Covestro faces force majeure!

On July 12, a fire broke out due to electrical issues at Covestro's plant in Dormagen, Germany, resulting in a force majeure situation for the production of caustic soda, chlorine, and hydrochloric acid (HCl). The annual production capacity for caustic soda at this plant is 448,000 tons, and for chlorine, it is 480,000 tons.

On July 16, Covestro announced that its TDA/TDI, OTDA-based products, and polyether polyol products were affected by force majeure.

The reason is that the missing chlorine gas cannot be supplied by other plants in the short term, nor can it be fully compensated through external purchase, resulting in an impact on its downstream production facilities (such as the TDI facility of this plant, which has a capacity of 300,000 tons/year) due to the interruption of chlorine gas supply. Additionally, Covestro's polyurethane dispersions (PUD) and polyether polyol facilities were also affected and had to be safely shut down.

Covestro stated that the supply from other plants cannot fully offset the impact of this disruption, and significant delays, reductions, and even interruptions are expected. The duration of the force majeure is still uncertain.

It is understood that in March of this year, Covestro completed the modernization of the TDI plant in Dormagen and officially put the plant into operation. This plant is the largest TDI production facility operated by Covestro in Europe.

TDI market situation

After Covestro declared force majeure, the market reacted immediately. It was reported that on July 17, a certain TDI producer in Europe raised prices by 500 euros/ton (approximately 4160 RMB/ton). On the morning of July 17, a major TDI distributor in northern China suspended sales starting immediately.

Last week, a sudden incident at BASF's TDI facility in South Korea caused shipment delays, prompting the Southeast Asian market to initiate limited supply; Shanghai Covestro urgently suspended pricing; Wanhua Chemical continuously adjusted prices, raising the distribution price by 1,000 yuan/ton in mid-July, and then suspended order acceptance due to a surge in orders from Southeast Asia. To ensure timely delivery of new orders, they paused order acceptance and plan to increase the price of new orders by an additional $100/ton (approximately 718 yuan/ton) in July.

Additionally, two key units in the northwest region have successively entered maintenance: one unit has been shut down for maintenance since July 16 for 35 days, during which water supply has been suspended; the other has a planned maintenance schedule set to start at the end of July, lasting about 10-15 days. On July 16, a major TDI factory in Hebei faced tight supply due to a surge in domestic and foreign trade orders, resulting in extended delivery times.

As of July 17, the domestic TDI price in North China is around 13,700-14,100 yuan/ton, with a daily increase of 700 yuan/ton; the price for Shanghai goods is between 14,000-14,300 yuan/ton, with a daily increase of 600 yuan/ton.

In terms of export volume, according to customs data, China's TDI exports reached 51,600 tons in May 2025, setting a new monthly historical record with a year-on-year increase of 98.45%. The significant year-on-year increase in exports is mainly due to the tariff window period stimulation and the "export rush" effect triggered by U.S. policies, which have led to a surge in short-term orders. At the same time, demand is expanding in Southeast Asia, with local processing enterprises concentrating on stockpiling, and the annual demand growth rate maintaining at 6-8%, making it a core market for Chinese exports. China's competitiveness in terms of cost and delivery cycle is difficult to replace, especially against the backdrop of reduced production capacity in Europe, indicating that the export share is expected to increase in the long term.

Overseas TDI production capacity continues to shrink.

Due to the impact of energy costs and environmental policies, overseas TDI production capacity continues to shrink. Among them, Petroquímica Río Tercero, the only TDI manufacturer in Argentina and the entire Latin America, is shutting down its TDI plant in Córdoba, with an annual capacity of 28,000 tons, in October 2024 due to its limited company size, intensified competition, and low profits.

BASF closed its TDI and its precursor facilities at the Ludwigshafen site at the beginning of 2023; Japan's Tosoh also ceased TDI production at its Nanyo facility in Japan (approximately 25,000 tons/year) in 2023.

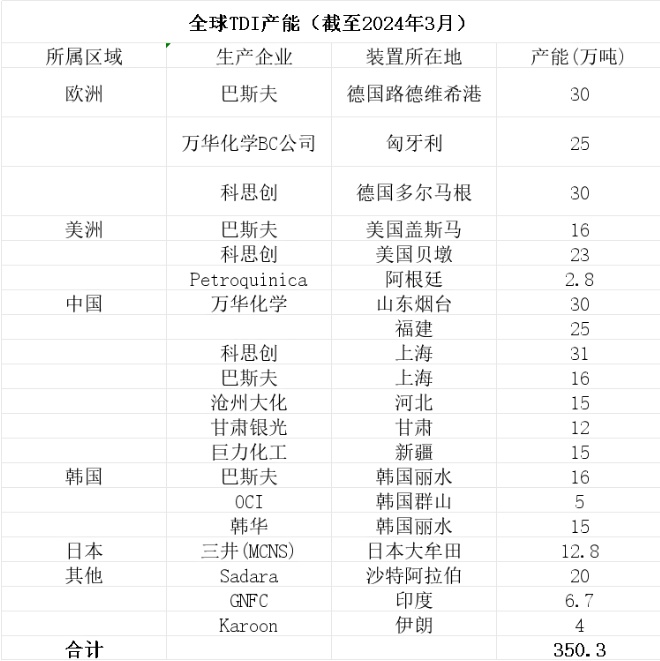

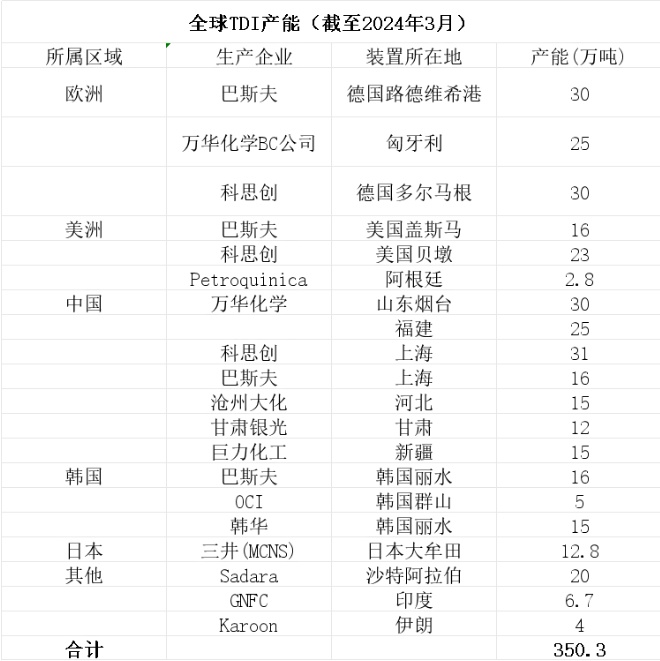

The global TDI capacity distribution is as follows.

As of the end of 2024, Wanhua Chemical will have a TDI capacity of 1.11 million tons per year, and the second TDI project in Fujian, with a capacity of 330,000 tons per year, is expected to be completed and put into production in 2025. By then, Wanhua's total TDI capacity will reach 1.44 million tons per year. Currently, it is the world's largest supplier of MDI and TDI.

In addition, Wanhua's Phase I and Phase II TDI projects in Fujian are planned to expand to 360,000 tons/year, and Hualu Hengsheng is also planning to build a new capacity of 300,000 tons/year in Jingzhou.

With the restructuring of global production capacity, our country needs to accelerate technological upgrades to address the dual challenges of international competition and low-carbon transition while ensuring supply.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Four Major Chemical New Material Giants Sell Off and Shut Down Again!

-

Covestro faces force majeure!

-

DuPont to Spin Off Nomex and Kevlar Brands for $14.4 Billion: Is Aramid Fiber Still Attractive?

-

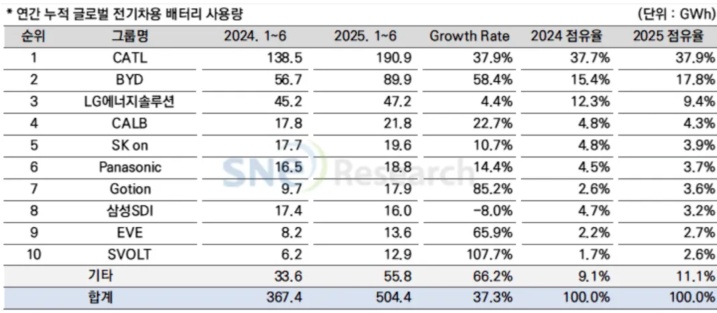

Massive Retreat of Japanese and Korean Battery Manufacturers

-

Napan Unveils Thermoplastic Composite Three-in-One Power System Solution, Battery Cover Weight Reduced by 67%