"15th Five-Year Plan" Period Economic And Social Development Main Goals Established; International Oil Prices Soar Over 5%; Plastic Futures Narrowly Rise

I. Crude Oil Market Dynamics

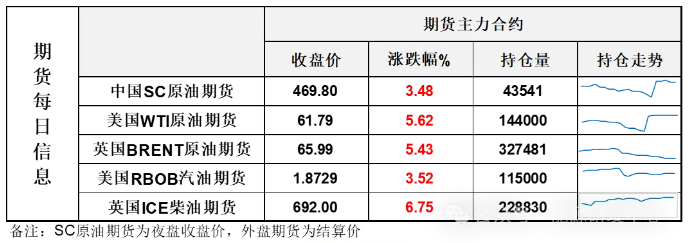

On October 23, the United States imposed new sanctions on the Russian oil company, increasing market concerns about potential supply risks, leading to a rise in international oil prices. NYMEX crude oil futures for the December contract rose by $3.29 per barrel to $61.79, a 5.62% increase compared to the previous period; ICE Brent crude oil futures for the December contract rose by $3.40 per barrel to $65.99, a 5.43% increase compared to the previous period. China's INE crude oil futures for the 2512 contract increased by 12.2 to 454 yuan per barrel, with the night session rising by 15.8 to 469.8 yuan per barrel.

Market Outlook

Oil prices have surged for two consecutive trading days. If the first day's spike in oil prices was a reactive response to a sudden event, then the continued rise on the second day represents a more objective and comprehensive assessment of the sanctions. In the coming days, China and the United States will hold economic and trade consultations in Malaysia, and according to the White House, the two leaders will meet on October 30. This round of economic and trade consultations and the leaders' meeting are expected to impact market expectations from an economic perspective, and both sides currently show a willingness to "talk," leading the market to maintain a cautiously optimistic outlook.

From the response of oil prices, it is evident that the sanctions against Russia will bring substantial shocks to the market, which again alters the market's operating rhythm. The strong support position of the annual low has been reinforced, and with the escalation of the oil price rebound, the previously declining oil price expectations have been raised and corrected. The market will need some time to observe its ability to recover from this disturbance, and it is expected that oil prices will maintain a period of resilient performance. The subsequent rhythm will ultimately need to focus on the new equilibrium state of the supply-demand pattern. During the high volatility phase of oil prices, attention should be paid to rhythm management.

II. Macroeconomic Market Trends

1、Russia-Ukraine situation1. Zelensky stated that there are domestically produced missiles with a range of 3,000 kilometers. An exchange of land with Russia is unacceptable. 2. Putin:The U.S. seems more intent on postponing the summit rather than canceling it. The new sanctions will not have a significant impact on the Russian economy.The US and Europe announced new sanctions on Russia, and foreign media reported that India's imports of Russian oil would drop to nearly zero. Kuwait stated that OPEC is ready to increase production to meet rising demand.

2、The United States increases pressure on Venezuela, with Trump seeking to take land action under the pretext of drugs.

The Fourth Plenary Session of the 20th Central Committee of the Communist Party of China will be held in Beijing from October 20 to 23, 2025.The plenary session proposed the main goals for economic and social development during the "14th Five-Year Plan" period.Significant achievements have been made in high-quality development, with a substantial increase in the level of technological self-reliance and self-improvement. Further comprehensive deepening of reforms has achieved new breakthroughs, the level of social civilization has noticeably improved, the quality of people's lives continues to enhance, major new progress has been made in the construction of a Beautiful China, and the national security shield has been further strengthened. Building on this foundation, we will strive for another five years to achieve a substantial increase in our economic strength, technological strength, national defense strength, comprehensive national power, and international influence by 2035. The per capita gross domestic product will reach the level of moderately developed countries, people's lives will be happier and more beautiful, and the basic realization of socialist modernization will be achieved.

4、The communiqué of the Fourth Plenary Session of the 20th Central Committee has been released. The Central Committee of the Communist Party of China will hold a press conference on the morning of the 24th.Introduce and interpret the spirit of the 20th Central Committee's Fourth Plenary Session of the Communist Party.

The spokesperson for the Ministry of Commerce answered questions from reporters regarding China-U.S. economic and trade consultations, stating that it was agreed upon by both China and the U.S. that a member of the Political Bureau of the Communist Party of China...Vice Premier He Lifeng will lead a delegation to Malaysia from October 24 to 27 for economic and trade consultations with the U.S. side.

On October 23, the European Union announced the inclusion of Chinese companies in its 19th round of sanctions against Russia, marking the first time it has sanctioned large Chinese oil refineries and oil traders. A spokesperson for the Ministry of Commerce stated that China urges the EU to immediately stop listing Chinese companies and not to go further down the wrong path. China will take necessary measures to firmly safeguard the legitimate rights and interests of Chinese enterprises, as well as to protect its energy security and economic development.

3. Plastic Market Dynamics

Overnight international crude oil continued to rise, with an increase of more than 5%; domestic energy and chemical products mainly closed higher in the night session, with the main contracts for plastic-related futures experiencing narrow gains.

The plastic 2601 contract is quoted at 6907 yuan/ton, an increase of 0.55% compared to the previous trading day.

The PP2601 contract is quoted at 6,598 yuan/ton, up 0.40% from the previous trading day.

Contract PVC2601 is quoted at 4709 yuan/ton, up 0.21% compared to the previous trading day.

The styrene 2511 contract is quoted at 6459 yuan/ton, an increase of 0.28% compared to the previous trading day.

Section 4: Market Forecast for Today

PE: The supply and demand pressure in the polyethylene market has slightly eased, and prices are expected to tentatively test an upward trend, with an increase of 5-50 yuan/ton.

PP: It is expected that the polypropylene market will recover and rise, with increased support from the cost side, marginal improvement in supply and demand, and favorable macroeconomic factors driving the market.

PVC: It is expected that PVC prices will continue to weakly consolidate, with supply remaining high, demand persistently sluggish, and cost support strengthening. The PVC market is anticipated to maintain a range-bound fluctuation.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

India's Q3 Smartphone Shipments Rise 3%; Japanese Mold Factory Closures Surge; Mercedes-Benz Cuts 4,000 Jobs

-

Dow To Restart Pe Units 5 And 7 This Week, Recovery Date For Unit 6 Remains Undetermined In The United States (US)

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Ascend's Restructuring Plan Approved! Jwell Launches Global Acceleration Plan; Nexperia Chip Crisis Threatens Global Auto Production

-

European TDI Soars Due To Covestro Plant Shutdown