Cosmetic Packaging Mandated to "Go Green", Business for Bio-Based Materials Arrives!

The global cosmetics packaging market is continuously expanding, and with the tightening of EU regulations on plastic products and changes in consumer preferences, well-known international cosmetics brands are beginning to formulate green packaging strategies. This is forcing the supply chain to complete the transformation of packaging materials within a short period. The substitution of materials in the cosmetics packaging industry is imperative. Biobased materials, with their low carbon emissions, renewable sources, and degradability, have become the core direction for the transformation of the global cosmetics packaging industry.

The global cosmetics packaging market size continues to expand.

According to a McKinsey analysis report on the beauty industry, the global beauty market (including cosmetics, perfumes, and personal care) has reached $446 billion in 2023 and is expected to increase to $590 billion by 2028. Although the overall market size of the cosmetics industry is considerable, brand competition is becoming increasingly fierce, and product packaging is becoming one of the core elements of brand differentiation. At the same time, social media platforms have had a significant impact on the growth of the beauty packaging market. The popularity of beauty tutorials and unboxing videos makes "high-appeal" and easily shareable packaging more likely to win consumer favor. The rapid development of e-commerce has prompted brands to pay more attention to the design and functionality of external packaging, ensuring it can withstand various challenges during transportation while maintaining sufficient attractiveness to ensure a good consumer experience.

According to the latest business report released by market research firm Research and Markets, the global beauty packaging market is expected to reach $36 billion in 2024 and increase to $50.2 billion by 2030, with a compound annual growth rate (CAGR) of 5.7% between 2024 and 2030.

The urgent need to reduce carbon emissions is driving transformation in the cosmetics packaging industry.

As the market continues to expand, the industry's growth model is also under new scrutiny, and the carbon reduction demands from various countries are forcing the cosmetics packaging industry to change its materials.

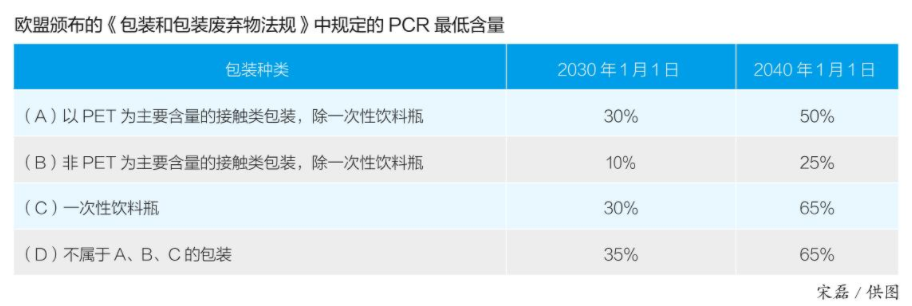

Regulations continue to tighten. The European Union has implemented mandatory regulations to promote the transformation of packaging materials, establishing the world's strictest green barriers. The "Single-Use Plastics Directive," enacted by the EU in June 2019, was fully implemented in member states starting July 2021, with the core goal of significantly reducing the impact of single-use plastics on the environment and human health by 2030. In January of this year, the EU officially issued the "Packaging and Packaging Waste Regulation," which further detailed regulatory requirements by establishing a three-tier recycling evaluation system: A (95% or higher recyclability), B (85% or higher recyclability), and C (70% or higher recyclability). Any packaging that fails to meet at least a C rating will be considered non-recyclable and prohibited from being marketed. Additionally, the regulation sets minimum content requirements for post-consumer recycled (PCR) plastic waste in plastic packaging, mandating that all plastic packaging must contain specified proportions of PCR components by January 1, 2030, January 1, 2040, or within three years of the regulation's enactment (whichever is the latest). If these minimum content requirements are not met, the related brand products will face removal from the market and fines.

Furthermore, the EU REACH regulation (a comprehensive regulation for the management of chemical substances in the EU) Amendment 2.0 requires that, from January 1, 2026, the intentional addition of microplastics smaller than 5 millimeters in any cosmetic packaging is prohibited. The draft extension of the carbon border adjustment mechanism (CBAM 2.0) plans to impose a differential tax on petroleum-based PP/PE products based on carbon pricing (currently 50 euros per ton) to narrow the cost gap with bio-based materials. EU regulations have turned "green" from a brand selling point into a compliance threshold, forcing the supply chain to complete the transition of packaging materials in a short period.

Consumer preference shift. With the spread and practice of sustainable development concepts, consumers show a clear preference for brands that use eco-friendly packaging materials. According to research, for EU consumers purchasing beauty products, "sustainable packaging" has become the second most important decision factor after product efficacy, with 76% of respondents indicating they are willing to pay a premium of 10% to 15% for bio-based packaging.

With the tightening of EU regulations on plastic products and the changing consumer preferences, cosmetic brands are compelled to seek alternative routes to enter the markets of Europe, North America, and Japan and South Korea, which together account for over 50% of the global market share.

The standards are becoming increasingly stringent. Bio-based materials are primarily made from renewable biomass resources as core raw materials, through biosynthesis and processing technologies to produce basic bio-based chemicals such as bioalcohols, organic acids, and alkanes, as well as bio-based polymers and composites like plastics, chemical fibers, and rubber produced from these raw materials. Currently, the European Union has not yet established a unified certification standard for bio-based materials, but a mainstream certification system has formed market entry barriers.

OK Biobased is an environmental certification for biobased materials in Belgium, which evaluates the biocarbon content and total carbon content based on the ASTM D6866 standard, and classifies materials into star ratings: 1 star (20%~40% biocarbon), 2 stars (40%~60% biocarbon), 3 stars (60%~80% biocarbon), and 4 stars (more than 80% biocarbon). It is an authoritative biobased material certification system in the EU. The International Sustainability and Carbon Certification (ISCC PLUS) calculates the full lifecycle carbon emissions of biobased materials from biomass cultivation to product dispatch using the "Lifecycle GHG Calculation Tool." RecyClass recyclability certification is a plastic packaging assessment system developed by the European Committee for Standardization, which comprehensively evaluates the compatibility of plastic packaging in the entire waste management process (including collection, sorting, recycling, etc.), as well as the reusability of recycled materials in their initial applications. The results are divided into six grades: from the best, fully recyclable (Grade A), to the worst, completely non-recyclable (Grade F).

Innovative Practices of Bio-based Materials

Currently, bio-based materials are at the forefront of the petrochemical industry's development, attracting widespread attention from industry professionals worldwide. Many multinational companies are increasing their investment in research and development and market presence in this field.

L'Oréal, Kimberly-Clark, and other international companies have established stringent green packaging strategies to ensure that plastic packaging is 100% reusable, recyclable, or compostable, and are further increasing the average proportion of bio-based materials or recycled plastics in plastic packaging. The French luxury group LVMH has formed a strategic partnership with the American innovative materials company Origin Materials to apply sustainable low-carbon footprint materials in the packaging of perfumes and beauty products. The German cosmetics company Beiersdorf uses Saudi Basic Industries Corporation (SABIC)'s TRUCIRCLE "second-generation" bio-based material portfolio renewable PP in its cosmetics packaging to reduce the use of fossil fuels.

International chemical giants are displaying differentiated competitive strategies in the field of bio-based materials. Brazil's Braskem is producing bio-based ethylene monomers through cellulose ethanol dehydration technology, further synthesizing a complete range of bio-based polyethylene products, including HDPE, LLDPE, and LDPE. The bio-based content of its low-pressure polyethylene resin can reach up to 96%, and its Triunfo plant in Brazil has been expanded to 275,000 tons per year of bio-based polyethylene. BASF has developed a bio-based product matrix covering multiple fields, including bio-based 1,4-butanediol (BDO) and derived bio-based polyols, ethyl acrylate, and more, which are widely used in downstream industries such as biodegradable plastics. Dow is focusing on three major bio-based materials: bio-based polyolefin elastomers (POE), bio-based acrylic emulsions, and bio-based polyethylene (Bio-Based PE).

China Petroleum & Chemical Corporation (Sinopec) regards green transformation as a new development opportunity, delving into cutting-edge fields such as recyclable, circular, bio-based, and biodegradable materials through technological innovation. In recent years, Sino-Korean Petrochemical and Zhenhai Refining & Chemical have continuously expanded the application scope of bio-based materials, successfully producing bio-based benzene using waste cooking oil and biomass naphtha as raw materials. Their downstream products have entered the European market and are used in the production of high-end materials such as adipic acid and nylon 66. By adopting the biomass balance certification system, the carbon footprint of related products is reduced by more than 70% compared to traditional processes, fully demonstrating the great potential of bio-based materials in the field of carbon reduction.

Recently, Zhongyuan Petrochemical achieved the first large-scale production of bio-based polyolefin products in China. This product is made from renewable plant oils and fats, utilizing the existing 180,000 tons/year ethylene cracking unit. Through processes such as hydrogenation cracking, polymerization, cracking, and separation, bio-based ethylene and propylene monomers are produced, which are then polymerized to form bio-based polyethylene (Bio-PE) and bio-based polypropylene (Bio-PP). These products are applied in industries such as packaging, consumer goods, and non-woven fabrics, fully meeting the demand for green materials across various sectors and filling a domestic gap. Sinopec Chemical Sales Co., Ltd. East China Branch (hereinafter referred to as "Chemical Sales East China") has promoted this product to a leading international company in the cosmetics packaging industry, successfully introducing bio-based resins into the supply chains of internationally renowned cosmetics brands such as L'Oréal and LVMH.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

India's Q3 Smartphone Shipments Rise 3%; Japanese Mold Factory Closures Surge; Mercedes-Benz Cuts 4,000 Jobs

-

Ascend's Restructuring Plan Approved! Jwell Launches Global Acceleration Plan; Nexperia Chip Crisis Threatens Global Auto Production

-

Dow To Restart Pe Units 5 And 7 This Week, Recovery Date For Unit 6 Remains Undetermined In The United States (US)

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

The Roller-Coaster Behind Sanhua Intelligent Controls' Stock Price: What Are the Advantages of Automotive Thermal Management Companies Crossing Into Humanoid Robots?