China's automotive new materials industry in 2025: Material Demand Surges Driven by New Energy Vehicles

In the context of the global automotive industry's accelerated transition towards electrification, intelligence, and lightweighting, new automotive materials, as the foundational support for technological innovation, are upgrading from "functional materials" to "scenario-based solutions." Leveraging the advantages of a complete industrial chain and policy support, China has transitioned from a "major consumer of materials" to a "source of innovation," and the industry has entered a period of technological iteration and industrial transformation overlap.

I. Analysis of the Current State of Industry Development

Lightweight Materials: Synergistic Evolution of Steel, Aluminum, and Carbon

According to the China Research Institute of Puhua Research Institute==Report on Competitive Analysis and Development Prospect Forecast of China's New Automotive Materials Industry from 2025 to 2030Currently, the lightweight material system presents a "tripod" pattern of "third-generation high-strength steel + aluminum alloy + carbon fiber." Third-generation high-strength steel optimizes its structure to maintain high strength while reducing costs, becoming the mainstream choice for vehicle safety components. Aluminum alloy, leveraging integrated casting technology breakthroughs, achieves large-scale applications in scenarios such as chassis components and battery trays. Carbon fiber materials, through process innovations like dry-jet wet spinning and prepreg molding, reduce costs and gradually penetrate into mid-range vehicle models. This "steel-aluminum synergy and carbon fiber breakthrough" composite development trend signifies a shift from competition based on single performance to a competition of systematic solutions in lightweight materials.

(2) Smart Materials: Reshaping Human-Computer Interaction Interface

Smart materials are becoming the focus of differentiation competition among car manufacturers. 4D printed shape memory alloys achieve dynamic deformation in active aerodynamic kits, reducing the drag coefficient; self-healing coatings use microcapsule technology to release repair agents at scratch sites on the car body, lowering maintenance costs; electrochromic glass can adjust its light transmittance according to light intensity, reducing air conditioning energy consumption. These materials not only endow cars with "perception-response-adaptation" capabilities but also deeply integrate with autonomous driving and vehicle networking technologies, promoting the upgrade of cars from "passive safety" to "active safety."

(3) Energy Materials: Technological Iteration Drives Performance Breakthroughs

The demand for battery materials in new energy vehicles is driving the trend of "scenario-based customization." High-capacity and long-life cathode materials, such as NCM811 and lithium manganese iron phosphate, have become the core of power battery upgrades. Cutting-edge technology routes like solid-state electrolytes and sulfide electrolytes are accelerating breakthroughs, with the potential to significantly reduce material costs. Battery recycling technologies, such as the "pyrometallurgical-hydrometallurgical combined process," are improving the regeneration rate of lithium and cobalt resources, promoting the industry's transition to "low-carbon and recyclable."

2. Competitive Landscape Analysis

(1) Market Segmentation and Entity Differentiation

The Chinese automotive new materials industry presents a "tiered competition" pattern.

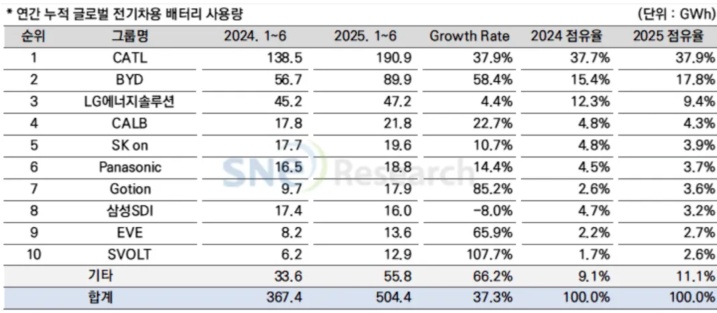

The first tier: Leading companies such as CATL and BYD dominate the power battery materials market through vertical integration, and their technical standards and production capacity directly influence the industry's pricing power.

The second echelon: Specialized and innovative enterprises focus on breakthroughs in niche sectors, such as Zhongfu Shenying in carbon fiber composite materials and Ningbo Yunsheng in rare earth permanent magnet materials, forming differentiated advantages and achieving rapid growth by integrating into the supply chains of mainstream car manufacturers.

The third echelon: Traditional material companies are accelerating their transformation, with Baosteel, Aluminum Corporation of China, and others extending into automotive high-strength steel and aerospace-grade aluminum alloys through process improvements, thereby reducing the dependence on imports of high-end materials.

(2) Regional Clusters and Collaborative Advantages

The industrial agglomeration effect is significant, forming three major core industrial belts.

Yangtze River Delta: Centered around Shanghai and Suzhou, focusing on new energy vehicle battery materials and electronic chemicals, and relying on companies such as CATL and Tinci Materials to build a "R&D-production-recycling" closed loop.

The Pearl River Delta: With Shenzhen and Dongguan as the core, focusing on lightweight materials and advanced composite materials, the localized supply chains of BYD and GAC Group drive the proximal support of aramid fiber and basalt fiber.

Central and Western Regions: Through the "Park + Enterprise + University" model, establish materials pilot bases in industrial parks to construct a closed-loop network of "R&D - Pilot Testing - Intermediate Testing - Industrialization."

(3) International Competition and Localization Substitution

Global competition exhibits characteristics of "high-end blockade and mid-to-low-end substitution".

In the high-end sector: Japan still holds a technological advantage in electronic packaging materials, and Germany in high-strength steel for automobiles, while Chinese companies are breaking through barriers through cross-licensing of patents.

