200% Performance Increase, Tianci Materials: Sweet After Bitter

Human nature drives cycles.

Since 2025, resources have become a hot topic in the global economic market. Lithium, as a strategic mineral resource, has benefited from the rapid release of demand in downstream fields such as new energy vehicles and energy storage, and its price has entered an upward cycle.

On January 26, 2026, the domestic lithium carbonate futures price was 164,600 yuan/ton, an increase of 90,000 yuan per ton compared to a year ago, representing a surge of 117%.

Hexafluorophosphate, also part of the lithium battery industry chain, saw its spot price reach 143,000 yuan/ton on January 26th, nearly tripling from the same period in 2025.

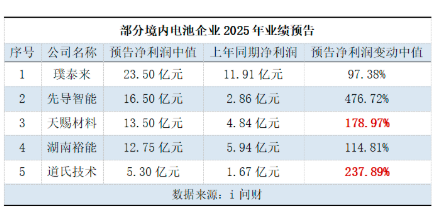

Given the overall industry environment, battery companies' 2025 financial statements generally look much better.

As of January 26, 2026, a total of 13 domestic listed battery companies had disclosed their 2025 performance forecasts. Among the top five companies with the highest median predicted net profit, all except Wuxi Lead Intelligent Equipment Co., Ltd. were battery chemical companies.

Among them,Tianci Materials, Dowstone, and others saw higher year-on-year net profit growth.with an average increase of around 200%.

Of these companies' substantial net profit increases, how much was achieved through their own competitiveness, and how much was due to chance? How long will the current upward cycle of the lithium battery industry chain last?

To understand these two questions, we must first analyze the current competitive state of the lithium battery market.

Supply-demand mismatch

Prices continue to rise

Regardless of the cycle, changes in supply and demand are the most crucial. Taking lithium hexafluorophosphate as an example, its price increase is mainly due to... Supply-demand mismatchImpact.

Lithium hexafluorophosphate is currently the most widely used inorganic salt electrolyte in commercial lithium-ion batteries, responsible for conducting ions and electrons between the positive and negative electrodes of the battery, making it an indispensable key raw material for lithium batteries.

From the perspective of downstream demand, as of the end of the third quarter of 2025, China's energy storage battery shipments reached 430 GWh, which is 1.3 times the total for the full year of 2024.

According to Frost & Sullivan data, global energy storage battery shipments are projected to reach over 1100GWh by 2029. The compound annual growth rate (CAGR) is projected to reach 23.10% from 2025 to 2029.

However, the current inventory of lithium hexafluorophosphate in China cannot support such a large demand.

From 2022 to July 2025, the domestic lithium hexafluorophosphate market was in a downward cycle, with most companies in the industry divesting capacity, and some even reducing or halting production. By November 2025, Chinese lithium hexafluorophosphate factories...Inventory is only around 1300 tons. 。

Approximately how much additional investment is required for a company to expand its lithium hexafluorophosphate production capacity? Wait for a 12-18 month period for new capacity construction.Moreover, environmental concerns also need to be considered, making rapid expansion difficult.

From the perspective of capacity expansion, the supply-demand mismatch in lithium hexafluorophosphate, leading to its high price, will likely persist for at least another year; judging from past price cycles, the high price period for lithium hexafluorophosphate may last even longer than a year.

From 2020 to 2024, lithium hexafluorophosphate underwent a complete price cycle, experiencing a peak price of around 600,000 yuan/ton in early 2022 and a low of 50,000 yuan/ton in July 2024.

Since 2025, the price of lithium hexafluorophosphate has shown an upward trend once again.A new cycle has likely begun.。

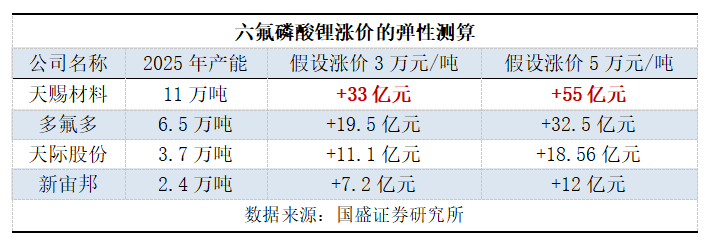

Currently, the leading domestic lithium battery material companies mainly include Tinci Materials, Do-Fluoride Chemicals, and Tianji Shares.Tinci Materials is the world's second-largest supplier of lithium hexafluorophosphate. , orders should also be more.

Starting from July 2025, Tinci Materials successively signed relevant cooperation agreements with CNENG New Energy, REPT Battero, AVIC NE, and Gotion High-tech. It is estimated that about 2.945 million tons of electrolyte will be supplied to these enterprises.。

According to the standard of 1 ton of lithium hexafluorophosphate producing 8 tons of electrolyte, 2.945 million tons of electrolyte requires 368,100 tons of lithium hexafluorophosphate.

However, Tianci Materials' LiPF6 capacity in 2025 will only be 110,000 tons/year, which means that the contracts signed in the second half of 2025 alone have alreadyPre-sell the company's production capacity for the next three years

Moreover, Tianci Materials' contracts with downstream customers generally involve "locking orders but not prices." If the price of lithium hexafluorophosphate continues to rise in the future, the company's profit margin will further increase.

According to research data from securities institutions, assuming minimal changes in marginal cost during this cycle, under scenarios of a price increase of 30,000 yuan/ton and 50,000 yuan/ton. Tianci Materials will increase its profits by 3.3 billion yuan and 5.5 billion yuan, respectively., which is the highest among several mainstream lithium battery material companies.

In other words, given Tianci Materials' current competitiveness, the company is likely to reap more benefits than its peers when the price of lithium hexafluorophosphate enters an upward cycle.

This stems from Tinci Materials' "resilience" shown at the bottom of the cycle.

Integrated layout reduces costs.

Layout solid-state battery materials

The most important factor in analyzing the competitiveness of cyclical businesses is to observe their performance during industry downturns.

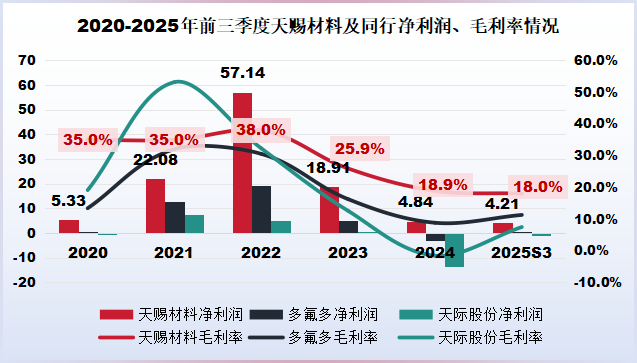

From 2022 to 2024, the prices of lithium battery materials were in a downward trend, leading to a decline in gross profit margins and net profits for companies like Tinci Materials, Do-Fluoride Chemicals, and Tianji.Only God-given materials have the smallest decline.。

In 2024, Defolodo and Tianji reported net losses of -308 million yuan and -1.361 billion yuan respectively, while Tianci Materials remained profitable with a net profit of 484 million yuan during the same period.

Regarding gross margin, as of the end of the third quarter of 2025, The gross profit margin of Tinci Materials is 18%.In manufacturing, this is still a moderately high level. In comparison, peer companies like Do-Fluoride and Tianji Materials have gross profit margins of 11.3% and 7.5% respectively, significantly lower than Tinci Materials.

Tianci Materials' ability to remain profitable during an industry downturn is primarily due to its integrated layout and construction over many years.

Tinci Materials has achieved an integrated layout of core electrolyte raw materials, including LiPF6, LiFSI, VC, DTD, and Lithium Difluorophosphate.Self-sufficiency rate of lithium hexafluorophosphate exceeds 95%.。

Duofluoride's main business includes new energy materials, fluorochemical materials, electronic information materials, and new energy batteries. 35% of its revenue comes from new energy materials, mainly focusing on the materials side.

Tianji's business is relatively concentrated, with 67% of its revenue in the first half of 2025 coming from lithium hexafluorophosphate, making its performance more susceptible to cyclical fluctuations.

Thanks to its integrated cost advantages, Tianci Materials' total expense ratio was only 7% at the peak of the cycle in 2022. By the bottom of the cycle in 2024, Tianci Materials' total expense ratio had only increased by 4 percentage points, reaching 11%.

Costs are relatively rigid, with strong resilience against industry volatility risks.

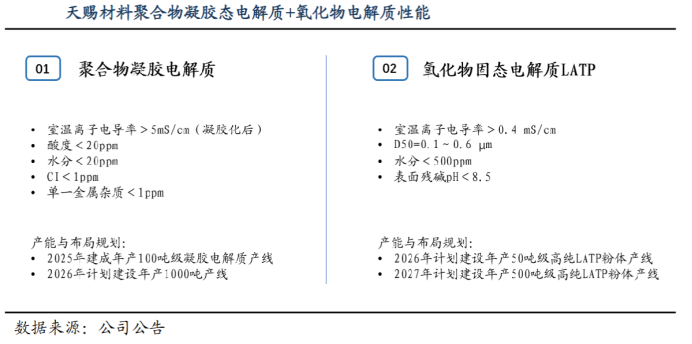

Next, Tianci Materials will continue to expand its downstream solid-state battery materials, primarily including semi-solid state.Two routes for all-solid-state.。

In terms of the semi-solid-state route, the company has deployed polymer gel electrolytes combined with oxide electrolytes (LATP).

Regarding polymer gel electrolytes, Tinci Materials' products exhibit room temperature ionic conductivity >5 mS/cm, acidity <20 ppm, water content <20 ppm, Cl <1 ppm, and single metal impurity <1 ppm. The plan is to establish a 100-ton production line by 2025.20The 26-year plan is to build a 1,000-ton production line.。

In terms of oxide electrolytes (LATP), the company's products feature a room-temperature ionic conductivity of >0.4 mS/cm, a D50 of 0.1~0.6 μm, moisture content <500 ppm, and a surface residual alkali pH <8.5. 2026Completed a 50-ton powder production line.,2027Annual plan to build a 500-ton powder production line. 。

For the all-solid-state route, Tianci Materials is focusing on lithium sulfide, sulfide/halide solid-state electrolytes, and UV adhesive materials. They achieve low-cost preparation of lithium sulfide through a liquid-phase metathesis method.

Currently, the market price of lithium sulfide is 4-8 million RMB/ton, corresponding to a sulfide electrolyte price of 2 million RMB/ton. If the cost of lithium sulfide drops to 500,000 RMB/ton, the electrolyte cost can be reduced to 330,000 RMB/ton, and the future cost of all-solid-state batteries is expected to drop to 0.6 RMB/Wh.

Tianci Materials utilizes a liquid-phase method, focusing on raw material selection, material refining, and solvent screening, to achieve continuous reaction conversion of electrolytes. This optimizes impurity removal and refining, enables continuous conversion, further reduces costs, and achieves high air stability.

The company plans to complete a 100-ton production line by 2026.Target cost less than 300,000 CNY/ton, with plans to establish a 1,000-ton production line by 2027.Target cost less than 200,000 RMB/ton。

From the perspective of the long-term logic of technological iteration, although the commercialization process of solid-state batteries still requires time, Tianci Materials' early layout is already accumulating strength for the next cycle.

In the cyclical shifts of industries, true competitiveness often lies hidden in a company's forward-looking strategies for technological iteration.

Tinci Materials is a very clever company. It deeply understands the characteristics of the cyclical industry it operates in, and actively manages these cycles by leveraging integrated "depth" and "forward-looking" technology to mitigate volatility.

Its future potential will no longer be limited to whether it can stand out in the fierce competition of liquid electrolytes, but will depend on whether it can once again occupy a core ecological niche in the next generation of battery technology revolution.

The above analysis does not constitute specific investment advice. The stock market is risky, and investments should be made with caution.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories