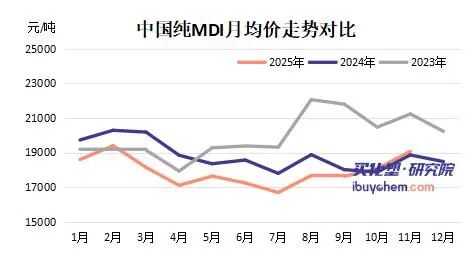

BASF South Asia Increases MDI Price by $200 as Supply Contraction Drives Pure MDI Prices to Soar Over 1,000 Yuan in a Month

On November 20, 2025, BASF announced a price increase of $200 per ton for its MDI series products in the South Asia region. Meanwhile, due to factors such as plant maintenance and import shortages, domestic pure MDI market prices rose in steps, ultimately remaining high and firm.

The current price trend in the pure MDI market is showing a distinct "step-like upward" pattern. Taking Shanghai goods as an example, the price has climbed from 18,400 RMB/ton at the beginning of the month to the current 19,500 RMB/ton, an increase of over 1,000 RMB/ton. The continuous increase in factory guide prices has become an important support. The Shanghai factory's November listing price has increased by 500 RMB/ton month-on-month to 24,000 RMB/ton. The semi-monthly drum cargo guide price has risen from 19,600 RMB/ton to 20,200 RMB/ton, further strengthening traders' willingness to quote at high levels.

The continuous tightening of the supply side is the core driving force behind the current price increase. Wanhua's Ningbo base, with a capacity of 1.5 million tons/year, is undergoing a maintenance shutdown for 55 days starting from November 15; following that, Covestro's 600,000 tons/year facility in Shanghai and BASF's 440,000 tons/year facility in Chongqing are also scheduled to enter maintenance in December, further reinforcing supply contraction expectations. As a result, the operating rate in the MDI industry has significantly decreased after mid-November, and the availability of barrel resources in the spot market remains tight, leading to generally cautious operations among industry players. The import side is also not optimistic, as delays in shipping from Japan and South Korea have led to a temporary scarcity of spot supplies, further exacerbating the shortage situation in the domestic market.

The regional differentiation pattern of the global MDI market is becoming increasingly evident. BASF's price increase in the South Asia region corresponds with the relatively good demand performance in other Asian regions. According to customs data, China's pure MDI export volume in October 2025 increased by 18.86% year-on-year, with a cumulative export volume of 103,400 tons from January to October. It is expected that the pure MDI export volume in 2025 will significantly exceed that of last year. The substantial increase in export volume reflects the ongoing demand for basic chemical materials driven by the industrialization process in emerging markets in Asia, as well as a microcosmic manifestation of the regional restructuring of the global supply chain.

Looking ahead, the high and firm trend in the pure MDI market is expected to continue. In the short term, the maintenance plans of major domestic factories are still underway, and uncertainties remain in the import shipping schedule, making it difficult to quickly alleviate the tight supply situation. The market is likely to maintain its high-level operation. In the medium to long term, the expectation of supply contraction continues to strengthen the market's bullish sentiment, but the demand side, dominated by rigid demand, may limit the scope for price increases. The global MDI market size is expected to expand at a compound annual growth rate of 5.2%, with the Asia-Pacific region contributing the most to this growth. Demand growth in areas such as building energy efficiency and lightweighting of new energy vehicles will provide long-term support for the market.

Overall, in November 2025, the core issue in the domestic pure MDI market is concentrated on the supply side, with plant maintenance and import shortages jointly pushing prices to high levels. Given the high concentration of global MDI production capacity and clear expectations of domestic supply contraction, the market is unlikely to change its strong stance in the short term. However, constraints from the demand side should not be overlooked. The future market trend will mainly depend on the progress of plant maintenance, the recovery of import shipment schedules, and the strength of downstream demand recovery. Industry participants need to closely monitor changes in the supply-demand dynamics.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

[Today's Plastics Market] General Materials Weakly Fluctuate, Engineering Materials Steadily Rise

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Daily Review: Polyethylene Prices Under Weak Consolidation, Sellers Face Significant Pressure to Move Inventory