2025 China Modified Engineering Plastics Industry Analysis Report: Market Size About 73.1 Billion Yuan, Huge Space for Domestic Substitution

Modified engineering plastics, which are new plastic products based on general-purpose and engineering plastics that have been processed and modified through methods such as filling, blending, and reinforcement to improve properties such as flame retardancy, strength, impact resistance, and toughness, have become an important component of the nation's strategic emerging industries. By 2025, driven by the demand growth in emerging fields such as high-end home appliances, new energy vehicles, and aerospace in China, the modified plastics industry is ushering in an upward economic cycle.

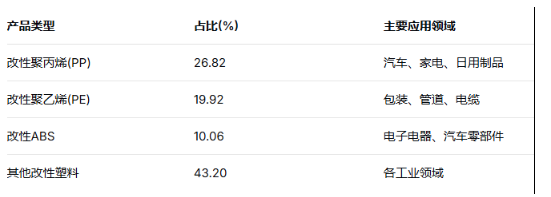

According to statistical data, as of 2024, China's production of modified plastics reached 33.2 million tons, an increase of 11.6% year-on-year, and it is expected to grow to 35.46 million tons by 2025. In terms of product structure, modified polypropylene dominates the market, accounting for 26.82% of the production, followed by modified polyethylene and modified ABS, accounting for 19.92% and 10.06% respectively.

In 2025, China's modified engineering plastics industry will exhibit three major development trends: technological upgrades driving products towards high-performance and multifunctional advancements to meet the demands for lightweight materials, high strength, and chemical resistance in the automotive and electronics sectors; expansion of application areas from traditional home appliances and automobiles to emerging fields such as new energy and intelligent manufacturing, with rapid penetration especially in the new energy vehicle sector where modified plastics are used for battery pack casings and charging pile components to meet lightweight and flame-retardant requirements; green transformation through the development of degradable plastics and the promotion of recycling technologies to enhance sustainable development capabilities.

At the same time, the support from national policies has created a favorable environment for industry development. Modified plastics, as a new material product, fall within the category of national strategic emerging industries. Relevant departments have successively introduced a series of encouraging policies to promote the sustained positive development of the industry. In addition, the trend of "substituting plastic for steel" is emerging across multiple industries, with demand growth driven by home appliance upgrades and automotive lightweighting. Moreover, companies going overseas are opening up new incremental markets.

In this context, China's modified engineering plastics industry is undergoing a critical transition from scale expansion to quality enhancement. Technological innovation, application expansion, and green sustainable development will become the three core drivers promoting high-quality development in the industry.

Modified engineering plastics refer to new types of polymer materials that are significantly enhanced in terms of flame retardancy, strength, impact resistance, toughness, and other properties through physical and chemical processing methods such as filling, blending, and reinforcing based on general plastics and engineering plastics. Through the modification process, engineering plastics can achieve superior overall performance to meet the stringent requirements for material properties in specific application scenarios. This trend of "replacing steel with plastic" has become an important direction of development in multiple industries, as modified plastic components can not only achieve the strength performance of certain steel materials but also offer a series of advantages such as being lightweight, having rich colors, and being easy to mold.

Modified plastics, as an important component of the new materials sector, have been included in China's national strategic emerging industries. In recent years, a series of encouraging policies have been introduced at both national and local levels to vigorously promote the rapid development of the polymer materials industry, including modified plastics. Against the backdrop of the "carbon neutrality and peak carbon emissions" strategy, modified engineering plastics are seizing unprecedented development opportunities due to their unique advantages in lightweight and recyclable utilization. After decades of development, China's modified plastics industry has gradually transformed from initially focusing on low-end products to a direction of high-end, functional, and specialized upgrades, achieving technological breakthroughs and import substitution in certain fields against foreign brands.

From the perspective of the industrial chain, the upstream of the modified engineering plastics industry mainly includes petrochemical raw materials, such as polypropylene (PP), polyethylene (PE), polyamide (PA), polycarbonate (PC), and other synthetic resins. The midstream consists of modified plastics production enterprises, which develop specialty materials to meet various needs through specific formulas and processes. The downstream applications are widespread in automotive, home appliances, electronics and electrical, new energy, rail transit, aerospace, and other fields. Moreover, with technological advancements, the scope of applications continues to expand.

Market Size and Structure of the Modified Plastics Industry in 2025

1. Market Size and Growth Trends

The modified plastics industry in China is currently experiencing rapid growth. According to data released by the China Business Research Institute, the production of modified plastics in China reached 33.2 million tons in 2024, representing an 11.6% year-on-year increase. It is expected that this figure will grow to 35.46 million tons by 2025. Meanwhile, the market size is also expanding in tandem. According to professional institutions' forecasts, the market size of China's modified engineering plastics is expected to reach approximately 73.1 billion yuan by 2025, demonstrating a steady growth trend.

This growth momentum is primarily driven by strong demand from emerging downstream sectors. The rapid development of high-end home appliances, the swift adoption of new energy vehicles, the upgrading of the aerospace industry, and intelligent manufacturing have collectively propelled the continuous increase in the production of modified plastics. Particularly in the new energy vehicle sector, as the penetration rate of new energy vehicles in China has surpassed 40%, the demand for lightweight, high-performance modified plastics has experienced explosive growth, injecting new energy into the industry.

From a global perspective, the growth rate of China's modified plastics market is significantly higher than the global average. According to statistics from QYR (Hengzhou Bozhi), the global modified plastics market sales are expected to reach $436.76 billion in 2024 and will grow to $530.24 billion by 2031, with a compound annual growth rate (CAGR) of approximately 2.9% during this period. In contrast, the average annual growth rate of the Chinese market far exceeds this level. This indicates that China is gradually becoming the most important market and production base for the global modified plastics industry.

2. Product Structure Analysis

In terms of product structure, modified polypropylene (PP) holds the highest production share in the Chinese modified plastics market, reaching 26.82%. This is mainly due to polypropylene's excellent overall performance, relatively low cost, and wide range of applications. Modified polyethylene (PE) follows closely with a share of 19.92%, while modified ABS ranks third with a share of 10.06%. These three types of products together account for more than half of the modified plastics market, forming the main part of the industry.

It is worth noting that although general plastic modification is currently the mainstay of the market, the growth rate of high-performance engineering plastics (such as PEEK, LCP, PPS, etc.) is significantly higher than the industry average. These high-performance materials, although currently relatively small in scale, are becoming competitive high grounds for enterprises due to their high technical barriers and high added value. Taking PEEK as an example, the production capacity in China will reach 9,750 tons in 2024, with an output of 3,900 tons and a capacity utilization rate of 40.0%. The demand is 5,000 tons, and the domestic share has reached 78%, showing the continuous breakthroughs of domestic enterprises in high-end fields.

Table: Structure Distribution of Modified Plastic Production in China in 2025

3. Application Domain Distribution

Modified plastics have a wide range of downstream applications. Currently, the home appliance industry is the largest application market for modified plastics, accounting for about 37% of the demand share. This is primarily due to the high requirements of home appliance products in terms of appearance, texture, durability, and flame retardancy, which modified plastics can effectively meet.

The automotive industry is the second largest application field for modified plastics, accounting for approximately 15%. In line with the trend of lightweight and energy-saving in automobiles, "replacing steel with plastic" has become an industry consensus, gradually expanding from interior parts to exterior parts and functional structural components. Especially in the field of new energy vehicles, modified plastics are widely used in key components such as battery pack casings and charging pile parts to meet the needs for lightweight and flame retardancy.

