The frequent fluctuations in raw styrene have created significant uncertainty regarding cost support. With supply remaining high and demand falling short of expectations, there has been some improvement in low-end sales, but prices struggle to rise. In the near term, the PS market may consolidate within a narrow range. It is anticipated that the华东market for modified styrene will likely trade between 8,400 to 9,800 yuan per ton.

【Today's Plastic Market】Local Upturn! PA6 and ABS Rise, with Maximum Increase of 250! PVC and PET Show Weak Fluctuations

Summary: Summary of April 2 plastic market general materials and engineering materials prices and forecasts! General materials show mixed trends, with limited improvement in supply and demand; polyethylene prices fluctuate slightly; PP sees a minor increase; PVC market falls by 10-20; ABS market fluctuates with increases and decreases, with a maximum increase of 250; PS and EVA markets fluctuate weakly and steadily. Most engineering materials remain stable, with PC seeing individual increases of 25-50; polyester chip prices drop by 10-20; POM sees the highest decrease of 150; PBT market centers weaken with fluctuation, with individual decreases of 50; PA6 market price increases by 50-200; PA66 and PMMA operate in a stalemate.

General Materials

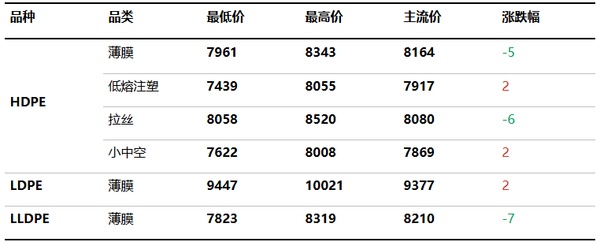

PE:Market demand is limited, and the price of polyethylene fluctuates.

3. Price Prediction

With the approach of the Qingming long weekend, merchants maintain an active attitude towards selling goods. Supply pressure remains, so the price levels for most grades are still low. In the short term, with expectations of increased production from new facilities such as Exxon and Inner Mongolia Baofeng, terminal inquiries may target even lower prices. As a result, traders might be forced to offer discounts; however, strong cost support will remain. After low-end transactions pick up, it will provide market confidence, leading prices to likely remain in a narrow range at a low level.

PP: Macro利好支撑 Polypropylene prices rise slightly

Price Forecast

Affected by the U.S. tariff policy, international oil prices may be dragged down by demand prospects, and the cost side is expected to provide limited support for polypropylene (PP). On the demand side, downstream procurement remains based on just-in-time needs, and is mainly focused on buying at low prices, which does not provide much boost to the market. On the supply side, there are currently no new capacity expansions, and in addition, short-term maintenance of production facilities remains relatively concentrated, so the supply pressure is still manageable. It is expected that the polypropylene market may experience range-bound fluctuations tomorrow, with mainstream prices for wire drawing in East China at 7,300-7,450 yuan/ton.

PVC:Weak supply and demand, PVC spot prices remain volatile.

3.Price forecastMeasure

The domestic PVC market is experiencing fluctuations and a weakening trend, with concerns about the impact of increased tariffs on raw material and product exports. The supply expectations for spot fundamentals have weakened due to maintenance, and domestic demand remains sluggish, with foreign trade exports being the main focus. Both supply and demand are lacking, leading to a weak and fluctuating spot price trend. In the short term, cost support remains stable, and it is expected that the PVC market will maintain a small range of weak fluctuations. The cash price for electric calcium carbide method PVC in East China is expected to be in the range of 4800-5000 yuan/ton.

PS: Styrene rebounds and then fluctuates, market prices stabilize.

3. Price Prediction

ABS:The market for filling gaps has ended, and today's trading has turned subdued.

1 Today's Summary:

① Prices in South China rose and fell; prices in East China rose and fell, but overall transactions were good.

2. The monthly ABS production in April is expected to slightly decrease from the previous month.

2 Spot Overview

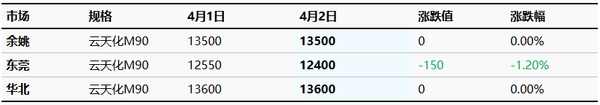

Table 1 Summary of Domestic ABS Prices (Unit: Yuan/Ton)

Based on the benchmarks of Yuyao and Dongguan regions, market prices have experienced both increases and decreases.Today's market trading has turned quiet, the short-covering rally has ended, and some models have seen a pullback and adjustment, with market prices fluctuating between increases and decreases.

3、Price Forecast

Today, prices in South China fell slightly, while those in East China declined, with overall transactions being weak. Trade merchants are finding it difficult to sell, and supply has increased significantly. It is expected that domestic ABS prices will continue to show a downward trend tomorrow.

EVA:Low demand for foaming, focus of negotiations is relaxed.

1 Today's Summary

This week, the ex-factory price of EVA petrochemical plants remains stable.

This week, most of the EVA petrochemical facilities are in stable production.

2 Spot Overview

Table 1 Domestic EVA Price Summary (Unit: Yuan/Ton)

Today's domestic EVA market atmosphere was lackluster. Traders in the market held divergent mindsets, leading to a somewhat chaotic offering situation. The demand for foaming applications advanced slowly, and some holders, driven by panic, offered discounts to promote transactions. Most deals were reached through negotiations, with a weak and wait-and-see atmosphere prevailing. By the close of the market, soft material was quoted at RMB 11,400-11,900/ton, and hard material was quoted at RMB 11,300-11,800/ton.

3.Price Forecast

In the short term, the domestic EVA market fundamentals are expected to remain in a stalemate. Demand from the photovoltaic sector provides temporary positive support, with EVA manufacturers holding firm to stabilize the market. Mainstream agents follow suit to maintain stability, while downstream foam demand continues to follow rigid needs. The market transaction pace remains slow, and the supply-demand game persists. Industry players adopt a cautious approach to operations. Longzhong Information predicts that the domestic EVA market will experience weak and stable consolidation in the short term.

Engineering materials

PC:The PC market is trending upwards with a strong consolidation.

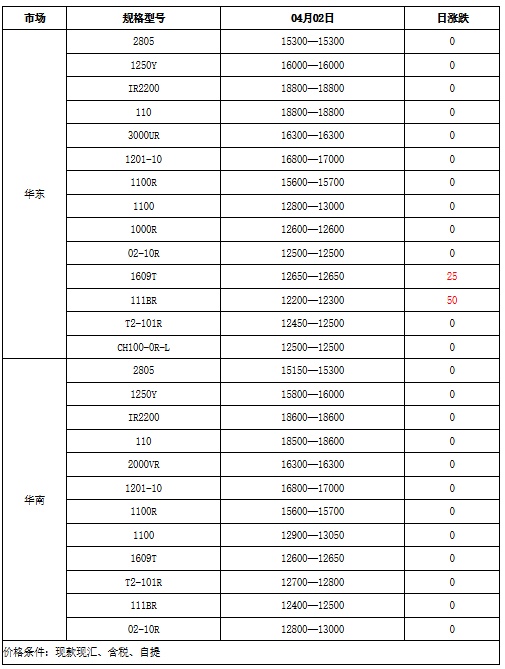

Table 1: Summary of Domestic PC Prices (Unit: RMB/ton)

Today's domestic PC market showed a slightly stronger trend. In the East China market, the mainstream intended price for domestic PC sources was between 12,200-12,650 yuan/ton, slightly stronger compared to the previous trading day. In the South China market, the mainstream intended price for domestic PC sources was between 12,400-13,000 yuan/ton, stable compared to the previous trading day. For foreign sources, prices of most goods remained stable. The mainstream price of Lotte 1100 in East China was 12,800-13,000 yuan/ton, stable compared to the previous trading day. The mainstream price of Covestro 2805 in South China was 15,150-15,300 yuan/ton, also stable compared to the previous trading day. The raw material Bisphenol A continued its upward trend, providing stronger support to the PC market. During the trading day, some offers continued to rise slightly, but downstream buyers became more cautious about chasing higher prices. New order transactions decreased compared to earlier in the week, and market participants started to adopt a wait-and-see attitude.

Price Prediction

It is expected that the PC market will digest the increase in the near future. The specific reasons are as follows:

Supply:Supply is abundant, and the seller's报价 is either stable or slightly fluctuating.

Requirement:The overall downstream willingness to chase gains remains cautious.

Cost: The slight increase in raw material bisphenol A provided support for the PC market.

PET:The price of polyester bottle flakes has dropped by 10-20.

1 Today's Summary

①,华润 prices fluctuate slightly while other factories remain stable (Unit: Yuan per ton)

②. Today, the domestic polyester bottle chip capacity utilization rate reached 72.61% (revised from yesterday's 72.61%).

2 Spot Overview

Table 1 Domestic Polyester Bottle Chip Price Summary (Unit: Yuan/Ton)

Based on the East China region, the spot price of polyester bottle chip (water bottle grade) today closed at 6065, down 15 from the previous working day, in line with the morning's expectations.

Crude oil prices are correcting. Although news of maintenance at a major PTA plant has emerged, raw material prices continue to lack upward momentum. Most polyester bottle chip plants are holding steady, with partial price adjustments. Traders are mainly focused on offloading inventory, with April shipments reportedly transacted at 6,040–6,130 or at a discount of 30 to a premium of 50 against the 2505 contract. The basis has weakened slightly, with sporadic restocking for rigid demand and subdued trading activity. (Unit: RMB/ton)

3、Price Forecast

The market is largely waiting for news on the U.S. imposing additional tariffs, leading to relatively stagnant trading. On the supply side, a major manufacturer has restarted a 700,000-ton facility, raising expectations for increased supply. Downstream demand remains focused on essential restocking, with low purchasing intention before the holidays. The polyester bottle chip market is experiencing weak fluctuations, and it is expected that the spot price for water bottle materials will operate in the range of 6000-6150 tomorrow.

POM:Demand performance is weak, transactions continue through negotiation.

3、Price prediction

The shipment situation in various regions has not improved significantly during the week. The total inventory of POM petrochemical plants will continue to rise. In addition, some manufacturers have lowered their ex-factory prices for the second time, making it difficult for the market sentiment to be supported. Traders are less interested in operations, and the focus of quotations will continue to fall. End users are mostly cautious and观望ing, with sporadic actual transactions. It is expected that the domestic POM market will fall narrowly in the short term.

PBT:The PBT market shows a weak and fluctuating trend.

1 Today's Summary

①PBT manufacturers' quotations remain stable.

This week, the supply side saw the restart of PBT operations at the Fujian Meizhou Bay facility.

③ China's PBT industry production reached 23,075 tons this week, with a capacity utilization rate of 54.32%, an increase of 4.47% compared to last week. The domestic average gross profit for PBT in China this week was -498 yuan per ton, a decrease of 97 yuan per ton compared to last week.

2 Spot Overview

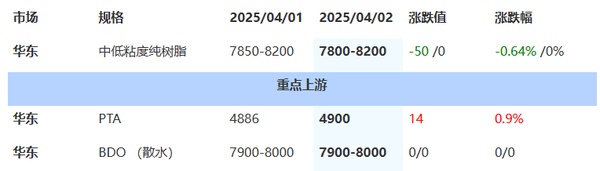

Table 1: Summary of Domestic PBT Prices (Unit: RMB/ton)

Translate the above content from Chinese to English and output the translation result directly without any explanationThe East China region is the benchmark.Today, the mainstream price for medium to low viscosity PBT resin is between 7800-8200 yuan/ton.Decreased by 50 yuan/ton compared to yesterday。Today, the PBT market is weak and falling, while the PTA market remains steady. The BDO market is operating with观望 (wait-and-see attitude). With general cost support, the PBT supply side continues to focus on sales, and there are reports of lower prices in the market, causing the market's focus to weaken and fall. According to Longzhong Information statistics, the price range for medium to low viscosity PBT pure resin in the East China market is between 7800-8200 yuan per ton.

3. Price Prediction

It is expected that the PBT market will remain weak and观望 (note: 'watchful' or 'cautious'). On the cost side, there is an expectation of reduced load in both supply and demand for PTA, with poor purchasing enthusiasm from downstream buyers, leading to a low overall valuation of the industry chain. However, cost support remains, and the market lacks a sustained driving force. In the short term, the domestic PTA spot market will maintain a volatile pattern. BDO currently has decent support on the supply side, with downstream demand following at a basic pace, but the cost transmission within the industry chain is not smooth, suppressing the movement of raw materials, and the market performance is weak. With average cost support, the PBT market sees an increase in the mentality of shipping out goods, and there may be an increase in low-priced sources in the market, causing the market focus to run weakly. Therefore, it is expected that the medium and low viscosity PBT resin in the East China market will be priced at 7800-8100 yuan/ton tomorrow.

PA6:Rigid报价 firm for slice manufacturers as PA6 market prices increase

1 Today's Summary

①. Sinopec's weekly settlement price for caprolactam was 10,280 yuan/ton (six-month interest-free acceptance), a decrease of 100 yuan/ton compared to last week.

② Sinopec pure benzene price at refineries in East China and South China increased by 150 yuan per ton, now executing at 6750 yuan per ton, with prices effective from April 1st.

2 Spot Overview

Table 1 Summary of Domestic Polyamide 6 Prices (Unit: RMB/ton)

Today, the price of conventional spinning polyamide 6 chips has risen. The supply of raw material caprolactam has decreased, and companies are holding firm on their quotations. The cost support for chips has strengthened, and polymerization companies, with thin profit margins, have raised the ex-factory prices of chips. However, downstream production companies are cautiously observing the market, replenishing stocks at appropriate prices, resulting in limited transactions. Market negotiations are based on actual orders. In East China, conventional spinning PA6 is priced at 10,650-10,950 yuan/ton cash on short delivery, while high-speed spinning spot is priced at 11,100-11,600 yuan/ton on acceptance delivery. In Chaohu, the price is 9,800-9,900 yuan/ton cash on self-pickup.

3、Price Forecast

From the cost perspective, the supply of raw material caprolactam has decreased, leading to a relatively firm price, and the pressure on polymerization costs has increased. From the supply and demand perspective, Zhejiang Fangyuan and Fangming are undergoing maintenance shutdowns, and some enterprises are reducing production, resulting in decreased supply. Downstream businesses are primarily restocking on demand, and some polymerization companies have reduced inventory pressure. It is expected that the nylon 6 market will operate with a slight preference for consolidation in the near term, closely monitoring downstream demand and manufacturers' pricing dynamics.

PMMA: The upstream and downstream sectors continue to game, and the market maintains a stable trend.

1. Today's summary

① Today's factory prices remain stable.

2. The domestic utilization rate of PMMA particles today is 64%.

2 Spot Overview

Table 1 Summary of Domestic PMMA Particle Prices (Unit: CNY/ton)

PMMA particle prices in East China closed at 16,700 yuan per ton today, unchanged from yesterday, below early expectations.Today, the PMMA particle market remained stable, with a predominant wait-and-see attitude. Suppliers showed no clear intention for deep price cuts, maintaining steady pricing sentiment. Downstream demand stayed unchanged, with procurement continuing at a rigid pace, while actual transaction volumes saw insufficient follow-up.

3. Price Prediction

The short-term PMMA particle market price is stable, with sellers maintaining a steady mindset and limited room for negotiation. At the beginning of the month, there is insufficient market news and we still need to wait for further clarification in the market. In summary, with ongoing games between upstream and downstream, the short-term PMMA particle market is expected to maintain a steady trend, with attention on the shipping rhythm and receiving dynamics.

PA66Downstream purchases at high prices are cautious, and the market is consolidating weakly.

3. Price Forecasting

Demand shows no significant recovery, with downstream sectors purchasing as needed. Under cost pressures, polymerization companies have a strong inclination to reduce production. It is expected that the domestic PA66 market will consolidate in the short term.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Overseas Highlights: PPG Establishes New Aerospace Coatings Plant in the US, Yizumi Turkey Company Officially Opens! Pepsi Adjusts Plastic Packaging Goals

-

Abbott and Johnson & Johnson: Global Medical Device Giants' Robust Performance and Strategies Amid Tariff Pressures

-

BYD releases 2024 ESG report: Paid taxes of 51 billion yuan, higher than its net profit for the year.

-

Behind pop mart's surging performance: The Plastics Industry Embraces a Revolution of High-End and Green Transformation

-

The price difference between recycled and virgin PET has led brands to be cautious in their procurement, even settling for the minimum requirements.