Auto Part-to-Vehicle Ratio Continues to Rise

When buying a car, you meticulously compare prices and budget carefully, but after using it, you might face a "hidden blow" from repair costs?

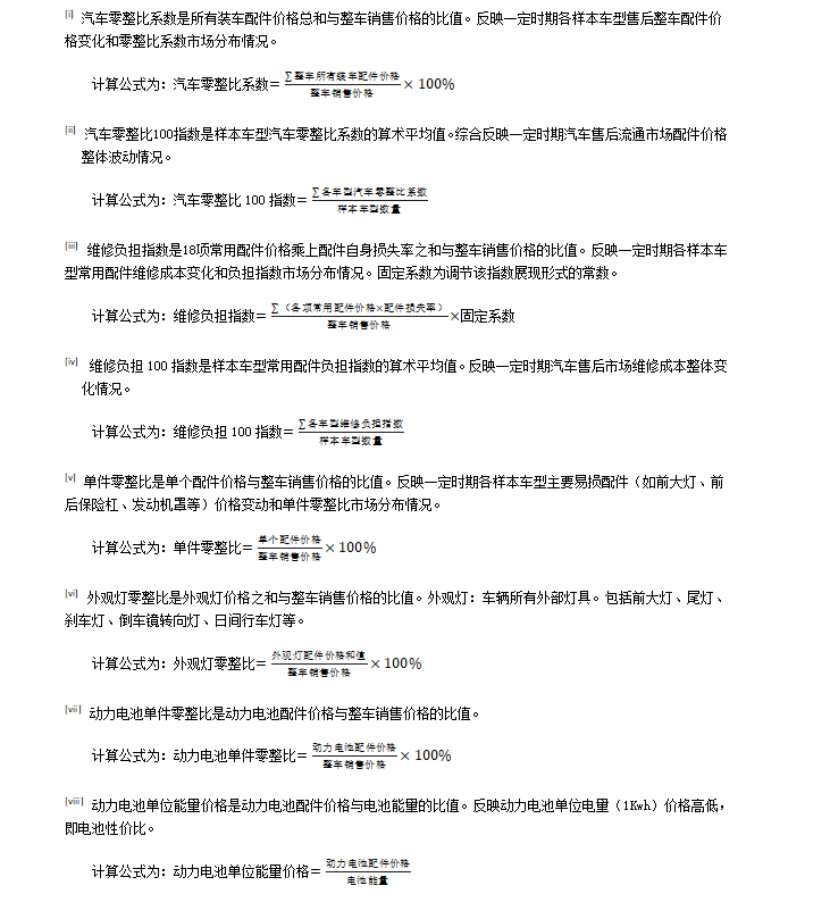

Recent reports on the 19th and 20th phases of the Automobile Property Ratio Index system released by CIRI (with data sampled on December 31, 2024, and June 30, 2025, respectively) have poured cold water on current and prospective car owners: whether for internal combustion engine vehicles or new energy vehicles, the parts-to-whole price ratios and related indices are all on the rise.

This means that the cost of vehicle repairs and parts replacement is climbing, which in turn increases the payout pressure on insurance companies. How much has this core metric—one that directly impacts car owners' wallets—actually risen? What hidden industry norms lie behind these costs? And is the repair cost gap further widening between luxury and mass-market brands, or between new energy vehicles and traditional internal combustion engine cars?

Image source: Pexels (AI digital content)

Fuel car prices are rising moderately, but wear-and-tear parts are becoming "money pits."

Although the increase in the spare parts-to-whole car ratio for gasoline vehicles is not drastic, it precisely hits the high-frequency maintenance needs of car owners, and the "hidden cost" of daily car use is quietly increasing.

According to data from China Insurance Association (CIRA), the 20th "Auto Parts-to-Whole Vehicle Ratio 100 Index" for gasoline vehicles reached 391.07%, an increase of 2 percentage points from the 19th period, representing a growth of 0.51%. During the same period, the "Repair Burden 100 Index" rose to 20.86, an increase of 0.1 percentage points from the 19th period, representing a growth of 0.47%.

It is important to clarify that the "Vehicle Spare Parts to Whole Vehicle Ratio 100 Index," as the arithmetic mean of the spare parts to whole vehicle ratio coefficients of sample models, directly reflects the overall fluctuation of aftermarket parts prices, while the "Maintenance Burden 100 Index" focuses on the change in maintenance costs of 18 commonly used parts, which is more closely related to the daily car usage experience of car owners.

Image source: China Insurance Research Institute

Behind the seemingly gentle increase, new car models have become the core driving force. The 10 new gasoline-powered car models included in this statistic have an average parts-to-whole ratio coefficient as high as 545.11%, and an average repair burden index of 27.74, significantly exceeding the average of 20.09 for the original 90 models, directly pushing up the overall index level.

The increase in the repair burden index, as pointed out by the China Insurance Institute, reflects the rising repair burden and insurance payout pressure for traditional vehicle owners.

This point is also confirmed in owner feedback. One luxury brand gasoline car owner complained in an interview with Gasgoo that new cars are getting cheaper, but the price of repairs and replacement parts hasn't fallen much and remains expensive.

What is more noteworthy is the price change of commonly used vulnerable parts, which is directly related to the daily car expenses of car owners.

According to data from China Insurance Research Institute (CIRI), compared to the 19th phase, among the 18 commonly used and easily damaged parts of fuel vehicle samples in the 20th phase, the average single piece zero-to-whole ratio of 11 parts increased, with the rearview mirror assembly leading the increase at 4.82%. The average price of 12 commonly used and easily damaged parts increased, with the rearview mirror assembly also topping the list with a 7.82% increase.

It is worth noting that side mirrors are among the most vulnerable exterior components of a vehicle, with a high replacement frequency following scrapes or collisions; thus, the price hike further exacerbates the repair costs for car owners.

The single-part-to-whole-car ratio is the ratio of the price of a single spare part to the price of the entire vehicle. It reflects the cost pressure on consumers for repair and replacement of individual parts, as well as on insurance payouts.

Data shows that the overall single-part zero-to-whole ratio of easily damaged parts with high insurance payouts for fuel vehicles in the 20th period has increased compared to the 19th period. Among them, the average single-part zero-to-whole ratio for headlights of 100 fuel vehicles was 3.2%, an increase of 0.02 percentage points from the 19th period. The FAW Audi A6L (FV7201BAQEG) had the highest indicator, at 10.4%.

Additionally, the average single-part spare parts ratio for the front bumper is 1.18%, a decrease of 0.01 percentage points from the 19th period, with GAC Trumpchi GS3 (GAC7151HCW6A) having the highest ratio at 3.09%; the average single-part spare parts ratio for the rear bumper is 1.31%, an increase of 0.02 percentage points from the 19th period, with Audi Q7 (AUDI Q7 45TFSI QUATTRO) having the highest ratio at 4.2%; the average single-part spare parts ratio for the engine hood is 2.47%, an increase of 0.04 percentage points from the 19th period, with Audi Q7 (AUDI Q7 45TFSI QUATTRO) having the highest ratio at 6.11%.

The most exaggerated part is the vehicle's exterior lights, with the average spare parts ratio reaching 10.35%, and the FAW Audi A3L even soaring to 26.17%. This means that simply replacing all exterior lights (including headlights, taillights, brake lights, etc.) would cost more than a quarter of the vehicle's price.

The "unaffordability" attribute of luxury brands is fully reflected in their parts-to-whole ratio data, leading many car owners to quip, "Driving a luxury car means you can't afford to crash it, and you can't afford to fix it."

New energy vehicles show more significant growth, and changes in power battery costs are attracting attention.

Compared to gasoline cars, the spare parts-to-whole car ratio for new energy vehicles has seen a more significant increase, but the changing cost of core components brings a glimmer of relief.

Image source: Visual China

The 20th phase of the "New Energy Vehicle Parts-to-Whole Ratio 100 Index" stands at 312.24%, an increase of 3.3 percentage points compared to the 19th phase, representing a rise of 1.07%. The "Maintenance Burden 100 Index" has risen to 27.66, an increase of 0.55 compared to the 19th phase, representing a rise of 2.03%. Behind these figures are multiple factors at play, including the immature after-sales maintenance system for new energy vehicles and the weak bargaining power for core components.

The addition of new models is also a major driver. The average zero-to-complete vehicle ratio index of the 22 new energy vehicles added in 2022 is 315.68%, and the average maintenance burden index is 28.79. The maintenance burden index of the original 78 models also increased by 0.07 compared with the previous period. This means that not only are the maintenance costs of newly launched new energy vehicles relatively high, but the maintenance burden of older models is also increasing year by year, bringing continuous economic pressure to car owners.

The price increase of vulnerable parts has spread across the board. Compared with the 19th issue, 16 of the 18 commonly used vulnerable parts of new energy vehicle models in the 20th issue saw an increase in the average single-part-to-whole ratio, with the outer taillight leading the way with an 11.59% increase; the average price of 11 commonly used vulnerable parts increased, with the front bumper leading the way with a 7.22% increase.

The single-part-to-whole ratio of high-payout and easily damaged parts has generally increased, and models with high single-part indicators are relatively concentrated. Among them, the average single-part-to-whole ratio for front headlights of 100 new energy vehicles was 2.43%, an increase of 0.17 percentage points compared to the 19th period. The FAW Audi Q4 e-tron (FV6469AABEV) had the highest indicator at 7.82%.

In addition, the average single-piece spare parts ratio for front bumpers was 1.09%, an increase of 0.11 percentage points from the 19th period, with FAW Bestune Pony (CA7000BEVB) having the highest ratio at 3.76%. The average single-piece spare parts ratio for rear bumpers was 1.19%, an increase of 0.09 percentage points from the 19th period, with FAW Audi Q4 e-tron (FV6469AABEV) having the highest ratio at 4.83%.

In addition, the average zero-to-whole ratio for individual luggage compartment covers was 2.32%, an increase of 0.13 percentage points compared to the 19th period, with FAW Bestune Xiaoma (CA7000BEVB) having the highest indicator at 7.05%; the average zero-to-whole ratio for vehicle exterior lights was 9.02%, an increase of 0.69 percentage points compared to the 19th period, with FAW Audi Q4 e-tron (FV6469AABEV) having the highest indicator at 22.78%.

Some argue that "since new energy vehicles now come with a lifetime warranty, you can just get them repaired at 4S dealerships for free," but the reality is quite different. Many owners have reported that the conditions for lifetime warranties are so stringent that 99% of people find them impossible to meet. Furthermore, most brands only offer lifetime coverage for the "three-electric" system (battery, motor, and electronic control), while wear-and-tear parts, exterior components, and other items are not included. Consequently, owners still have to pay out of pocket for repairs that require it.

Fortunately, amidst the overall upward trend, changes in the cost of power batteries have become a highlight. As the core component of pure electric vehicles, they account for the highest proportion of the total vehicle price and are also a key factor influencing insurance payouts.

Among the 70 pure electric new energy vehicles in the 20th issue of new energy sample models, the average parts-to-whole ratio for power batteries was 49.59%, a decrease of 0.38 percentage points compared to the 19th issue (49.97%). In addition, the average unit energy price of power batteries for the 70 pure electric models in the 20th issue was 1538.83 yuan/kWh, a decrease of 2.23% overall compared to the 19th issue. This indicates that the unit price of power batteries has decreased, offering better value for money.

This change benefits from the rapid advancement and scaled production of power battery technology. In recent years, the prices of lithium battery materials have fallen, and production processes have been continuously optimized, leading to a sustained decrease in the unit cost of power batteries. This not only helps to reduce the overall vehicle manufacturing cost of pure electric vehicles, but also provides a certain cost margin for owners' subsequent maintenance and replacement.

Notably, lithium iron phosphate (LFP) batteries and ternary lithium batteries are showing a diverging trend: the average single-part-to-whole ratio of 33 LFP battery-powered vehicle models is 47.89%, a decrease of 0.34 percentage points from the previous period, while the average single-part-to-whole ratio of 31 ternary lithium battery-powered vehicle models is 54.25%, an increase of 0.87 percentage points from the previous period.

This difference is related to the energy density, lifespan, production cost, and other characteristics of the two types of batteries, and it also serves as a reminder to consumers when choosing a car: if you value subsequent maintenance costs, lithium iron phosphate vehicles may be more cost-effective.

However, looking at the present, it is undeniable that since the second half of 2025, lithium carbonate prices have been continuously rising, reportedly increasing nearly twofold from the low of 58,000 yuan/ton in June 2025, with a rise of nearly 40% since the beginning of 2026 alone.

The price increase wave has spread to the power battery sector, with battery and material companies such as Dega Energy and Hunan Yunneng officially announcing price adjustments. Battery product prices and processing fees have seen varying degrees of increase. This cost pressure may gradually permeate the after-sales sector, and the prices of core after-sales projects such as power battery repair and replacement may rise accordingly. Coupled with the tight supply-demand balance of lithium carbonate in the market, the cost increase pressure on the after-sales end of new energy vehicles may continue to intensify.

Behind the rise in the zero-to-whole ratio, the game and balance of multiple interests.

The continuous increase in the parts-to-whole ratio of automobiles is not due to a single factor, but rather the result of a multi-party interest game involving car manufacturers, parts suppliers, and the insurance industry.

From the perspective of car manufacturers, some brands maintain profit margins on whole car sales by increasing the prices of after-sales parts to offset the sales discounts offered upfront. Luxury brands, in particular, often view the after-sales market as a significant source of profit growth, ensuring high returns on after-sales business by controlling parts supply and setting high pricing standards. Ultimately, car owners pay the price for this "front-end concessions, back-end recoupment" model.

Some car owners have bluntly told Gasgoo, "Automakers might be doing it on purpose. If new cars don't sell, they lower the price to trap you and then make money by raising the prices of repair parts."

The monopolistic position of component suppliers has also exacerbated the rise in spare part prices. Certain core components are exclusively supplied by a handful of providers, and the lack of sufficient market competition grants these suppliers significant pricing power. Meanwhile, the high technical barriers to entry for core components of new energy vehicles make it difficult for new players to enter the market quickly, which also prevents component prices from decreasing in the short term.

Industry insiders have reported to Gasgoo that the phenomenon of exorbitant profits from parts monopolies urgently needs to end. Some genuine parts are priced two to three times higher than aftermarket alternatives, yet there is a lack of effective price regulation.

Image source:

The pressure of insurance payouts is also continuously trickling down. The rising parts-to-whole price ratio directly leads to increased claim amounts. To maintain profitability, insurance companies are forced to raise premium rates, creating a vicious cycle of "rising price ratio → increased payouts → higher premiums." For car owners, this results in the dual pressure of expensive repairs and rising insurance costs, leading to a significant surge in the overall cost of vehicle ownership.

Additionally, information opacity in the automotive aftermarket is a significant contributing factor. Consumers are often at an information disadvantage during repairs, making it difficult for them to understand the true cost and reasonable pricing of spare parts, which provides repair facilities with opportunities to inflate prices. The "parts-to-whole" risk ratio data released by CIRI (China Insurance Research Institute) is specifically designed to break this information asymmetry, allowing consumers to clearly understand the differences in maintenance costs across various vehicle models.

This report by CIRI has torn open the "price veil" of the automotive aftermarket. The continuous rise in the parts-to-whole ratio is essentially a game between the burden of car owners' repair costs, the pressure on insurance payouts, and the cost structure of the industry.

For consumers, the "sticker price" should not be the only factor to consider when buying a car; the property-to-parts ratio (PPR) must become an essential reference, as the frustration of "being able to afford the car but not the repairs" is a bitter pill to swallow. When selecting a vehicle, in addition to focusing on performance and features, one should proactively check the model's PPR coefficient and the prices of common wear-and-tear parts, prioritizing models with relatively lower maintenance costs. This is especially true for new energy vehicles (NEVs); although the cost of power batteries is declining, the rising trend in overall repair costs still warrants caution.

For automotive companies, optimizing the pricing system for aftermarket parts and improving supply chain efficiency is not only a responsibility to protect consumer rights but also crucial for enhancing market competitiveness. As competition in the automotive market intensifies, the after-sales service experience has become a significant factor influencing consumers' car purchasing decisions. Only by reasonably controlling parts prices and increasing the transparency of repair services can long-term consumer trust be earned.

The insurance industry, on the other hand, needs to optimize vehicle insurance rate determination models and improve underwriting policies based on the latest parts-to-whole ratio data. Differentiated car insurance rates can be formulated according to the parts-to-whole ratio level and maintenance cost differences of different models, achieving accurate matching of risk and premiums and avoiding the unreasonable premium pressure on car owners caused by a "one-size-fits-all" pricing model.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories