30-Day Price Hike of 30%! TDI “Maintenance Season” Sees Wanhua Chemical, Covestro and BASF Each With Their Own Agenda

Recently, Wanhua Chemical released a series of announcements stating that the 250,000-ton/year TDI unit at its Hungarian subsidiary BorsodChem has resumed normal production after maintenance, while the 400,000-ton/year MDI unit is still pending restart. According to the annual maintenance plan, the TDI unit (300,000 tons/year) and related supporting facilities at Wanhua Chemical's Yantai Industrial Park will begin phased shutdowns for maintenance starting on August 19, 2025, with an expected maintenance period of about 40 days. Additionally, the newly constructed second-phase TDI unit (360,000 tons/year) at Wanhua Chemical's Fujian Industrial Park has recently been completed and put into operation, successfully producing qualified products.

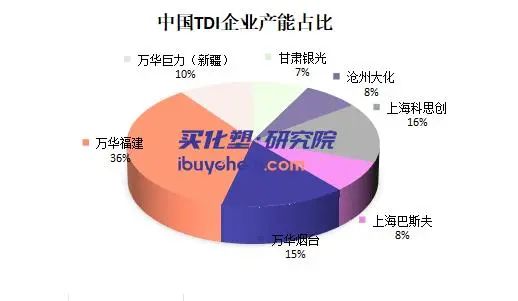

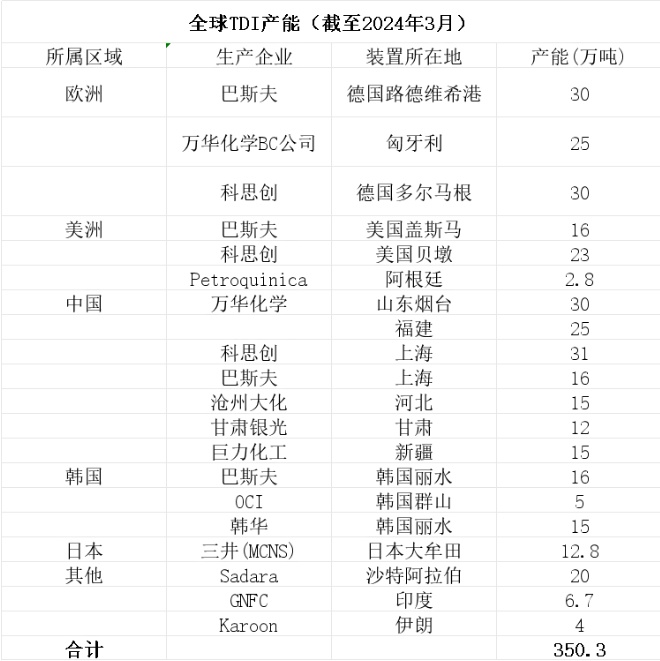

With the commissioning of the second phase of Wanhua's Fujian facility, Wanhua Chemical's TDI production capacity has reached 1.47 million tons, injecting new increments into the global TDI capacity. Theoretically, this could alleviate the tight supply situation in the market and may even exert some downward pressure on prices. However, the global TDI market is currently in a maintenance season, with major producers' maintenance schedules creating a tight supply situation that largely offsets the impact of the new capacity.

An additional 360,000 tons still cannot solve the urgent problem?

Covestro's plant in Germany has encountered force majeure, resulting in a prolonged shutdown. The U.S. plant will undergo maintenance starting in September for one month, during which only the Shanghai plant among Covestro's three major TDI production bases will operate normally. To optimize global resource allocation, Covestro is further reducing its supply to the Chinese market by an additional 15% in August, on top of the already significantly reduced supply. It is noteworthy that the Shanghai plant will undergo an extended overhaul starting in the fourth quarter, which means that Covestro's supply shortage will continue at least until February next year. The ongoing tightening of Covestro's supply will undoubtedly further exacerbate the supply gap in the global TDI market.

Shanghai BASF is also facing tight supply conditions. In August, TDI supplies are scarce, and the company will temporarily stop accepting new orders. This move indirectly reflects the tightening market supply and has sharply increased procurement pressure on downstream enterprises. Cangzhou Dahua's TDI unit is scheduled for an unplanned shutdown for maintenance in mid-August, lasting about seven days. This brief maintenance has also led to tight supply and necessitated limited sales.

Wanhua Chemical is also facing a tight resource situation. It is understood that Wanhua Chemical’s TDI distribution channel implemented a fixed price of 19,000 yuan/ton in the second ten days of August. Due to plant maintenance and strong overseas demand, supply remains tight. There were previous rumors of a maintenance plan for Yantai Wanhua in August; now that the plan has been implemented, it further confirms the current supply shortage. In addition, Xinjiang Juli shut down for maintenance on July 16 for approximately 35 days, which also exacerbated the market supply tightness to some extent.

Despite Wanhua Chemical's addition of 360,000 tons/year of TDI capacity, the market supply side continues to be under pressure amid the global maintenance season, with major producers announcing intensive maintenance plans. Supply reductions from companies such as Covestro, BASF Shanghai, and Cangzhou Dahua intertwine with Wanhua Chemical's new capacity and partial unit maintenance. This reflects the prominent current supply-demand contradictions in the market. Tight supply supports prices at high levels, while downstream companies face rising cost pressures.Buy Chemicals and PlasticsAccording to the research institute's monitoring, as of now, the price of domestic goods in the East China region is 15,000-16,000 yuan/ton, and Shanghai goods are 16,000-16,500 yuan/ton. The current price has increased by more than 30% compared to early July. With the continued tight supply situation at Covestro and the advancement of other companies' maintenance plans, the supply gap in the global TDI market may further widen. Prices are likely to remain volatile at high levels, and there is even a possibility of further increases.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Four Major Chemical New Material Giants Sell Off and Shut Down Again!

-

Covestro faces force majeure!

-

DuPont to Spin Off Nomex and Kevlar Brands for $14.4 Billion: Is Aramid Fiber Still Attractive?

-

Massive Retreat of Japanese and Korean Battery Manufacturers

-

Napan Unveils Thermoplastic Composite Three-in-One Power System Solution, Battery Cover Weight Reduced by 67%