Abbott and Johnson & Johnson: Global Medical Device Giants' Robust Performance and Strategies Amid Tariff Pressures

In April 2025, two of the world's leading medical device giants, Johnson & Johnson and Abbott, announced their financial reports for the first quarter. Although both companies revealed the impact of tariffs on their finances in the reports, they still maintained growth and demonstrated different coping strategies. The performance of these companies not only reflects the complexity of the global medical device industry but also shows the adaptability of multinational companies in the face of external pressures such as the China-U.S. trade war.

Johnson & Johnson: Steady Growth

Tariff pressure resulted in a loss of 400 million dollars.

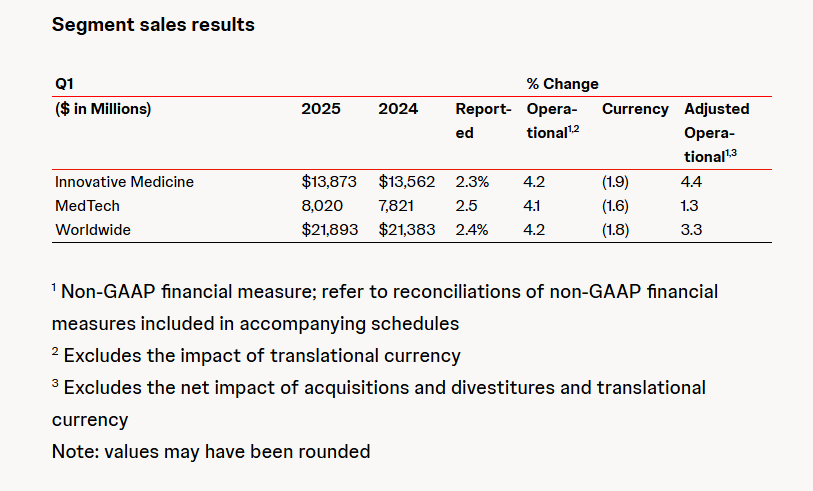

Johnson & Johnson's Q1 2025 earnings report shows the company's total revenue reached $21.9 billion, a year-over-year increase of 2.4%. The performance of the medical technology division was particularly impressive, with revenue reaching $8.02 billion, a year-over-year increase of 2.5%. Among this, the cardiovascular business stood out, with sales reaching $2.1 billion, a year-over-year increase of 16.5%. However, despite the strong performance, Johnson & Johnson still faces significant tariff challenges and is expected to suffer a financial loss of $400 million in 2025 as a result.

Joseph Wolk, Chief Financial Officer of Johnson & Johnson, stated that this loss was mainly due to the high tariffs imposed by the U.S. on Chinese medical device exports and China's retaliatory tariffs on American products. Johnson & Johnson is mitigating this impact through price adjustments and cost pass-throughs, but the adjustment space is limited due to existing medical device contracts. Nevertheless, Johnson & Johnson has maintained its financial outlook for 2025 and plans to reduce future tariff impacts by restructuring its operations and optimizing production bases.

Abbott: Global Layout and Short-term Response Strategies

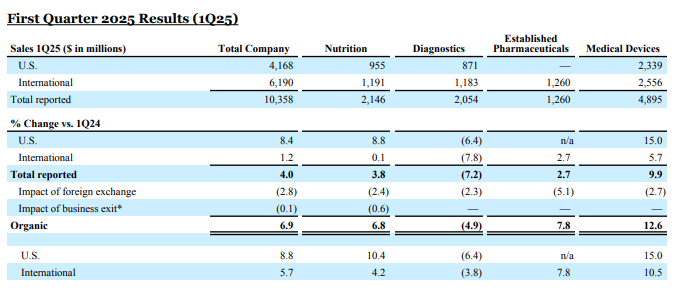

Similar to Johnson & Johnson, Abbott also announced impressive financial results in the first quarter of 2025. The company's overall revenue was $10.36 billion, a year-on-year increase of 4%. Medical device sales were $4.9 billion, a year-on-year increase of 9.9%. Nevertheless, Abbott's CEO, Robert Ford, clearly stated in the earnings call that he expects tariffs to have a "hundreds of millions of dollars" negative impact on the company, mainly in the U.S. and Chinese markets. Ford further pointed out that Abbott's estimated tariff costs are about $300 million, close to Johnson & Johnson's estimated $400 million.

Unlike Johnson & Johnson, Abbott has adopted a more proactive regional production layout and short-term relief plans. The company announced it will invest $500 million in Illinois and Texas to expand its manufacturing and R&D base for blood and plasma screening equipment. This investment not only helps Abbott diversify risks and mitigate the impact of tariffs on production, but also demonstrates the company's balanced approach between globalization and localization.

Tariff Impact: Global Medical Devices

Challenges and Opportunities in the Industry

As Sino-US trade friction intensifies, the global medical device industry is facing unprecedented challenges. The tariffs imposed by the United States on Chinese medical devices, particularly in high-end equipment such as CT and MRI imaging devices, have led to a significant increase in procurement costs. Additionally, tariffs on key components such as CT tubes and superconducting magnets have put considerable pressure on companies with high import reliance.

For Chinese medical device companies that rely on the US market, tariffs have exacerbated their market challenges. Meanwhile, domestic medical device companies see an opportunity to catch up. Companies like Mindray and United Imaging have increased their R&D investments, driving technological innovation, and have gradually replaced some of the high-end equipment market share. For international giants, maintaining competitiveness, reducing costs, will be the core tasks in the coming years amid this global trade war.

Coping Strategy: Dual Layout of Globalization and Localization

Facing tariff pressure, Johnson & Johnson and Abbott have adopted different but complementary strategies. Johnson & Johnson focuses on mitigating the rise in costs through price adjustments, optimizing production bases, and business restructuring, maintaining competitiveness in the global market. Abbott, on the other hand, has strengthened the global supply chain's risk resistance through a distributed production network and regional layout. The company has not only increased investment in the United States but also actively promoted the expansion of global production bases to cope with long-term tariff policy changes.

Moreover, both Johnson & Johnson and Abbott are actively cooperating with industry organizations to seek tariff exemptions, but they remain cautious about the likelihood of success. Both companies have stated that once tariffs are implemented, they are difficult to retract. This historical experience has prompted them to place greater emphasis on adjusting their long-term strategies.

Conclusion: Globalization Challenges and Opportunities for Multinational Enterprises

Overall, Johnson & Johnson and Abbott achieved steady growth in their Q1 financial reports despite the impact of tariffs. Through different coping strategies, the two giants demonstrated how they adjusted their strategies in the complex environment of globalization and localization to mitigate the negative effects of tariffs.

Although tariff pressure poses challenges for global medical device companies in the short term, it also creates new opportunities for localized production, technological innovation, and supply chain optimization. As the China-US trade friction continues to develop, multinational companies will have to constantly adjust their strategies to maintain a competitive edge in the global market. For domestic companies, this is a good opportunity to accelerate innovation and promote domestic alternatives.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories