Argus regenerative polymers: 2025 Global Market Milestones

On December 30, Zhuangsu Shijie observed that the overseas Argus Global reporting team reviewed the significant events that impacted the recycled plastics market over the past 12 months. This has been compiled into Chinese for readers' reference, as follows:

Over the past year, the global recycling industry and the entire petrochemical sector have faced challenges, with profit margins squeezed, demand often sluggish, and geopolitical situations uncertain. Amid the generally pessimistic industry outlook, various issues have dominated headlines at national, regional, and even global levels. Our global reporting team has compiled some significant events that have impacted local markets over the past 12 months.

Weak business environment impacts recycling capacity.

This year, the recycling industry in Europe continues to face pressure, with market participants and representatives calling for regulatory support policies to alleviate challenges such as high energy costs and competition from cheap virgin polymers.

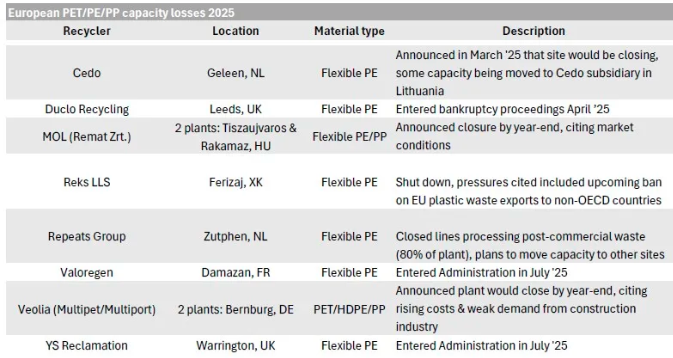

According to Argus statistics, mechanical recycling of PET and polyolefin recyclers will lose about 250,000 tons/year of capacity by 2025, which includes the complete shutdown of nine dedicated PET/PE/PP plants. However, it is expected that some capacity will be reconfigured through the transfer of equipment to other locations rather than being completely lost.

In addition to reducing existing capacity in Europe, the weak business environment has also suppressed investment in new capacity, which is detrimental to the development of recycling infrastructure in the region. Polyolefin producers LyondellBasell and Borealis have suspended plans for new recycling capacity investments. Borealis stated to Argus in June that it would not "invest funds in new capital expenditures" under the current economic conditions; LyondellBasell has suspended its plans for a recycling center in Europe and decided to delay the final investment in a pyrolysis plant in the United States until market conditions improve.

The shutdown of production capacity has affected buyers, although it may not necessarily tighten the overall supply of materials, it forces buyers to find and certify alternative suppliers. The EU Circular Economy Act is scheduled to be implemented in 2026, aiming to increase the supply of high-quality recycled materials and stimulate demand. People will closely watch whether this act can reverse this trend. As the related impacts gradually expand within this decade and the targets of the Packaging and Packaging Plastic Waste Regulation draw nearer, its effects will become more significant.

The single-use plastic products directive provides insufficient support for post-consumer recycled PET (rPET).

Recyclers originally hoped that the recycled material content targets and collection improvement measures set by the Single-Use Plastics Directive (SUPD) would boost rPET demand and improve the quantity and quality of raw materials by 2025. However, the directive has not produced the effects many expected, and the overall situation is more challenging than initially anticipated.

Firstly, in terms of demand, many EU member states were already close to the minimum recycled material content requirement of 25% by 2025 on average, while some companies have exceeded this level through voluntary commitments. Moreover, due to the lack of enforcement of the targets or clear consequences for non-compliant member states, many market participants are calling for the European Commission to make clear decisions.

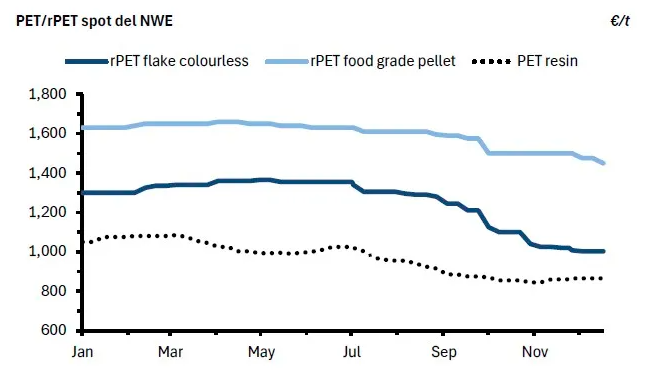

Secondly, the decline in virgin PET (vPET) prices has led to an increase in the premium of rPET relative to vPET, weakening the voluntary use of recycled materials in the bottle industry, especially in other application areas. In May, the price of rPET flakes was 375 euros/ton higher than vPET, and although it narrowed significantly by December, it was still 135 euros/ton higher. The premium for food-grade pellets relative to vPET was up to 700 euros/ton at its highest, and as of the time of writing this article, it remains 585 euros/ton.

