Baoli plastics acquired! why engineering plastics have become a sweet spot for giants?

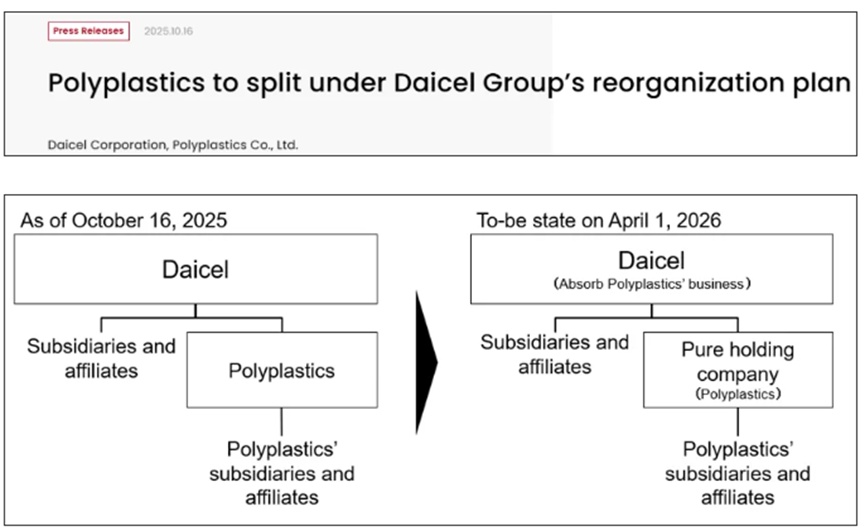

Daicel Corporation announced that it will acquire all operations of Polyplastics Co., Ltd. through an absorption-type merger effective April 1, 2026. This marks the official end of the Celanese joint venture relationship that began in 1964, with Polyplastics becoming fully integrated into the Daicel Group.

Source: Polyplastics

Engineering plastics, as the backbone of high-end material industries, are becoming a key arena in global manufacturing competition. With the rapid development of high-end industries such as 5G communications, new energy vehicles, and aerospace, the market size for engineering plastics continues to expand. According to the "2024-2029 Analysis of Current Development Status and Investment Trend Forecast of China's Engineering Plastics Industry" report by the China Research Institute, the global engineering plastics market size is projected to be $142.99 billion in 2024, with an expected compound annual growth rate of 5.5% by 2029.

1. The History of Equity Changes for Daicel, Polyplastics, and Celanese

The relationship changes of the three companies can be traced back to the last century.

Daicel was founded in 1919 through the merger of eight celluloid companies, with core businesses in cellulose derivatives, organic chemicals, plastics, and pyrotechnic devices.

In 1964, Daicel and Celanese Corporation established Polyplastics Co., Ltd. as a joint venture, with the initial intention of Celanese leveraging Daicel's local resources to develop the Asian market. The joint venture adopted a 55:45 equity structure, with Daicel holding 55% and Celanese holding 45%. This equity structure has been maintained for over half a century. The joint venture, named Polyplastics Co., Ltd., is headquartered in Japan and is a leading supplier, manufacturer, and seller of engineering materials, including acetal copolymer (POM), liquid crystal polymer (LCP), and polyphenylene sulfide (PPS) polymers.

In 2020, Daicel acquired Celanese's 45% stake for $1.575 billion, and upon completion of the transaction, Daicel owned 100% of Polyplastics.

The latest news indicates that Daicel has decided to complete the final integration of Polyplastics through an absorption-type merger starting from April 1, 2026.

2. The Engineering Plastics Landscape of Polyplastics and Celanese

01 Polyplastics' Product Matrix

Polyplastics, as a leading company in the field of engineering plastics, has developed a rich product line. Many of its core technologies originated from Celanese, but it has gradually developed independent innovation capabilities.

LAPEROS® LCPBased on Celanese's Vectra® technology, Polyplastics has conducted in-depth development to meet the demands of the Asian market, particularly forming a unique competitive edge in low dielectric loss, high-frequency performance, and thin-wall molding technology in the fields of 5G communications and miniaturized electronic components. The current total LCP production capacity in Japan and Taiwan is about 20,000 tons, with plans to increase it to 25,000 tons per year.

Duracon® POMBased on Celanese's POM technology, high fluidity and low VOC copolymer formaldehyde products have been developed through process optimization. Currently, Polyplastics has four polyoxymethylene polymerization plants with a total annual supply capacity of 338,000 tons. The first phase of the 90,000-ton plant in Nantong, China, was put into operation in 2024, and the second phase of 60,000 tons is expected to be put into operation in 2026.

TOPAS® COCOriginating from Celanese, in 2006, Polyplastics and Daicel acquired the COC business from Celanese's subsidiary, Ticona Polymers, and established TOPAS Advanced Polymers GmbH. With a production capacity of approximately 30,000 tons per year, it is the world's largest supplier of cyclic olefin copolymers.

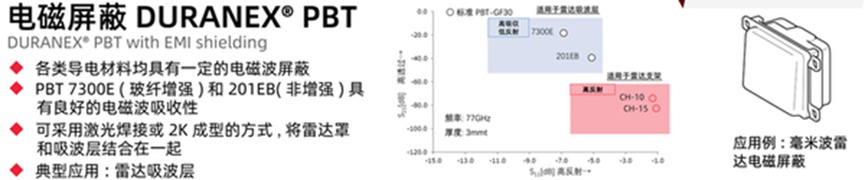

DURANEX® PBTThe same technology originates from Celanese and has been launched as an own brand after localization improvements, featuring excellent heat resistance and electrical properties. For example: the conductive grade DURANEX® PBT 201EB with electromagnetic wave shielding function, specifically designed for automotive millimeter-wave radar applications, helps reduce assembly processes; the 532AR series with superior thermal shock resistance, suitable for sensors and electric vehicle components in harsh environments; and the 330LW grade offering excellent laser welding characteristics, with high laser transmittance and low warpage, providing an efficient solution for the packaging of precision electronic components, among others.

Source of image: Polyplastics

DURAFIDE® PPSBaoli's PPS originates from the linear PPS resin jointly developed with Kureha Corporation, initially branded as FORTRON®, and subsequently established PPS modification plants in Japan and Malaysia. In 2012, it was renamed DURAFIDE® and began global sales. Within China, the factory in Nantong is engaged in the modification and compounding of PPS under the DURAFIDE® brand. In recent years, Baoli has also launched several self-developed products, the most representative being long fiber reinforced thermoplastics (LFT), high-performance resin powders, and polyether ketone (PEK).

02 Celanese's Product Portfolio

Celanese possesses a comprehensive portfolio of engineering plastic products. As a world-leading supplier of engineering plastic raw materials, its Hostaform®/Celcon® POM acetal copolymer, GUR® PE-UHMW ultra-high molecular weight polyethylene, and Vectra® LCP liquid crystal polymers, as well as polyphenylene sulfide, all hold leading positions globally.

Source: Celanese

The range of its products includes:

Hostaform® / Celcon® / Duracon® (Polyoxymethylene POM)

Celanex® / Duranex® (Thermoplastic Polyester PBT)

Vandar® (thermoplastic polyester alloys)

Impet® (Thermoplastic Polyester PET)

Riteflex® (Thermoplastic Polyester Elastomer TPC-ET)

Vectra® (Liquid Crystal Polymer LCP)

Fortron® (Polyphenylene Sulfide PPS)

GUR® (Ultra-High Molecular Weight Polyethylene PE-UHMW)

Celstran® / Compel® (Long Fiber Reinforced Thermoplastics LFRT)

In 2022, Celanese completed the acquisition of the majority of DuPont's Mobility & Materials division for $11 billion. This move significantly altered the competitive landscape of the global engineering plastics industry. Through this transaction, Celanese acquired several important product lines from DuPont, including engineering plastics such as Zytel® and Rynite® nylon (covering PA66, PA6), Crastin® PBT, and specialty nylons; elastomers such as Hytrel® TPC-ET, Vamac® EAE; and other materials like polyester (PET). This acquisition greatly enhanced Celanese's product portfolio and market competitiveness in the high-end engineering plastics sector.

3. The Strategic Value and Market Opportunities of Engineering Plastics

Engineering plastics, as key strategic materials, are receiving significant attention from major global economies. Their core value lies inExcellent overall performanceCompared to general-purpose plastics, it has excellent heat and cold resistance, high mechanical strength, and good corrosion resistance; compared to metal materials, it has advantages such as being lightweight, easy to process, and having high production efficiency.

From a market-driven perspective, engineering plastics are facing numerous opportunities.

1. New Energy Vehicles and Lightweight Trends: The trend of "replacing steel with plastics" in the automotive industry is evident, with engineering plastics increasingly being used in power systems, electrical components, and interior and exterior decorations. Engineering plastics have become an important alternative to metal materials, playing a crucial role in reducing vehicle weight and improving fuel economy.

5G Communication and Electronic Intelligence: The high-frequency aspect of 5G places new demands on antenna materials. Engineering plastics such as LCP have become mainstream materials for 5G antennas due to their low dielectric loss and stable high-frequency performance. It is estimated that by 2023, the global LCP market size will reach 1.45 billion USD.

3. Growth in demand for medical and high-end equipment: There is strong demand for high-performance cycloolefin polymers such as COC/COP in fields like medical pre-filled syringes and diagnostic consumables, with a clear trend of replacing glass materials.

Polyplastics' recent capacity layout reflects these market trends: the LCP polymerization plant in Taiwan will commence operations in February 2025, and the second COC plant in Germany is scheduled to start production in April 2026. These investments indicate that Polyplastics is actively capturing the high-end engineering plastics market.

4. Conclusion: Industry Trends Behind Mergers and Acquisitions

The rise of Chinese companies is changing the global competitive landscape for engineering plastics. Domestic companies such as Kingfa Sci & Tech, Pret, and Waterborne Co., Ltd. have made breakthroughs in special engineering plastics fields like LCP, gradually achieving domestic substitution. In 2024, the Chinese engineering plastics market is expected to be approximately 203.1 billion yuan, and it is projected to exceed 205.04 billion yuan by 2025.

Faced with the rise of the Chinese market and intensified global competition, traditional giants are enhancing overall competitiveness by integrating resources and optimizing configurations. Daicel's comprehensive integration of Polyplastics is precisely a move reflecting the trend of resource concentration towards leading companies in the engineering plastics industry.

In the next decade, the engineering plastics industry will exhibit trends such as high performance, environmental friendliness, and intelligence, and mergers and acquisitions may become the norm in the industry.

Edited by: Lily

Source materials: DT New Materials, Celanese, Liansu Network, DuPont, and other public reports

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

India's Q3 Smartphone Shipments Rise 3%; Japanese Mold Factory Closures Surge; Mercedes-Benz Cuts 4,000 Jobs

-

Ascend's Restructuring Plan Approved! Jwell Launches Global Acceleration Plan; Nexperia Chip Crisis Threatens Global Auto Production

-

Dow To Restart Pe Units 5 And 7 This Week, Recovery Date For Unit 6 Remains Undetermined In The United States (US)

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

The Roller-Coaster Behind Sanhua Intelligent Controls' Stock Price: What Are the Advantages of Automotive Thermal Management Companies Crossing Into Humanoid Robots?