Trump plans to announce new tariffs! Oil prices plummet, and the polypropylene spot market may have an upward trend in April.

One, Overnight Crude Oil Market Dynamics

Market concerns about the US increasing tariffs and escalating trade risks may lead to a global economic recession, causing international oil prices to drop. NYMEXCrude oil futuresMay contract fell by $0.56 to $69.36 per barrel, down 0.80% month-on-month; ICE Brent crude futures May contract fell by $0.40 to $73.63 per barrel, down 0.54% month-on-month. China's INE crude oil futures main contract 2505 dropped by 1.7 to 541.7 yuan per barrel, and fell by 3.7 to 538 yuan per barrel during the night session.

Market outlook

Although oil prices have achieved a three-week上涨 should be replaced with "consecutive weekly gains", the pace of increase in crude prices slowed down noticeably on Thursday, and the decline in prices on Friday further suggests that the recent rebound in oil may be coming to an end. The impact of sanctions and rising geopolitical tensions has dominated oil price fluctuations over the past three weeks, causing fairly noticeable disruptions to supply.

As April approaches, OPEC+ will gradually begin to implement its exit from the production cut plan, and discussions surrounding the tariffs from the Trump administration in the United States will return to the market. President Trump plans to announce new tariffs in the coming days.

The decline in oil prices during Friday's night session erased most of the weekly gains, pushing oil prices into a correction phase. However, regional disparities in strength are expected to persist, so it's important to hedge risks and manage the pace carefully.

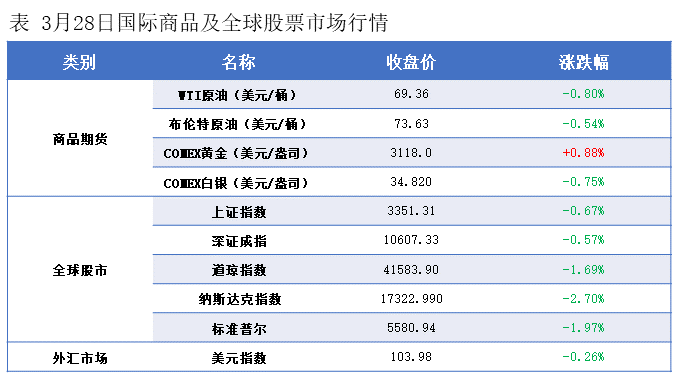

II. Macroeconomic Market Dynamics

The final reading of the University of Michigan Consumer Sentiment Index for March in the U.S. was 57, lower than the preliminary reading of 57.9, marking the lowest level in over two years. The final one-year inflation expectation was 5%, compared to the preliminary reading of 4.9%; the final five-year inflation expectation was 4.1%, the highest since February 1993, up from the preliminary reading of 3.9%.

◎The Eurozone's industrial sentiment index was -10.6 in March, expected -10.5, previous -11; economic sentiment index 95.2, expected 97, previous 96.3; service sector sentiment index 2.4, expected 6.7, previous 5.1.

◎The UK's final GDP growth for Q4 2024 increased by 1.5% year-on-year, compared to the expected and preliminary growth of 1.4%. Seasonally adjusted retail sales in February rose by 1% month-on-month, against an expected decline of 0.4%.

◎Canada's January GDP increased by 2.2% year-on-year, compared to an expected 2.1% and a previous 2.2%; it rose by 0.4% month-on-month, compared to an expected 0.3% and a previous 0.2%.

French CPI preliminary value for March rose 0.8% year-over-year, with expectations of a 0.9% increase and a final reading of 0.8% in February; the monthly rise was 0.2%, below expectations of a 0.3% increase, following a flat reading in February.

Three. Early Market Dynamics of the Plastics Market

The international oil prices fell, and the domestic plastic futures主力contract showed a震荡downward trend overnight:

The plastic 2505 contract reported 7,674 yuan/ton, down 0.42% from the previous trading day.

The PP2505 contract is quoted at 7,322 yuan per ton, down 0.39% from the previous trading day.

The PVC2505 contract was quoted at 5063 yuan/ton, down 1.19% from the previous trading day.

Four, Today's Market Forecast

PE:In terms of supply, it is expected that the supply of goods in the market will be relatively abundant in April. The projects in Inner Mongolia Baofeng, Wanhua Chemical, and Shandong Yulong, which have been put into production earlier, may gradually increase their load and release more output. Additionally, as demand in downstream industries further warms up in April, the production enthusiasm of PE (polyethylene) plants is likely to increase, and previously shut-down facilities are expected to restart. On the demand side, the northern region is entering the peak season for agricultural films, with agricultural film companies maintaining high operational rates. Large manufacturers are running at full capacity, and some factories are stocking up in advance, which provides strong support for PE demand. Furthermore, with the continuous development of the e-commerce industry, the demand for PE in the express packaging sector remains relatively stable. However, the recovery speed of orders in the packaging industry in the southern region is relatively slow, which may have some impact on the overall demand growth. Overall, it is expected that the polyethylene market may show a trend of fluctuating upward in April.

PP:In terms of supply, it is expected that the on-site supply in April will show a decreasing trend due to the maintenance of multiple PP facilities, such as the Jinan Refinery and Sinopec Tianjin. However, the commissioning of new facilities and changes in operating rates of existing facilities may also impact the actual supply situation. In terms of demand, PP demand is expected to increase in April, as the arrival of spring brings more agricultural and construction projects, leading to a rise in demand for products such as fertilizer bags, cement bags, and pipes and fittings. Additionally, with the support of national policies, consumption of PP in the automotive and home appliance sectors is likely to show a favorable growth trend. However, the additional tariffs imposed overseas on downstream products still pose a negative impact on exports, which may hinder the growth of demand to some extent. Overall, it is anticipated that the polypropylene market may present a trend of fluctuating upward in April.

PVC:In March, the futures and spot markets returned to the lower range for consolidation and struggle, with limited variables provided by supply and demand factors. On the international front, crude oil prices continued to rise as market traders weighed potential supply tightness and the impact of new U.S. tariffs on the global economy. After the U.S. issued tariff threats against buyers of Venezuelan oil, concerns about global supply tightness emerged. Overall, in the short term, the PVC spot market is expected to maintain a narrow adjustment trend in the absence of clear influencing factors, but extended high-level consolidation is likely to create downward pressure.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Overseas Highlights: PPG Establishes New Aerospace Coatings Plant in the US, Yizumi Turkey Company Officially Opens! Pepsi Adjusts Plastic Packaging Goals

-

Abbott and Johnson & Johnson: Global Medical Device Giants' Robust Performance and Strategies Amid Tariff Pressures

-

BYD releases 2024 ESG report: Paid taxes of 51 billion yuan, higher than its net profit for the year.

-

Behind pop mart's surging performance: The Plastics Industry Embraces a Revolution of High-End and Green Transformation

-

The price difference between recycled and virgin PET has led brands to be cautious in their procurement, even settling for the minimum requirements.