In the mid-to-low-end sector, China has achieved global substitution in materials such as aluminum alloy sheets and ordinary lithium battery separators through cost control and production scale, with export shares continuously increasing. The "changing lanes to overtake" strategy in the new energy vehicle sector has created opportunities for material substitution. For instance, the technological breakthrough in lithium iron phosphate battery materials has enabled China to surpass Japanese and Korean companies in the field of power batteries.

3. Technical Analysis

(I) Transformation of Material Research and Development Model

The materials research and development model is shifting from the "trial and error" method to an intelligent iteration of "computation + experimentation." AI algorithms optimize formulation design by analyzing material genomic data, significantly shortening the development cycle of new battery electrolyte materials. Digital twin technology constructs a virtual mapping of the material's service process, predicting fatigue life in advance and reducing R&D costs.

(2) Technological Innovation and Cost Breakthrough

Integrated die-casting technology promotes the large-scale application of aluminum alloys in chassis components, while the carbon fiber prepreg molding process reduces the cost of composite materials. The dry-jet wet spinning technology enhances the production efficiency of carbon fiber precursors. These process innovations blur the boundaries between materials and manufacturing processes, driving the industry to shift from "material supply" to "process-material integrated solutions."

(3) Green Manufacturing and Circular Economy

The application proportion of bio-based materials (such as plant fiber-reinforced plastics) and degradable composites continues to increase, significantly reducing carbon emissions compared to traditional materials. Breakthroughs in battery recycling technology have improved the regeneration and utilization rates of lithium and cobalt resources, establishing a closed-loop ecosystem from "mining-use-recycling." On the policy front, the country has explicitly required the improvement of recycling rates for power battery materials, encouraging enterprises to focus on the disassembly of retired batteries and material regeneration technologies.

4. Industry Development Trend Analysis

(I) Technological Integration: Cross-Border Symbiosis of Materials with AI and Manufacturing Technology

In the next five years, smart materials will occupy a significant proportion of the new materials market in the automotive industry. Their integration with autonomous driving and the Internet of Vehicles will give rise to a new generation of material systems characterized by "self-sensing, self-healing, and self-decision-making." For example, piezoelectric sensor materials can monitor the stress distribution of the car body in real-time, providing structural health data to autonomous driving systems. Meanwhile, 4D printing technology enables the integrated formation of complex structural components, promoting the upgrade of automotive manufacturing to a "mold-free, rapid iteration" model.

(2) Scenario Deepening: From Single Components to System Integration

The application of new materials has surpassed the scope of single components and is evolving towards integrated vehicle systems. Solid-state battery technology is breaking through the limitations of liquid electrolytes through innovations in material systems, while multi-material composite body design coordinates lightweight, safety, and manufacturing costs. This systematic innovation requires companies to transition from "material suppliers" to "solution providers," driving the industry chain from linear competition to ecological collaboration.

3. Globalization Strategy: From Regional Manufacturing to Global Branding

Leading companies are expanding overseas through technology exports, cultural exchanges, and localized services: collaborating with Southeast Asian automotive companies to develop lightweight materials suitable for local climates, participating in the construction of "Belt and Road" green automotive industrial parks by exporting intelligent production solutions, and establishing material performance testing centers at key locations to promote Chinese testing standards. This global expansion not only enhances the international influence of these enterprises but also advances the automotive new materials industry from "regional manufacturing" to "global branding."

5. Investment Strategy Analysis

(1) Focus on technology pre-research and scenario verification

Enterprises need to build a flexible supply chain system of "technology pre-research - scenario verification - capacity reserve", strengthen collaborative innovation with universities and research institutions, and focus on original material research and patent layout. For example, there are opportunities for technological breakthroughs in cutting-edge fields such as solid-state battery electrolytes and metamaterials, but attention must be paid to the risks of high R&D investment and long cycles.

(2) Layout of Green Manufacturing and Circular Economy

At the policy level, the country accelerates the commercialization of technology through tax incentives and demonstration projects. Enterprises need to incorporate green design into the full lifecycle management of their products. For example, recycled aluminum significantly reduces carbon emissions compared to primary aluminum, allowing companies investing in recycled aluminum capacity to gain a low-carbon premium. The battery recycling system forms a billion-dollar market, and companies that proactively engage in retired battery dismantling and material recycling technologies will gain a first-mover advantage.

(3) Focus on regional clusters and collaborative innovation

In regions such as the Yangtze River Delta and the Pearl River Delta, industrial clusters are accelerating technology implementation through tax incentives and demonstration projects, allowing enterprises to leverage the regional ecosystem to lower conversion barriers. For example, a certain industrial park has established the country's first carbon fiber composite material recycling production line, achieving efficient reuse of thermosetting carbon fibers. A battery company has led the formation of a "Battery Material Innovation Alliance," integrating processes such as lithium mining, diaphragm manufacturing, and recycling to construct a closed-loop ecosystem from extraction to recycling.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Four Major Chemical New Material Giants Sell Off and Shut Down Again!

-

Covestro faces force majeure!

-

DuPont to Spin Off Nomex and Kevlar Brands for $14.4 Billion: Is Aramid Fiber Still Attractive?

-

Massive Retreat of Japanese and Korean Battery Manufacturers

-

Napan Unveils Thermoplastic Composite Three-in-One Power System Solution, Battery Cover Weight Reduced by 67%