The Winter of South Korea's Chemical Industry: Profit Decline and Industrial Restructuring Viewed Through Hyosung's Idle PDH Unit

On March 27, 2025, Hyosung Chemical announced that its first 200,000 tons/year propane dehydrogenation (PDH) unit in Ulsan will remain idle. The unit has been shut down since May 2024 and there is still no plan for restart. Meanwhile, although its second 350,000 tons/year PDH unit has completed its annual maintenance, its current operating rate of 90% still shows weakness.

In fact, this phenomenon is not an isolated case but a microcosm of the Korean chemical industry's deep dive into the quagmire of profit losses—the fourth-quarter financial reports of major players like LG Chem and Lotte Chemical in 2024 all showed losses exceeding one trillion韩元. What does such a change signify? And how will it impact future market trends?

PDHDevice profit decline: the "cost and demand" of"Scissor difference"

1 Cost side: High energy prices and raw material fluctuations

The high-cost dilemma faced by South Korea's chemical industry mainly stems from fluctuations in global energy prices and an increase in domestic power generation costs. The continuous rise in international oil and gas prices acts as the Sword of Damocles hanging over the heads of South Korean chemical companies. Given South Korea's resource scarcity and heavy reliance on imported energy, every fluctuation in international energy prices triggers a ripple effect in its chemical sector. In recent years, the unstable trend of international oil prices has brought significant uncertainty to the raw material procurement of South Korean chemical companies. When oil prices rise, the production costs of chemical enterprises increase, directly impacting product pricing and market competitiveness. Additionally, fluctuations in gas prices have also had a noticeable effect on South Korea's chemical industry; rising gas prices lead to a substantial increase in expenditure during the production process.

2. Demand Side: Imbalance in the Supply and Demand of the Propylene Market

Due to the intensifying competition in the chemical industry market and the decline in international chemical product prices, South Korea's chemical industry is at a clear disadvantage in price competition. In the global chemical market, the increasingly fierce price wars in recent years have also severely squeezed the profit margins of enterprises.

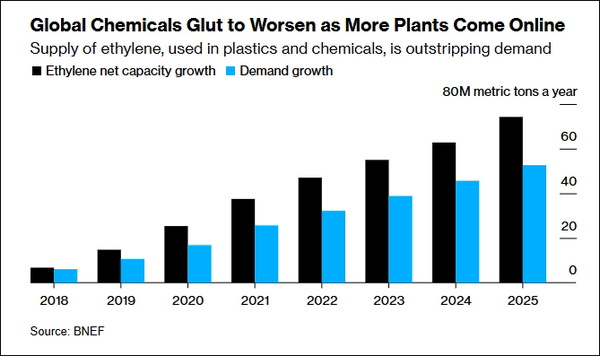

In recent years, the global production capacity of chemicals such as ethylene and propylene has grown rapidly. Chart by Bloomberg.

The global chemical industry is experiencing overcapacity, with price declines observed in multiple segments such as polyolefins, coatings, and dyes. Taking polyolefins as an example, as global capacity continues to expand, market supply is gradually becoming oversupplied, causing product prices to continuously fall. South Korean chemical companies are facing significant challenges in these traditionally advantageous sectors. Due to their relatively high production costs, they struggle to compete with emerging market competitors in price wars.

3. Profit model collapse

Taking PDH units in East China as an example, the average profit in the fourth quarter of 2024 fell to -304 yuan/ton, with some companies incurring losses of more than 500 yuan per ton. This contrasts sharply with the industry's average gross profit margin of 15% before 2021, a situation that has undoubtedly shocked investors across the entire industry.

II. Crisis in the Entire Korean Chemical Industry: Eruption of Structural Contradictions

The South Korean chemical industry relies on imports for 70% of its energy. In 2024, with international oil prices surpassing $90 per barrel and domestic electricity prices rising by 20%, LG Chem's petrochemical business reported a quarterly loss of 99 billion won, while Lotte Chemical's loss reached 1.1 trillion won. This contrasts with European chemical giants like BASF in Germany, which are shifting towards renewable energy, highlighting the vulnerability of South Korea's energy strategy.

First, the high-end market has been breached. Chinese companies like Wanhua Chemical have increased their market share to 35% in specialty chemicals such as MDI and PC through technological breakthroughs, encroaching on South Korea's traditional strongholds. Additionally, the South Korean chemical industry is steadily losing ground in the low-end market: Southeast Asian and Indian companies, leveraging labor cost advantages, are waging price wars in the bulk chemicals market, such as polyolefins.

There is another layer of pressure: the carbon neutrality policy promoted by the South Korean government requires the chemical industry to reduce emissions by 40% by 2030, but the imposition of carbon taxes and the need for equipment upgrades significantly increase the average annual costs for enterprises.

Three, Breakout Path: From Amputating an Arm to Save the Body to Technological Leapfrogging

Facing multiple challenges such as high energy prices and intensifying global competition, South Korea's chemical industry is undergoing unprecedented difficulties. According to the latest data, in 2024, the combined operating loss of South Korea's four major chemical companies (LG Chem, Lotte Chemical, Kumho Petrochemical, and Hanwha Solutions) reached 445 billion Korean won (approximately $318 million). Among them, Lotte Chemical, one of the largest ethylene producers, reported a loss of 414 billion Korean won. Local companies such as Korea Petrochemical Industry and Yeochun NCC also suffered losses.

However, the industry has not remained idle, and an escape strategy centered on high-value-added transformation, technological innovation, and global布局has quietly begun. (Note: The word "全球布局" was partially translated as "global布局". In the context of business and industry, a more complete translation would be "global layout" or "global strategy", but since the original sentence was cut off, I've provided the beginning of the phrase. For a full and accurate translation, the entire phrase "全球战略布局" should be considered, which translates to "global strategic layout" or "global strategy".) For a more accurate translation assuming the sentence is meant to be complete: "However, the industry has not remained idle, and an escape strategy centered on high-value-added transformation, technological innovation, and global strategic layout has quietly begun."

Breakthrough Path One: Structural Adjustment Aims at Specialty Chemicals

Recently, the South Korean government has introduced the "Petrochemical Industry Restructuring Plan," which clearly identifies specialty chemicals as a strategic direction. Through policies such as tax incentives and low-interest loans, the government encourages companies to shift towards producing high-profit products like copolyesters and acrylonitrile-butadiene-styrene (ABS), as these products have higher profit margins compared to basic chemicals like ethylene. At the same time, the government has amended the "Industrial Competitiveness Law," allowing companies to conduct cross-border mergers and acquisitions without the need for shareholder approval and to defer related income tax payments, thereby enhancing corporate competitiveness. For example, in February 2025, SK Group's battery business platform SK On completed a merger with SK Trading International (an oil trading company) and SK Enterm (a tank terminal operator), forming a new "Global Battery and Trading Company." After the merger, SK On's assets are expected to increase from 33 trillion won to 40 trillion won (approximately 200 billion RMB), and revenue is projected to rise from 13 trillion won to 62 trillion won.

Breakthrough Path Two: Technological Revolution Drives Dual Improvement in Efficiency and Environmental Protection

Technological innovation has become a "lifesaver" for South Korean chemical companies. For instance, in July 2023, Hanwha Solutions announced the deployment of an AI optimization system in its ethylene cracker at the Yeosu petrochemical complex. This system analyzes parameters such as cracker furnace temperature and feedstock ratio in real-time, dynamically adjusting operating conditions. Hanwha mentioned in its third-quarter 2023 financial report that the AI system reduced energy consumption by 12% in the ethylene facility, saving approximately 28 billion KRW (about $21 million) in annual energy costs.

Breakout Path Three: Responding to Geopolitical Risks through Restructuring Global Supply Chains

Facing US-China trade friction and the "China+1" trend in supply chain relocation, South Korean chemical companies are accelerating their overseas expansion. For example, Lotte is investing an additional 1.2 billion Malaysian ringgit (approximately 2.5 billion RMB) in Sarawak, Malaysia, to expand its electrolytic copper foil factory, aiming to become a key supplier of electric vehicle battery materials in Southeast Asia. Additionally, South Korea's Hyosung plans to invest an extra 1.5 billion US dollars in Vietnam, with the new investment used to construct a biotechnology-based production facility and a carbon fiber plant in Ba Ria-Vung Tau Province, southern Vietnam.

End of the document

The downturn in South Korea's chemical industry, although driven by market competition, also presents opportunities for Chinese enterprises.

First, South Korean chemical companies appear to struggle in price wars, with their chemical performance remaining sluggish. This, to some extent, proves that in the same chemical products, even generic ones, South Korean companies find it difficult to compete with Chinese enterprises. On one hand, China is the world's largest producer and consumer of plastics, accounting for 15% of global plastic consumption, giving it a vast market scale and domestic demand. On the other hand, China also possesses strong competitiveness in production costs, resource access, and industrial chain integration.

Secondly, although South Korean companies are actively laying out special fields such as carbon fiber and high-value-added products like specialty engineering plastics, the technological gap between China and South Korea in these areas is not significant. China has also made remarkable progress in new materials and high-end chemicals, possessing a certain level of technological strength and market competitiveness. Therefore, the expansion of South Korean companies in these fields does not pose a serious threat or a "stranglehold" on Chinese chemical enterprises.

Editor: Lily

Source of materials: China Petroleum News Center, China Foreign Coatings Network, etc.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Amcor Opens Advanced Coating Facility for Healthcare Packaging in Malaysia

-

ExxonMobil and Malpack Develop High-Performance Stretch Film with Signature Polymers

-

Plastic Pipe Maker Joins Lawsuit Challenging Trump Tariffs

-

Pont, Blue Ocean Closures make biobased closures work

-

Over 300 Employees Laid Off! Is Meina Unable to Cope?