At these price levels, even the plastic taxes on virgin plastics imposed by individual countries—such as Spain at €450/ton and the UK slightly over £220/ton—are insufficient to support the use of rPET, leading recyclers to find customers increasingly turning to vPET. Additionally, when recyclers have to lower sales prices to compete with vPET (and imported rPET), the prices for bundled raw materials do not see a similar decrease, resulting in squeezed profit margins for recyclers. This situation is particularly pronounced due to high energy prices and fixed costs compared to other regions.

China enters the pyrolysis industry

The pyrolysis industry of plastic waste in China has rapidly expanded over the past year due to the increasing market attention to sustainable development.

Two large factories have been put into trial operation, and the third one is planned to be completed by the end of 2025. More projects will be announced in the coming years, despite still facing technical challenges.

Supported by Shandong Huicheng Environmental Protection, Dongyue Chemical completed the construction of China's largest 200,000-ton/year pyrolysis unit in Jieyang City, Guangdong Province, in the second quarter. However, the plant has faced difficulties in continuous operation. Currently, the plant has been shut down for upgrades, including hydrogenation and dechlorination systems, and is expected to restart in January 2026. Despite the setbacks, Huicheng Environmental Protection still plans to build a capacity of 5.4 million tons/year nationwide, including 3 million tons/year in Jieyang City, Guangdong Province, 1.8 million tons/year in Yueyang City, Hunan Province (three investment agreements have been signed with the Yueyang City government this week), and 600,000 tons/year in Heze City, Shandong Province.

In addition, the 30,000-ton/year facility jointly developed by Green Harvest Energy and Sinoma in Weifang City, Shandong Province began trial operation in August; its full 60,000-ton/year capacity will be implemented in phases. Green Harvest has also established a joint venture in Jilin Province and plans to build facilities in Fujian Province, Jiangsu Province, and Saudi Arabia.

Overcoming technical challenges such as chlorine removal, impurity control, and feedstock inconsistency caused by PVC contamination will be key to ensuring the long-term success of the industry, as is the case with new pyrolysis plants globally. These issues can undermine product quality, lead to frequent shutdowns, and increase operating costs by raising energy consumption, catalyst usage, and maintenance expenses. However, ambitious expansion plans indicate strong interest in the industry.

UK Packaging Waste Recovery Note (PRN) Prices Fluctuate Again

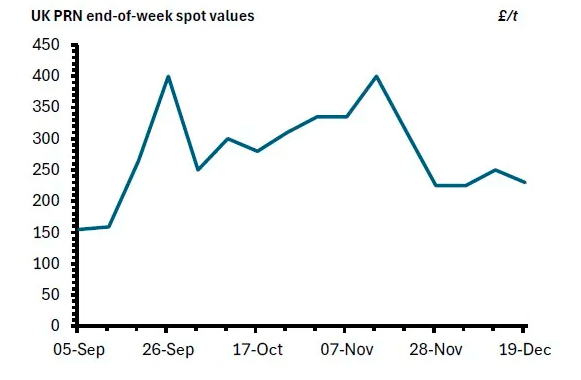

In the second half of 2025, the price of Packaging Recovery Notes (PRN) in the UK experienced significant fluctuations, causing repeated turmoil in the bales material market and creating difficulties for recyclers, particularly their raw material procurement managers.

The value that UK recyclers obtain from plastic packaging waste depends on the value of the material itself and the value of the PRNs that can be generated from it. Fluctuations in PRN prices can lead to a widening price gap between buyers and sellers of bundled raw materials, as both parties have different views on how to handle the sharp price changes. Additionally, with new PRN registration and certification rules set to be implemented next year and concerns about potential delays already emerging, the likelihood of further fluctuations at the beginning of the year remains high.

