Trump's "secondary tariffs" pressure, Iran responds toughly! Oil prices surge over 3%, plastics usher in a "Silver April" with a strong start.

Overnight Crude Oil Market Dynamics

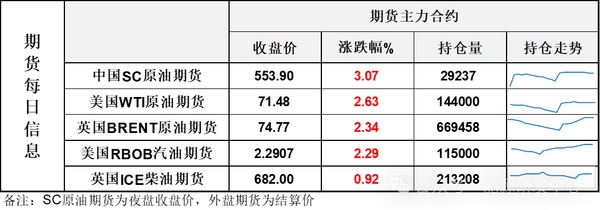

International oil prices surged sharply due to Trump's warnings of possible secondary tariffs on Russian oil buyers, threats to bomb Iran, and impose tariffs.WTI crude oilFinally closed up 3.41% at $71.32 per barrel. Brent Crude OilClosed up 3.14% at $74.67 per barrel.

Future Market Viewpoint

In addition to Trump's threats against Iran and Russia that have made the market nervous, investors are also closely monitoring the economic impact of his impending announcement of reciprocal tariffs. The market is generally concerned that this move could undermine the economy and, in turn, affect oil demand, causing oil prices to continue to decline during the Asian session.

The recent continuous strengthening of the monthly spread indicates that the series of sanctions imposed by Trump on multiple countries have heightened expectations of a tightening supply, which is the core driver of this round of oil price surge. Meanwhile, the gradual withdrawal of voluntary production cuts by OPEC+ and the implementation level of compensatory production cuts planned by some of its member countries also bring uncertainties to the supply side. Trump's imposition of reciprocal tariffs globally has created a series of uncertainties for the economy, increasing investors' concerns about weaker-than-expected demand. The factors affecting oil prices remain complex. The surge in oil prices on Monday refreshed the rebound high and began to challenge the strong resistance area, with funds increasing bets on geopolitical tensions. The development of the situation in the coming days will be crucial, determining the extent of the oil price surge. High volatility in oil prices will remain the norm, so it is important to manage risk and participate cautiously.

II. Macroeconomic Market Dynamics

◎Trump will announce reciprocal tariffs in the White House Rose Garden on April 2, with details potentially revealed on Wednesday morning Beijing time.U.S. officials stated that the plan would not include any exemption clauses (including those related to farmers) and would impose industry tariffs at another time.

The U.S. automotive manufacturing industry is seeking to exclude certain car parts from tariffs.

◎U.S. Energy Information Administration (EIA): U.S. crude oil production in January fell to the lowest level since February 2024.

According to Iran's Tasnim News Agency: Iran summoned the Swiss ambassador representing U.S. interests.Issue a warning against Trump's threats.

◎Federal Reserve - Williams:The current economy does not exhibit stagflation.① It relies on data to adjust policies, with high uncertainty, but long-term inflation expectations remain stable. ② Barksdale: A cut in interest rates requires confidence in the decline of inflation; it's not the right time to predict how many times there will be rate cuts this year. There are concerns about the impact of tariffs on inflation and employment.

◎ It is reported that more ECB officials are prepared to accept a pause in interest rate cuts in April.

◎The National Bureau of Statistics released data showing that in March, China's manufacturing PMI, non-manufacturing PMI, and composite PMI were 50.5%, 50.8%, and 51.4%, respectively, increasing by 0.3, 0.4, and 0.3 percentage points from the previous month, all rising for two consecutive months. Among them, the construction industry PMI has increased month-on-month for two consecutive months, reaching a new high since June 2024.

China will take multiple measures to effectively reduce the burden on enterprises. The Ministry of Industry and Information Technology, in collaboration with relevant departments, will issue the 2025 National Implementation Plan for Reducing Enterprise Burden. The State Administration for Market Regulation will carry out regular special actions to address arbitrary charges on enterprises and expedite the introduction of the "Measures for Handling Illegal and Non-compliant Enterprise Fee Collection Practices." The Ministry of Finance will ensure that the benefits of fee reduction and burden alleviation policies are solidly delivered to business entities.

The State-owned Assets Supervision and Administration Commission of the State Council stated that it will promote state-owned enterprises to intensify their efforts in expanding into industries such as new energy vehicles and integrated circuits, while encouraging accelerated development of sectors like biopharmaceuticals through mergers and reorganizations. It also emphasized the need to strategically plan and cultivate future industries in a phased manner, expedite the nurturing of the first batch of pioneering enterprises, and leverage major projects like manned spaceflight and deep-sea and deep-earth exploration to strive for a competitive edge in future development.

III. Early Morning Dynamics in the Plastic Market

International oil prices rose by 3%, while overnight domestic plastic futures main contract showed a fluctuating upward trend.

The plastic 2505 contract was reported at 7,687 yuan/ton, up 0.42% from the previous trading day.

The PP2505 contract is quoted at 7,344 yuan per ton, up 0.45% from the previous trading day.

The PVC2505 contract is quoted at 5094 yuan/ton, up 0.43% from the previous trading day.

Four: Today's Market Forecast

PE:In terms of costs, there is room for crude oil prices to fall, and cost support has weakened. In terms of supply, some companies have maintenance plans, which have alleviated supply pressures. In terms of demand, although it is currently the traditional peak season for PE downstream, feedback from downstream products indicates that overall demand has fallen short of expectations, with limited follow-up terminal orders. Overall, although supply pressures have eased somewhat, demand improvement is limited, market participants' sentiment has not shown significant improvement, and there is a lack of positive factors in the market. Therefore, it is expected that polyethylene prices will remain weak today.

PP:The sluggish global economy has impacted the export strength of domestic products, and additional tariffs imposed by overseas markets have constrained downstream product export orders, leading to a low short-term market demand valuation. However, the cost support for PDH production remains, keeping market prices locked at lower levels. Intensive PP plant maintenance has eased supply and demand pressures. The market is currently caught in a struggle between supply-demand dynamics and cost factors. In the short term, the polypropylene market is expected to test transaction levels around 7280-7430 yuan/ton. Key areas to watch include the impact of tariff adjustments on downstream product exports, as well as changes in industry chain inventory and demand.

PVC:The supply and demand fundamentals of PVC remain weak. On the supply side, minor maintenance of equipment has led to a slight reduction in production, while demand orders are underperforming, with weak performance in procurement and raw material demand. Export deliveries remain high, effectively reducing domestic inventory. Costs remain firm in the short term, supporting the bottom price. It is expected that the market will maintain a weak range-bound fluctuation in the near term, with the spot price of calcium carbide-based PVC in East China expected to be in the range of 4800-5000 yuan/ton.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Overseas Highlights: PPG Establishes New Aerospace Coatings Plant in the US, Yizumi Turkey Company Officially Opens! Pepsi Adjusts Plastic Packaging Goals

-

Abbott and Johnson & Johnson: Global Medical Device Giants' Robust Performance and Strategies Amid Tariff Pressures

-

BYD releases 2024 ESG report: Paid taxes of 51 billion yuan, higher than its net profit for the year.

-

Behind pop mart's surging performance: The Plastics Industry Embraces a Revolution of High-End and Green Transformation

-

The price difference between recycled and virgin PET has led brands to be cautious in their procurement, even settling for the minimum requirements.