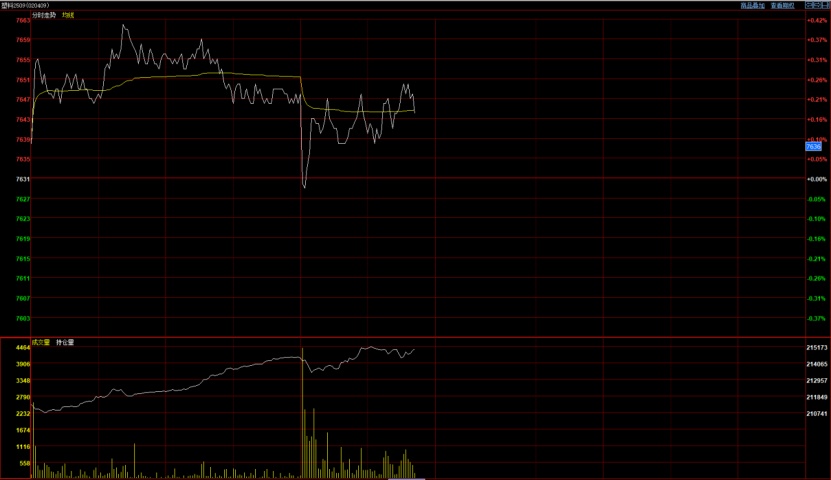

After the announcement of the additional tariff, domesticallyPEThe futures market remained calm, as of the time of this report.PE2509Contract Report7648The translation of the Chinese phrase "****" into English is "increase" or "rise".0.21%;PP2509 contract reported 7332Increase in price0.05%。

From the perspective of market trends, the impact of high tariffs on the demand side is limited; capital is expecting possible domestic countermeasures, and in combination with the migration and rollover of the main contracts, the far-month contracts.09The contract's price performance remains relatively strong.

Author: Gao Xing, Senior Market Analysis Expert

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Amcor Opens Advanced Coating Facility for Healthcare Packaging in Malaysia

-

ExxonMobil and Malpack Develop High-Performance Stretch Film with Signature Polymers

-

Plastic Pipe Maker Joins Lawsuit Challenging Trump Tariffs

-

Pont, Blue Ocean Closures make biobased closures work

-

Over 300 Employees Laid Off! Is Meina Unable to Cope?