U.S. Equivalent Tariffs Target China: Impact on EVA and Photovoltaic Industries Remains to Be Seen

Introduction: The deepening game of tariffs between China and the US, how does the "tariff war" affect the import volume of EVA from the United States and the photovoltaic industry closely related to EVA?

1. The import pattern of EVA changes under the pressure of tariffs.

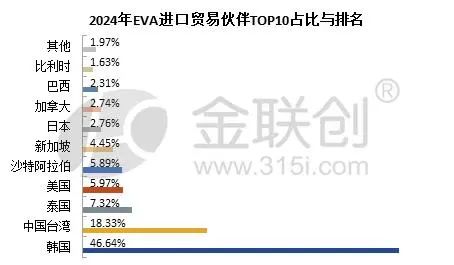

Data source: General Administration of Customs

In 2024, the total import volume of EVA was 915,900 tons, down 34.21% year-on-year, hitting a five-year low. China has multiple trade partners for EVA imports, with the United States ranking fifth, accounting for 5.97% of imports. After the imposition of additional tariffs, the cost of importing EVA from the United States has increased significantly, and trade barriers have been significantly upgraded. Under the dual pressures of cost and policy, it is expected that the import volume of EVA from the United States will decrease. This change brings opportunities for China's EVA production enterprises, and the market share of domestic EVA products will further increase.

II. "Reciprocal Tariffs" Put Pressure on Photovoltaic Industry

From the table above, it can be seen that the United States has imposed "reciprocal tariffs" of 32%, 36%, 46%, and 49% on products from trade partners such as Indonesia, Thailand, Vietnam, and Cambodia. This policy continues the United States' long-standing resistance to Chinese photovoltaics and includes the main photovoltaic manufacturing countries in Southeast Asia under high tariffs. According to data from the U.S. Energy Information Administration (EIA), the total import volume of photovoltaic components in the United States in 2024 is 48.7GW, with Southeast Asia's share dropping to 65%, and China's direct export share rebounding to 12% (about 5.8GW), but the scale of Chinese enterprises transferring through third countries such as Mexico and Turkey reaches 8.3GW, accounting for 17% of U.S. imports. The highest proportion of photovoltaic component imports in the United States is still in Southeast Asia, however, 80% of Southeast Asia's photovoltaic capacity is invested and constructed by Chinese enterprises. EVA, as an important upstream raw material for photovoltaic components, the impact of tariffs on photovoltaic components will indirectly affect EVA products.

U.S. "reciprocal tariffs" have taken effect, causing a surge in the cost of imported photovoltaic modules. This has suppressed domestic photovoltaic installation demand in the U.S., leading to a decline in imports from Southeast Asia. At the same time, the capacity of Chinese companies in Southeast Asia has been impacted, and the volume of photovoltaic products transshipped through third countries to the U.S. may be affected. The challenges faced by China's photovoltaic industry in the U.S. market have intensified.

Despite the uncertainty in the Sino-US tariff game, the trend of global energy transition towards clean and low-carbon remains unchanged. As long as China's EVA and photovoltaic industries adhere to innovation-driven and open cooperation, they can turn challenges into opportunities in the global energy transformation, achieve high-quality and sustainable development, and contribute Chinese strength to the global clean energy cause.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Overseas Highlights: PPG Establishes New Aerospace Coatings Plant in the US, Yizumi Turkey Company Officially Opens! Pepsi Adjusts Plastic Packaging Goals

-

Abbott and Johnson & Johnson: Global Medical Device Giants' Robust Performance and Strategies Amid Tariff Pressures

-

BYD releases 2024 ESG report: Paid taxes of 51 billion yuan, higher than its net profit for the year.

-

Behind pop mart's surging performance: The Plastics Industry Embraces a Revolution of High-End and Green Transformation

-

The price difference between recycled and virgin PET has led brands to be cautious in their procurement, even settling for the minimum requirements.