The latest, bulk procurement by the consumables alliance is here!

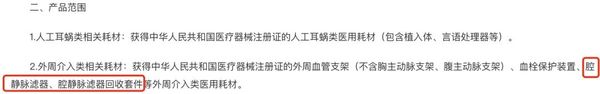

Another large-scale alliance centralized procurement announcement, involving two types of high-value consumables.

Inferior vena cava filter, ablation electrode centralized procurement approaching

pay attention to the company's ability to bear

On March 19, the Heilongjiang Public Resources Trading Center issued the "Notice on Holding a Symposium for Enterprises Participating in the Centralized Procurement of Vena Cava Filter Ablation Electrode Medical Consumables" (hereinafter referred to as the "Notice").

last DecemberAt the Heilongjiang medical insurance work conference, it was clearly mentioned that the mechanism for drug procurement and implementation needs to be further improved, which has been reflected in the preparatory stage of this round of vena cava filter and ablation electrode procurement.

In addition to requiring companies to introduce their products, production capacity, sales, and prices, the discussion at this meeting in Heilongjiang also included "companies' expectations and affordability regarding centralized procurement prices," "measures taken by companies in response to changes in demand after centralized procurement," and "suggestions for centralized procurement rules."

Due to the limited information currently disclosed, the scope of this round of vena cava filter and ablation electrode centralized procurement cannot be determined. However, from the expression "led by Heilongjiang" in the Notice, it is highly likely to be at the inter-provincial alliance level.

On January 17, at a press conference of the National Healthcare Security Administration, it was mentioned that the sixth batch of high-value medical consumables centralized procurement will be carried out in the second half of the year. At the same time, it is expected that around 20 national alliance procurements with professional characteristics will be conducted at the local level, including traditional Chinese medicine, Chinese herbal decoctions, and high-value consumables.

So far, Hunan has clearly stated that it will lead the national joint procurement of high-frequency electric knife head medical consumables; Hebei has also put the centralized procurement of aortic stents and abdominal aortic stents on the agenda; Fujian has also proposed a plan to lead the national joint procurement of medical consumables at the medical insurance meeting.

Combining the above information, the centralized procurement of vena cava filters and ablation electrodes led by Heilongjiang also has the potential to be upgraded to a national alliance procurement.

02

potential market accelerating expansion

Domestic players ride the collective procurement east wind

The two major categories of consumables involved are not new to centralized procurement.

Among them, the price of vena cava filters once decreased from an average of 23,000 yuan to around 9,000 yuan in the centralized procurement of four types of vascular interventional medical consumables by the Lu-Jin-Ji-Yu Alliance, a reduction of about 58%.

According to Frost & Sullivan data, the market size of interventional devices for peripheral arterial disease in China was 2.4 billion yuan in 2019, and it is expected to further increase to 12.2 billion yuan by 2030, with a compound annual growth rate of 15.7% during this period. The patient base for the peripheral venous intervention market is larger, showing a rapid growth trend.

In terms of maturity, radiofrequency ablation is the most mature at present, followed by cryoablation, while electric field ablation represents the latest technological frontier.

Domestic layout for PFA is still accelerating, but the market for radiofrequency ablation has matured. According to Zhiyan Zhan statistics, in 2019, the market size of China's radiofrequency ablation equipment industry was 2.736 billion yuan, and by Q1 2024, the market size of China's radiofrequency ablation equipment industry reached 1.028 billion yuan, with a year-on-year increase of 7.82%.

Microwave ablation is also developing rapidly in China. Data from the AskCI Consulting shows that in 2023, the market size of microwave ablation in China was 3.87 billion yuan, with a year-on-year growth of 29.87%. It is estimated that the market size of microwave ablation in China will reach 5.07 billion yuan in 2024.

Based on the overall expansion of the domestic market, the potential for increased production of microwave ablation electrodes and radiofrequency ablation electrodes is being rapidly unleashed, and the advancement of centralized procurement in Heilongjiang will add new momentum to the rise of domestic products in this field.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories