7.2 Billion Yuan! China eVTOL Order Sets New Record—Where Are the Opportunities for Carbon Materials?

Recently, China's eVTOL industry reached a historic milestone. Shanghai Time Technology signed a purchase agreement with UAE-based company Autocraft, in which Autocraft will purchase 350 E20 electric vertical take-off and landing aircraft (eVTOL) with a total order value of up to $1 billion (approximately 7.2 billion RMB). This marks the largest overseas order received by a Chinese eVTOL company to date. More importantly, this transaction not only reaffirms the global market enthusiasm for the eVTOL industry but also opens up new possibilities for key material technologies involved, such as batteries and carbon fiber.

01

Igniting the "Low-Altitude Economy" Track

The collaboration aims to promote the implementation of low-altitude applications such as urban air mobility and tourism flights of the E20 eVTOL in the Middle East and North African markets. According to disclosures from the time regarding technology, the first batch of deliveries will need to wait for the E20 to obtain the airworthiness certificate from the Civil Aviation Administration of China. This means that the order is not merely a "paper commitment," but is highly dependent on the aircraft's performance, technical standards, and the engineering maturity of the complete system. Consequently, it will also place extremely high demands on core components, including power batteries, structural materials, and electromechanical systems.

eVTOL differs from traditional helicopters or fixed-wing drones in that it requires high-frequency operation, lightweight design, safety redundancy, and high energy efficiency compatibility. In such systems, battery performance, carbon fiber structural components, and matching conductive materials become the key factors that truly determine cost, flight range, and safety performance. This E20 large order will not only accelerate the pace of Chinese eVTOL companies going global but is also expected to create a demonstration effect, driving a new round of technological deployment in upstream material sectors.

02

Battery Technology Enters the "Semi-Solid State" Era

As the exclusive battery supplier for the E20, Funeng Technology has once again become the focus of the industry. According to the company's announcement, the second-generation semi-solid-state eVTOL battery cells it provides for Time Technology are on the verge of small-scale mass production, with an energy density of up to 320Wh/kg, significantly higher than the current mainstream liquid ternary lithium batteries for passenger vehicles (250~270Wh/kg). Especially in the eVTOL platform, which requires high discharge rates and high power output, Funeng Technology's 10C-level long pulse performance indicators are highly groundbreaking.

More noteworthy is its subsequent product roadmap: in 2026, the "second-generation Plus" battery cell will be launched, with energy density further increased to 350 Wh/kg; meanwhile, the "third-generation" product currently under testing targets the 400 Wh/kg threshold and will preliminarily adopt an all-solid-state system. This series of evolutionary steps not only highlights Farasis Energy’s depth of R&D in eVTOL battery technology, but also reflects the future development trend of the battery industry toward "three highs" integration—high energy density, high safety, and high power output.

In addition, Farasis Energy has become the designated battery supplier for XPeng AeroHT’s eVTOL, providing a high-voltage power system for its next-generation prototype. This strategic cooperation expansion not only further consolidates Farasis Energy’s position as a frontrunner in the low-altitude economy sector, but also creates a synergistic closed loop with multiple eVTOL manufacturers, further enhancing its product validation and mass production capabilities.

Refining to battery materials, eVTOL demands more stringent comprehensive performance requirements for anode materials. Firstly, high energy density requires that the anode material possesses a higher specific capacity per unit mass. Secondly, fast-charging capability demands the anode to have excellent ion diffusion rates and structural stability. Lastly, the requirement to maintain 90% capacity at -20℃ poses challenges to low-temperature conductivity and structural integrity.

Currently, although Funeng Technology has not disclosed the specific type of anode used in its semi-solid-state system, the industry generally believes that it has been testing or evaluating various high-capacity materials, including high-rate graphite, porous carbon, silicon-oxygen composites, among others. Among these, the silicon-oxygen anode, with its high specific capacity (up to 1500~2000mAh/g), is a strong candidate. However, due to its high volume expansion rate and short cycle life, it still requires techniques such as nano-coating and doping modification to improve structural stability.

According to feedback from leading companies in the lithium battery industry, the current mainstream eVTOL battery anode strategy primarily revolves around a composite design approach of "high energy + high power + wide temperature adaptability." It is expected that in the future, material companies will continue to optimize in directions such as porous carbon framework + silicon-oxygen filling + conductive agent network construction. Companies like Funeng Technology, BTR, and Putailai still have significant room for innovation in this field.

03

Carbon Fiber: A Decisive Element in Lightweighting

Compared to traditional aircraft, eVTOLs have a more significant reliance on structural lightweighting. The E20 has a maximum takeoff weight of 1.5 tons and a design range of around 200 kilometers. To maintain a flight time of 40 to 60 minutes, it is extremely sensitive to the balance between the weight of the battery system and the overall weight of the aircraft. Under the premise of meeting strength, stiffness, fatigue resistance, and impact resistance requirements, carbon fiber composites undoubtedly become the optimal solution.

According to currently available information, the E20 utilizes a large number of carbon fiber composite components, with its fuselage, rotor, cabin supports, and landing gear all featuring composite material structures. Titanium alloy connectors are used in some high-stress areas as reinforcement. Industry insiders generally believe that carbon fiber composites account for over 40% of the empty weight in eVTOL airframes, significantly higher than in traditional drones or small civilian aircraft. Leading domestic carbon fiber companies such as Zhongfu Shenying, Guangwei Composites, and Hengshen Co., Ltd. have already begun engaging with clients and preparing for mass supply for eVTOL application scenarios.

It is noteworthy that the requirements for carbon fiber materials in eVTOLs are not only about the strength-to-weight ratio but also about thermal expansion compatibility, laminate design capability, and fracture toughness under multidimensional impacts. The current mainstream solutions include high-strength carbon fiber prepregs of T800/T1000 grade, combined with resin systems such as epoxy and BMI. Some leading companies, like AVIC Composite Corporation, are developing thermoplastic resin-based composite systems to enhance maintenance convenience and recyclability.

Furthermore, as eVTOL enters the stage of high-frequency commercial applications, higher demands are placed on mass production, structural integration, and molding cycles. This will pose a new round of challenges to the automated forming and hot-press/RTM processes of carbon fiber composites, and may also drive an overall advancement of equipment and process chains.

04

New Opportunities in the Carbon Materials Industry Chain

The rapid development of eVTOL not only drives the growth of complete machine and system enterprises but also imposes systematic requirements on upstream functional materials. From the current trends, the core industry chain opportunities are mainly concentrated in three areas:

Firstly, there is the airworthiness certification and engineering breakthrough of carbon fiber composite materials, especially the transition from T700 to T800 and above grades for domestic production, and the integrated enhancement of process equipment. Secondly, the integration and thermal management of battery systems, particularly focusing on the evolution path from semi-solid to solid-state, to form a high-energy high-power compatible architecture. Thirdly, the diversified exploration and scenario adaptation of lithium battery anodes, from high-rate graphite to silicon-oxygen composites, from slurry design to fast-charging lifespan control, which will form a dedicated "aerial battery" industry standard.

Chinese enterprises are demonstrating strong vitality in this new wave. Companies such as Timese Technology, EHang Intelligent, and XPeng AeroHT are accelerating airworthiness certification applications and the fulfillment of overseas orders; Farasis Energy, Envision AESC, and Ganfeng Lithium are continuously optimizing eVTOL energy systems; in the field of carbon fiber, enterprises like Zhongfu Shenying and Guangwei Composites are leading efforts to accelerate research and development for compatibility with flight platforms. The low-altitude economy industrial ecosystem is rapidly taking shape, and innovation in materials will directly determine its future ceiling.

05

eVTOL is not a "trend," but a race of systemic capabilities.

The recent 7.2 billion yuan order for this technology achievement marks a landmark event for eVTOLs entering the global market. However, what truly deserves attention is that the upstream core material systems, represented by carbon materials, battery systems, and anode designs, are being redefined in this aviation revolution. Whoever can provide lighter, stronger, and safer material solutions is likely to gain the upper hand in this multibillion-dollar industry.

The era of carbon materials has never been closer to the dream of "flight" than it is today.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Four Major Chemical New Material Giants Sell Off and Shut Down Again!

-

Covestro faces force majeure!

-

DuPont to Spin Off Nomex and Kevlar Brands for $14.4 Billion: Is Aramid Fiber Still Attractive?

-

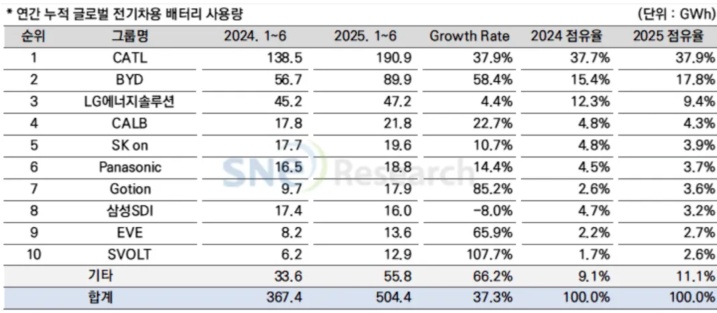

Massive Retreat of Japanese and Korean Battery Manufacturers

-

Napan Unveils Thermoplastic Composite Three-in-One Power System Solution, Battery Cover Weight Reduced by 67%