Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

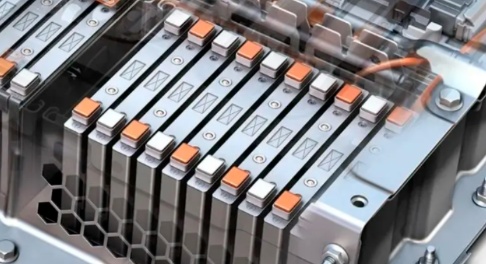

With the accelerated development of the global new energy vehicle and energy storage industries, solid-state batteries have become a core direction for next-generation battery technology due to their high energy density (>400 Wh/kg), intrinsic safety (no risk of electrolyte leakage), and long cycle life (>1000 times).

- Technical route differentiation

The three major electrolyte routes of sulfides (CATL, Ganfeng Lithium), oxides (Shanghai Shiba), and polymers (Ruitai New Materials) are developing in parallel. - The period of capacity explosion is approaching.

The key window for mass production from 2025 to 2027, with leading companies planning production capacities exceeding tens of thousands of tons. - Significant differentiation in performance

The profitability at the materials end remains stable (CATL's net profit increased by 33%), while equipment manufacturers show leading growth (SENIOR's net profit increased by 61%).

No. 10: Putailai (603659): Dual Layout of Solid-State Electrolytes and Equipment

Main business: diaphragm coating/anode materials/solid-state equipment; core products: LLZO/LATP electrolytes, dry film forming equipment.

Solid-state battery progress: a 200-ton solid-state electrolyte pilot production line in Sichuan has been put into operation; received solid-state equipment orders exceeding 200 million yuan (including isostatic pressing equipment).

Latest Performance: 2025 H1 revenue of 7.09 billion yuan (+12.0%), net profit of 1.06 billion yuan (+23.0%).

The 9th one:Xian Dao Intelligent (300450): A Global Oligarch in Solid-State Battery Equipment

Main business: Lithium battery/solid-state battery production line equipment; core products: dry coating/isostatic pressing equipment (all-solid-state production line).

Solid-state battery progress: the only global provider of a complete solid-state line solution, with a market share of over 70%; orders for the first half of 2025 are expected to reach 400-500 million yuan (a year-on-year increase of 100%).

Latest Results: Revenue for the first half of 2025 was 6.61 billion yuan (+14.9%), with a net profit of 740 million yuan (+61.2%).

The 8th one:Yunnan Germanium (002428): Core Germanium Source for Sulfide Electrolytes

Main business: germanium mining/tetrachloride (fiber optic grade); Core product: germanium tetrachloride (purity 99.9999%).

Solid-state battery progress: The only domestic enterprise producing sulfide electrolytes in mass production is a germanium source enterprise; germanium enhances the ionic conductivity of sulfides and reduces interfacial resistance.

Latest performance: Revenue for the first half of 2025 was 530 million yuan (+52.1%), with a net profit of 22.15 million yuan (+339.6%).

The 7th house:Orient Zirconium (002167): Global Leader in Zirconium Oxide

Main business: Zirconium series products (zirconia/electrically fused zirconia); core products: high-purity nano zirconia (core material for solid-state electrolytes).

Solid-state battery progress: global market share >50%, 500 tons of nanowires to be produced by Q2 2025; signed a three-year long-term agreement with Qingtao/Weilan (locking in 60% capacity).

Latest performance: Revenue for 2025 H1 was 630 million yuan (-23.1%), with a net profit of 29.08 million yuan (+148.6%).

The 6th company:Shanghai Xiba (688113): Exclusive mass production of LLZO oxide electrolyte.

Main Business: Water Treatment + Solid Electrolyte Materials; Core Product: LLZO Oxide Electrolyte (Yield >98%).

Solid-state battery progress: The world's only LLZO ton-level production company supplies BYD blade batteries; production capacity will expand to 2,000 tons per year by 2025.

Latest Performance: Revenue for H1 2025 was 220 million RMB (-15.9%), with a net profit of 110 million RMB (+156.6%).

Main business: lithium salts/additives (with LiTFSI as the core); core product: LiTFSI (compatible with three major solid-state routes).

Progress in Solid-State Batteries: The world's only LiTFSI mass production company supplies to Qingtao/ProLogium; jointly developing high-purity lithium sulfide with CATL (cost reduced by 80%).

Latest Performance: Revenue in the first half of 2025 was 970 million yuan (-7.4%), with a net profit of 81.91 million yuan (-24.2%).

Company 4: Tinci Materials (002709): Leader in Electrolyte Additives

Main business: Electrolyte (core), LITFSI solid-state battery materials; Core products: Sulfide/oxide electrolytes (ionic conductivity >8 mS/cm).

Progress in Solid-State Batteries: Pilot production at the 100-kilogram level by 2026, mass production at the ton level by 2027; signed a supply agreement with Welion New Energy for 100 tons of electrolytes (2025-2030).

Latest performance: Revenue in H1 2025 was 7.03 billion yuan (+29.0%), and net profit was 270 million yuan (+12.8%).

Company 3: Amprius Technology (300073): Core Supplier of Solid-State Cathode Materials

Main Business: Lithium battery cathode materials (ternary, lithium-rich manganese-based, solid-state electrolyte); Core Products: Sulfide all-solid-state cathode materials (ton-level shipments), lithium-rich manganese-based materials (leading in compaction density).

Solid-state battery progress: Sulfide electrolyte mass production in tonnage, introduced to customers such as Qingtao, Weilan, and Huineng; oxide electrolyte pilot line in hundred-ton scale put into production, customer certification in progress.

Latest performance: Revenue of 4.43 billion yuan in H1 2025 (+25.2%), net profit of 310 million yuan (+8.5%).

The second family:Ganfeng Lithium (002460): Dual Drivers of Lithium Resources and Solid-State Batteries

Main business: lithium salts (56.78%), lithium batteries (35.52%); core products: sulfide electrolytes (ionic conductivity > 8 mS/cm), 420Wh/kg solid-state battery cells.

Solid-state battery progress: Unique layout of three major electrolyte routes, Chongqing base's sulfide electrolyte quality production line has been put into operation (cost reduced by 40%); 21700 cylindrical batteries (50,000 units produced daily) will begin mass production in early 2026, supporting drones/eVTOL.

Latest performance: Revenue of 8.38 billion RMB in H1 2025, net loss of 530 million RMB (cash flow of 300 million RMB).

Company 1: CATL (300750): Global leader in power batteries, full-chain layout of solid-state technology.

Main business: Power batteries (73.55% of revenue), energy storage systems (15.88%), battery material recycling (4.41%). Core products: Condensed state battery (4C fast charging), sulfide all-solid-state battery (500Wh/kg).

Solid-state battery progress: Technology: Sulfide electrolyte interface impedance reduced by 60%, with over 2,000 patents; Mass production: 100GWh capacity planned for 2027, condensed matter batteries have been supplied to NIO ET9/Xiaomi SU8; Revenue: Solid-state batteries will account for 12% in Q1 2025.

Latest performance: Revenue for the first half of 2025 was 178.89 billion yuan (+7.3%), net profit was 30.49 billion yuan (+33.3%), and gross profit margin was 25.6%.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories