Chemical Industry Giant Restructures, Integrates Engineering Plastics Segment!

On October 16th, Daicel Corporation (hereinafter referred to as "Daicel") and its wholly-owned subsidiary Polyplastics Co., Ltd. (hereinafter referred to as "Polyplastics") announced a group corporate restructuring plan, with the core content being the comprehensive integration of Polyplastics' engineering plastics division.

I. Basic Information on Enterprises Related to the Restructuring

Daicel Corporation is headquartered in Osaka, Japan, and is an international diversified chemical company with core businesses covering safety and materials sectors. In 2020, it launched its mid-term strategy "Accelerate 2025," clearly identifying "business structure transformation" and "strengthening the engineering plastics business" as core objectives. In the same year, it incorporated Polyplastics into the group, achieving full ownership.

Polyplastics is headquartered in Tokyo, Japan, focusing on the field of engineering plastics. Its business covers industries such as automotive, electronics, and medical, with core operations including engineering plastic technical services and solution provision. Since becoming a wholly-owned subsidiary of Daicel in 2020, Polyplastics has achieved growth in performance while advancing its global production capacity layout.

II. Core Restructuring Plan

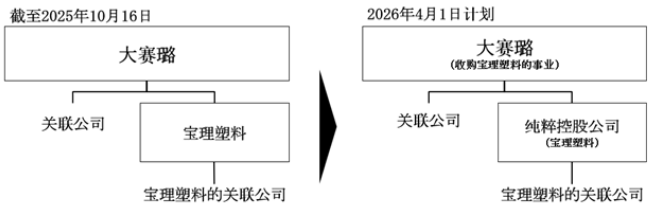

According to the official disclosure, this restructuring will adopt the "acquisition and division" model, with the key timeline set for April 1, 2026. The specific arrangements are as follows:

Business Segmentation: Polyplastics divides its operations into two major sectors: one is the engineering plastics business (including the entire chain of R&D, production, and sales, as well as related supporting businesses), and the other is the holding and management of equity in associated companies.

Business Takeover: Daicel will fully undertake the engineering plastics business of Polyplastics after its split. The technical patents, production bases, customer resources, and sales team of Polyplastics in this field will be integrated into the Daicel system.

After the separation, Polyplastics Co., Ltd. will retain its corporate status; Daicel is currently studying the name change of Polyplastics, including its affiliated companies both domestically and internationally in Japan. The new name and the time of the change will be announced later.

3. Background of the Restructuring and Preliminary Collaborative Achievements

This restructuring is based on Daicel's strategic plan to "Build a New Daicel" and relies on the collaborative development foundation of the two companies since 2020. From 2020 to before the announcement of the restructuring plan, the collaboration between the two parties has achieved the following results:

In November 2024, DP Engineering Plastics (Nantong) Co., Ltd in Jiangsu Province, China, will commence commercial production of POM (polyoxymethylene).

In February 2025, the LCP (Liquid Crystal Polymer) plant of Polyplastics Taiwan Co., Ltd. in Kaohsiung City, Taiwan, China will be put into operation.

The second COC (cyclic olefin copolymer) plant of TOPAS Advanced Polymers GmbH in Saxony-Anhalt, Germany, is scheduled to be commissioned in April 2026.

The aforementioned capacity layout covers the Asian and European markets, establishing a global supply chain system.

IV. Restructuring Objectives

Dai Suilu Dai Suilu clarified that the core goal of the integration of the engineering plastics sector is to maximize the value of the group company, specifically focusing on four aspects:

-

Share Baoli Plastics' expertise in engineering plastics technology services and solutions to improve the group's technology system.

-

Promote the business synergy between the engineering plastics sector and Daicel's safety and materials sectors, and explore cross-business scenario cooperation.

-

Integrate the technical and management talent resources of two enterprises and optimize talent allocation.

-

Centralize corporate function management (including supply chain, finance, human resources, etc.) to reduce operational costs and enhance decision-making and execution efficiency.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

India's Q3 Smartphone Shipments Rise 3%; Japanese Mold Factory Closures Surge; Mercedes-Benz Cuts 4,000 Jobs

-

Ascend's Restructuring Plan Approved! Jwell Launches Global Acceleration Plan; Nexperia Chip Crisis Threatens Global Auto Production

-

Dow To Restart Pe Units 5 And 7 This Week, Recovery Date For Unit 6 Remains Undetermined In The United States (US)

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

The Roller-Coaster Behind Sanhua Intelligent Controls' Stock Price: What Are the Advantages of Automotive Thermal Management Companies Crossing Into Humanoid Robots?