China's Auto Parts Suppliers Reap Overseas Profits

In the wave of the global automotive industry accelerating its transition towards electrification and intelligence, numerous Chinese auto parts suppliers are making strong inroads into overseas markets by leveraging technological breakthroughs and cost advantages. An increasingly clear industry trend is that these companies are not only continuously expanding their overseas business footprint, but also demonstrating strong profitability. Overseas business, which used to be merely a "supplementary revenue," has now become an indispensable profit growth pillar for many enterprises.

Overseas business can be more profitable?

From the first half of 2025, many Chinese automotive parts companies have shown remarkable performance in their overseas business, substantiating the profit potential of international markets with solid financial report data. This is especially true in the field of new energy.Intelligent Connected NetworkIn some sectors, the gross profit margins of certain companies' overseas businesses are even higher than those in the domestic market, demonstrating strong profitability resilience.

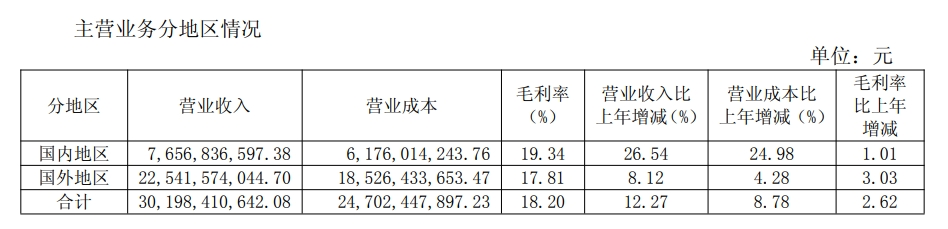

As a significant supplier in the global automotive electronics and automotive safety sectors, Joyson Electronics' steady growth and profitability in its overseas business are highly representative. In the first half of the year, Joyson Electronics achieved an operating income of 30.347 billion yuan, with revenue from foreign markets reaching 22.542 billion yuan, accounting for as much as 74.28%. This data indicates that the overseas market has become the absolute pillar of the company's revenue. In terms of profitability, the gross profit margin in foreign regions for the first half of the year was 17.81%, slightly lower than the domestic region's 19.34%. However, it is noteworthy that the gross profit margin for its overseas business increased by 3.03% year-on-year, which is higher than the 1.01% increase in the domestic region.

Image Source: Screenshot from Joyson Electronics Financial Report

As a leading enterprise in the global automotive glass industry, Fuyao Glass has also demonstrated remarkable profitability in its overseas business. In the semi-annual financial report, Fuyao Glass clearly stated that the company's overseas sales account for about half of its total sales, and the scale is showing a trend of annual growth. The report also shows that the operating profit margin of Fuyao Glass's North American subsidiary in the first half of the year was 15%, which is an increase from last year's annual level of 13%, demonstrating strong growth momentum in profitability.

Baolong Technology's overseas business is characterized by "scale growth and structural optimization in parallel." In the first half of the year, Baolong Technology's overseas revenue accounted for 45.45% of the company's total revenue, which is lower than the 49.39% in 2024. However, this change is not due to a contraction in overseas business but rather the rapid expansion of domestic business. The financial report shows that in the first half of the year, Baolong Technology's domestic intelligent suspension, ADAS (Advanced Driver Assistance Systems), and sensor businesses experienced rapid growth, and the TPMS (Tire Pressure Monitoring System) business also continued to grow. The domestic main business revenue increased by 33.07% year-on-year, which to some extent lowered the proportion of overseas revenue. However, in absolute terms, the company's overseas revenue in the first half of the year still increased by 13.62% compared to the same period last year, maintaining a steady growth trend.

Although the gross profit margin of overseas business is not separately disclosed in its 2025 mid-year report, based on the statement made by Zhang Zuqiu, Chairman and President of Baolong Technology, when answering questions related to the 2024 mid-year report—“the gross profit margin of domestic business is inherently lower than that of overseas business”—and considering the stable growth of overseas revenue in the first half of 2025, it can be inferred that Baolong Technology's overseas business likely still possesses a relatively outstanding profitability advantage, which is an important support for the company's profit side.

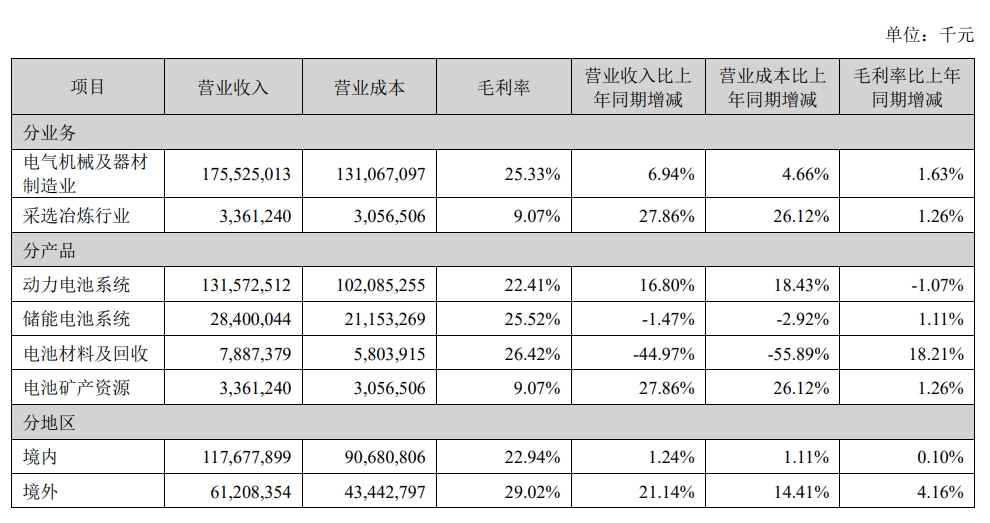

New Energy VehiclesIn the core component sector, CATL's overseas business performance is regarded as a "benchmark." As a leading player in the global power battery industry, CATL's overseas expansion directly reflects the global competitiveness of China's new energy vehicle supply chain. In the first half of the year, CATL achieved overseas revenue of approximately 61.208 billion yuan, an increase of over 20% compared to the same period last year, accounting for 34.2% of the company's total revenue. Although this proportion is not particularly outstanding compared to many other automotive component companies venturing abroad, the gross profit margin for CATL's overseas business reached 29.02% in the first half of the year, an increase of 4.16 percentage points from the same period last year, significantly higher than the domestic business's gross profit margin of 22.94%.

The image source: Screenshot from CATL financial report

Guoxuan High-Tech, as an important player in the power battery sector, has also shown good growth momentum and profit potential in its overseas business. In the first half of the year, Guoxuan High-Tech achieved overseas revenue (including Hong Kong, Macau, and Taiwan) of approximately 6.4 billion yuan, a year-on-year increase of 15.79%, accounting for 33% of the company's total revenue. Regarding gross margin, this segment's gross margin reached 19.02%, higher than that in China. The region has a gross profit margin of 15.14%, indicating a significant profitability advantage.

In addition to the aforementioned companies, Desay SV as a representative enterprise in the intelligent connected field has shown strong growth momentum in its overseas business, which currently accounts for a relatively low proportion but demonstrates excellent development potential. In the first half of the year, Desay SV's overseas business achieved revenue of 1.038 billion yuan, a year-on-year increase of 36.82%, accounting for approximately 7.1% of the company's total revenue, an increase compared to the same period last year.

Overseas profits have traces to follow.

When Chinese auto parts companies continue to deliver impressive results in overseas markets, a critical question naturally arises: How have they managed to carve out a niche for profitability in global competition, given their former "low-end manufacturing" label? The answer is not coincidental; it is the inevitable result of the synergistic effort of four major forces: the drive by Chinese car companies to go global, technological breakthroughs, localized operations, and upgraded cost advantages.

In recent years, China's independent brands and emerging forces have accelerated their efforts to target overseas markets such as Europe and Southeast Asia. This not only brings growth in vehicle sales but also acts like a "leading goose," driving the upstream and downstream supply chains to go global in tandem. After all, for car manufacturers, when establishing factories overseas and launching new models, they prefer to collaborate with familiar local component suppliers. This approach ensures the stability of the supply chain and product compatibility while reducing the communication costs associated with cross-cultural collaboration.

Image Source: Chery Automobile

Jiangsu Jingshen Electronics mentioned in its financial report that Chinese automotive companies are gradually moving from pure product exports to a full-chain output phase of "research, production, and sales." At the same time, Chinese automotive parts manufacturers have formed multiple advantages in the field of intelligence, such as technology and supply chain. As Chinese automotive companies gradually achieve technology exports, they are also beginning to provide intelligent products and solutions to mainstream car manufacturers in Europe.

In the first half of the year, in the automotive safety business sector, Joyson Electronics actively supported Chinese car manufacturers in expanding overseas. The company has already secured several localized business orders from domestic OEMs and is continuously advancing more cooperation projects with domestic OEMs in Asia, Europe, and the Americas, aiming to seize the supply chain's first-mover advantage as Chinese car manufacturers venture abroad.The automotive intelligent solutions have further secured relevant orders from overseas car manufacturers and are currently engaged in preliminary cooperation with multiple overseas clients on body domain products, intelligent driving domain control, and cabin-driving integration domain control.

With the "channels" established by car companies going abroad, technological breakthroughs have become the core strength for auto parts companies to establish a foothold in overseas markets and earn high value-added profits. If in the past Chinese auto parts companies were trapped in the quagmire of "low-end homogenization," earning only hard-earned processing fees, now their technological advantages achieved through research and development have finally opened up the "profit channels" in high value-added fields.

Fuyao Glass's overseas success is a typical example of deep technical cultivation. It spent decades focusing intensively on automotive glass technology, launching high-value-added products such as intelligent panoramic sunroof glass, dimmable glass, and head-up display glass, precisely aligning with the automotive industry's needs.LightweightingThe trend of intelligence is evident. As mentioned earlier, the operating profit margin of Fuyao Glass's North American subsidiary further increased in the first half of the year, and the contribution of high value-added products is undoubtedly significant. It is worth noting that the North American market has strict quality requirements for automotive glass, and consumers have a strong demand for high value-added products such as HUD glass.

Image source: Fuyao Glass

CATL's performance in the field of power batteries is more convincing. As a leading company in global installed capacity, its batteries are at the top level in energy density, fast charging technology, and safety, enabling long range and rapid energy replenishment. Through material optimization, it further enhances lifespan and safety. This hard strength precisely matches the high standards of international car manufacturers, laying the foundation for profitability.

Furthermore, Chinese companies have rapidly improved their capabilities in "system solutions" and are no longer confined to supplying individual components in the fields of smart cockpits and intelligent driving. Instead, they offer integrated services of "hardware + software + algorithms," which not only increase added value but also strengthen their ties with overseas car manufacturers, creating conditions for long-term profitability.

Technological innovation has provided Chinese component companies with a "door-opener," while localization has helped them gradually turn "away games" into "home games," addressing the pain points of the traditional export model. In the early days, Chinese companies relied on the "export trade" model for overseas business, facing high tariffs, hefty logistics costs, and delivery cycles that could last several weeks, which eroded profits at multiple levels. Nowadays, more and more companies are implementing a strategy of "localized production, research and development, and sales," fundamentally optimizing their profit structures.

The numerous companies mentioned above are certainly not to be overlooked, and their overseas expansion continues to strengthen. For example, CATL is steadily advancing the construction of its factory in Hungary, the joint venture factory with Stellantis in Spain, and the battery industry chain project in Indonesia. Guoxuan High-Tech is also progressing various overseas projects in an orderly manner. Desay SV is clearly focusing on core overseas markets such as Europe, Japan, and Southeast Asia, developing customized strategies for different regions. Most target customers have achieved breakthroughs in the first phase of business, and are about to enter an expansion phase. In addition, many Chinese automotive parts companies, such as Jifei Co., Top Group, and Yinlun Co., are accelerating their globalization efforts, aiming to further expand into global markets.

Cost advantage has always been an important support for Chinese component companies to maintain resilience in global competition. Today, this advantage has evolved beyond the single perception of "low labor costs" to gradually upgrade into a comprehensive competitiveness that includes "economies of scale, global resource integration, and supply chain resilience."

The scale effect is the cornerstone of cost advantages. Taking Fuyao Glass as an example, its global annual... The company has strong bargaining power in raw material procurement due to its large scale, and mass production reduces unit equipment depreciation and labor costs, with automated production lines leading the industry in efficiency. This scale advantage not only supports domestic profitability but also allows the company to replicate its mature cost control system when establishing factories overseas, quickly achieving profitability. Guosen Securities pointed out in relevant analyses that Fuyao Glass's competitive advantage stems from economies of scale, high automation, vertical industry chain, and labor costs. Its expansion overseas and high value-added products are opening a new growth cycle.

Global resource integration further amplifies cost advantages. In April of this year, a relevant representative from Joyson Electronics mentioned that the company's restructuring and integration of global resources have gradually released the effects of globalization. "Especially in the European and North American markets, we have integrated and optimized local projects guided by business and cost considerations, which has not only enhanced the overall global operational efficiency but also provided strong support to the company's performance through scale advantages."

Supply chain resilience also safeguards cost stability. In the face of global supply chain fluctuations, Chinese companies reduce the impact of external risks on costs by establishing multi-source supplier systems and locking in raw material prices in advance, ensuring stable production and profitability.

Notably, even Nissan Motor is studying the cost competitiveness of Chinese suppliers. In September this year, according to a Reuters report, a Nissan executive stated that in order to reduce costs, the company is examining the cost competitiveness of Chinese suppliers and exploring ways to expand their operational model globally. The executive mentioned that Chinese suppliers are accelerating their global expansion and have already commenced operations in Hungary, Morocco, and Turkey. Nissan is considering incorporating these Chinese suppliers into its international strategy as potential partners for the future. This is enough to prove that Chinese component companies indeed have the strength.

The overseas market is not something everyone can handle.

The overseas market is full of opportunities, but also fraught with challenges. This is also reflected in the financial reports of some companies.

Starting in 2013, Ningbo Huaxiang's European business began to encounter difficulties, with a long-term trend of significant losses gradually becoming apparent. Data shows that from 2013 to 2022, Huaxiang Germany incurred losses of 98.41 million yuan, 99.67 million yuan, 414 million yuan, 218 million yuan, 226 million yuan, 217 million yuan, 171 million yuan, 330 million yuan, 140 million yuan, and 73.65 million yuan, respectively. For 2023 and 2024, Ningbo Huaxiang's European business recorded losses of 243 million yuan and 385 million yuan, respectively. These consecutive years of losses have dragged down its overall performance.

This is also the reason why Ningbo Huaxiang divested its European business in the first half of this year. On May 30th, it completed the sale of 100% equity in six European holding subsidiaries. After this divestiture, the main operating entities in Europe are no longer included in the company's consolidated financial statements, completely eliminating the "negative assets" that have occupied resources and dragged down profits for many years.

At the same time, Ningbo Huaxiang stated that the company is committed to making its North American business the focus of its overseas development. The current priority is to strengthen operational capabilities and stabilize the production environment, thereby reducing waste, lowering quality costs, and excess freight costs, with the goal of significantly reducing losses in the North American business by 2025 and ensuring overall growth in the company's overseas operations.

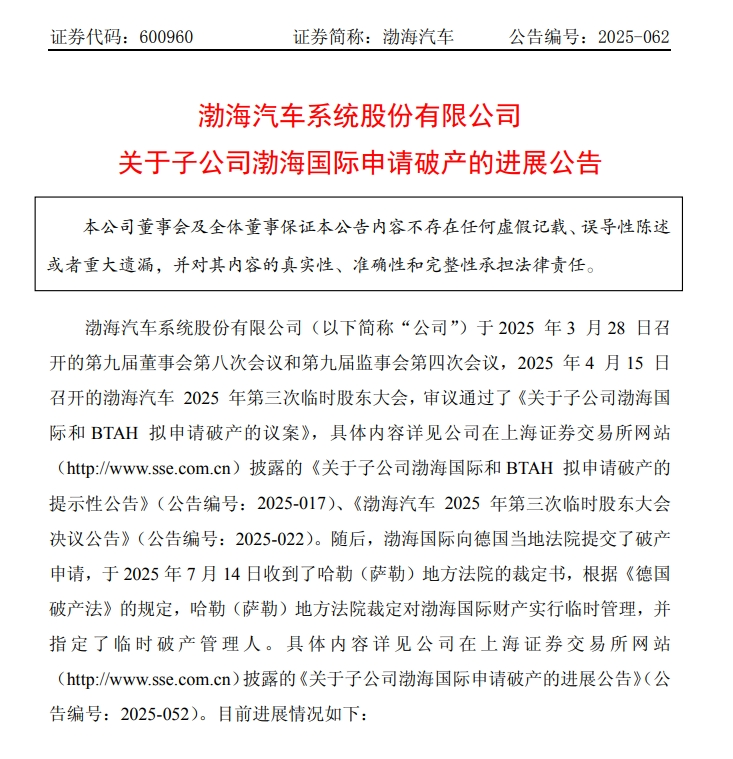

For example, Bohai Automobile announced in September this year that the bankruptcy proceedings of Bohai International are being conducted in accordance with the relevant provisions of the German Insolvency Act. Regarding the reasons for Bohai International's application for bankruptcy, Bohai Automobile stated in an announcement released on March 30 that its wholly-owned subsidiary Bohai International and BTAH have experienced a decline in orders and operating income due to multiple factors, resulting in an increasing loss. The company's board of directors approved the application for bankruptcy by Bohai International and BTAH to reduce losses and protect shareholders' interests.

Image Source: Screenshot from Bohai Automotive Announcement

Bohai International's bankruptcy application reflects the obstacles faced by Bohai Automotive's overseas business, which is the main reason for the company's increased losses. According to financial data, Bohai Automotive's domestic business continued to grow in 2024, with revenue and gross margin increasing by 12.91% and 1.58%, respectively. However, the overseas business "dragged down" the company, with revenue and gross margin declining by 28.51% and 25.19% year-on-year. The decline in overseas business has become the main reason for the company's increased losses amidst the contrast of growth and decline.

This is only a microcosm of enterprises facing pressure in their overseas operations. In addition, recently, Ampleon, a subsidiary of Wingtech Technology, encountered a global operations freeze order issued by the Dutch government citing "national security" concerns, and the forced takeover of shares and removal of Chinese board members by the court, which also highlights the challenges faced by Chinese enterprises going abroad. In fact, even CATL, which has achieved substantial success in overseas markets, has openly stated that "going abroad is not easy."

Recently, Zhu Lingbo, the CTO of CATL's overseas division, expressed in an exclusive interview with Gaishi Automotive, "Going overseas is very difficult, really difficult, especially when building a factory in Germany."

It is understood that, unlike the approximately one and a half years needed for approval and production in domestic factory construction, the process of building factories overseas is much more complex. Especially for lithium batteries, which are considered a new industry in the local area, the requirements are as stringent as possible. For instance, under local regulations and laws, the construction process requires many "licenses," involving everything from groundbreaking to building construction, and even changes to equipment within the factory require "licenses." Zhu Lingbo stated, "From having an idea to putting it into practice, the implementation process is accompanied by the development of various capabilities, including engineering capabilities, R&D capabilities, and overseas construction capabilities. All of these are cultivated through the promotion and delivery of each project."

Of course, the challenges of going overseas go far beyond just setting up factories. From a market perspective, overseas market demands are diverse and ever-changing. Different countries and regions have varying preferences for automotive products in terms of performance, configuration, and appearance, and there are also differences in policies, regulations, and standards: Europe focuses heavily on environmental and safety standards, while the United States places greater importance on intelligence and comfort. If one fails to accurately gauge local demands, it is easy to face difficulties in adapting.

On the technical front, although Chinese companies have made breakthroughs in certain areas, international competition is exceptionally fierce. In the field of intelligent driving, international giants, with their deep technological accumulation and vast data advantages, remain highly competitive in chips and algorithms. For Chinese companies to capture market share, they must continue to invest heavily in research and development; if they cannot keep up with the pace of innovation, they risk being left behind.

The global supply chain, though gradually recovering, still faces risks such as geopolitical conflicts, trade protectionism, and raw material price fluctuations. The Russia-Ukraine conflict once disrupted the European supply chain, leading to component shortages and soaring costs. Under trade protectionism, tariffs and non-tariff barriers are increasing, raising entry thresholds. Raw material price fluctuations further test companies' cost control capabilities.

Baolong Technology mentioned in its financial report that the increase in tariffs will raise export costs, weaken profit margins, and may also lead to weakened consumer demand in target markets, exacerbating market competition. The uncertainty of tariff policies may force auto parts companies to reassess their supply chain strategies and layouts, increasing operational complexity and management costs.

Cultural and management pitfalls often cause Chinese enterprises to "stumble." Operating overseas means dealing with different cultures and business practices, and missteps in cross-cultural communication can easily lead to problems. For instance, when Chinese companies engage in overseas mergers, acquisitions, or set up factories, they often encounter challenges in cultural integration, resulting in low management efficiency and talent loss. In some Western countries, strong labor unions strictly regulate employee compensation and working hours, which can make companies accustomed to domestic management models feel "tied down."

In summary, the journey of Chinese auto parts companies going abroad has never been a smooth path but rather a "challenge game" full of opportunities and challenges. Some companies have made money through technology, cost advantages, and global layout, while others are still struggling with losses and bankruptcy. As the global automotive industry shifts towards new energy and intelligent connectivity, the overseas market will expand, but to get a share of the pie, companies must first overcome challenges such as market differences, supply chain risks, and cross-cultural management.

As Zhu Lingbo said, going abroad nowadays is no longer just about selling products or telling stories. It is more like a major examination of a company's comprehensive strength. It requires companies to quickly adjust to sudden changes in rules and to build a moat in multiple dimensions such as compliance, localization, and supply chain resilience.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

India's Q3 Smartphone Shipments Rise 3%; Japanese Mold Factory Closures Surge; Mercedes-Benz Cuts 4,000 Jobs

-

Ascend's Restructuring Plan Approved! Jwell Launches Global Acceleration Plan; Nexperia Chip Crisis Threatens Global Auto Production

-

Dow To Restart Pe Units 5 And 7 This Week, Recovery Date For Unit 6 Remains Undetermined In The United States (US)

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

The Roller-Coaster Behind Sanhua Intelligent Controls' Stock Price: What Are the Advantages of Automotive Thermal Management Companies Crossing Into Humanoid Robots?