Price increases this year typically occur after monthly data is released, showing that the year-to-date PRN generation has consistently fallen short of the annual total obligation, resulting in a slight gap. However, high prices seem difficult to sustain, as buyers tend to exit the market once they believe their own shortfall has been addressed.

In addition to creating complex issues for UK recyclers, PRN price fluctuations may also attract the attention of recyclers on the European continent and other regions through exports. For each ton of packaging waste exported, exporters can generate an equivalent Packaging Waste Export Recovery Note (PERN), meaning that rising PRN prices make exports more attractive. This has led to widespread complaints that the PRN, intended to support the UK recycling industry, actually benefits exporters and their overseas customers more.

Southeast Asia strengthens plastic packaging regulations

In 2025, Southeast Asia intensified efforts to curb plastic pollution and improve consumer safety by introducing a series of major regulatory reforms.

Malaysia has taken a tough stance on the import of plastic waste by implementing stricter controls under the revised Customs (Prohibition of Imports) Order, which came into effect on July 1. Currently, Malaysia prohibits the import of plastic waste from non-parties to the Basel Convention, including the United States. Goods from parties to the Basel Convention must meet strict purity standards, undergo pre-shipment inspection, and receive approval from Malaysia's standards body, SIRIM Berhad.

On July 24, Indonesia introduced the SNI 8218:2024 standard for paper and cardboard used in food packaging in other regions, in conjunction with its broader food contact material regulations that have been notified to the World Trade Organization.

Singapore passed the Food Safety and Security Act, granting regulatory authorities the power to ban harmful substances, enforce product recalls, and require packaging producers to fulfill Extended Producer Responsibility (EPR) reporting obligations starting from March 2025.

These measures mark a significant step forward for the region towards stricter packaging standards and greater producer responsibility. By combining import restrictions, material safety requirements, and an EPR framework, Southeast Asian countries aim to reduce waste and accelerate the transition to a circular economy.

U.S. recyclers worry about lack of policy change.

Entering 2025, the recycling industry is advocating for stronger regulations and incentives to boost the demand for post-consumer recycled (PCR) materials. However, despite existing Extended Producer Responsibility (EPR) programs and recycled content regulations in some states continuing to be implemented, recyclers feel that the necessary further regulatory developments to support their industry are yet to materialize. The incoming federal government's lack of focus on sustainability regulations leaves recyclers pessimistic about the potential for unilateral measures to be enacted.

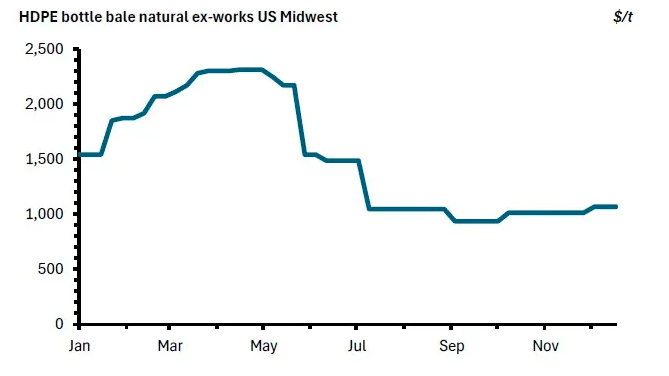

In the first half of this year, the price fluctuations of high-density polyethylene (HDPE) natural materials indicate how vulnerable the market can be without widespread requirements for recycled material content or enforcement measures. The price of HDPE natural baled material was 70 cents per pound at the beginning of the year, peaked at 105 cents per pound, and then fell to 47.50 cents per pound in July. The initial price increase was driven by market tightness, partly due to low collection rates in many states. Subsequently, when prices became too high for downstream buyers, and collection rates seasonally increased in states with better recycling infrastructure, the significant drop in demand and subsequent price crash were evident.

By December, HDPE bale feedstock prices have slightly increased as supply tightens, but overall market sentiment remains cautious. The lack of federal action and uncertainty about future legislation have slowed down investments in recycling infrastructure. Additionally, in the recycling markets for HDPE, polypropylene (PP), and PET, a significant portion of buyers typically use recycled materials to save costs, which puts recyclers in direct competition with low-cost virgin materials. This is evident in the decline of HDPE colored bale feedstock prices, which fell from 10 cents per pound at the beginning of the year to 3.75 cents per pound in December.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories