Chemical Giant Suffers Huge Loss of 6.9 Billion! Over 200 Positions at Risk! Today’s Plastic Prices Fluctuate Narrowly, PET Sees Gains

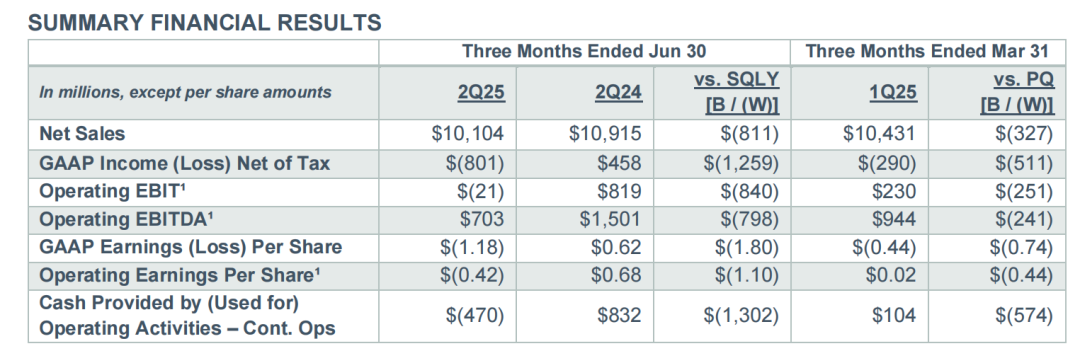

According to the latest news, in the first three quarters of this year, Dow accumulated a loss of $967 million; INEOS's BDO plant faces the risk of closure, with its 200 jobs "under threat"; to make matters worse, the European Carbon Border Adjustment Mechanism (CBAM) is set to officially take effect in early 2026.

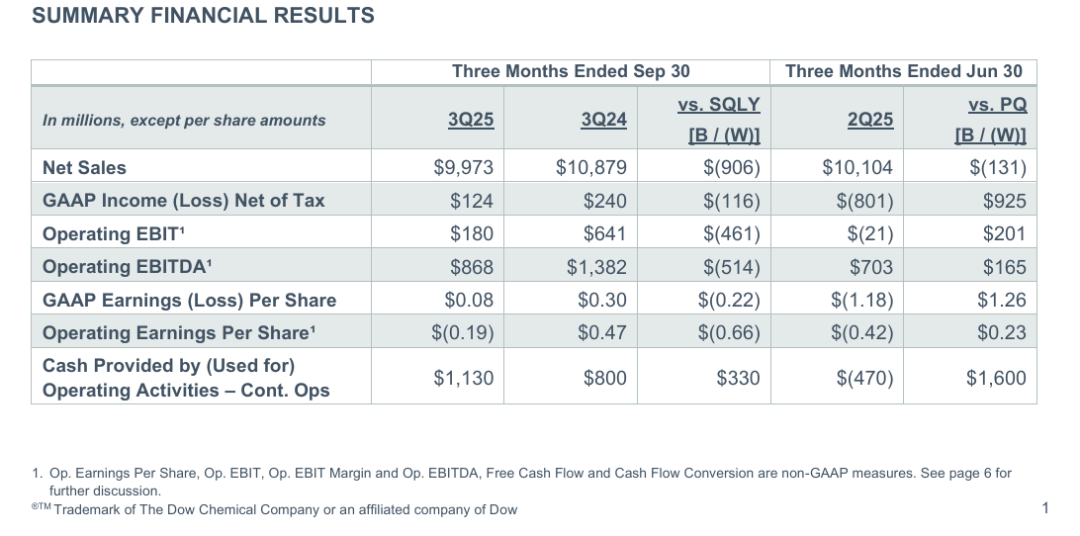

On October 23, Dow announced its latest performance results.

In the third quarter, net sales were approximately $10 billion, a year-on-year decline of 8%, with all operational departments experiencing a downturn. According to Generally Accepted Accounting Principles (GAAP), net profit was $124 million, turning from a loss to a profit; operating EBITDA was approximately $870 million, a year-on-year decrease of 37%. It is worth noting that based on the net profit of the previous three quarters, Dow has accumulated a loss of $967 million this year (unaudited, approximately 6.89 billion yuan).

It is worth mentioning that Dow's newly built polyethylene and alkoxylation assets along the U.S. Gulf Coast have brought strong demand, indicating that Dow has achieved quarter-on-quarter growth in sales and profits in key end markets.

Dow's third quarter financial report

From a business perspective, Dow's main three business divisions include: 1. Packaging and Specialty Plastics (with net sales of approximately $4.9 billion for the period, a year-over-year decrease of 11%); 2. Industrial Intermediates and Infrastructure (with net sales of approximately $2.8 billion for the period, a year-over-year decrease of 4%); 3. Performance Materials and Coatings (with net sales of approximately $2.1 billion for the period, a year-over-year decrease of 6%).

These businesses primarily involve product chains such as ethylene and ethylene downstream products, epoxy resin, polyurethane, acrylic acid and esters, and organosilicon.

Ineos

On the same day (the 23rd), INEOS issued another warning.

Overall, INEOS stated that Europe is enforcing stringent carbon taxes in the name of environmental protection while allowing high-carbon footprint products to undermine local production. This policy contradiction is eroding the strategic industrial foundation of Europe, which includes INEOS's BDO (1,4-Butanediol) assets in Marl, Germany. The BDO plant faces the risk of shutdown, threatening over 200 technical jobs.

According to a notice from INEOS, the European BDO market is mainly occupied by imported products from Xinjiang, China.

Andrew Brown, CEO of INEOS, stated: "We must take urgent action. China and the United States are defending and subsidizing their domestic industries, while Europe is burying its own with high energy costs, carbon taxes, and suffocating bureaucracy. Without swift and strong trade barriers, Europe cannot compete with state-supported imports."

This is not the first time INEOS has issued a warning about the carbon tax. This year, the company was also penalized for reducing carbon dioxide emissions.

Regarding the issue of carbon tariffs, Academician Ding Zhongli's statement in 2010 that "emission rights are development rights" has become increasingly valuable.

Additionally, it is worth mentioning that the European Carbon Border Adjustment Mechanism (CBAM) is set to officially come into effect in early 2026.

Recently, a coalition of 79 industrial companies led by the Austrian steel manufacturer Voestalpine has called on politicians to abandon plans for significant reductions in the free allocation of emission allowances under the European Emission Trading System (ETS). According to the EU's plan, the allocation of free emission allowances will be significantly restricted starting in 2026 and will be completely terminated by 2034. The coalition also includes companies such as BASF, Thyssenkrupp, INEOS, and Lanxess.

Regarding the imposition of carbon tariffs, Evonik CEO Christian Kullmann stated that in Germany alone, emissions trading jeopardizes at least 200,000 high-paying industrial jobs.

Today's plastic prices

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

India's Q3 Smartphone Shipments Rise 3%; Japanese Mold Factory Closures Surge; Mercedes-Benz Cuts 4,000 Jobs

-

Ascend's Restructuring Plan Approved! Jwell Launches Global Acceleration Plan; Nexperia Chip Crisis Threatens Global Auto Production

-

Dow To Restart Pe Units 5 And 7 This Week, Recovery Date For Unit 6 Remains Undetermined In The United States (US)

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

The Roller-Coaster Behind Sanhua Intelligent Controls' Stock Price: What Are the Advantages of Automotive Thermal Management Companies Crossing Into Humanoid Robots?