DuPont to Spin Off Nomex and Kevlar Brands for $14.4 Billion: Is Aramid Fiber Still Attractive?

Recently, American materials science giant DuPont announced the divestiture of its iconic high-performance materials brands Nomex and Kevlar, with a transaction value of approximately $2 billion (about 14.4 billion yuan).

So, why did DuPont decide to divest these two major aramid fiber brands? In which fields are the products of these two brands primarily used? Who are the main participants in the market? Specialized insights will provide you with an interpretation.

Source of the image: DuPont

"It is not due to performance reasons! Why did DuPont give up on the two major [projects]?""Printing press"?

In July 2025, DuPont announced the divestiture of its two flagship brands, Nomex and Kevlar, which is not a decision made on a whim, but rather the result of profound strategic considerations. Although the "Water Treatment and Protection" division, where these two brands belong, is projected to achieve revenue of $5.42 billion in 2024, contributing nearly half of the division's income, and the profit situation is stable, DuPont has still decided to sell them. There are reports that private equity firms Advent International and Platinum Equity are potential buyers.

This decision hides DuPont's rethinking of its strategic positioning and future growth path.

Business Portfolio OptimizationThe primary motivation for DuPont's recent spin-off is the ongoing strategic transformation from diversification to focus. The goal is to create a company that specializes in high-growth, high-profit areas within the specialty materials sector. Although Nomex and Kevlar have a long history and stable market performance, the DuPont management has assessed that these two businesses no longer align with the company's future focus on the three core areas of "semiconductors, healthcare, and water treatment."

From the financial data, DuPont's total revenue of $12.4 billion in 2024 shows that the Electronics and Industrial segment accounts for 47.88%, while Water and Protection accounts for 43.78%. The organic growth rate of the electronics business is as high as 10%, significantly above the company's average level, which prompts DuPont to concentrate its limited resources on more growth-promising sectors.

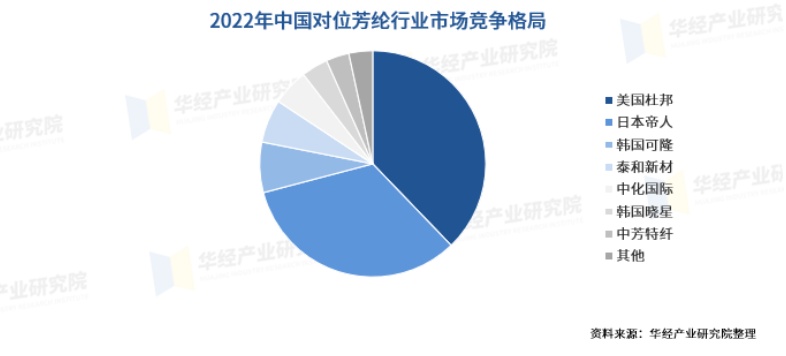

Structural changes in the aramid fiber industryThe divestiture was also driven by this factor. As a global bulk commodity, the aramid fiber industry is currently facing the challenge of overcapacity. By the end of 2024, the global nominal capacity of aramid fiber is expected to be around 170,000 to 180,000 tons, while demand is only 140,000 to 150,000 tons, resulting in an imbalance between supply and demand that is putting pressure on the overall profit margins of the industry. On the other hand, technological advancements and capacity expansions by companies in emerging markets such as China are changing the traditional competitive landscape dominated by giants like DuPont and Teijin.

In this environment, future enterprises will turn to differentiated and high value-added products (such as lithium battery coated aramid and aerospace-grade honeycomb core materials) to enhance profit margins. For example, on July 9, Taihe New Materials stated on an interactive platform that its aramid-coated separators have achieved mass delivery, and in the early stage of industrialization, it will focus on developing fields such as computing centers, power tools, aircraft, and new energy vehicles that place a strong emphasis on safety.

Financial restructuringFrom a perspective of angles, this divestiture is closely related to DuPont's recent impairment actions. In 2025, DuPont will classify its aramid business as an independent reporting unit and conduct an impairment test, confirming a goodwill impairment of up to $768 million. This accounting treatment reflects the industry pressure faced by the aramid business and prepares for future sales. By divesting Nomex and Kevlar, DuPont can optimize its balance sheet, reduce the drag of non-core assets on capital returns, and simultaneously gain approximately $2 billion in cash flow to support R&D investments and strategic acquisitions in its core business.

Zhuansu Shijie noticed that in April 2025, the State Administration for Market Regulation launched an antitrust investigation against DuPont China Group. DuPont's 2024 financial report shows that China is DuPont's second-largest source of revenue after the United States, with the prices of high-end products like aramid fibers in the Chinese market exceeding the international average by over 30%, relying on a long-term technology monopoly to obtain excess profits. If the investigation involves price monopoly or market blockage, DuPont's business in China may face risks such as order transfers and capacity constraints.

It is worth noting that DuPont's recent split is related to its...Independent listing of electronic businessThe plan has formed a strategic response. In January 2025, DuPont announced the acceleration of the spin-off process for its electronics business, planning to establish a new company named Qnity Electronics Inc. by November 2025. At the same time, the company canceled the previously scheduled spin-off of its water treatment business, believing that retaining the water treatment business would be more beneficial for creating shareholder value.

This series of actions indicates that DuPont is implementing a clear "focus on core + release value" combination strategy: on one hand, it is achieving value release by spinning off high-growth businesses (electronics) and highly mature businesses (aramid); on the other hand, it is building a more balanced and synergistic business portfolio by retaining and strengthening water treatment and other businesses.

NomexAnd KevlarThe technological hegemony of legendary materials is being challenged.

DuPont's decision to divest the Nomex and Kevlar brands is by no means about ordinary industrial products; rather, they are aramid fibers known as "industrial gold." Their birth and application history have nearly rewritten the safety and protection standards in multiple industries.

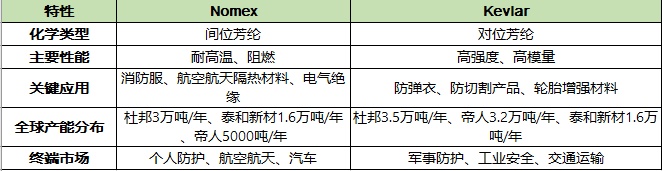

NomexNomex is a heat-resistant and flame-retardant meta-aramid fiber developed and commercialized by DuPont in 1967. The uniqueness of this material lies in its outstanding thermal protection performance—it does not melt, drip, or support combustion, and it maintains structural integrity even in high-temperature environments. The long-term usage temperature of Nomex can reach up to 200°C, and it can withstand high temperatures of up to 400°C for short periods, making it an ideal choice for high-temperature protective applications.From the perspective of production patterns, global para-aramid production capacity is mainly concentrated in DuPont.(3ten thousand tons China Taihe New Materials (1.6)ten thousand tons Japan Teijin (5000) And Super Messi (5000) In the hands of enterprises, DuPont occupies a dominant position in technology and the market.

Figure Nomex®Flame-retardant fibers used for personal protective equipment (Source: DuPont official website)

Nomex'sApplication fieldsExtremely broad, mainly including the following aspects: inPersonal protective equipmentIn terms of this aspect, Nomex is the core material for products such as firefighting suits, rescue suits, and high-temperature work clothes. The vast majority of professional firefighters' protective clothing worldwide is made from Nomex. These garments, thanks to the outstanding performance of Nomex, can provide firefighters with multiple protections against heat, fire, and electrical arcs.Aerospace fieldNomex is widely used in flame-retardant fabrics for aircraft seats, thermal insulation materials in the cabin, and thermal insulation layers around the engine. Its lightweight characteristics help reduce the weight of the aircraft, thereby saving fuel.Automobile IndustryIn high-end models, Nomex is often used as an engine compartment insulation material, battery pack protection material, and in fire-resistant racing suits for drivers. Additionally, Nomex is also applied in electrical insulation materials, high-temperature filtration materials, and other industrial fields, forming a diversified application ecosystem.

KevlarIt is the para-aramid fiber developed by DuPont in 1965, which belongs to the aramid family like Nomex, but has a different molecular structure and performance characteristics. The most prominent feature of Kevlar is itsExtremely high strength-to-weight ratioIts strength is 5-6 times that of high-quality steel, while its weight is only about one-fifth that of steel. This super strong mechanical performance, combined with excellent heat resistance and cut resistance, makes Kevlar a revolutionary material in the field of protection.The global production of aramid fibers also shows an oligopoly pattern, with major manufacturers including DuPont.(3.5ten thousand tons Japan Teijin (3.2ten thousand tons China Taihe New Materials (1.6ten thousand tons Korea Kelong (7000) And Sinochem International (8000) 。

Image Kevlar®Fiber (Source: DuPont official website)

KevlarApplication scenarioEqually rich and diverse, it has almost redefined the protective standards of multiple industries.Individual protectionIn terms of applications, Kevlar is the core material for products such as bulletproof vests, bulletproof helmets, and armored vehicles. The bulletproof equipment of most law enforcement agencies and military forces around the world relies on Kevlar. It is estimated that the application of Kevlar materials has saved the lives of thousands of police officers and soldiers.

Industrial protectionIn the field, Kevlar is used to manufacture cut-resistant gloves, high-temperature industrial hoses, protective mining equipment, and other products, significantly improving the safety of industrial operations.TransportationIn the industry, Kevlar is applied to automotive tire cords, brake pad reinforcement materials, marine ropes, and other products, utilizing its high strength to enhance product performance and service life. Additionally, Kevlar is widely used in sports equipment (such as racing boats, bows and arrows, golf clubs, etc.), building reinforcement materials, and optical cable reinforcement cores in emerging fields.

Source: Huajing Industry Research Institute

Table: NomexWith Kevlar Technical Characteristics and Application Fields Comparison (Source: Special Plastics Vision)

It is worth noting that although Nomex and Kevlar have been divested, their technical value and market position should not be underestimated. For potential acquirers, these two brands represent stable cash flow and mature customer relationships. For DuPont, divesting these mature businesses allows management to focus more on high-growth areas such as electronic materials, semiconductor technology, and water treatment, optimizing resource allocation and enhancing shareholder value.

Editor: Lily

Material sources: NTMT textile new materials, polymer recycling applications, chemical new materials, and other public reports.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories