Asahi Kasei And Teijin Strategically Integrate! Subsidiaries Merge To Form Joint Venture Aiming For Sustainable Growth

On December 2, Specialized Plastics World learned that Asahi Kasei announced yesterday that its wholly-owned subsidiary Asahi Kasei Advance has reached a merger agreement by absorption with Teijin's wholly-owned subsidiary Teijin Frontier. According to the agreement, Teijin Frontier will remain as the surviving company and will officially transform into a joint venture jointly held by Asahi Kasei (holding 20%) and Teijin (holding 80%) on October 1, 2026.

Asahi Kasei Advance, established in 2015, is a trading company primarily dealing with fiber, chemical products, and building materials from the Asahi Kasei Group. Considering the continuous expansion of its business, after evaluation, integrating its operations into Teijin Frontier is seen as a more promising development path compared to the independent development of Asahi Kasei Advance. Teijin Frontier possesses both the trading functions of strong global procurement capabilities and the manufacturing functions of high-performance fiber research and production, providing unique solutions for various fields such as apparel textiles and industrial materials.

The core objective of this integration is to consolidate the business platforms, sales networks, and customer resources of Teijin Frontier and Asahi Kasei Trading, promoting sustainable growth and maximizing corporate value. By leveraging the strengths of both parties, we aim to create a more competitive and stable enterprise entity, laying the foundation for sustainable value creation.

Asahi Kasei (China) Co., Ltd.'s subsidiary engaged in textile production and sales, Hangzhou Asahi Kasei Textile Co., Ltd., will be transferred to Asahi Kasei Trading before the integration.

The consolidation does not have a significant impact on the performance of Asahi Kasei's consolidated financial statements.

Business Portfolio Transformation Strategy

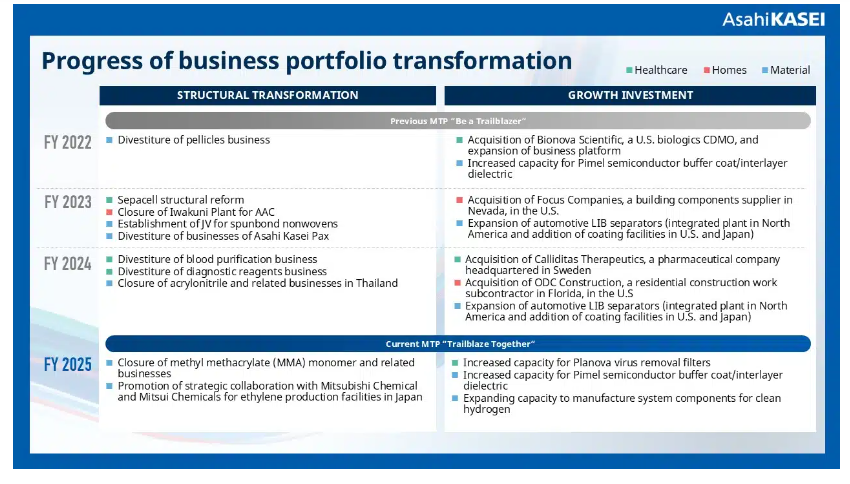

Under the framework of the three-year medium-term management plan "Trailblaze Together," Asahi Kasei is enhancing capital efficiency and accelerating profit growth by converting past growth investments into actual returns. To support this goal, the company is undertaking structural reforms by concentrating resources on four core growth pillars: pharmaceuticals, critical care, overseas housing, and electronics.

Recently, Asahi Kasei has exited the methyl methacrylate (MMA) monomer and related businesses, and expanded the production capacity of the Pimel series of photosensitive polyimides. These measures fully demonstrate the company's rigorous execution of its strategy and further consolidate the foundation for sustainable profitable growth.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories