August New Energy Vehicle Sales Rankings: Geely Nears 150,000 Units to Set New Record, While BYD’s Growth Slows and Annual Target May Be Lowered

In August, the wholesale sales of new energy passenger vehicle manufacturers nationwide reached a new high, achieving 1.3 million units with a year-on-year increase of 24% and a month-on-month increase of 10%. From January to August, the cumulative wholesale volume reached 8.93 million units, representing a year-on-year growth of 34%, with the market overall continuing its growth trend.

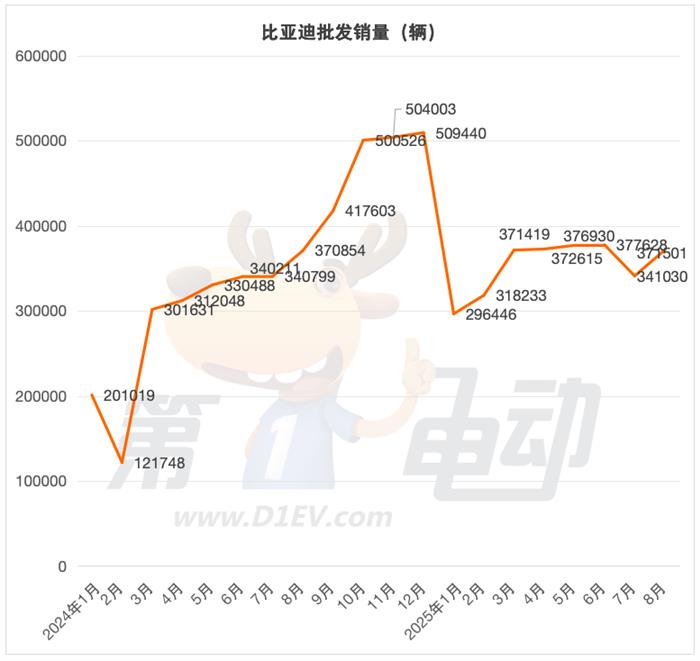

Although BYD maintained its lead with sales of 371,501 units in August, its year-on-year growth was only 0.2%, marking a significant slowdown in growth rate. The cumulative sales from January to August only reached 51.5% of the original annual target. Some media reports suggest that BYD may lower its annual target by 16%.

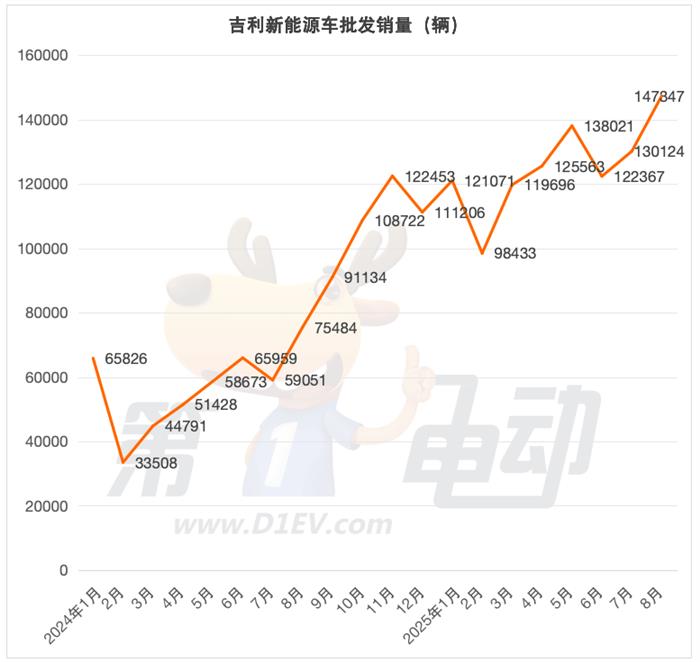

In stark contrast, Geely New Energy sold 147,300 units in August, a year-on-year increase of 95%. The Galaxy brand made a significant contribution, with monthly sales exceeding 110,000 units. Zeekr and Lynk & Co are also steadily advancing in the high-end market, firmly holding the runner-up position on the new energy sales chart.