In the electronic and electrical appliance sector, the proportion is approximately 8%, while office equipment and power tools account for 7% and 3%, respectively. Moreover, with the development of emerging technologies, the application of modified plastics is continually expanding in fields such as new energy, intelligent manufacturing, and the low-altitude economy. For instance, in the AI server sector, special engineering plastics are used in liquid cooling system pipelines; in the drone sector, lightweight materials provide solutions for structural components.

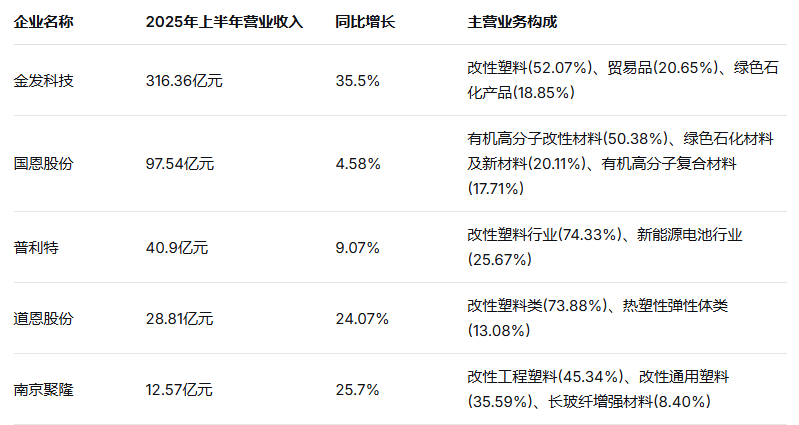

Market Competition Landscape

The Chinese modified plastics market has formed a diversified competitive landscape. From the perspective of enterprise nature, it is mainly divided into three camps: international giants, leading domestic enterprises, and small and medium-sized specialized enterprises. International giants include BASF, Dow Chemical, DuPont, LG Chem, etc., which still hold a strong advantage in the field of high-performance products. Leading domestic enterprises are represented by companies like Kingfa Sci & Tech, Goody Technology, Polyrocks, Dawn Polymer, Nanjing Julong, and others. Through continuous technological innovation and market expansion, these enterprises have occupied an important position in the domestic market and are gradually penetrating into high-end fields.

From the market hierarchy perspective, the Chinese modified plastics market is characterized by a reliance on imports for high-end products and intense competition for mid-to-low-end products. Currently, China's modified plastics are primarily mid-to-low-end products, accounting for as much as 75%, while high-end modified plastics account for only 25%. This structure indicates that domestic enterprises still have significant room for improvement in the high-end sector, and it also suggests a huge potential for future domestic substitution.

Table: Overview of Key Enterprises in China's Modified Plastics Industry in 2025

Policy support creates a favorable development environment.

Modified plastics, as a crucial component of the new materials sector, receive strong support from national industrial policies. In recent years, relevant national departments have successively introduced a series of encouraging policies, clearly designating high-performance polymer materials and advanced composite materials as strategic emerging industries, thereby providing robust policy assurance for the development of the modified plastics industry. These policies not only offer support in terms of research and development investment and technological innovation but also promote industry development through various means such as downstream application promotion and tax incentives.

Under the strategic context of "carbon neutrality and carbon peaking," the material industry related to green, environmental protection, and lightweight has gained unprecedented development opportunities. Modified plastics, with their unique advantages in lightweight (reducing energy consumption) and recyclability (promoting the circular economy), have become an important pathway for multiple industries to achieve carbon reduction targets. Meanwhile, as China's "strong manufacturing nation" strategy is further implemented, the transformation and upgrading of the manufacturing industry have led to a growing demand for high-end materials, creating vast market space for the modified plastics industry.

Technological progress drives industrial upgrading.

Technical innovation is the core driving force behind the development of the modified plastics industry. In recent years, China's modified plastics industry has been upgrading from general-purpose materials to high-performance, multifunctional ones through continuous technological research and development. Companies have developed new materials with excellent mechanical properties, heat resistance, and specific functions based on core technology platforms such as dynamic vulcanization and esterification synthesis. In response to the demand for lightweight, high-strength, and chemical corrosion-resistant materials in industries like automotive and electronics, the industry has significantly enhanced product mechanical strength and durability through molecular structure modification and nanocomposite technology.

In the field of special engineering plastics, Chinese companies have made remarkable technological breakthroughs. The localization rate of high-performance engineering plastics represented by PEEK (polyether ether ketone), LCP (liquid crystal polymer), PPS (polyphenylene sulfide), among others, continues to increase. Data shows that by 2024, China's self-sufficiency rate in special engineering plastics will reach about 60%, a significant improvement from 36% in 2021, indicating a noticeable acceleration in the localization process. Among them, the localization rate of PEEK materials has reached 78%, PPS has reached 73%, and LCP has reached 70%. The localization rate of most products has already reached over 70%.

This technological upgrade not only meets the stringent requirements for material performance in the high-end manufacturing sector but also promotes the industry's transition from "price competition" to "technology competition," laying a solid foundation for replacing imported high-end plastics.

3. Downstream demand continues to grow.

Robust downstream demand is a key driving force for the rapid development of the modified plastics industry. From traditional home appliances and automobiles to emerging fields such as new energy, intelligent manufacturing, and aerospace, the demand for modified plastics is showing a continuous growth trend.

In the home appliance sector, the trend towards high-end and intelligent products has raised higher demands for materials, such as improved aesthetic quality, lightweight design, and enhanced flame resistance, which in turn has driven the demand for high-performance modified plastics.

In the automotive sector, particularly with the rapid development of new energy vehicles, the demand for lightweight materials is increasingly urgent. The application of modified plastics in automobiles has gradually expanded from early interior components to exterior parts and functional structural components, such as battery pack housings and charging station parts. Data shows that by 2025, the penetration rate of new energy vehicles in China will exceed 40%, bringing new growth opportunities to the modified plastics industry.

In the field of electronics and electrical engineering, with the development of technologies such as 5G communication, artificial intelligence, and the Internet of Things, the performance requirements for electronic materials are constantly increasing, such as low dielectric constant, high heat resistance, and electromagnetic shielding, which drives the application of special engineering plastics in this area.

Emerging application areas: In the low-altitude economy, lightweight materials provide solutions for drone structural components; in the AI server sector, special engineering plastics are applied in liquid cooling system pipelines; in the robotics field, material solutions such as PA, PEEK, long glass fiber reinforced materials, and elastomers are continuously emerging for robot joints, feet, shells, and more. These emerging application areas are becoming new growth points for the modified plastics industry.

Green Transition and Sustainable Development

Green environmental protection has become a global consensus, and the modified plastics industry is actively responding to this trend by promoting the industry's green transformation through material innovation and process optimization. Specifically reflected in:

Biobased and biodegradable materials: The industry actively responds to environmental protection policies by developing biodegradable plastics and promoting recycling technologies to reduce environmental impact. Biobased biodegradable materials are replacing traditional plastics in the field of single-use products, thereby reducing white pollution. For instance, the application of polylactic acid (PLA) modified materials synthesized from renewable resources is gradually expanding in packaging and consumer electronics.

Recycling Technology: Chemical recycling technology enables the high-value regeneration of waste plastics, promoting resource recycling. To address the challenge of recycling specialty engineering plastics, the industry is exploring new technologies such as chemical recycling and physical recycling to improve material recovery rates. For example, the chemical depolymerization and repolymerization technology for PEEK waste has entered the pilot stage, with the potential for large-scale application in the future.

Low-carbon production processes: Enterprises can reduce carbon emissions during the production process through methods such as green chemical processes and the substitution of clean energy. For example, using aqueous synthesis instead of the traditional organic solvent method to produce polyimide can significantly reduce environmental pollution.

The green transition not only helps enterprises meet increasingly strict environmental regulations but also reduces production costs through energy conservation and consumption reduction, enhancing the ESG competitiveness of products in the international market and injecting momentum into the long-term development of the industry.

Industry Competition Landscape and Enterprise Analysis

1. Market Competition Situation

After years of development, China's modified plastics industry has formed a relatively complete industrial system and a diversified competitive landscape. From the perspective of market entities, it mainly includes the following three types of enterprises:

International chemical giants such as BASF, Dow Chemical, DuPont, and LG Chem occupy a leading position in the high-end modified plastics market with their strong R&D capabilities, advanced production technologies, and global business layouts.

Leading domestic enterprises: such as Jinfat Technology, Guoen Co., Ltd., Pulite, Daon Co., Ltd., and Nanjing Julong, these companies fully utilize local market advantages, maintaining a dominant position in the mid-range market through continuous technological innovation and customer service, and gradually penetrating into the high-end market.

Small and medium-sized specialized enterprises: These companies typically focus on specific niche markets or regional markets, occupying a position in the market through differentiated competition strategies.

From the perspective of market concentration, the concentration in China's modified plastics industry is relatively low, exhibiting the characteristics of "a large market with small enterprises." However, with the increasing environmental requirements and the rising technological barriers, industry consolidation is accelerating, and market concentration is expected to gradually increase.

2. Key Enterprise Analysis

(1) Kingfa Sci.&Tech.

Jinfa Technology is a leading enterprise in China's modified plastics industry, primarily engaged in the research and development, production, and sales of new chemical materials. The company's main products include modified plastics, environmentally friendly high-performance recycled plastics, biodegradable plastics, special engineering plastics, carbon fibers, and composite materials. In the first half of 2025, the company achieved operating revenue of 31.636 billion yuan, a year-on-year increase of 35.5%; it realized a net profit attributable to shareholders of 585 million yuan, a year-on-year increase of 53.95%. Modified plastics are the company's core business, accounting for 52.07% of its revenue.

Jinfa Technology is at the forefront of R&D investment in the industry, continuously promoting product structure optimization and extending into high value-added areas. In the field of specialty engineering plastics, the company's PEEK capacity expansion project is gradually being realized, breaking the monopoly of foreign giants, and the application proportion in areas such as new energy vehicle battery packs and connectors has significantly increased.

Guoen Co., Ltd.

Guoen Corporation's main businesses include the large-scale chemical industry and the health industry, with organic polymer modified materials being the company's core business. In the first half of 2025, the company achieved operating revenue of 9.754 billion yuan, a year-on-year increase of 4.58%, and a net profit attributable to shareholders of 346 million yuan, a year-on-year increase of 25.82%. The company's main products include organic polymer modified materials, green petrochemical materials and new materials, and organic polymer composite materials, with organic polymer modified materials accounting for 50.38% of the revenue.

Guoen Co., Ltd. has actively promoted a vertical integration layout in recent years by extending upstream to reduce the risk of raw material cost fluctuations and expanding into downstream high value-added areas to enhance profitability.

(3) Nanjing Julong

Nanjing Julong's main business is the research and development, production, and sales of high-performance polymer new materials and advanced composite materials applications. The company's products include high-performance modified plastics, thermoplastic elastomer materials, carbon fiber composite structural components and parts manufacturing and assembly, as well as bio-based resource recycling plastic-wood profiles. In the first three quarters of 2025, the company achieved a total operating revenue of 1.996 billion yuan, a year-on-year increase of 23.78%, and a net profit of 101 million yuan, a year-on-year increase of 79.46%.

Nanjing Julong is actively entering emerging sectors such as robotics, aerospace, and the low-altitude economy. The company has launched material solutions such as PA, PEEK, long-glass-fiber reinforced materials, and elastomers for robotic joints, end-effectors, and shells. Meanwhile, its subsidiary, Julong Composites, focuses on the scaled manufacturing of carbon fiber composite components and complete drones in a "dual-track" approach, and has established a one-stop production line from composite structural parts to complete assembly.

1. Technological Development Trends

In the coming years, the modified engineering plastics industry in China will exhibit the following technological development trends:

High performance and functionalization: As the demand for material performance increases in high-end manufacturing fields such as aerospace, new energy vehicles, and 5G communications, modified engineering plastics will evolve towards higher strength, high temperature resistance, corrosion resistance, and low dielectric loss. For example, the application of polyether ether ketone (PEEK) in medical implants and semiconductor devices will be further deepened, and the demand for LCP films in flexible displays and high-frequency communications will continue to grow.

Lightweighting and Compositing: To meet the lightweight requirements of automobiles and electronic devices, modified engineering plastics will be compounded with reinforcement materials such as carbon fiber and glass fiber to form high-performance composite materials. For example, the application of carbon fiber reinforced PEEK materials in aerospace structural components will significantly enhance the material's specific strength.

Green environmental protection and sustainable development: The research and development of bio-based and biodegradable materials will become key focus areas in the industry. With global environmental regulations becoming stricter, the development of bio-based specialty engineering plastics (such as bio-based polyamides and biodegradable polyesters) will accelerate. At the same time, recycling technologies will also make breakthroughs. To address the challenges of recycling specialty engineering plastics, the industry will explore new technologies such as chemical recycling and physical recycling to improve material recovery rates.

Intelligent Manufacturing and Digitalization: With the advent of the Industry 4.0 era, the modified plastics industry will accelerate its pace of intelligent transformation by introducing advanced technologies such as big data and artificial intelligence to optimize production processes and enhance product quality stability and production efficiency.

Market Outlook Forecast

Based on the current development trends, the following predictions are made for the future prospects of China's modified engineering plastics industry:

The market scale continues to expand: It is expected that by 2030, China's production of modified plastics will further increase from 35.46 million tons in 2025, with an average annual compound growth rate maintained at 8% to 10%. The growth rate of high-performance modified engineering plastics will significantly exceed the industry average, with an annual growth rate expected to reach over 15%.

The process of domestic substitution is accelerating: Currently, there is still considerable room for improvement in the domestic production rate of mid-to-high-end products in China's modified plastics market. Taking special engineering plastics as an example, the self-sufficiency rate is expected to reach about 60% in 2024, compared to 36% in 2021, indicating a significant increase. In the future, as domestic companies continue to make technological breakthroughs, the process of domestic substitution will further accelerate. It is anticipated that by 2030, the domestic production rate of high-end modified engineering plastics will exceed 80%.

The application fields are constantly expanding: the application of modified engineering plastics is rapidly penetrating emerging areas such as new energy and intelligent manufacturing, moving beyond traditional household appliances and automobiles. In the field of new energy vehicles, modified plastics are used for battery pack housings and charging station components; in the low-altitude economy sector, lightweight materials provide solutions for drone structural components; in the AI server domain, specialty engineering plastics are applied in liquid cooling system pipelines. These emerging scenarios pose new requirements for materials in terms of high-temperature resistance, thermal conductivity, and other characteristics, driving companies to develop customized products and thereby opening up new market spaces.

Industry Integration and Concentration Enhancement: With increasing environmental requirements and rising technical thresholds, the modified plastics industry is set to experience a wave of integration. Leading companies will expand their market share through mergers and acquisitions, as well as capacity expansion, gradually increasing industry concentration.

3. Investment Opportunities and Risk Analysis

Investment Opportunity

High-end product domestic substitution: In the "bottleneck" field of high-performance engineering plastics, such as PEEK, PPS, and LCP, domestic companies are continuously achieving technological breakthroughs, and there is substantial room for domestic substitution.

Emerging application fields: The demand for specialty engineering plastics is rapidly increasing in new fields such as new energy vehicles, artificial intelligence, low-altitude economy, and biomedicine, bringing new growth points to the industry.

Green environmentally friendly materials: bio-based, biodegradable, and recyclable green environmentally friendly modified plastics align with the direction of sustainable development and have broad market prospects.

Industrial chain integration: Integrated enterprises that possess upstream raw material production and downstream product application development capabilities have obvious advantages in cost control and technological collaboration, making their competitiveness more prominent.

(2) Risk Warning

The risk of raw material price fluctuations: The main raw materials for modified plastics are petroleum-based synthetic resins, whose prices are significantly affected by fluctuations in international crude oil prices, which may cause instability in the company's profitability.

Technological Competition Risk: As the industry progresses towards high-tech and high value-added directions, technological competition will become increasingly intense, and companies face risks of core technology loss and technological iteration.

International environmental uncertainty: The rise of global trade protectionism and geopolitical conflicts may introduce uncertainties to the global development of the industry.

Environmental policies are becoming stricter: As national environmental requirements continue to rise, enterprises are facing increased investment in environmental protection and rising production costs.

1. Research Conclusion

Through a comprehensive analysis of China's modified engineering plastics industry in 2025, the following conclusions can be drawn:

First, the modified engineering plastics industry in China is currently in a state ofRapid Development StageThe market scale continues to expand, the technology level continues to improve, and the application fields continue to broaden. By 2025, China's production of modified plastics is expected to reach 35.46 million tons, the market size is about731 billion yuanIt shows a good growth trend.

Second, the driving forces for industry development are diverse, includingNational Policy Support、Technological advancement、Downstream demand growth Green transitionThese factors collectively drive the industry towards high-quality development.

Third, China's modified engineering plastics industry has formed.Diversified competitive landscapeDomestic companies are continually growing in competition with international giants, and have achieved breakthroughs in some high-end areas. However, overall, high-end products still rely on imports, and there is significant room for domestic alternatives.

Fourth, the future of the industry will move towardsHigh performance enhancement、Functionalization、Green Environmental Protection GlobalizationIt has broad development prospects in the emerging application fields and high-end product areas.

Suggestions for Development

Based on the above research conclusions, the following recommendations are proposed for the development of the modified engineering plastics industry in China:

Increase investment in research and innovation.Enterprises should continuously increase R&D investment, break through key core technologies, especially in the field of high-performance engineering plastics, and accelerate the process of domestic substitution. At the same time, strengthen industry-university-research cooperation to promote the transformation of scientific and technological achievements.

Promote the transformation towards intelligence and greenness.Enterprises should actively promote intelligent manufacturing to improve production efficiency and the stability of product quality; at the same time, accelerate the development and application of green and environmentally friendly materials to promote sustainable development in the industry.

Optimize product structure and market layout. Enterprises should actively adjust their product structure and extend towards high value-added and high-end directions; meanwhile, they should seize development opportunities in emerging fields such as new energy vehicles, artificial intelligence, and low-altitude economy to expand market space.

Enhance collaboration in the industrial chainEncourage upstream and downstream enterprises to strengthen collaborative cooperation, build a stable supply chain system, and enhance the overall competitiveness of the industry chain. Enterprises with conditions can enhance their risk resistance capabilities through vertical integration.

Actively participate in international competition.On the basis of establishing a foothold in the domestic market, enterprises should actively "go global" by participating in international competition through overseas capacity layout, technological cooperation, and other means to enhance their global operational capabilities.

In summary, the outlook for China's modified engineering plastics industry is broad, with significant potential for domestic substitution. Driven by both policy support and technological advancements, the industry is expected to achieve high-quality development, providing strong support for the construction of a manufacturing powerhouse.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

[Today's Plastics Market] General Materials Weakly Fluctuate, Engineering Materials Steadily Rise

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Daily Review: Polyethylene Prices Under Weak Consolidation, Sellers Face Significant Pressure to Move Inventory