BOPP: Fourth Quarter Demand Warms Up, Gross Profit Turns From Loss To Profit

Lead:Entering the fourth quarter, the demand for BOPP has improved, with an increase in downstream replenishment driven by essential needs. Meanwhile, the pace of new production capacity in the industry has slowed, and the finished product inventory of film manufacturers has gradually decreased. The supply-demand conflict has eased, leading to a continuous increase in BOPP margins, temporarily reversing the loss situation. It is expected that BOPP profitability will likely maintain the current favorable status in mid to late December.

2025BOPP profitability increased in the year, with a significant rise in the fourth quarter.

2025Increased BOPP gross profit for the year, especially in the fourth quarter, gradually transitioning from a loss to a profit.In 2025, the demand for BOPP gradually recovers, especially in the fourth quarter, with an increase in market trading volume. Meanwhile, the pace of new industry production slows down, with launches being gradually postponed to the second half of the year or even the end of the year. During holidays, manufacturing companies also actively shut down operations to control finished product inventories. This alleviates the supply-demand conflict, giving BOPP a certain resistance to decline, and it does not follow the wide downward trend of raw materials. Consequently, BOPP profitability gradually increases.Thick filmProcessing fees have gradually increased from the original 1000-1200 yuan/ton to 1300-1500 yuan/ton, with some enterprises reaching over 1500 yuan/ton during certain periods.。

As of December 9th, the daily gross profit fluctuation range for thick light films in the fourth quarter was between -65 yuan/ton and 75 yuan/ton. Starting from October, the gross profit has periodically turned from negative to positive, and by mid to late November, the gross profit completely shifted to positive. On a monthly basis, since May, the profitability of BOPP thick light films in 2025 has improved compared to the previous year, with fluctuations around the cost line starting in the fourth quarter, gradually turning from loss to profit.

Overall demand is improving, and the increase in new orders in the fourth quarter is bolstering support for gross profit.

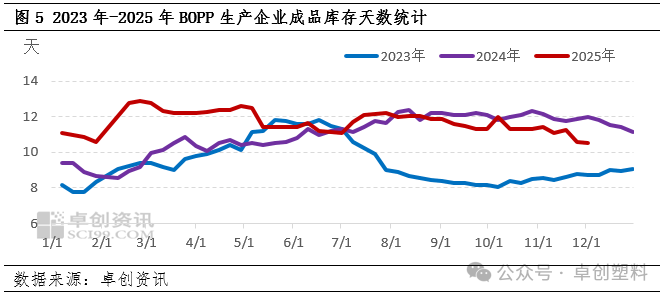

2025The annual order release volume has significantly increased compared to last year, especially in the fourth quarter. The improvement in demand has provided strong support for the increase in gross profit.In the first half of the year, under the macroeconomic boost of "tariffs, anti-involution, and the sharp rise in crude oil prices due to tensions in the Middle East," the stocking volume in the BOPP downstream increased. During the "Golden September and Silver October" peak season, terminal demand improved, and the BOPP market saw active trading. The fourth quarter also diverged from traditional patterns, with BOPP downstream users continuing to enter the market for stocking, and market demand-driven trading increased. From the monthly average order volume and undelivered order days of 20 BOPP sample companies, most periods in 2025 were better than in 2024. In the fourth quarter, the volume of new orders and undelivered order days for manufacturing companies remained at a medium-high level, with undelivered order days around 9-14 days. The improvement in demand supports an increase in BOPP gross profit.

The pace of capacity expansion has slowed, inventories are gradually declining, and the supply-side pressure is not significant for the time being.

As of December 10, the BOPP industry has11 production lines, but many of the new lines have been delayed in their launch, with 9 lines gradually being put on the market in the second half of the year or even in the fourth quarter. Additionally, companies are actively controlling inventory by taking maintenance shutdowns, and with improving demand, the inventory levels at film manufacturers remain manageable and have gradually decreased entering the fourth quarter. Most companies' finished product inventory has dropped to around 5-12 days, although some have relatively low or high inventory levels. The easing of supply-side pressure provides some support for gross margins.

The short-term supply and demand pressure in the industry is not large, and the BOPP profit margins are expected to remain at a considerable level in mid to late December.

In December, the gross profit margin for BOPP is expected to remain positive. On the supply side, two new production lines are anticipated to commence in the middle to late part of the month, and there is a plan to restart an old line. However, the start-up times are relatively later, and the production period is short, so the contribution to market supply in the short term is limited. On the demand side, downstream buyers will continue to place new orders in December to stock up for the Christmas and Spring Festival, resulting in a certain increase in demand. Overall, the gross profit margin for BOPP in December is expected to remain at a considerable level, but attention should be paid to the commissioning of new lines and the release of demand.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Nissan Cuts Production of New Leaf EV in Half Due to Battery Shortage