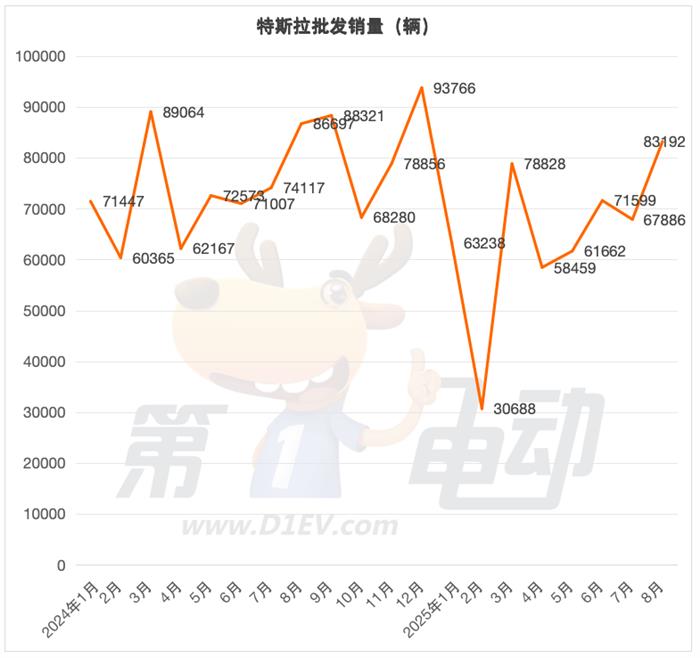

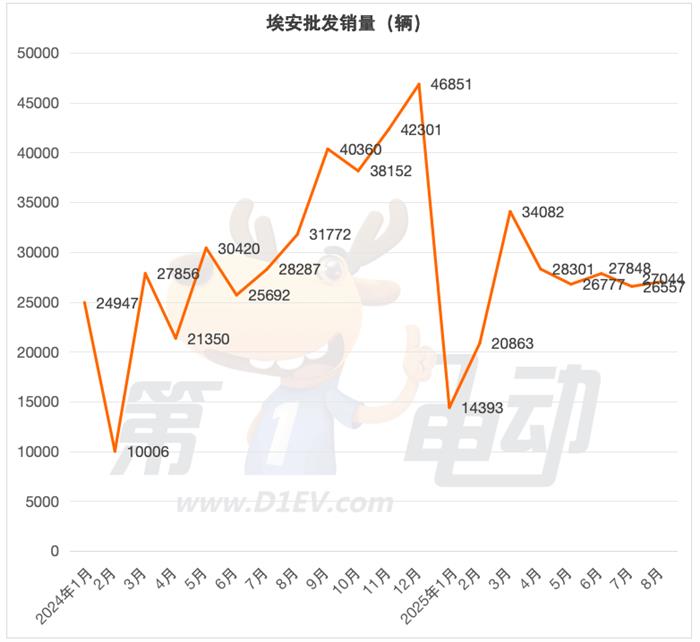

Tesla, Li Auto, and Aion have found themselves in the predicament of year-on-year decline. As leading car companies come under pressure, FAW Bestune and Dongfeng Nissan have emerged as "dark horses" in the market. Overall, competition in the new energy vehicle market intensified in August. The ability of automakers to develop product portfolios, position themselves in the market, and build their brands has become the key to determining whether they can maintain their foothold amid these changes.

▍BYD's growth slows down, Geely reaches a new high again.

BYD's sales in August reached 371,501 units, representing a month-on-month increase of 8.9% but a year-on-year growth of only 0.2%. The growth rate has slowed significantly compared to previous periods, indicating that market momentum is facing a temporary test.

In the overall sales structure, the Seals and Sea Lions models have become the absolute highlights, jointly supporting the "mainstay" of sales growth. Data shows that the monthly sales of both models have exceeded the 50,000 units mark, together contributing over 100,000 units, accounting for more than 26.9% of total sales in August, successfully entering BYD's core sales lineup.

The Dynasty Series, as BYD's "cornerstone lineup," continues to maintain stable output: Qin family sold 625,610 vehicles, Song family 27,132 vehicles, and Yuan family 37,046 vehicles. In the Ocean Network segment, several models also demonstrate stable market performance: Seagull becomes the sales leader of the Ocean Network with 34,204 vehicles sold; Dolphin achieved a monthly sales figure of 21,708 vehicles, maintaining competitiveness in the small pure electric sedan market; Song PLUS, as an important model in the Ocean Network, had sales of only 16,055 vehicles in August, showing a significant decline.

From the full-year sales progress perspective, BYD's cumulative sales of new energy vehicles from January to August reached 2.826 million units, representing a year-on-year increase of 22%. Although it still maintained positive year-on-year growth, the growth rate has clearly slowed compared to the rapid expansion in previous years. What is more noteworthy is that by the end of August, its sales had only achieved 51.5% of the initial 2025 sales target of 5.5 million units, indicating a lag in the target completion progress.

According to today's media reports, BYD has adjusted its annual sales target, reducing the original target by 16%. The adjusted annual sales target is now 4.6 million vehicles. This adjustment reflects the market pressure currently faced by BYD—not only a short-term slowdown in sales growth but also marking the slowest annual growth rate in five years since its rapid rise in the new energy sector.

In August, Geely New Energy sold 147,300 vehicles, up 13.2% month-on-month and a remarkable 95% year-on-year increase, setting a new record and ranking just behind BYD.

From the perspective of the product matrix, Geely Auto’s Galaxy remains the mainstay. After becoming an independent brand, Galaxy has become the sales powerhouse for Geely Auto’s new energy vehicles, with sales reaching 110,700 units in August, a year-on-year surge of 173%. Taking a longer-term view, in the first eight months of this year, cumulative sales of the Galaxy brand have exceeded 750,000 units, laying a solid foundation for Geely’s new energy performance for the whole year.

Behind the outstanding performance is Galaxy's precise strategy of "full price range coverage." In August, the Xinyuan model achieved a monthly sales figure of 48,000 units, with cumulative sales surpassing 350,000 units, securing the top spot in its market segment. Meanwhile, the Galaxy E5 and Starship 7 EM-i models each consistently achieved monthly sales of over 10,000 units, forming the "backbone team" of Galaxy. The newly launched Galaxy A7 made a stunning debut, with over 10,000 pre-orders on the first day and 12,000 deliveries in the first month. The Galaxy M9, which began pre-sales, garnered 40,000 orders within 24 hours with a starting price of 193,800 yuan.

In the high-end market segment, Geely's brands have also delivered solid results. The Zeekr brand delivered 17,600 vehicles in August, a month-on-month increase of 4%. The Zeekr 9X, which debuted at the Chengdu Auto Show with a super-luxury starting price of 479,900 yuan, received over 42,600 orders within one hour, showing strong potential to become a bestseller. The Lynk & Co brand also performed steadily, with August sales reaching 27,200 vehicles, a year-on-year increase of 21%. The newly pre-sold Lynk & Co 10 EM-P garnered over 10,000 orders within 24 hours, further supporting the brand’s move toward high-end development.

▍Tesla, Li Auto, and Aion saw year-on-year declines.

As a former benchmark in the new energy vehicle market, Tesla's sales in August reached 83,192 units, a 22.5% increase month-on-month from July, but a 4.0% decrease year-on-year, highlighting the growth pressure it faces amid competition from domestic automakers.

Recently, the Model Y L officially began its first batch of deliveries. According to a salesperson at a Beijing store, since its launch on August 19, sales of the Model Y L have been booming, with 120,000 units ordered as of that day and an average daily order volume of nearly 10,000 units. If this information is accurate, Tesla's sales in September are expected to reach a new peak.

In August, Li Auto's performance was particularly poor, with sales of 28,529 units ranking low on the list. Additionally, it experienced a year-on-year decrease of 40.7% and a month-on-month decrease of 7.2%, making it one of the car companies with the largest decline on the list.

However, as the sales and service organization enters normal operation, the momentum of the L series will gradually recover. Coupled with the upcoming launch of the Li Auto i6, Li Auto's sales are expected to rebound. The CEO of Li Auto once stated on Weibo that his inner goal is: by the end of this year, Li Auto aims to "secure fifth place and strive for third" in the high-end pure electric segment, with the target for the Li Auto i6 being a stable monthly sales volume of 9,000 to 10,000 units.

Aion's sales in August reached 27,044 vehicles. Although this represents a slight month-on-month increase of 1.8% compared to July, it also shows a year-on-year decline of 23.5%, indicating that the company is facing significant growth bottlenecks. From the company's own perspective, Aion's product lineup is relatively concentrated in the mid-range market, which is one of the most competitive segments in the new energy vehicle industry. Competitors such as BYD, Geely, and Changan have all invested heavily in this segment, resulting in a continuous compression of Aion's market space.

In addition, Aion has shortcomings in brand building and user operations. Compared to emerging car companies like NIO and XPeng, its brand recognition and user stickiness are relatively low, making it difficult to create differentiated advantages in homogeneous competition. Facing the current situation, Aion urgently needs to adjust its product strategy by either breaking into the high-end market to enhance brand premium or launching more innovative models in the mid-range market in order to break the growth deadlock.

▍FAW Bestune and Dongfeng Nissan achieve a doubling surge.

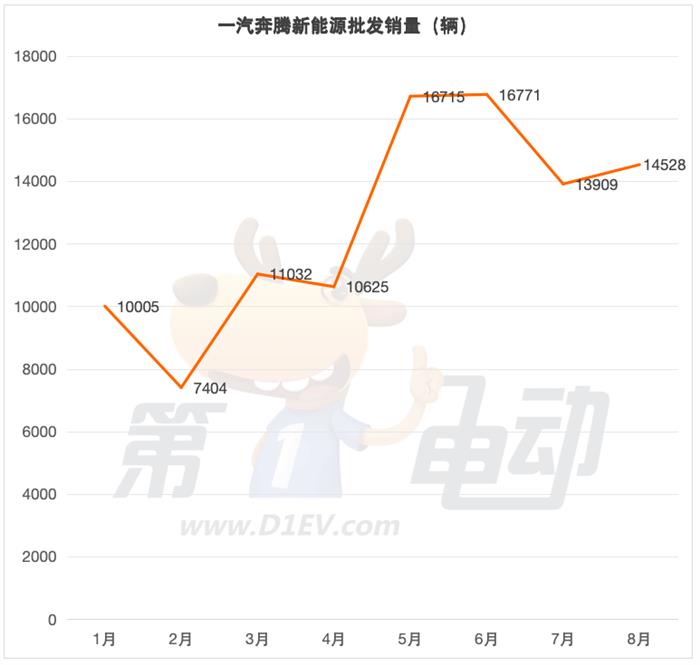

In August, FAW Bestune became the "dark horse" on the list with sales of 14,528 units and a year-on-year growth rate of 812.0%. Such an astonishing growth rate is attributed not only to the previously low sales base but also to its precise market positioning and product strategy. In the process of transitioning to new energy, FAW Bestune has avoided the fiercely competitive mid-to-high-end market and set its sights on the entry-level new energy passenger vehicle sector. It has launched affordable and highly practical models targeting the needs of consumers in third- and fourth-tier cities and lower-tier markets.

At the same time, FAW Bestune has leveraged FAW Group's channel advantages to establish a comprehensive sales and after-sales service network in lower-tier markets, further enhancing the market penetration of its products.

In the increasingly competitive auto market in August, Dongfeng Nissan delivered an impressive sales performance—monthly sales reached 11,031 units, representing a year-on-year increase of 324.8%. Behind this remarkable achievement, the core drivers of growth are the strong brand reputation and comprehensive channel network accumulated over many years in the fuel vehicle sector, which have been successfully extended to the new energy vehicle market.

As the core model of Dongfeng Nissan's new energy lineup, the Nissan N7 reached a milestone in August with monthly deliveries surpassing the 10,000 mark, reaching 10,148 units, a month-on-month increase of 57%. This achievement once again sets a new monthly delivery record for the model. Since its launch in April this year, the Nissan N7 has shown stable market performance without experiencing the "cooling off" phenomenon typical in the initial phase post-launch, and has also achieved a steady reduction in delivery cycles.

More importantly, the strong performance of the Nissan N7 is not an isolated case of "single-product success," but has, by itself, revitalized the entire joint venture new energy sector, providing a reference path for breaking through the long-standing "transformation pains" faced by joint venture brands.

From the current trend, Dongfeng Nissan's new energy vehicle layout has begun to show results. With the dual strengths of "advantage in fuel vehicles + breakthroughs in new energy," Dongfeng Nissan is expected to seize a more central position in the new energy lineup among joint venture brands.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Four Major Chemical New Material Giants Sell Off and Shut Down Again!

-

Covestro faces force majeure!

-

DuPont to Spin Off Nomex and Kevlar Brands for $14.4 Billion: Is Aramid Fiber Still Attractive?

-

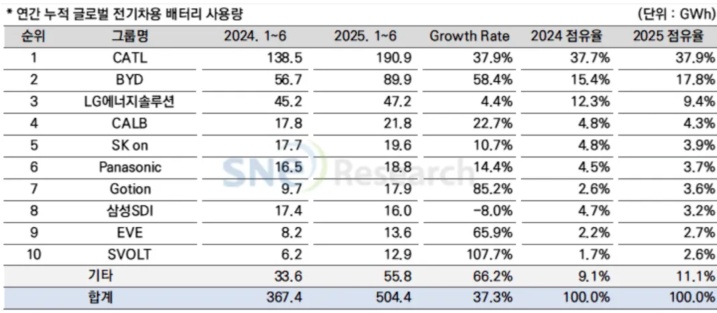

Massive Retreat of Japanese and Korean Battery Manufacturers

-

Napan Unveils Thermoplastic Composite Three-in-One Power System Solution, Battery Cover Weight Reduced by 67%